Summary:

- Walmart Inc. reported its second quarter 2024 results yesterday. Unlike rival Target, the brick-and-mortar behemoth reported solid ticket and traffic growth.

- In this update, I review Walmart’s second quarter results, focusing on working capital.

- I address Walmart’s growth efforts in e-commerce and overseas, particularly in India and China. However, growth in the latter segment should be taken with a grain of salt.

- I also answer the question of whether WMT stock is a buy now after solid earnings and given the company’s growth prospects.

aluxum

Introduction

In a diversified stock portfolio that aims to generate respectably growing income through dividends in all economic climates, one is naturally drawn to stocks of companies that satisfy basic human needs, such as consumer packaged goods manufacturers and retailers. Owning stock in the world’s probably best-known retailer, Walmart Inc. (NYSE:WMT), seems only natural.

I first covered the company in May 2022, after high inflation began to rear its ugly head and the retailer’s stock sold off sharply. In a follow-up article published in February 2023, I revisited my original investment thesis and detailed what I expected to see from the company in 2023 and beyond. I concluded that the stock was not a good buy – either from a total return or dividend growth perspective. In the meantime, however, the stock delivered a return of nearly 12%, slightly outperforming the S&P 500 Index (SP500).

With fiscal 2024’s second quarter results on the table, I now want to reassess and find out whether the stock’s continued good performance is justified or merely the result of investors’ growing optimism after the bear market of 2022. I will discuss whether the company’s growth efforts are bearing fruit, considering it will inevitably have to abide by the law of large numbers at some point – or has it already?

Walmart Q2 Earnings And Sales – Solid, And Even Taking Market Share From Competition?

Walmart delivered solid earnings and sales growth in the second quarter of fiscal 2024. This doesn’t seem too surprising for one of the most trusted – if not the most trusted – omnichannel retailers in the United States. Particularly in times of high inflation, consumers increasingly emphasize value for money, and Walmart continues to deliver on its promise and customers’ expectations, thanks largely to its scale, highly efficient distribution network and procurement systems, and fundamentally sound working capital management.

The company beat analyst estimates on both earnings per share (EPS) and revenue. Non-GAAP EPS of $1.84 was $0.13, or nearly 8%, above consensus. On a GAAP basis, earnings were significantly higher ($2.92), primarily due to unrealized gains on investments in JD.com (JD) and Symbotic. Recall that in Q3 of fiscal 2023, the company posted a loss of $1.11 per share in this context. Such earnings fluctuations are rightly excluded from adjusted EPS, in my view. In addition to the changes in the fair value of these investments, Walmart adjusted earnings for a $0.03 negative impact due to an incremental opioid case settlement expense (see p. 31 of WMT’s fiscal 2023 10-K for more information).

Revenues increased by 5.7% year-over-year to $161.6 billion, above the period-average inflation rate in the United States (3.4%), although it should be noted that this rate was significantly impacted by deflationary effects due to lower energy costs. Grocery inflation remains in the mid-single digits, which was also underlined by comments made by Chief Financial Officer John Rainey during the earnings call. At constant exchange rates, revenue growth was only 30 basis points weaker, confirming Walmart’s focus on the U.S. (about 70% of net sales in fiscal 2023). The company’s domestic sales grew a solid 6.4% year-over-year on a comparable basis, excluding fuel.

Looking at ticket size and traffic, Rainey noted in the Q&A session that both grew about 3% in the second quarter, which is certainly a solid performance given Walmart’s size. The company’s strong value proposition continues to show its impact at a time when smaller competitor Target Corp. (TGT) saw comparable sales decline 5.4% and traffic decline 4.8%. In terms of goods sold, management noted a 240 basis point shift from general merchandise to grocery and health and wellness products.

This is putting pressure on margins, but should not be over-interpreted. Rather, the shift should be taken as a sign of consumer confidence in Walmart to meet its self-declared objectives in any economic environment. As consumer sentiment improves (Q3 looks good so far) and grocery inflation eases, I would expect Walmart’s sales mix to return to mean-revert.

Walmart’s Cash Flow Issues Are Resolving, And The Company Is Poised To Become An Even Stronger Player In E-Commerce

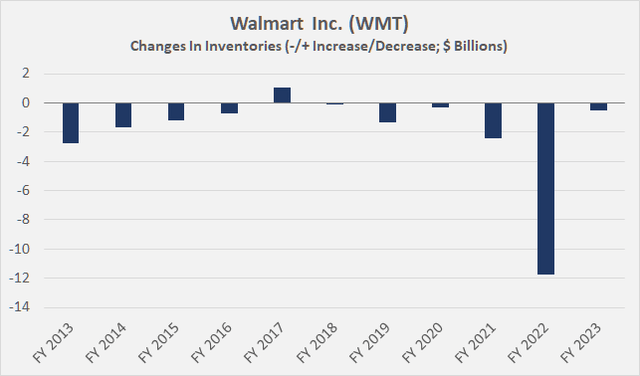

The company is successfully working through its high inventory levels (as are most, if not all, retailers) and has been able to slow inventory purchases again. The improved inventory situation is highlighted by a 50 basis point increase in gross margin, largely due to lower inventory markdowns. It is worth recalling that fiscal 2022 saw a huge increase in inventories (Figure 1), which had a negative impact on operating cash flow, which fell by 33% year-over-year.

