Summary:

- Walmart’s Q3 earnings report shows solid growth in net sales and comparable sales. Nevertheless, WMT stock is down 8% on what looks like only minor flaws.

- I take a look at WMT’s fiscal third quarter results, particularly in terms of growth trends, profitability and cash flows, highlighting potential reasons for the selloff.

- WMT stock remains overvalued, and I’m even inclined to say that short-term Treasuries are a comparatively better investment at this point.

- However, while it sounds straightforward to sell WMT stock at a P/E of 25 and an FCF yield <3%, it depends on one's goals and priorities whether the stock should be held or sold.

demaerre/iStock via Getty Images

Introduction

Retail giant Walmart (NYSE:WMT) reported its fiscal third quarter results today. Smaller rival Target (TGT) surprised its rather pessimistic investors yesterday, sending the stock soaring 17% mainly on better-than-expected margins and amid a broad relief rally. However, apart from the different size, scale and value proposition of the two companies (see my comparative analysis), it should be noted that Target stock has been under severe pressure since the beginning of 2022, while Walmart stock just reached a new all-time high. With this in mind, I will take a look at Walmart’s latest earnings report and assess whether the undoubtedly premium valuation is justified.

Walmart Q3 Earnings Review – Why So Sad, Mr. Market?

At the time of writing, WMT stock is down 8% in reaction to its fiscal third quarter results – let’s take a look at what Mr. Market might not like about the report.

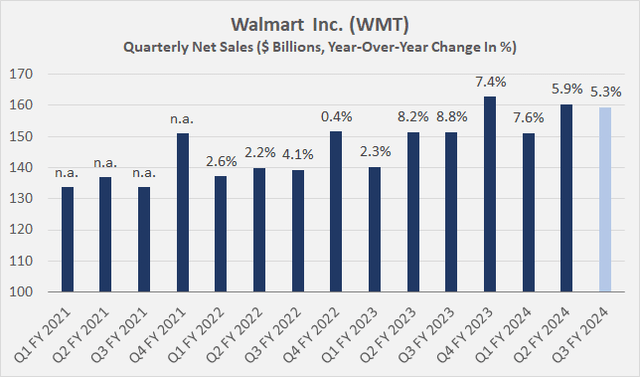

The company posted adjusted earnings per share of $1.53, slightly beating the consensus estimate of $1.52. Management reported consolidated revenues of $160.8 billion, representing 5.2% year-over-year growth – admittedly a solid result amid continued high inflation (assuming fundamentals remain intact, retailers should be able to pass on all or most of the increased costs). Net sales grew by 5.3% year-over-year (Figure 1) and U.S. comparable sales grew by 4.7%, both including and excluding the impact of fuel sales. Sam’s Club comparable sales growth slowed again when excluding the impact of fuel sales to 3.8%, compared to 5.5% in the last quarter and 10% in the third quarter of fiscal 2023.

Figure 1: Walmart Inc. (WMT): Consolidated net sales and year-over-year change in percent (own work, based on company filings)

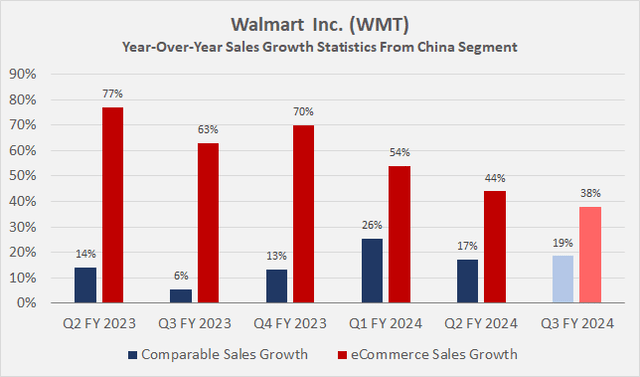

Walmart’s international performance was superficially very strong (+11% sales growth), but should not be overstated due to the extremely strong U.S. dollar in the third quarter of fiscal 2023. On a constant currency basis, net sales grew by 5.4% year-over-year, mainly driven by Walmex and China. However, Walmart China is still a very small segment with a contribution of only 2.8% to total net sales, so the strong year-over-year net sales growth of 25% should not be over-interpreted. Comparable sales growth was significantly weaker than net sales growth, but as Figure 2 shows, the company’s expansion efforts in China appear to be increasingly bearing fruit. That said, e-commerce sales growth slowed for the fourth consecutive quarter (red bars in Figure 2), underlining the fierce competition in this market.

