Summary:

- Walmart has not been a market-beating investment in the past decade, but recent real estate consolidation and focus on e-commerce and advertising show potential.

- The ‘Old Walmart’ consists of core brick-and-mortar businesses, while the ‘New Walmart’ focuses on digital growth through e-commerce and advertising.

- Walmart’s valuation is at a peak due to its success in e-commerce and advertising, but further upside is expected.

Alexander Farnsworth

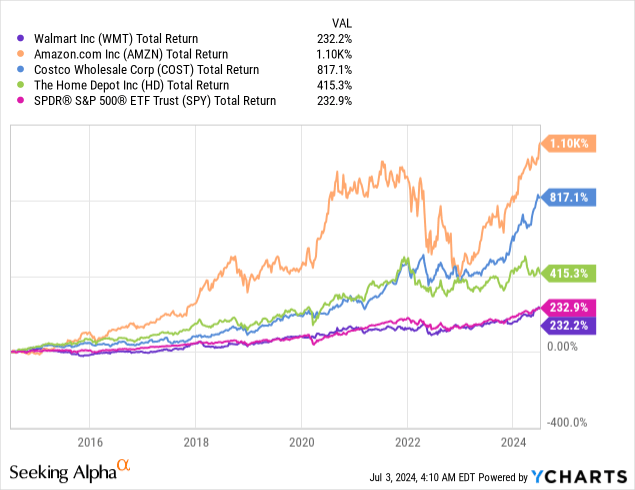

Walmart (NYSE:WMT), the largest company in North America in terms of sales, hasn’t been a market-beating investment for the past decade.

However, after several years of real estate consolidation, exiting underperforming geographies, and leaning heavily into e-commerce and advertising, it appears Walmart has reached an inflection point.

What is the right multiple for the ‘New Walmart’? Let’s try to figure that out.

Understanding Walmart & Brief History Lesson

Founded by Sam Walton in 1962, Walmart was born with the idea of selling a wide variety of goods for an “Everyday Low Price”. Walmart quickly became a success and began expanding rapidly across the United States.

In the 1990s, Walmart went international, opening stores in Mexico, Canada, China, and Germany.

Walmart embraced technology from the get-go, with store managers from all over the U.S. communicating data and sharing ideas. They also developed the supercenter concept, combining grocery shopping with general merchandise like furniture and clothes.

Today, Walmart is the world’s largest company by revenue and number of employees. That said, Walmart certainly doesn’t enjoy a shortage of competition.

Over the years, a long list of retailers has grown to a huge scale along with Walmart, with names like Costco (COST) and Home Depot (HD) rising to hundreds of billions of sales.

In addition, e-commerce giant Amazon is taking a big bite of Walmart’s lunch too.

With Walmart’s already huge scale and maturely developed channels, it makes sense that the company struggled to generate above-market growth, and therefore, it makes sense that its stock performed virtually in line with the market (SPY).

However, since 2010, Walmart has been investing heavily in its e-commerce and advertising businesses, exited underperforming geographies, and consolidated its footprint.

After getting fit and building those new opportunities, the market is recognizing Walmart is poised for its next leg of growth:

So, let’s dive deeper into Walmart’s prospects.

The ‘Old Walmart’

Walmart has five main pillars for growth, which are Walmart U.S., Walmart International, Sam’s Club, E-Commerce, and Advertising. The ‘Old Walmart’, refers to the company’s core brick-and-mortar businesses.

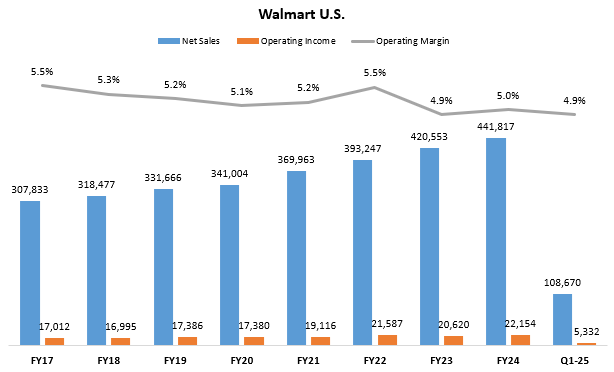

Created by the author using data from Walmart’s financial reports.

Walmart U.S. operates 4,609 stores as of the end of last quarter, down from a peak of 4,769 in January 2019. The segment has grown sales at a 5.3% CAGR between FY17-FY24, with e-commerce leading the way. The main competitive advantage here is groceries and Walmart’s unparalleled geographic presence, with 90% of Americans living within 10 miles of a Walmart store.

