Summary:

- Amazon is the leader, pioneer and trailblazer in e-commerce. Its competitive moat continues to widen as it innovates and expands in scale.

- Walmart is the bricks and mortar retail leader. It has fallen behind in e-commerce but investing aggressively to catch up, both by leveraging its own unique strengths, assets, and intellectual property, and emulating Amazon.

- For many years, Amazon had the distinct advantage of a highly valued stock to fund its growth investments. In the last year, Amazon stock has pulled back, narrowing this advantage.

- I believe it is still “early days” for Amazon–there remains a long runway for growth ahead for Amazon and the stock could be attractive for long-term investors.

- Walmart will continue to dominate offline retail for the foreseeable future but there is a non-trivial risk that it may be relegated to the list of low growth retailers if it does not execute timely and flawlessly on its e-commerce strategy.

Justin Sullivan

Overview

I previously compared the business models of two leading bricks and mortar retailers in Walmart Inc (NYSE:WMT) with Costco Wholesale Corp (COST), and also wrote about how Amazon.com Inc (NASDAQ:AMZN) has been growing by gaining retail market share.

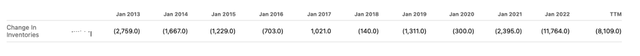

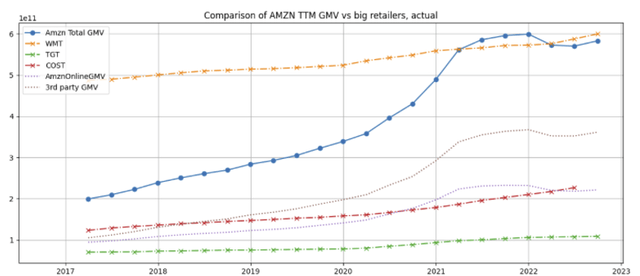

Walmart was the undisputed king of retail for the last several decades. As some of us will recall, there were even calls to break it up as some regulators and industry observers believed it wielded too much power. Times have changed — Amazon’s GMV (gross merchandise volume) has caught up to Walmart’s (Figure 1) in 2021 as the COVID-19 outbreak accelerated the shift towards online digital channels and is poised to capture even more retail market share.

Figure 1 GMV of Amazon, Walmart, and other major retailers

Created by author with public data

(Note: I estimated Amazon’s total online sales GMV by dividing its online GMV by (1 – third party sales as a percentage of total retail sales). Both sets of numbers are provided in Amazon’s financial disclosures.)

While Walmart continues to be the clear leader in the slower growing bricks and mortar retail segment, it remains far behind Amazon in the fast-growing e-commerce segment with just a 7% of US e-commerce compared to Amazon’s 39.5% (Figure 2).

Figure 2 US share of retail e-commerce sales

CNBC

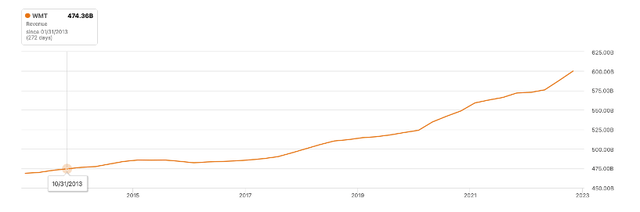

Over the last ten years, Walmart’s total revenue grew by less than $125 billion (Figure 3) (although I note that it had shed approximate $40 billion in annual revenue through the sale of its UK, Japan, Latin American and other operations). The company’s e-commerce revenue of $70 billion (reported in its 10-K 2021 filing) represented more than half this growth.

Figure 3 Walmart 10-year revenues

Amazon is far ahead in the e-commerce game, and Walmart finds itself in the unfamiliar and uncomfortable position of playing catch up. In this article, I will analyze the capabilities of these two retail giants in the increasingly important e-commerce arena and the implications on longer-term shareholder value.

E-commerce growth and share compared to offline channels

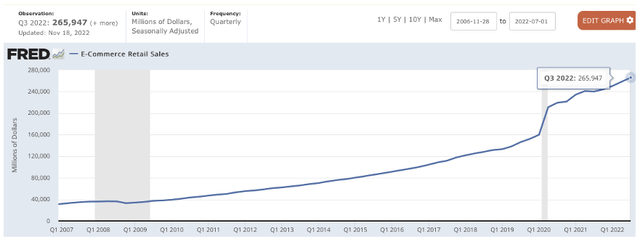

E-commerce retail sales surged in 2020 due the abrupt shift of retail online following the COVID-19 outbreak and have continued their steady growth trajectory (Figure 4) (though I acknowledge that part of recent growth was driven by inflation-led price increases) as many consumers who were forced to make purchases online during the lockdowns experienced the convenience of e-commerce and will continue buying online even after the pandemic is over.

