Summary:

- Walmart stock achieved a new all-time high on Thursday after easily topping Q2 expectations.

- The stalwart in low-price retail reported continuing strength in its value-based offerings and continued momentum in its ecommerce platform.

- The company also reported gains among key demographics.

- Positive commentary pertaining to the macroeconomic environment, as well as upward revisions in full-year guidance, contributed to the bullish sentiment.

- Following Walmart’s rise, WMT shares appear fairly valued at current trading levels.

Alexander Farnsworth

Walmart (NYSE:WMT) shares soared to a new all-time high following the release of its fiscal Q2 earnings results; and rightfully so. The company easily beat expectations and enacted another positive revision upwards to its full-year guidance. WMT also reported continued share gains among key demographics. The stock benefitted from an additional uplift from a strong retail report, which showed sales rising more than expected.

In prior coverage on WMT, I rated shares as fairly valued for the current macroeconomic environment. The stock has since gained about 13%, far surpassing the S&P 500’s (SPY) 4% gain over the same period. The stock has also been a winner on a YTD basis. Relative to the Dow Jones Industrial Average (DJI), the stock is up nearly 40% compared to the DJIA’s 7.5% gain.

Walmart’s success can be attributed, in part, to its strong ROI in capturing a growing share of higher-income consumers, which has boosted sales of its discretionary products. Simultaneously, its value-based offerings have continued to attract those looking for relief from persistent inflation. Additionally, the rising popularity of bulk purchases among younger consumers has provided a boost to Walmart’s Sam’s Club unit.

Following its surge to new all-time highs, Walmart commands a healthy forward premium to earnings. While the stock may continue to rise, I believe a prudent approach is to wait for a more attractive buying opportunity that could emerge in the future.

Walmart Stock Key Metrics

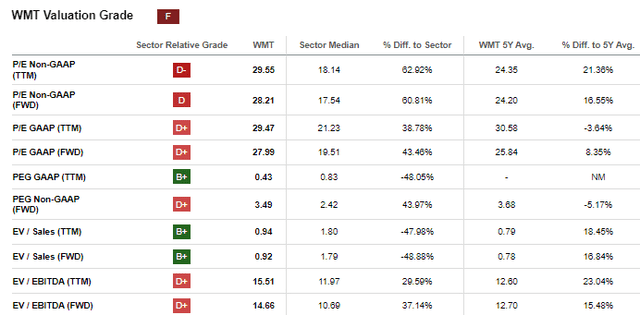

At its current trading value at its new all-time high price, WMT commands a forward trading multiple of about 30x its projected earnings midpoint. This is about 5 turns above its 5-year average. The stock commands a hefty valuation elsewhere, too. At 15x, WMT’s forward EV/EBITDA stands about 37% above the sector median.

Seeking Alpha – WMT Valuation Metrics

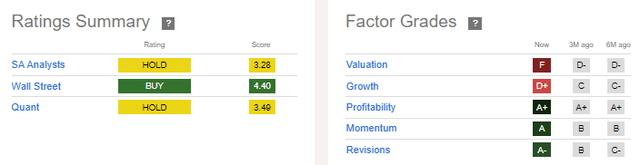

The premium valuation metrics continue to factor negatively in WMT’s Seeking Alpha (“SA”) quant scoring. The company’s valuation, however, is perhaps justified by strong marks on profitability and momentum. In my view, WMT continues to outperform expectations and is gaining ground among a broadening customer base. I believe this warrants WMT’s multiple expansion.

Seeking Alpha – WMT Ratings Summary

Views on Wall Street and the broader SA community are more mixed. While Wall Street analysts view the stock as a “buy” with a target price of approximately $75/share, analysts on SA are more neutral, with over 70% of coverage over the last 90 days geared towards a “hold” rating.

What Did WMT Expect Heading Into Earnings?

Walmart began its fiscal year on a strong note, with Q1 results topping expectations. Driving results at its last earnings release was notable growth with upper-income households, as well as continuing strength in its ecommerce platform. Additionally, despite increased investments in emerging business lines, the company still reported a healthy beat on earnings, led in part by rising gross margins.