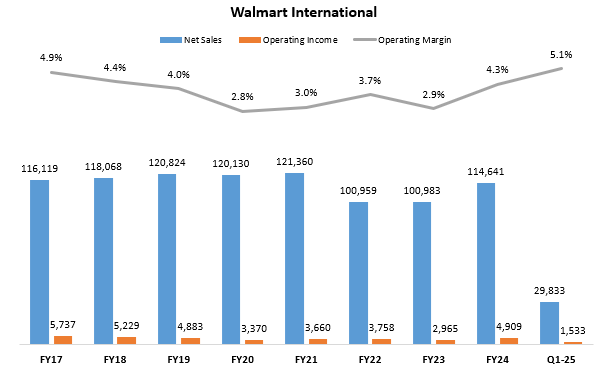

Created by the author using data from Walmart’s financial reports.

Walmart International operates 5,399 stores as of the end of last quarter. The segment has grown sales at a 6.5% CAGR since exiting the UK, with e-commerce, Mexico, and China leading the way. The main competitive advantage here is Walmart’s ability to capitalize on its U.S. strength and leverage its know-how in other geographies.

Created by the author using data from Walmart’s financial reports.

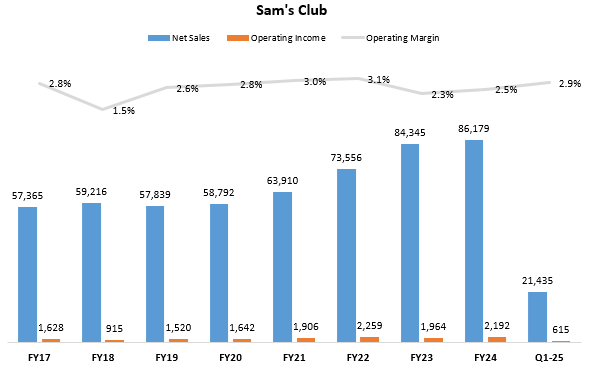

Sam’s Club, which is the company’s club business, operates 599 locations in the U.S., essentially the same store count since 2018. The segment has grown sales at a 6.0% CAGR between FY17-FY24, with e-commerce, home & apparel, and groceries, leading the way. Sam’s Club is the second-largest club operator in the U.S. behind Costco.

The ‘New Walmart’

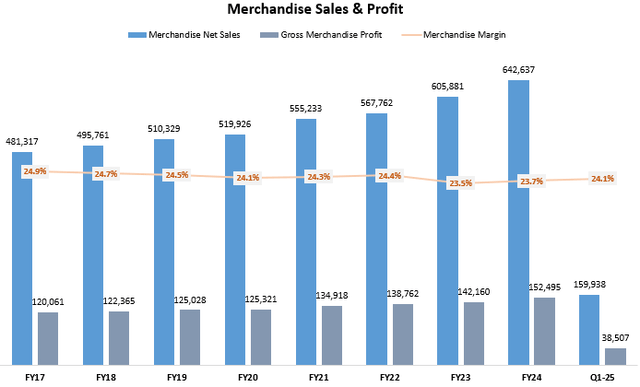

Walmart’s legacy businesses are solid and resilient. They will most likely continue to lead the brick-and-mortar landscape in our lifetime while offering everyday low prices and maintaining stable margins.

Created by the author using data from Walmart’s financial reports.

With that said, those legacy businesses, as we saw, are not enough to outperform the market. So what’s changed? The answer is Walmart’s digital businesses.

Walmart is way ahead of its legacy competitors when it comes to E-commerce and advertising. Furthermore, its management team smartly identified the company’s advantages compared to the overwhelming leader in Amazon, which is struggling to build up a significant fresh grocery operation.

Created by the author using data from Walmart’s financial reports.

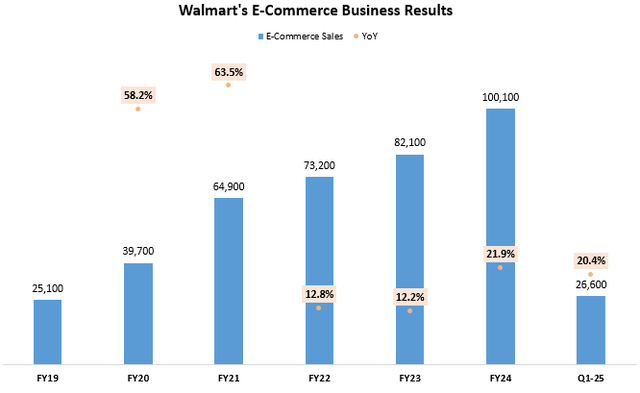

E-commerce sales, which include all of Walmart’s revenues that are initiated digitally (pick-up, delivery, fulfillment, and advertising), grew nearly 4x between FY19-FY24, and are on pace for another year of above-20% growth.

