Summary:

- LFL sales growth shows stable positive dynamics, supported by price initiatives and international segment momentum.

- Sam’s Club sales, however, are decreasing due to the previous year’s oil promotion effect.

- There’re several indicators that Walmart will deliver better margins this year, including an oil price decrease & store restructuring program, which will likely compensate negative consequences of the minimum wage rise.

- Despite increased EBITDA & FCF projections, Walmart’s valuation still doesn’t look attractive. We believe that there are more interesting opportunities on the market.

bgwalker

Investment Thesis

Walmart (NYSE:WMT) continues to show great performance due to recent price initiatives and steady consumer and will benefit from oil price decrease & unit restructuring in margins terms. However, the market participants have already accounted for further positive in Walmart valuation, so now stock doesn’t look attractive enough to buy. We maintain HOLD status and recommend to seek for better investment opportunities.

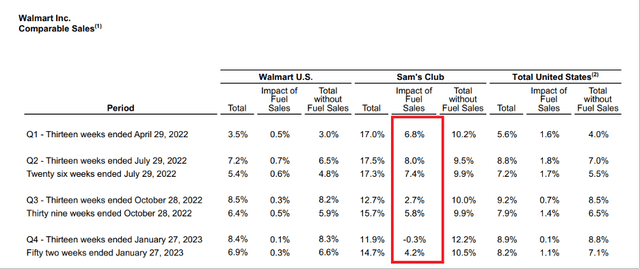

Comparable sales continue to show positive dynamics

Walmart got off to a good start this year, showing some of the industry’s highest growth of comparable sales across all units. US growth reached 7.2% y/y, compared with our forecast of 7.0% y/y, but Sam’s Club started to decelerate slightly: LFL sales went up by 4.0% y/y, compared with the forecast of 7.2% y/y, as the effect of fuel discounts – a powerful sales driver last year – took a larger toll on this year’s growth rates than we had expected.

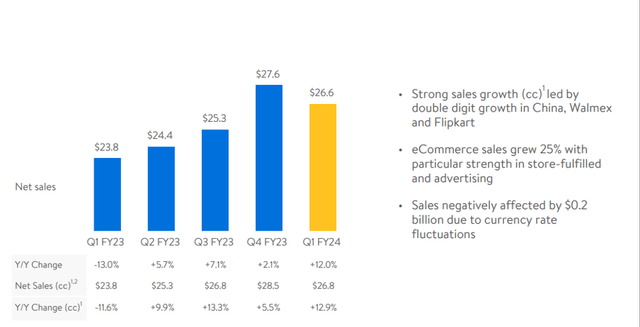

In the international business, growth of comparable sales, on the contrary, was well ahead of our forecast: The segment’s revenue jumped by 12% y/y in 1Q, compared with the forecast of 3% y/y. The strong performance was driven by the recovery of China’s economy and the development of the e-commerce service Flipkart, where sales surged by 64% y/y.

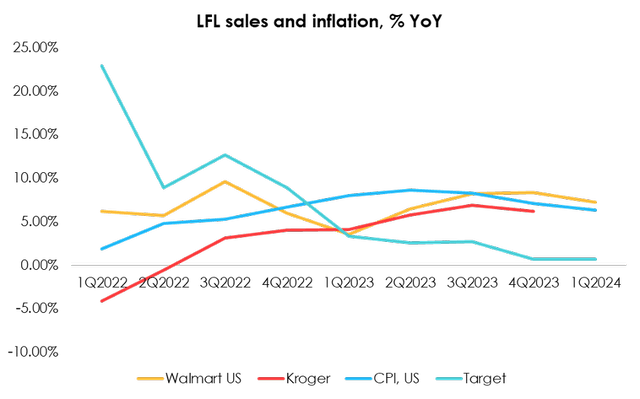

At the same time, we see that despite huge market share Walmart continues to gain momentum, as compared to the peers, it was outpacing its competitors (except for Target in CY2021) and was the only company to grow LFL sales higher than CPI YTD. We believe that market consolidation has generally finished. Due to high penetration and generally appreciated brand Walmart has both pricing & traffic power, so the competition in the middle-term doesn’t look like a danger to Walmart at all, at least, in the domestic market.

We believe that Walmart will be able to continue outperforming its competitors, unless reasonable strategy initiatives will be taken (aggressive promotions & pricing actions, consumer-attractive deals and collaborations or CAPEX-intensive expansions). Walmart remains most well-positioned now for the consumers.

In view of the strong sales performance in the international business and the greater negative impact on this year’s growth from last year’s success of fuel discounts, we are raising the forecast for the growth of Walmart International’s comparable sales from the average of 4.30% y/y to 9.82% y/y for 2024, but are lowering expectations for the same metric for Sam’s Club from the average of 5.15% y/y to 1.02% y/y for 2024.

