Summary:

- Walmart reported their fiscal Q2 ’24 financial results on Thursday, August 17th, 2023, and the results were quite good.

- Walmart’s cash flow valuation looks a lot more reasonable than its EPS multiple.

- The key Walmart metric (in my opinion) over the next few years that should be watched by investors is the operating margin, as the earnings preview detailed.

bgwalker

Walmart (NYSE:WMT) reported their fiscal Q2 ’24 financial results on Thursday, August 17th, 2023, and the results were quite good, with a 9% EPS beat and a 1% revenue beat (revenue and EPS grew 6% and 4%, respectively, y.y) as well as decent Walmart US comps i.e. +6.4% with Sam’s at +5.5%, along with e-commerce growing 24% globally and now comprising 15% of total Walmart revenue.

- The inventory glut issues are over: Walmart saw its 3rd consecutive quarter of y.y revenue growth exceeding inventory growth;

- Faster inventory turn certainly helped cash flow. The $13.6 billion in cash flow from operations generated in Q2 ’24 looks to be a record for quarterly cash from ops, which generated free cash flow of $8.8 billion;

- Gross and operating margins improved y.y, gross margins by 39 bps and operating margin by 10 bps, although that needs to continue, particularly operating margin gains.

- Revenue and EPS estimates continue to be revised higher. It’s important that revenue estimate revisions remain positive since it signifies further market share gains in grocery.

- Walmart’s “earnings quality” remains high: while the P/E multiple is 22x the ’24 EPS estimate, the cash flow per share for WMT as of the latest quarter is just 11x;

Walmart’s cash flow valuation looks a lot more reasonable than its EPS multiple, and with a 3% free cash flow yield at $155 per share, the stock remains reasonably valued.

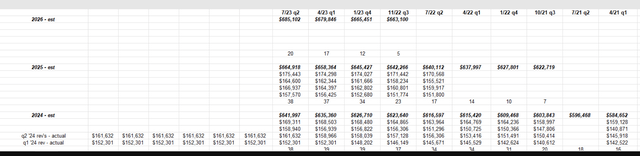

Here are the revenue revisions for WMT for the last several quarters:

Normally, revenue revisions are shown under a different format, but this was simply cut-and-pasted from the valuation spreadsheet and shows the positive progression for fiscal years 2024 through 2026 over the last 8-9 quarters.

The fact that Walmart revenue revisions remain positive is an unambiguous positive for the stock.

Summary/conclusion:

The key Walmart metric (in my opinion) over the next few years that should be watched by investors is the operating margin, as the earnings preview detailed. But will it be a cost-driven expansion, from supply chain automation and fulfillment “synergies” (basically cost savings) or will it be revenue-aided like Walmart’s entry into advertising, which has much better margins than the retail grocery business, or will it be some combination of both?

It’s tough to grow a business expected to generate $665 billion in revenue in fiscal ’25 faster than low-to-mid-single digits, and yet, Walmart continues to push the envelope, usually successfully.

The retail giant is exiting the Covid and pandemic-driven volatility that greatly distorted the calendar years 2020 to 2022.

When the fiscal year 2024 ends in January ’24, and on the February ’24 conference call, I’d like to hear some quantification of the savings and potential operating margin impact around the supply chain and fulfillment automation that was announced in early April ’23.

Personally, I think the stock is worth closer to $200 per share, but the time frame to get there is the big question, as well as its performance relative to the S&P 500. The faster the margin gains, the better the stock will perform, both relatively and absolutely.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.