Figure 4 E-commerce retail sales (ECOMSA)

FRED St. Louis Federal Reserve

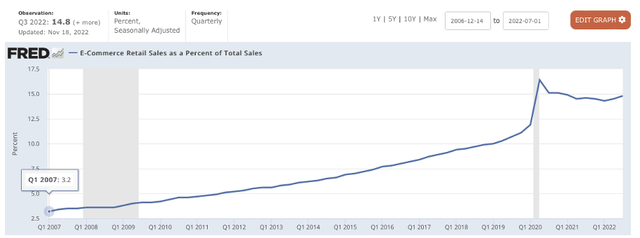

E-commerce as percentage of total US retail sales tripled from 5% to 15% over the last decade. It experienced a surge following the outbreak of the COVID-19 pandemic and appears to have plateaued following the huge run-up in 2020 (Figure 5), but I believe its longer-term upward trajectory is all but inevitable.

Figure 5 E-commerce retail sales as a percent of total sale (ECOMPCTSA)

FRED St. Louis Federal Reserve

E-commerce’s cost advantage over offline retail will widen over the long term as delivery route densities rise with order volumes (I will elaborate on this below). In addition, the time and transportation costs consumers save by not having to go to the store regularly to pick up everyday necessities such as laundry detergent, toothpaste, or pet food) will continue to nudge more consumers towards online purchases. Fortunately for bricks and mortar retailers, there will always be consumers who enjoy visiting physical stores as a social activity or to shop for high-end luxury goods, but for the rest of us, e-commerce offers a time and cost saving alternative.

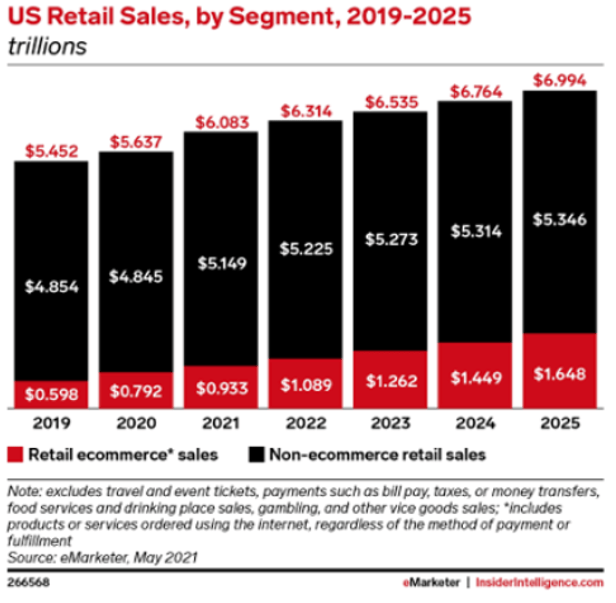

According to eMarketer, US e-commerce sales is projected to grow by 50% over the next three years (Figure 6) and reach 30% of total retail sales by 2025.

Figure 6 Projected US retail sales: online vs offline

eMarketer

Segmentation of the retail market

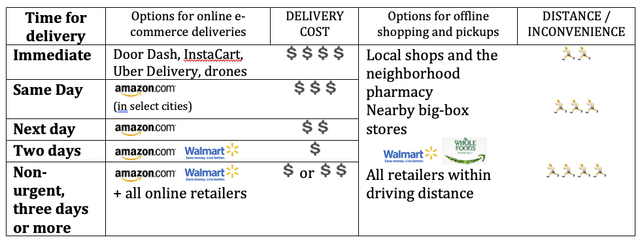

I segment the market according to the urgency of the purchases, i.e., how quickly customers need or wish to receive their purchase. Their decisions involve a tradeoff between cost and convenience (Figure 7).

