Summary:

- Walmart is trading higher in the pre-market trading hours following results that topped expectations.

- The retail giant reported comparable sales growth of 3.8% and adjusted EPS of $0.60/share.

- WMT notably reported share gains among higher-income households.

- Included with the release were favorable updates to full-year guidance.

- Despite the positive results, I view WMT shares as fairly valued for the current market environment.

Alexander Farnsworth

In my last update on Walmart (NYSE:WMT) in late 2023, I noted that shares were a hold following its rise to an all-time high. Since the update, shares have gained about 13%, modestly behind the broader S&P’s (SPY) gain of 18% over the same period.

Much has occurred since the update. In February, the company confirmed that it would be buying TV maker, Vizio (VZIO), for +$2.3B. The deal has since come under increased scrutiny from the FTC. While the acquisition would likely boost WMT’s advertising business, an emerging revenue stream for the company, the overall business still remains underdeveloped compared to competitors like Amazon (AMZN).

To support its expansion into other areas, WMT enacted two notable cost-cutting moves. First, it closed all 51 of its health clinics it opened over the last five years. Then just this week, WMT announced that it was cutting corporate jobs and asking remote workers to return to offices.

WMT also implemented a 3/1 stock split in February. While not overly impactful, in my view, the split did add an additional layer of consideration to the FY25 guidance that was provided on the Q4 conference call.

Shares rose in the pre-market trading hours following the release of Q1 results that came in ahead of expectations with favorable updates to full-year guidance. While WMT’s results reflect continuing strength in their mainstay business and growing momentum in emerging lines, at current trading levels, I continue to view shares as a hold.

Walmart Stock Key Metrics

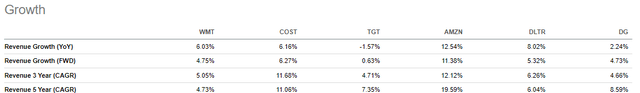

Recent reporting from the Wall Street Journal (“WSJ”) highlighted Amazon’s increasing threat to WMT. Over the past five years, AMZN has grown sales at a compound rate of nearly 20%. This compares to just under 5% for WMT. Nearer term, AMZN grew sales by 12.5% YOY versus WMT’s 6%. A continuing in this trend could threaten WMT’s top spot in total sales, in my view.

Seeking Alpha – Revenue Growth Metrics Of WMT Compared To Peers

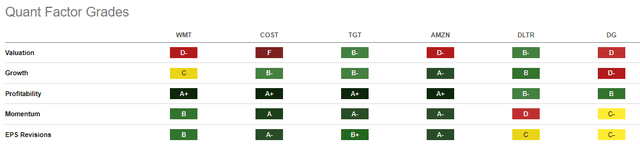

The slower revenue growth prospects are likely one reason WMT grades poorly on this mark by Seeking Alpha’s (“SA”) Quant Scoring system.

Seeking Alpha – Quant Factor Grades Of WMT Compared To Peers

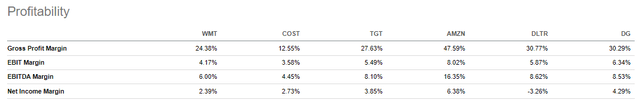

While the company grades strongly on profitability, margins tend to be lower than the general competition, primarily due to WMT’s greater dependence on lower-margin essential sales.

Seeking Alpha – Profitability Metrics Of WMT Compared To Peers

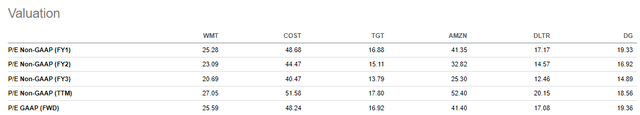

At approximately 27x forward earnings, shares appear overpriced in relation to its five-year average of about 23x. This may be contributing to some of the neutral sentiment present in the stock by SA Quants and Analysts, alike. Wall Street, however, remains bullish, seeing approximately 10% upside potential.

Seeking Alpha – Valuation Metrics Of WMT Compared To Peers

What Did WMT Expect Heading Into Earnings?