Figure 2: Walmart Inc. (WMT): Sales growth statistics from the China segment (own work, based on company filings)

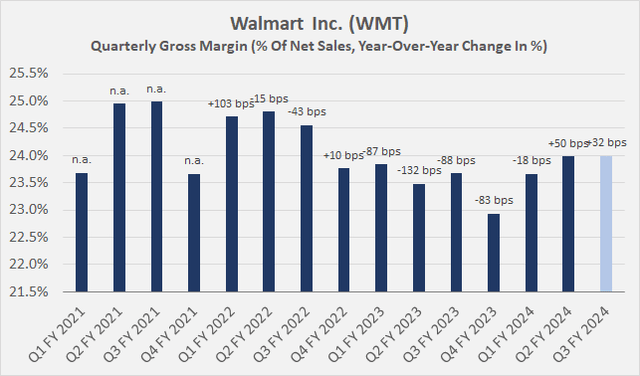

Against the backdrop of overall robust sales growth, it was reassuring that Walmart’s consolidated gross margin increased slightly by 32 basis points. But of course, it will be important to see how Walmart performs next quarter and whether the stabilization proves to be sustainable. I suspect it is, but there’s still room for improvement compared with the historical average. In my view, it’s safe to conclude that Mr. Market was readily expecting gross margin to stabilize further, largely due to easing inflationary pressures and already quite strong results in the fiscal second quarter:

Figure 3: Walmart Inc. (WMT): Gross margin and year-over-year change in basis points (own work, based on company filings)

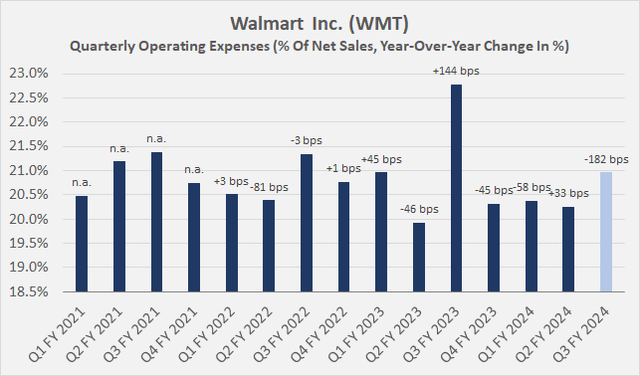

Operating expenses were a bit high this quarter (Figure 4), which may have contributed to Mr. Market’s negative sentiment (I wouldn’t overinterpret the 182 basis point improvement year-over-year). However, given wage-related pressures, I think the quarterly results are quite good and remain in line with the three-year average of 20.9% of net sales (standard deviation ±0.7%). In my view, it’s quite remarkable how Walmart is coping with this difficult environment, especially given the pronounced operating leverage of the retail sector. This clearly demonstrates Walmart’s leadership position and how well its associates and management understand the customer base.

Figure 4: Walmart Inc. (WMT): Operating expenses in percent of net sales and year-over-year change in basis points (own work, based on company filings)

Operating cash flow has been significantly better so far this year than in the same period last year. However, this is largely due to lower additions to inventories (+$7.3 billion vs. +$9.0 billion a year ago) and significantly increased payables (+$7.3 billion vs. with +$3.2 billion). As already discussed in my previous article (Q2 earnings review), I think it’s unlikely that fiscal 2024 will be a new record in terms of free cash flow due to the still high working capital, but also due to the strong investments. Year-to-date, Walmart has invested $14.7 billion, up $2.6 billion year-over-year, strengthening its e-commerce, pickup and delivery presence – not only through Walmart+, but also through Walmart Fulfillment Services and Walmart Go Local. E-commerce grew 24% year-over-year in the U.S., and the associated contribution to comparable sales was a strong 300 basis points (vs. 80 basis points in Q3 of fiscal 2023).

From a balance sheet perspective, there were no significant changes. At around $64 billion, inventories roughly flat compared to the previous year. Against this backdrop, it is probably wise to expect a somewhat underwhelming holiday season, which is also reflected in the lower additions to inventories since the beginning of the year (see above). Indeed, management has warned about consumer spending trends.