Immediate purchases, which might include urgent prescriptions, perishables, or meals, are typically expensive to deliver they require a dedicated courier, which is very costly, so many customers who are able to might prefer to walk or drive to the neighborhood shop or local pharmacy. Conversely, many people might choose to make non-urgent purchases online as those can be delivered by cheaper means (e.g., US mail or UPS) which make the all-in cost acceptable or even attractive compared to in-store options.

There is certainly a segment of customers who crave immediate gratification and will pay up for quick delivery but assume this is the exception rather than the rule. There are also customers who love the browsing or social experience of shopping, but these typically involve designer apparel, luxury items, and specialty goods as opposed to the consumer staples like Corn Flakes, Tide detergent and smartphone cables that people buy from Amazon and Walmart.

Figure 7 Retail market segmentation

Created by author using public data

Amazon is far ahead of Walmart in e-commerce

Amazon’s early mover advantage and focused strategy of getting product to customers quickly and cheaply has enabled it to capture more than five times the e-commerce share of Walmart (Figure 2 above). It is no longer just about the unaided recall of the amazon.com brand name, the network effect of its marketplace platform, or the stickiness of its Prime membership program. Amazon has continued to widen its moats by delighting customers through both shortening delivery times and lowering delivery costs which it has passed onto customers.

Delivery time : Amazon introduced two-day delivery in 2005, then upped the ante in 2019 when it started building the infrastructure needed to offer next-day delivery to a large proportion of its customers and same day delivery in select cities. Amazon is eroding the advantage that local shops and neighborhood pharmacies have by virtue of their real estate presences and moving up the value chain depicted in Figure 7.

Delivery costs : Amazon has built a significant cost advantage over competitors because it has assembled a large footprint of highly efficient physical warehouses, fulfillment centers, and delivery trucks to serve its large base of customers, which together with the application of smart algorithms to its massive trove of customer data, has enabled the company to drive up the route density of its last mile delivery, pushing down the per customer delivery cost to levels far below its competitors’.

(1) Fulfillment centers

Amazon’s 111 fulfillment centers in the US and 185 around the world are strategically located close to its customers but in low-cost areas. These are highly automated, customized e-commerce facilities that are fine-tuned to optimize receiving, sorting, picking, and shipping; maximize throughput efficiency; and minimize labor for direct shipments of individual customer orders (to get better sense for the operations, I highly encourage you to view the video Inside an Amazon fulfillment center on YouTube).

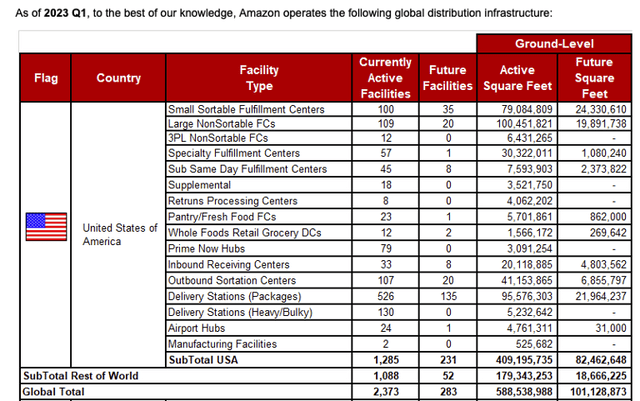

According to MWPVL, a global logistics and supply chain consulting firm, Amazon current operates a network of 1285 US and 1088 international distribution facilities, which includes sortation centers, hubs, delivery stations, with an additional 283 facilities planned (Figure 8).

Figure 8 Amazon’s global distribution infrastructure

(Amazon Distribution Network Strategy | MWPVL International)

The large footprint of fulfillment centers enables Amazon to keep inventory of products near areas of high demand, and this is the reason third party sellers on Amazon are often asked to ship their products to several different fulfillment centers. For example, it saves cost and time to ship ski apparel from warehouses near mountain resorts and beach attire in from warehouse along coastal areas. In addition, it has a fleet of 110 aircraft to speed up delivery by moving products amongst it warehouses or to hubs for delivery where necessary.

It would be very difficult for all of Walmart and Sams Club’s existing 185 US fulfillment centers, most which were set up to distribute and supply inventory in bulk to its superstores, to match Amazon warehouses’ efficiency in picking and shipping small or one-off quantities of products directly to end-consumers.Walmart currently has about 33 fulfillment centers dedicated to e-commerce, but does not appear to have the same footprint of hubs, sortation centers, and delivery stations, though it could repurpose parts of its supercenter stores for these functions. Until it catches up with a nationwide distribution infrastructure optimized for direct-to-customer e-commerce, Amazon will continue to have a cost advantage.