In providing guidance for the new fiscal year during the Q4 conference call, CFO, John Rainey, had highlighted that the forecasted range would be broader due to several factors. Notably, the leap year introduced an additional day in Q1, alongside an extra week for comparable sales in Q4. Additionally, any earnings comparisons had to consider the 3/1 stock split that occurred in February.

Considering these variables, Rainey projected constant currency sales growth between 3% and 4%, with operating income expected to increase by 4% to 6%. He noted that growth would be weighted more heavily in international markets. Overall, Walmart anticipated FY25 EPS to fall within the range of $2.23/share to $2.37/share or $6.70/share to $7.12/share on a pre-split basis.

For Q1 specifically, Walmart expected sales to grow between 4% and 5%, and operating income to rise by 3% to 4.5%, with the leap year contributing approximately 1% to sales growth. However, timing-related considerations on technology were expected to weigh on earnings growth. Overall, Walmart projected Q1 EPS to be in the range of $0.49/share to $0.52/share per share, or $1.48/share to $1.56/share on a pre-split basis.

Walmart Q1 Results Recap

For the first fiscal quarter of the new year, WMT reported comparable sales growth of 3.8%, above the midpoint of their guided range. During the quarter, WMT continued having success by its value proposition. In an interview with CNBC, Rainey mentioned the disparity in pricing between food at home and food away from home as reasons for the continued success in WMT’s grocery business.

A notable contributor to growth during the growth was the company’s gains with upper-income households. WMT has targeted more spending to this demographic by curtailing outlays in other areas. The growth here shows the payoff of these investments. Another significant component to sales growth was eCommerce, which reported growth of 22%. This came on the heels of increasing popularity in its delivery business.

Moving to the bottom line, WMT reported adjusted EPS of $0.60/share, above expectations by about $0.08/share. The company also reported an increase in their gross margin rate of 42 basis points (“bps”). The earnings growth is despite the increased investment in emerging business lines, such as advertising, and increased spending to lure in higher-income shoppers.

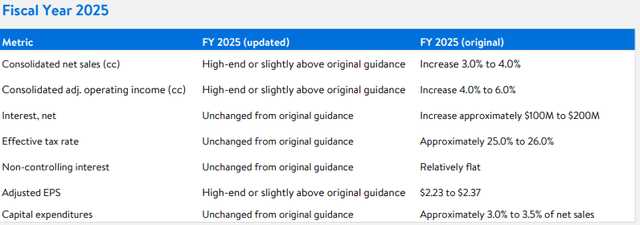

In looking ahead, WMT updated their guidance to reflect performance at the top end or slightly above the original range. On an overall basis, WMT still sees adjusted EPS landing in a range of between $2.23/share to $2.37/share, with the actual likely falling above the midpoint of $2.30/share.

WMT Q1 Earnings – Summary Of Guidance

Is WMT Stock A Buy, Sell, Or Hold?

In terms of forward catalysts, WMT’s recent expansion into new revenue streams, like the acquisition of Vizio to boost its advertising business, shows promise. However, it remains underdeveloped compared to competitors like Amazon. Additionally, the company has had mixed success with new ventures, as evidenced by the recent closure of its health clinics.

Despite these challenges, Walmart is still delivering strong results, as evidenced by the Q1 print, which showed earnings exceeding expectations and margin growth achieved despite increased investments in emerging revenue sources and efforts to attract higher-income customers. Notable growth in Walmart’s delivery business reflects the payoff from past investments in strategic initiatives. And increasing traffic from higher-income customers reflects the payoff from nearer-term investments.

Walmart is making strategic moves to attract additional shoppers, including building new stores for the first time in nearly a decade and launching premium food lines. However, the costs of these initiatives and ongoing competition from Amazon, Aldi, and Kroger (KR) may ultimately catch up to WMT and weigh on financial performance in future periods. And at approximately 27x its forward earnings estimate, I view shares as fairly valued in the current market environment. Further progress in Walmart’s strategic initiatives could justify a reassessment. But at present, I view shares as best left on hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.