Summary:

- Walmart has shown resilience and growth in the face of challenges, with stock price outperforming market indices over the past three years.

- Q1 earnings showed strong performance, especially in international sales and e-commerce, setting high expectations for the upcoming Q2 report.

- Management’s focus on supply chain innovation, omnichannel experience, and emerging segments like advertising and memberships will be key to Walmart’s future growth and valuation.

- However, market’s Q2 expectations of Walmart indicate elevated expectations ahead of management’s projections leading to higher valuation premiums.

JHVEPhoto

Investment Thesis

After successfully navigating periods of turbulence arising from uncertainty from the pandemic, inventory shrinkage that plagued the retail sector, and supply chain inflation, Walmart (NYSE:NYSE:WMT) looks to be a renewed retail enterprise.

The Bentonville, AR-based retail behemoth has found a renewed sense of purpose, expanding its strength in its retail business and shrewdly investing in strategic initiatives that are accretive to its vision for long-term growth.

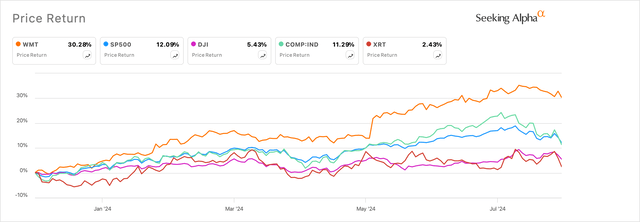

Markets have also responded accordingly by rewarding the company with their beliefs and bidding up the stock price. This has resulted in a respectable performance in Walmart’s stock over the past three years, beating market indices and benchmarks.

Walmart is having a banner year in 2024, beating all indices (Seeking Alpha)

At the same time, with Walmart set to report earnings in two weeks from now, on August 15th, before markets open, the upcoming Q2 report from Walmart will be crucial in defining the path forward for 2024.

Walmart is already up 33% this year, three times the ~11% that the S&P 500 has returned, & I believe the company will have a steeper wall climb in the upcoming Q2 earnings cycle with its valuation levels being elevated. After analyzing the company’s updates since its Q1 earnings and the broader retail landscape, I believe investors would benefit by staying neutral on the company for now, despite its long-term fundamental strength.

Recapping Walmart’s Q1 Earnings and Updates Since Then

In the previous quarter, Walmart reported total Q1 FY25 sales worth $161.51B, up 6.1% and marking another quarter of reacceleration in total sales. The company’s total sales came in much higher than the 4-5% projected sales growth that management themselves had estimated for Q1.

Walmart Q1 sales beat estimates while U.S. comp store sales slowdown moderated (Investor Presentation, Walmart)

Walmart was able to achieve this performance while U.S. comp. store sales continued to decelerate, albeit at a slower pace of 3.8%.

In the U.S., management reported that the company continued to hold on to their share of higher-income households that they have been steadily acquiring since 2022, and this cohort of consumers was one of the cohorts responsible for driving growth in transactions and unit volumes that led to the comp. sales growth in the U.S. Health & Wellness as well as Grocery categories continued to be popular categories of consumer spending as viewed by management in Q1 as well.

But the interesting observation in my view was the robust performance reported by Walmart in their international retail stores, as can be seen in the chart below.

Walmart reported impressive international sales in Q1 FY25 (Investor Presentation, Walmart)

Walmart continued to grow its international sales by double digits, with strong growth from China, Walmex, and Flipkart. Ecommerce sales continued to be a major channel of sales growth, growing by a median of 23% in international geographies. I see that this was better than the 9.6% growth in international sales that Amazon (NASDAQ:AMZN), Walmart’s competitor, had demonstrated in their Q1 earnings.

Walmart’s Q1 results were a reaffirmation of the LT vision that management had outlined in their 2023 Investor Day presentation last year. Management had highlighted investments that they had been making in their “leveraging a state-of-the-art integrated supply chain network” and expanding on their omnichannel experience, which would drive ~4% top-line and bottom-line growth.

Things to watch out for in Q2 FY25 earnings

Since Walmart’s Q1 earnings, management has participated in a few conferences, such as Evercore ISI’s Retail conference and a BofA conference. At both conferences, management reaffirmed their growth strategy, which leaned on supply chain innovation & omnichannel experience via e-commerce as detailed in their 2023 Investor Day presentation.