——————-

A quick sidebar: To get a sense for the scale of Amazon’s logistics, it has more facility square footage and spends more on capex than dedicated logistics companies like Federal Express (FDX) and UPS (UPS) combined. Based on numbers from the respective companies’ 10-K filings, Amazon currently has over 500 million square feet of facility space, more than three times that of UPS’s ca. 146 million square feet and Fedex’s ca. 150 million square feet (this excludes Fedex’s Office segment which provides print and graphic services). Even though Amazon does not break down the space between datacenters and logistics facilities, I think it is safe to assume that it has pulled far ahead of its two largest logistics competitors.

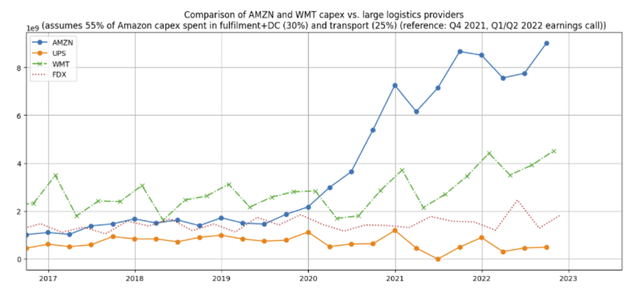

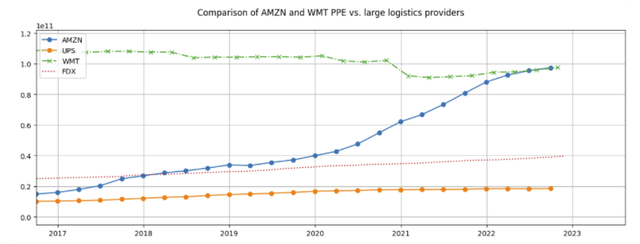

In the last year, Amazon spent more on fulfilment and transportation-related capital expenditures than Walmart, Federal Express, and UPS’s combined (Figure 9, solid blue line). In addition, the value of Amazon’s net plant, property, and equipment (Figure 10) is on par with Walmart but significantly higher than Federal Express and UPS, although I would be the first to acknowledge that this is not an apples-to-apples comparison.

——————-

Figure 9 Capital spending comparison

Created by author using public data

Figure 10 Net plant, property, and equipment comparison

Created by author using public data

(2) Delivery trucks and routes

Each last mile truck delivery incurs a fixed cost, but the per-customer cost can be lowered by raising the route density, i.e., by spreading the delivery cost amongst more customers who are in the same vicinity. Given the fact that Amazon’s e-commerce GMV is orders of magnitude (ca. 8x) larger than Walmart’s, it is a safe bet that its delivery trucks have far higher route densities.

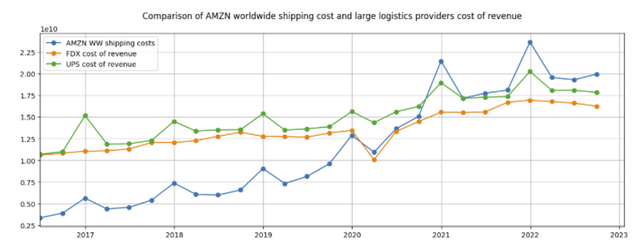

Amazon has become a force in shipping–its generates 225,000 unique routes per day during peak seasons and its worldwide shipping costs have exceeded the cost of revenue of both Federal Express and UPS (Figure 11).

Figure 11 Amazon worldwide shipping costs vs cost of revenue for FDX and UPS

Created by author using public data

Immediate delivery is inherently more expensive because it is very difficult to find and match customers in the same neighborhoods who will place orders with sellers in the same vicinity for delivery within the same time window. As such, Uber Delivery and DoorDash’s services will likely be limited to higher value deliveries, and it will be difficult for their smaller vehicles to match the Amazon truck’s volume and route density. Consumers may pay a premium for delivery of meals, alcoholic beverages, or urgent medications, but I cannot see many consumers paying up for immediate delivery of Tide detergent pods or Corn Flakes. The same logic applies to drone delivery—given the weight limitations, I believe it will remain a niche for the foreseeable future.