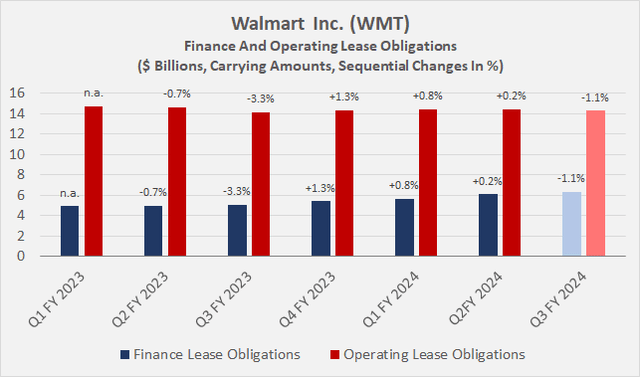

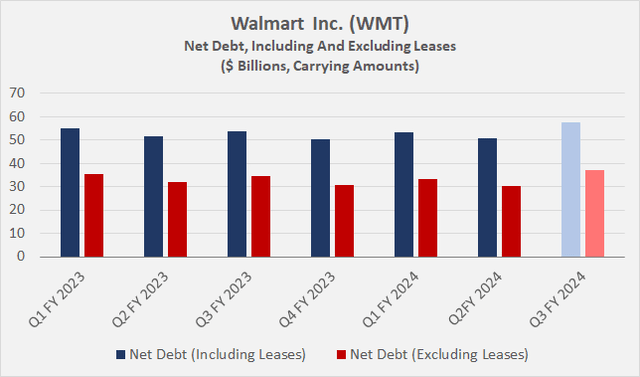

Walmart’s lease arrangements are very stable (Figure 5), suggesting that the company is satisfied with its store footprint and is not planning for a downturn (i.e. potentially allowing leases to expire). The higher net debt, both quarter-over-quarter (+13%) and year-over-year (+7%), confirms Walmart’s heavy investment in its e-commerce capabilities and supply chain (Figure 6). As an aside, I acknowledge that leases are generally not included in the calculation of net debt (at least not prior to the adoption of ASU 2016-02, ASC Topic 842), but since they’re contractual obligations that are typically material to retailers, I think it makes a lot of sense to include them in the calculation.

Figure 5: Walmart Inc. (WMT): Operating and finance lease obligations (own work, based on company filings)

Figure 6: Walmart Inc. (WMT): Net debt, including and excluding operating and finance lease obligations (own work, based on company filings)

Conclusion – Why I Consider The Stock a Potential Sell

All in all, Walmart delivered another solid quarter with a few minor weaknesses, such as slightly higher relative operating expenses, a continued slowdown in comparable sales growth at Sam’s Club and China e-commerce growth. Mr. Market also likely has issues with management’s cautious commentary on consumer spending trends. Likely also contributing to Mr. Market’s negative sentiment was the difference between the increased sales guidance (net sales growth is now expected to be 5.0% to 5.5% vs. 4.0% to 4.5% previously) and EPS guidance, because the latter was raised disproportionately less (midpoint $6.44, +0.5%) and the fact that the updated earnings guidance is below the consensus estimate of $6.50.

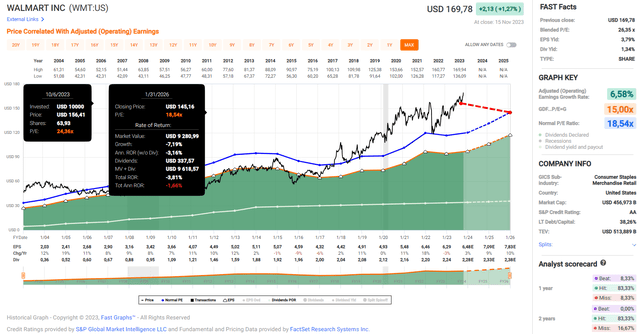

And that’s exactly the issue I see with stocks that are priced to perfection. Just a small hiccup leads to a significant drop in price (WMT shares are down 8% at the time of writing). But despite today’s drop (we’ll see where the journey takes us), I can’t understand the high valuation. The stock still trades at a blended price-to-earnings ratio of 25 (Figure 7), and the free cash flow yield is downright poor (<3%). Granted, the long-term average growth rates in earnings and free cash flow suggest that a higher valuation is warranted, but investors should keep in mind that growth has slowed considerably over the years. Walmart’s domestic growth prospects already are very limited and its international expansion faces significant uncertainties (see my earlier articles).

Figure 7: Walmart Inc. (WMT): FAST Graphs chart, based on adjusted (operating) earnings per share; note that I manually picked a share price representing WMT’s current stock price (FAST Graphs)

With that in mind, and putting myself in the shoes of someone who bought Walmart stock just recently, I think the stock is a sell. The weak growth prospects, the extremely low dividend yield of 0.85% and the slow long-term dividend growth (expect no more than the usual annual increase of $0.04, i.e. less than 2%) make me look for better opportunities – of which there are still plenty at the moment. I’m even inclined to say that short-term Treasuries are a comparatively better investment (even if they are taxed less favorably than dividend income).

However, from the perspective of a long-term investor who’s looking for reliability, steady income and not necessarily outperformance, I still consider Walmart stock to be a hold, also taking into account possible tax consequences and a potentially very high dividend yield on cost. In this context, however, I think it is important to compare the own yield on cost with the starting yield of alternative investments using the following formula:

Figure 8: Calculation of replacement yield (own work)

Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.