In the Evercore ISI conference, management hinted at some sort of penetration in the e-commerce market, saying:

I think it’s also important to note that a lot of that growth is coming through e-commerce. That’s probably fairly obvious. But when the e-commerce opportunity for us is growing at 20% year-on-year consistently, we’re just seeing a lot more customers that are coming to us in a manner that they haven’t historically, where maybe historically, we were more of a brick-and-mortar business. We’re continuing to move more and more to e-commerce, and I think this speaks to how convenience is resonating with customers.

Another pillar of the omnichannel strategy that Walmart has embarked on is the robust high-margin growth in Walmart Plus & delivery. Management reiterated their observations from the Q1 call, where they said that 20% of Walmart’s operating income had actually come from Walmart Plus as well as its advertising business.

Additionally, management said that Walmart Plus users usually “spend about twice as much as an average customer.” Per Evercore’s estimates, there are reportedly 15M Walmart Plus members, so the spending habits that management pointed to would be extremely beneficial to Walmart’s top line and their operating income.

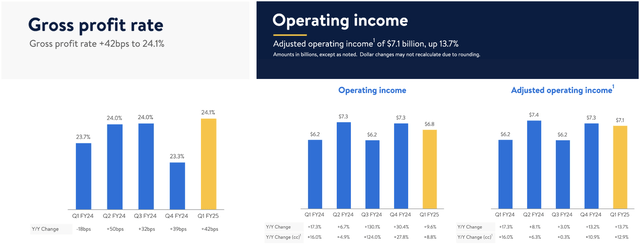

Currently, Walmart’s management is calling for consolidated operating income to grow 3.0-4.5%, mostly in line with the 3.5-4.5% top line growth for Q2. This indicates Walmart is expecting margins to remain relatively flat in Q2 after the 14 bp margin expansion seen in Q1 to 4.24%.

Walmart’s gross margins and operating leverage trends for the past four quarters (Investor Presentation, Walmart)

What investors can expect moving forward from the Q2 call onwards is some additional color on how Walmart is expanding its margins, especially its gross margins. On the previous Q1 call, management took feedback from analysts and mentioned they will break down its margin composition by segments to help investors consistently pinpoint segments of growth that were impacting Walmart’s margin profile.