What Walmart is doing to catch up

Walmart currently operates over 3,500 superstores, 185 distribution centers in the US (157 for its Walmart stores and 28 for Sam’s Club) and 179 internationally. Of these 365 distribution centers, just 31 are dedicated e-commerce fulfillment centers (source: WMT 2021 10-K filing, page 8)—far fewer than Amazon’s 111 in the US and 185 around the world. Furthermore, Walmart does not appear to have the Amazon’s wide network of support facilities hubs, sortation centers, and delivery stations (Figure 8) or scale last mile delivery trucks. However, like Amazon, Walmart also has a rich dataset of customer comprising of more than 230 million weekly offline and online customer visits on which it applies artificial intelligence and machine learning algorithms to improve its search and supply chain capabilities.

(1) Using its superstores as “micro-fulfillment” centers

Walmart’s 31 dedicated e-commerce fulfillment centers falls short of Amazon’s 185 fulfillment centers around the world. Even though Walmart’s 3,500 superstores, which 90% of all Americans live within 10 miles of, can be leveraged as e-commerce pick-up locations and “micro-fulfillment” centers, I doubt they can be cost competitive in this cut-throat business where every last dime matters.

The idea of using supercenters to fulfill end-consumer delivery or pickup orders sounds intuitively appealing as they are located closer to consumers than Amazon warehouses and can theoretically get products to consumers more quickly. However, these supercenters were designed with shoppers in mind and are not re-configurable to optimize both in-store shopping and highly automated product picking.

Large as the supercenters may be, they are no match for the massive scale of e-commerce fulfillment centers, some of which are the size of 28 football fields (compared to 1-2 football fields for the typical Walmart supercenter) with highly sophisticated software algorithms and automated robotics to maximize throughput and minimize labor.

A superstore’s inventory is subject to multiple rounds of tedious manual handling upon arrival–products need to be arranged neatly on store shelves so in-store customers can find them easily (rather than for e-commerce fulfillment efficiency). Once an online order is received, employees would need to physically walk through the aisles to manually pick each line item in the order, package the items, and either prepare them for shipping or place them in a staging area ready to be brought out when the customer arrives. Pickups can be costly and complex—for example, a customer may not there when the employee brings the items out for a variety of reasons–the customer could have gone to the wrong store or couldn’t wait because the employee took too long. This additional labor and storage space requirements adds layers of costs compared to shipping a product directly from a fulfillment center to the end-customer.

Walmart supercenters that are located closer to populated areas may be able to get the products delivered to the customer or available for pickup more quickly, but Amazon Prime’s next day and expanding same day delivery service is chipping away at this advantage.

(2) Building up its network of fulfillment centers and supply chain capabilities

Last summer, Walmart announced the construction of four next generation fulfilment centers that will leverage robotics and machine learning to increase its fulfillment speed and capacity. According to the company’s news release:

“These four next generation FCs alone could provide 75% of the U.S. population with next- or two-day shipping on millions of items, including Marketplace items shipped by Walmart Fulfillment Services. Combined with our traditional FCs, we can reach 95% of the U.S. population with next- or two-day shipping, and by making use of the expansive reach of our stores, [author’s note: presumably as hubs, sortation centers and delivery stations] we can offer same-day delivery to 80% of the U.S. population.”

In the release, Walmart also announced its intention to retrofit and “modernize and transform its supply chain by adding game-changing automation technology to its facilities”. This sounds ambitious and impressive, and I have no reason to doubt Walmart’s ability to deliver (no pun intended). While I have no basis or detailed knowledge to compare the state of Walmart’s fulfillment centers and automation technologies to Amazon’s, the one thing I am certain of is that Amazon will not be standing still or willingly cede its lead.

(3) Offering fulfillment services to third party sellers

In February 2020, Walmart created Walmart Fulfillment Services, an end-to-end fulfillment services for sellers who list their items Walmart’s Marketplace, similar to Amazon’s FBA (Fulfilled by Amazon) service which was launched in September 2006. Walmart subsequently entered into an agreement that enables Shopify sellers to list their products on Walmart’s Marketplace.

There are a variety of reasons that sellers list their products on Walmart’s Marketplace: some view it as less crowded and thus more profitable, while others use it as a diversify to Amazon’s marketplace. However, I believe the network effect will enable the largest and most vibrant marketplace with the largest number of trusted buyers and sellers to capture the lion’s share of transactions.