Figure 1: Walmart Inc. (WMT): Changes in inventories over the last ten years (own work, based on company filings)

No wonder Walmart’s management did not hesitate to announce strong growth in both operating and free cash flow (FCF): The former nearly doubled to $18.2 billion, and the latter quintupled to over $9.0 billion. But before you break out a bottle of champagne now, remember that the second quarter is a particularly easy comparison due to said working capital issues.

However, despite the recovery, it would be unreasonable to expect a record year for Walmart in terms of FCF, as working capital is still quite high and the strong capital expenditures.

Inventories declined by $3.2 billion year-over-year from a balance sheet perspective, but increased slightly so far in fiscal 2024 (cash flow perspective). Receivables are generally quite low, but accounts payable increased $2.4 billion year-over-year (balance sheet perspective), or $3.0 billion year-to-date from a cash flow perspective, somewhat offsetting the cash tied up in inventories.

Walmart invested $9.2 billion in the company so far in fiscal 2024, $1.7 billion more than last year, primarily to strengthen its e-commerce, pickup and delivery presence (>4,000 locations) – not only through Walmart+, but also through Walmart Fulfillment Services (supply chain and fulfillment capabilities for online marketplace sellers) and Walmart Go Local. As an aside, last year, the company even began offering its Walmart+ members access to the Paramount+ streaming service. The company’s presence in the U.S. is nothing short of spectacular, making it easily the most convenient universal retailer in the country. But make no mistake: Walmart is far from being able to compete with e-commerce incumbent Amazon.com Inc. (AMZN) in this particular discipline.

Internationally, the company seems to have learned its lesson by pursuing growth opportunities that don’t necessarily involve establishing the iconic Walmart brand overseas (e.g., Germany, until the exit in 2006 ). In my opinion, the company has found its secret recipe to cement its dominance internationally as well, through acquisitions and collaborations.

The acquisition of a 77% stake in Flipkart, a leading Indian e-commerce company that was recently strengthened by the acquiring Tiger Global’s stake, was definitely an important step in 2018. Last year, Walmart increased its stake in PhonePe, a digital transaction platform and former subsidiary of Flipkart, by about 13% to 89%. In the second quarter of fiscal 2023, Walmart’s stake declined to 85% due to PhonePe’s ongoing capital raising. The U.S. retailer is also aggressively expanding into other financial services providers such as Cashi in Mexico and ONE domestically. Skeptical investors might argue that Walmart is losing its focus and is now desperate for new growth opportunities as it finds that it is increasingly subject to the law of large numbers. I see it differently and view the company’s efforts as a smart move to gain a share of the (arguably highly competitive) payment services business by leveraging its extremely strong network but also brand name.

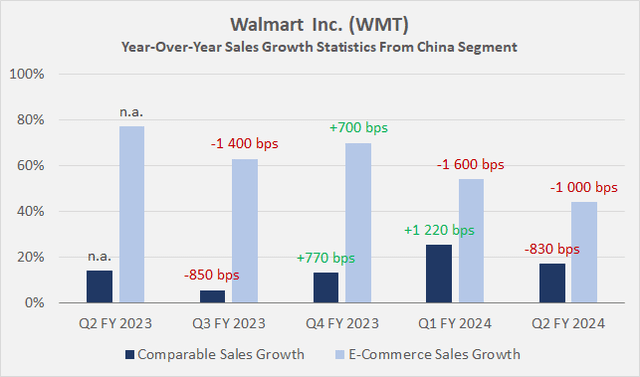

In my view, Walmart’s partnership with JD.com from China should also pay off over time. Partnering with a local primus was definitely a smart idea. Comparable sales growth in the second quarter was solid at 17.2% year-over-year, but it’s important to realize the fairly easy comps due to strict COVID-19-related lockdowns last year. E-commerce sales growth slowed again in the second quarter to 44% year-over-year (Figure 2), so it’s worth keeping an eye on the normalization in China. There is an inherent need for aggressive growth, given that Walmart China contributed only 2.6% of consolidated net sales in the second quarter. To end on a positive note, however, Walmart achieved e-commerce penetration of around 47% (up 7 percentage points from the previous quarter), which is very encouraging.

Figure 2: Walmart Inc. (WMT): Sales growth statistics from its China segment (own work, based on WMT’s fiscal 2024 Q2 earnings press release)

Conclusion – Why I Don’t Buy WMT Stock Despite Its Dominance

Walmart reported solid results yesterday. The company beat estimates for both earnings per share and revenue. While competitor Target reported a decline in same-store sales and lower traffic, Walmart shined on both counts. The sales mix suggests consumer confidence is still quite low, but things are improving, in my opinion.

The company is successfully working through its excessive inventories, and cash flow is expected to recover significantly this year. Inventory markdowns continue to weigh on margins, but this is temporary, as is the current fairly pronounced price sensitivity among consumers. Walmart is in a great position as one of the most trusted retailers in the country thanks to its unwavering commitment to value for money. At the same time, however, let’s not forget that competition in retail is fierce – Walmart’s Sam’s Club cannot (yet?) compete on a level playing field with Costco’s (COST) membership offerings or Amazon’s undoubtedly strong value proposition and very high convenience in e-commerce.