Also, Walmart shuttered 78 stores in 1Q as part of a restructuring program. The company looks to come back to opening new stores down the line but over the short term the decrease of the floorspace could put additional pressure on revenue.

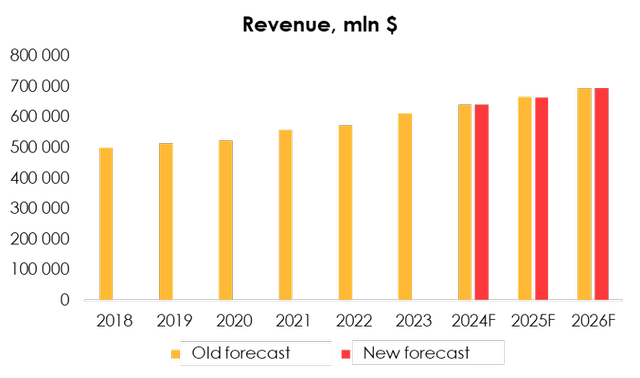

In light of the increased forecast for comparable sales in the international business that has been offset by store closures in 1Q, we are lowering the forecast for Walmart’s revenue from $640 777 mln (+4.8% y/y) to $639 554 mln (+4.6% y/y) for 2024 and from $666 366 mln (+4.0% y/y) to $664 799 mln (+4.0% y/y) for 2025.

Fuel prices & store closures will benefit margins

With respect to operating costs, we see a few positive drivers, such as:

- Oil price and the crack spreads dropped in 1Q, affecting the price of diesel fuel and freight costs

- The producer price index (PPI) climbed by 141.8 pp in 1Q, down from our expectations for 145 pp, which to a large extent is attributable to the performance of the markets of oil and oil products

- Walmart shut down 78 stores in 1Q – 33 in the US, 44 internationally and 1 Sam’s Club – thus, cutting down on operating costs

Gross margin remains under pressure as consumer preferences have shifted toward cheaper goods, including purchases at promotion prices. Gross margin reached 24.31% (-0.22 pp) in 1Q, in line with our forecast of 24.33%. We are leaving unchanged our original assumptions for gross margin and anticipate a recovery of this metric starting from 4Q of fiscal year 2024.

Nonetheless, given the slowing cost inflation and declining prices of oil products, as well as some store closures in 1Q, we are cutting the forecast for operating costs from $129 716 mln (+2.0% y/y) to $128 054 mln (+0.7% y/y) for 2024 and from $134 424 mln (+3.6% y/y) to $134 166 mln (+4.8% y/y) for 2025.

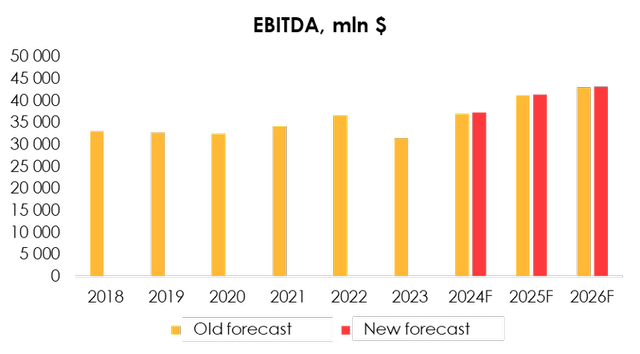

As a result, we are raising the EBITDA forecast from $36 872 mln (+17.5% y/y) to $37 354 mln (+19.1% y/y) for 2024 and from $41 116 mln (+11.5% y/y) to $41 281 mln (+10.5% y/y) for 2025.

Valuation

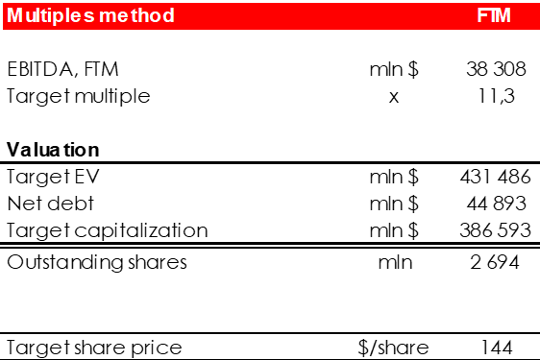

The fair value price is $144. We are maintaining the rating for the shares at HOLD as we stated in previous article.

Invest Heroes

Conclusion

Despite Walmart margins are getting better and sales dynamics is greatly positive, market seem to price all the further positive already and at current prices Walmart stock isn’t attractive for value investors. We recommend to seek for better opportunities on the market or to wait Walmart stock to adjust.

To manage your positions we recommend to follow Walmart and peers (Target, Kroger) financial and industry research (e.g. Census Bureau, JLL Research, CBRE).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.