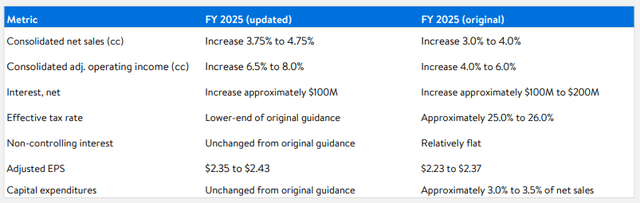

The positive performance In Q1 supported revisions to original guidance, including an increase in the top end of its range. Full-year adjusted EPS, for example, was seen landing at a midpoint of $2.30/share on a range of $2.23/share to $2.37/share.

In outlining guidance, CFO John Rainey somewhat tempered expectations by adding the caveat that it may be too much for investors to expect every quarter to be as good as the first. Nonetheless, Rainey still alluded to the fact that the company has the wind at their back. For Q2, specifically, WMT expected sales to increase between 3.5% to 4.5% and for operating income to grow between 3% to 4.5%. This was then expected to result in EPS of between $0.62/share to $0.65/share.

Walmart Q2 Results Recap

Though Rainey cautioned investors from expecting an encore performance to Q1, WMT still roared past expectations. The retailer reported comparable sales growth of 4.2%, topping expectations for 3.5% growth. In his statement accompanying the release, CEO Doug McMillon highlighted that every facet of the business is growing, with a compounding effect seen in ecommerce.

The results supported the statement. During the quarter, global ecommerce grew 21%. This builds upon growth of 22% in Q1. The rise in ecommerce is significant as it has enabled continued growth in other aspects of their business. Results showed that membership income grew 23%, with plus memberships up double-digits and their Sam’s Club unit achieving a record member count.

Within Sam’s, Rainey noted during the conference call that membership is growing notably among the Gen Z and Millennial generations. In Q2, it was reported that the two groups made up about half of the unit’s new members. As the younger cohort continues to embrace the value of bulk, I expect continuing growth in the periods ahead for Sam’s Club.

Investments made to capture an additional share of higher-income consumers appears to be paying off. Partly supporting U.S. comparable sales growth were strong traffic trends. Higher engagement was seen across all demographics, though upper-income households were mostly to credit for the gains. Still, earnings commentary noted that customers remain value-oriented. Ultimately, the combination of the two helped support growth in both their discretionary and consumable categories.

In looking ahead, the management team again released positive revisions to their full-year guidance after reporting first half growth in net sales and operating income of more than 5% and 10%, respectively. WMT now sees full-year sales growth of between 3.75% and 4.75% and operating income growth of 6.5% to 8%. This is expected to contribute to a new adjusted EPS midpoint of $2.39/share, or about 3.9% above the previous midpoint.

WMT Earnings Release – Summary Of Full-Year Guidance

Is WMT Stock A Buy, Sell, Or Hold?

WMT’s rise to all-time highs appears justified, given its Q2 results, which surpassed expectations. The nearly 4% increase in its earnings guidance midpoint since Q1 highlights the success of Walmart’s investments in attracting higher-income consumers, achieved without compromising earnings growth.

The continuing growth of the Sam’s Club unit is particularly noteworthy, especially as it was fueled by significant membership growth among the Gen Z and Millennial generations, demographics which made up about half of the unit’s new members in Q2. In my view, this trend points to sustained growth as younger consumers increasingly see the value in bulk purchases.

WMT’s share gains on the day were aided in part by a stronger than expected July retail sales report, as well as by management commentary that eased recession worries. Following these gains, Walmart’s shares are now up around 40% YTD. In addition, the stock’s forward multiple stands at about 30x, notably above its five-year average in the mid-20x range.

Though WMT’s results through H1 may justify the multiple expansion, momentum positioning by investors may not be the best move at this time. Despite gains among higher-income consumers, commentary did note a step-down within this demographic. Furthermore, Rainey did note that prudence is warranted in providing guidance, given current economic conditions.

In my view, a “hold” on Walmart Inc. shares remains appropriate. While the company has performed strongly, its premium valuation could lead to a more pronounced pullback if it fails to meet expectations. With a softening labor market potentially affecting Walmart’s core customer base, future results may also be impacted. I would reassess if shares did pull back from current trading levels, but until then, a “hold” appears prudent.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.