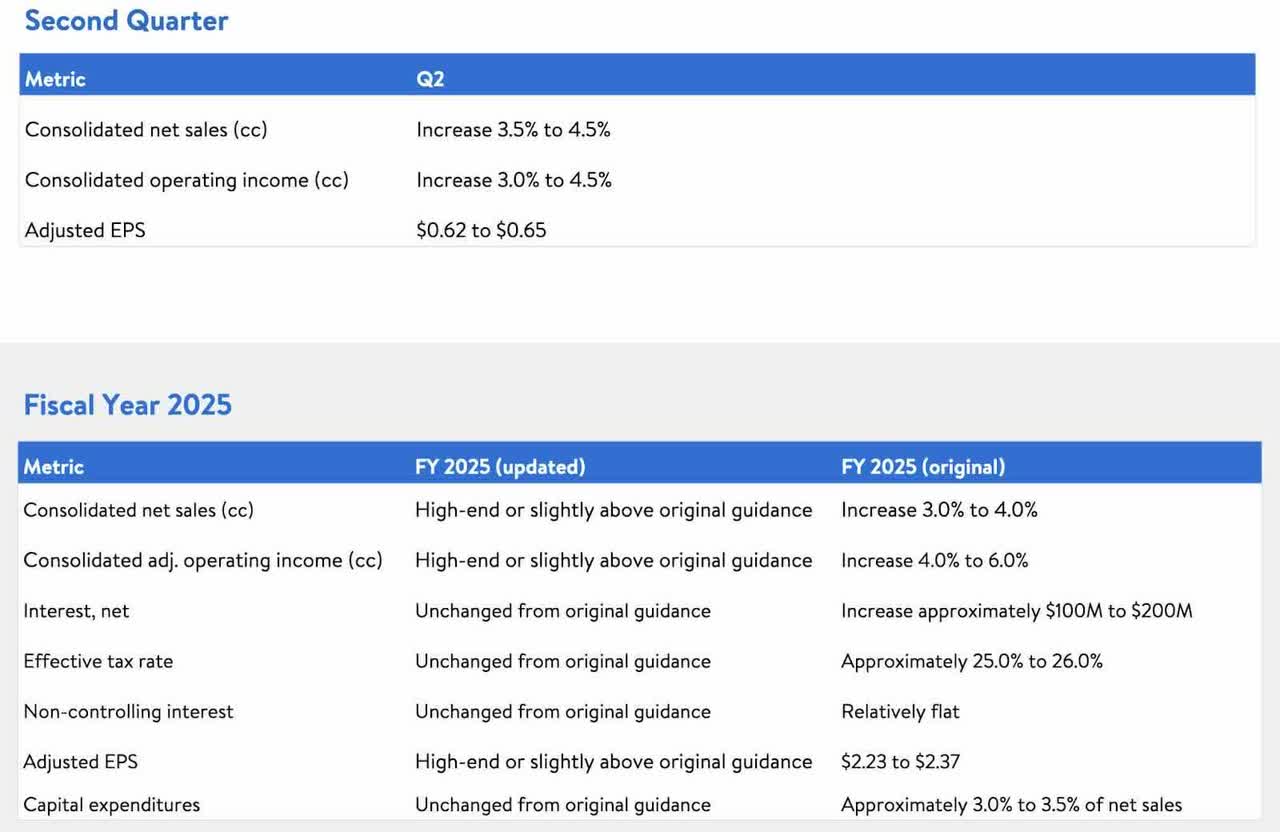

Walmart’s management has marginally upgraded their outlook for Q2 and FY25, now expecting revenue and operating income to reach the high end of their initial guidance, as seen in the chart below.

Walmart has raised their guidance towards the higher end of their original guidance (Q1 Press Release, Walmart)

Here is some additional commentary across key metrics to watch out for:

-

Revenue Growth: Markets are optimistic about Walmart delivering growth at the high end of their guidance range for Q2, expecting 5% growth in Q2 EPS to 64 cents and 4.4% growth in Q2 sales to $167.3B. Additionally, for FY25, markets are expecting Walmart to guide FY25 revenue growth of 4.7%, well above management’s guidance range, while EPS is expecting to grow at 9.7% to $2.43.

-

Consumer Outlook: Personally, I will be very keen to hear how management characterizes their Q2 performance and their outlook, keeping in mind the backdrop of “choiceful and discerning” customers being choosy about how much they spend. This becomes even more important as a recent string of economic data this week indicates a weakening consumer environment from the perspective of jobs, manufacturing, and services.

-

International Sales & Sam’s Club: Markets will also be looking for signs of continued sales growth in Walmart’s International segment as well as Sam’s Club segment. Management has been optimistic about the growth also being seen in Sam’s Club, where the entire omnichannel experience seems to be resonating with the newer cohort of customers led by Millennials and Gen Z customers.