Walmart continues to invest aggressively in e-commerce, and the 24% growth in the second quarter of fiscal 2024 was definitely encouraging to see. I think the company’s investments in emerging markets, particularly China and India, are very promising. While it can be difficult to translate Walmart’s values to a completely different culture, partnerships like the one with JD.com, and the majority stake in Flipkart seem like a promising approach. Walmart’s e-commerce penetration in China is very high, but growth continues to slow and should be watched closely given the segment’s still almost negligible contribution to sales. The company’s increasing efforts to enter the payment services space, which in itself is a highly competitive field, could be seen as a sign of desperation. However, if one is more optimistic, there is nothing to stop the company from leveraging the power of the Walmart brand (which is definitely associated with trust) and that of a foreign primus like PhonePe.

However, even though it looks like Walmart is pulling the right levers to ensure that it can continue to grow despite its size (>$610 billion in global sales), a great business does not necessarily make a sound investment.

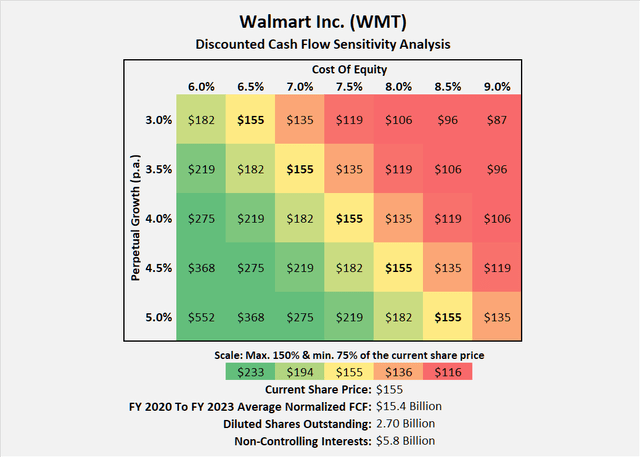

My discounted cash flow model (parameters in Figure 3) suggests that the company needs to grow its free cash flow by about 4% in perpetuity for the stock to be fairly valued at present. This assumes that the potential investor is satisfied with a cost of equity of 7.5%. Given Walmart’s very reliable earnings and cash flows over long periods of time, I think a fairly modest risk premium is indeed appropriate. However, anything less than 3% on top of the current yield on long-term U.S. Treasuries (currently 4.2%) strikes me as too low.

However, I don’t want to be misunderstood as saying that I view WMT stock as fairly valued at $155. Given that the company has only been able to grow its free cash flow by about 2.7% over the past decade, applying a perpetual growth rate of 4.0% seems a bit optimistic. In my opinion, market participants have already priced in Walmart’s success in international markets. As a conservative investor, I am always cautious about including significant cash flow contributions that are far in the future in my valuations. At current levels, there is clearly no margin of safety for WMT stock.

Figure 3: Walmart Inc. (WMT): Discounted cash flow sensitivity analysis (own work, based on company filings and own estimates and calculations)

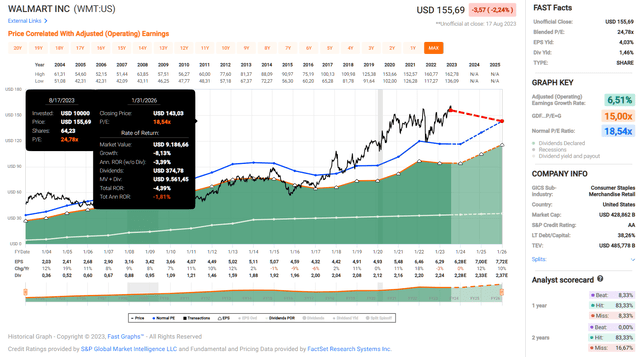

The FAST Graphs chart in Figure 4 also indicates poor (short-term) return prospects. A long-term average market multiple ratio of 18.5 times adjusted earnings is acceptable, in my view, given the company’s dominance in brick-and-mortar retail and its wide economic moat. However, a blended price-to-earnings ratio of 25 currently seems definitely excessive for a mature company with solid but limited growth prospects in percentage terms. Finally, WMT stock is also a poor investment from a dividend perspective. A current yield of 1.47% compares pretty poorly to a five-year average yield of 1.70%, and especially considering the weak dividend growth. In my last article, I shared several yield projections – in short, the yield-on-cost of WMT stock will barely reach 3.0% after 50 years if management continues to maintain annual dividend increases of $0.04, which have been maintained since 2014.

I want to end this article on a personal note and thank all my readers and followers for the continued support. I realized I just published my 200th article, and the journey so far has been a particularly valuable experience – thank you for the continued strong engagement. As you know, I always greatly appreciate the discussion in the comments sections below my articles.

Figure 4: Walmart Inc. (WMT): FAST Graphs chart, based on adjusted operating earnings per share (FAST Graphs tool)

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.