(4) Expanding its last mile network and increasing delivery route density

Anecdotally, I see more Amazon local delivery trucks traversing neighborhoods around the country than Walmart trucks (and Fedex or UPS trucks), and these Amazon delivery trucks appear to be making lots of stops, which indicate very healthy route densities.

With just ~14% of Amazon’s e-commerce GMV, it might seem an uphill battle for Walmart to build up a competing last mile delivery network. However, in August 2021, Walmart launched GoLocal, a white-label delivery service (in addition to its InHome grocery delivery service) to help merchants (such as Home Depot (HD)) with local presences deliver products to end-customers on-time and cost-effectively. Today, GoLocal serves a large base of merchants in sectors such as clothing and apparel, automotive, grocery and alcohol, restaurants, consumer electronics, and hardware, enabling it to increase its route density and thus offer competitive pricing. More recently, Walmart forged a deal with Salesforce (CRM) enabling AppExchange users to leverage Walmart GoLocal’s service for local fulfillment and delivery solutions.

As the volume picked up, Walmart has signed agreements to purchase 4,500 electric vans from Canoo in July 2021 and 5,000 from BrightDrop in January 2022, reminiscent of but just a fraction of Amazon’s announced order for 100,000 Rivian electric vans in 2019.

A high-level financial analysis

Revenue and per-share revenue

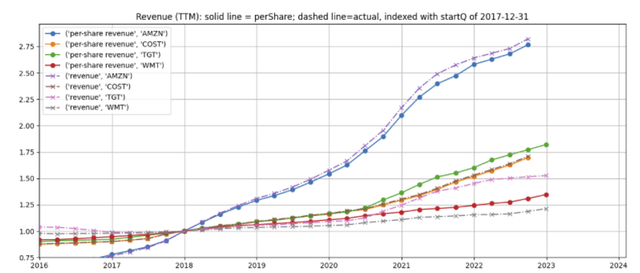

Amazon’s per-share revenue (Figure 12, solid blue line) has growth at twice the rate of Walmart’s (solid red line), but I note that Amazon’s GMV has grown even faster as the share of 3rd party sales continued to climb.

Figure 12 Revenue and per-share revenue comparison

Created by author using public data

Even though Walmart has higher TTM revenues than Amazon, just about $70 billion of its sales are e-commerce (including pick-up orders). Amazon’s GMV of ~$600 billion is higher than its TTM revenue (see Figure 1)

Margins

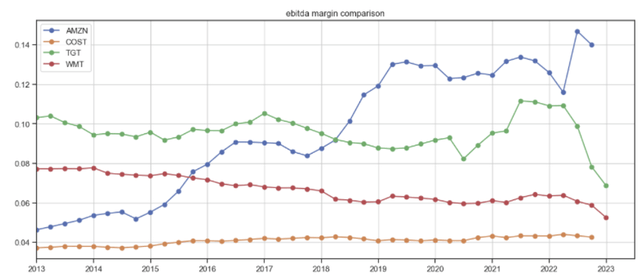

Walmart’s EBITDA margins have contracted over the last decade (Figure 13, red line). In contrast, Amazon’s EBITDA has risen, driven by scale and Amazon Web Services, and despite its large R&D spend of ~$66 billion for the twelve months ended September 2022, which represented over 12% of total revenues (Figure 14).

Figure 13 EBITDA margin comparison

Created by author using public data

Figure 14 AMZN R&D as percentage of revenues (TTM)

Valuation

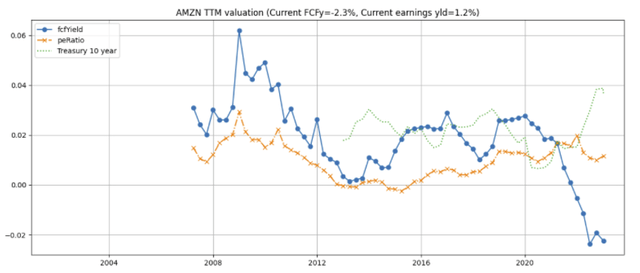

Amazon

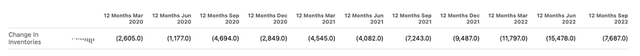

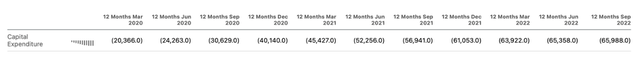

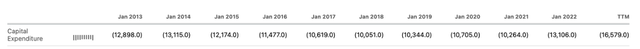

Amazon’s free cash flow yield (Figure 15), has dropped sharply due to higher inventory costs stemming from inflation of consumer goods (Figure 16), as well as its high R&D expenses (Figure 14) and capex (Figure 17) incurred as it invests aggressively for the long term in accordance with Jeff Bezos’ philosophy of sacrificing short-term earnings for long-term cash flow.