-

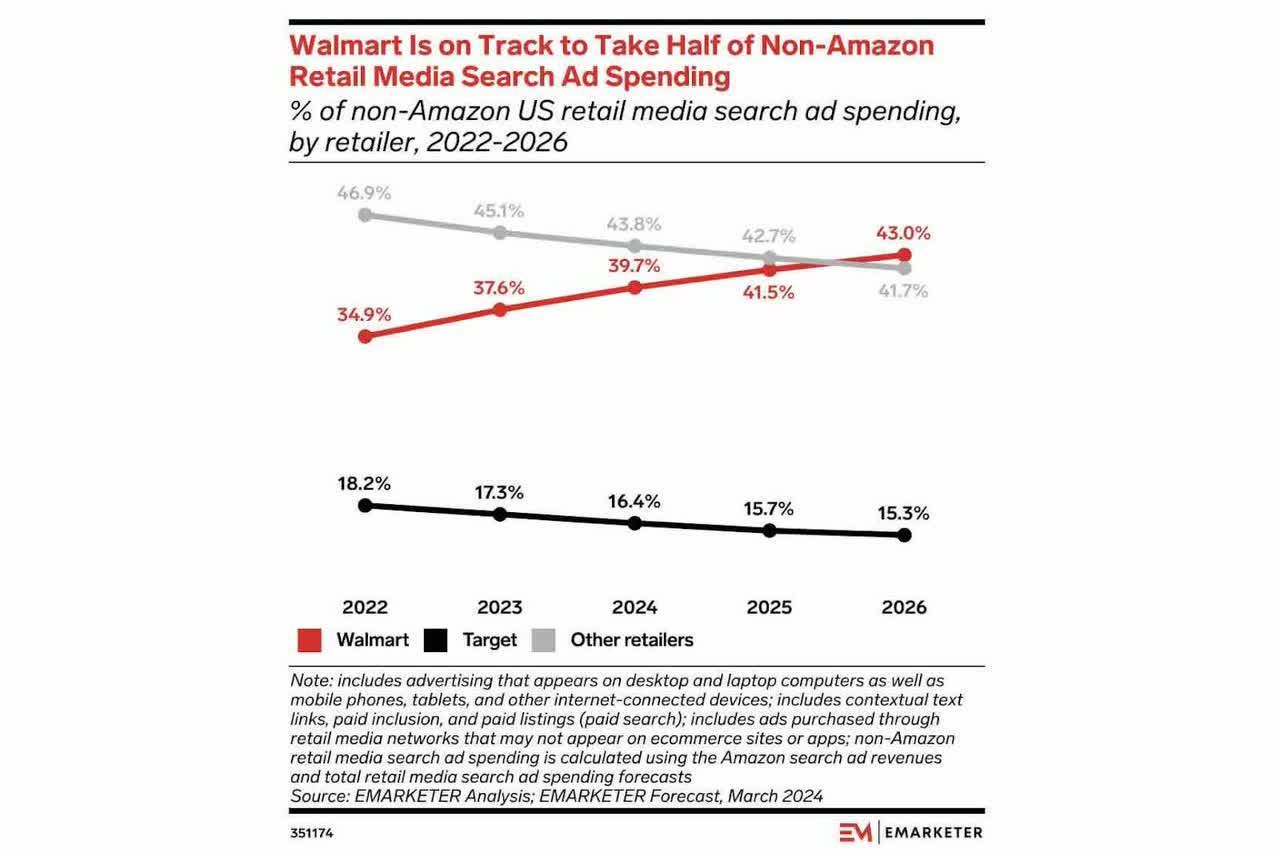

Digital Advertising Momentum: Walmart’s advertising revenue has been picking up at an impressive pace, growing at break-neck speeds of +20% consistently. With Walmart Connect driving growth as well as Flipkart and WalMex driving stronger international growth in ad sales, This is important, in my opinion, since emerging segments such as advertising, memberships, etc. are not just growing at double-digit growth rates but are making larger contributions to Walmart’s total operating income. In the Q1 call, management said “about a third of that came from our newer businesses like advertising, membership, and data ventures, and we’re quite excited about that.” Sustained momentum in this space will be crucial for Walmart to warrant high valuations and multiple premiums, in my opinion.

Walmart will continue growing its share of non-Amazon retail media search ad spending over the next two years (eMarketer)

Valuation Indicates Limited Upside Before Earnings

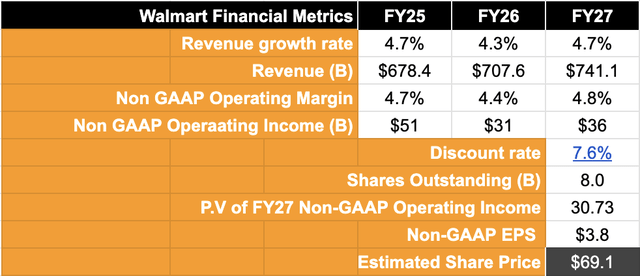

Looking ahead, assuming that Walmart is able to meet Q2 expectations and even raise their guidance, I believe the company can generate $678B in FY25 sales this year, growing at 4.7%. My assumption for higher-than-expected revenue growth is based on higher-than-expected growth in unit volume since management has mentioned they do not expect any price inflation at their stores for the next few quarters. In addition to this, the growth in their emerging segments, such as advertising, memberships, etc., should drive 4.7% CAGR sales growth through the next three years.

In terms of profitability, the increased mix of higher-margin digital ad revenue and memberships should increase the composition of these fast-growing segments in the operating margin profile for Walmart, driving incremental margin expansion. As a result, I believe Walmart can deliver a 9.6% CAGR in operating income growth, with margins expanding by about 20 bp per year on average.

Walmart’s valuation shows limited upside heading into Q2 earnings (Author)

The high single-digit growth in Walmart’s earnings that I expect over the next three years, warrants a forward valuation multiple of ~18x, if I compare this to the 10-year earnings growth rate of the S&P 500. This valuation indicates Walmart’s upside is capped as it heads into its Q2 earnings.

Takeaway

Walmart sits at a critical juncture, with the stock having run up faster than most market indices, while the company is expected to report Q2 earnings in two weeks. Expectations are clearly running high, and markets may even be hoping for Walmart to beat-and-raise guidance. But should the company stay conservative, Walmart’s stock would stay range-bound for a few months.

As a result, I will rate the stock a Hold at its current levels and look for more information from the Q2 earnings report before reassessing my outlook on Walmart.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.