Figure 15 Amazon valuation

Created by author using public data

Figure 16 Amazon inventory purchases

Figure 17 Amazon capex

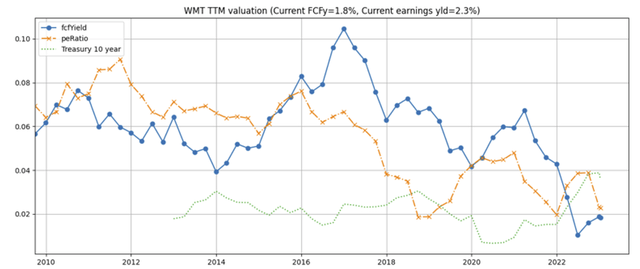

Walmart

Like Amazon, Walmart’s free cash flow yield (Figure 18) has also dropped largely due to higher inventory costs stemming from inflation of consumer goods (Figure 19) and capex (Figure 20) incurred as it too invested aggressively in fulfillment centers, delivery trucks, and other assets (as described above) to catch up with Amazon. However, its TTM capital expenditure of $16 billion represents just one-quarter of Amazon’s $65 billion for the same period (Figure 17).

Figure 18 Walmart valuation

Created by author using public data

Figure 19 Walmart inventory purchases

Figure 20 Walmart capex

Amazon’s stock price advantage

In its earlier days, Amazon had the distinct advantage of a highly valued stock (Figure 15) which enabled it to fund its aggressive growth investments through stock issuances with less dilution to existing shareholders. Even though Amazon today generates cash, has ample access to debt, and is less reliant on stock issuances to fund its growth, a highly valued stock continues to lessen the dilutive effect of employee stock based compensation to shareholders.

In contrast, Walmart lacked this advantage as it went through the last decade with a less rich stock valuation, particularly in the 2015-2019 period (Figure 18).

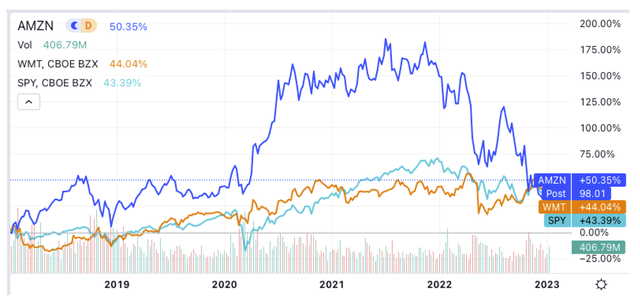

Over the last year, Amazon stock has pulled back by as much as 50% (Figure 21, dark blue line), while Walmart stock is trading near its all-time highs (orange line). This has narrowed Amazon’s stock price advantage for the time-being.

Figure 21 Stock price comparison

Concerns

The risks for Amazon shareholders are the high valuation of the stock (which is both blessing for Amazon but a risk for potential new shareholders) and the calls of regulators to break Amazon into Amazon Web Services and a RetailCo to lessen its dominance that we hear from time-to-time.

However, I believe Walmart faces more business risk if it does not build up its e-commerce capabilities. Walmart continues to dominate the offline retail market and I do not see Walmart in any near-term danger whatsoever, but I note that the world of retail is littered with bodies of former giants once perceived as invincible that did not adapt to the changing retail environment (think Lord & Taylor, Mervyn’s, Montgomery Ward, Sears, and Wannamaker’s, among others).

In summary

I believe Amazon‘s long lead and its wide and expanding competitive moat in e-commerce makes it an attractive investment for long term investors.

While I expect Walmart to deliver reasonable returns to investors for the foreseeable future from the strength and dominance of its bricks and mortar retail, there are very real, long term downside risks to shareholder value if it fails to narrow and catch up to Amazon’s lead in e-commerce. As such, caution is warranted.

Disclosure: I/we have a beneficial long position in the shares of WMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.