In addition to leveraging its geographic presence and grocery advantages, Walmart is building a ‘closed-loop’ advertising offering that connects digital and physical, a feat that would be extremely hard to replicate by competitors.

In advertising, the most important capability is measuring the return on ad spend. While companies like Alphabet (GOOG) (GOOGL) and Meta (META) have developed a very reliable way to measure conversions probabilistically, deterministic measures will always be better. This is why a company like Amazon is taking the digital advertising landscape by storm, as it’s able to close that loop between an ad impression and a purchase.

Walmart has a similar capability and more. It is currently the only company that can close the loop between a digital advertisement and a physical purchase, and as long as physical purchases continue to be a huge portion of retail sales, Walmart’s offering will remain extremely desired.

That said, Walmart still has a long way to go before its ad offering reaches the attractiveness of Amazon, as it’s still lacking in terms of inventory (places to put ads), and many other important services.

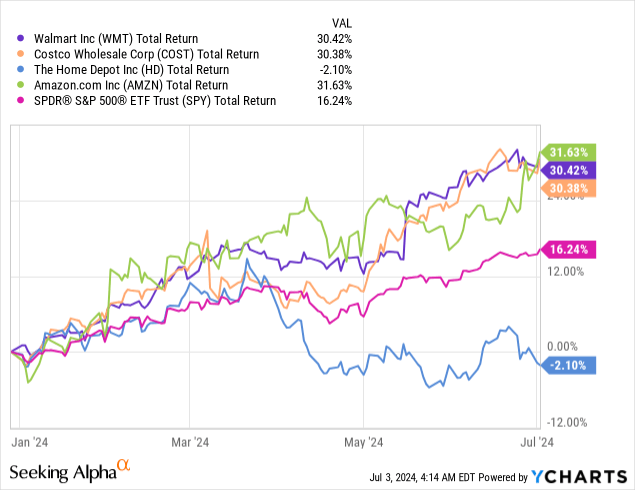

Still, one of the main drivers for Walmart’s YTD performance is undeniably its e-commerce and advertising success.

Valuation & Growth Prospects

Walmart’s years of investment and restructuring reached a tipping point. All of the company’s segments are ready for their next leg of growth, and management is even discussing footprint expansion for Sam’s Club.

E-commerce is gaining significant traction, and the advertising business improves by the day.

All of this is reflected by reaching record highs in profit margins, as well as sustaining MSD growth in sales.

This should continue for the foreseeable future, with management targeting sales growth above 4% and consistent operating margin expansion.

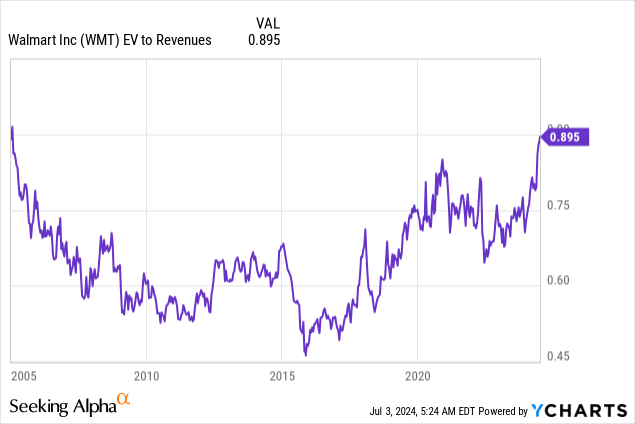

It is therefore no surprise that Walmart is trading at the highest multiple in nearly twenty years (I used EV to Revenues because I believe there’s no noise there).

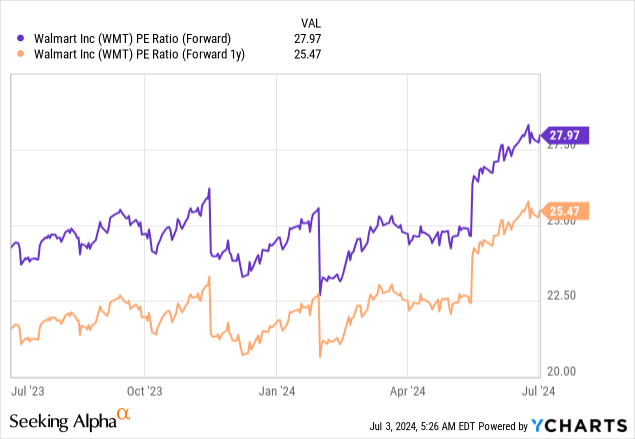

Looking at the company’s PE ratios, we can also see an uptrend and a peak, with the 28 times forward earnings multiple being 20% above the 5-year average.

I do recognize Walmart deserves a higher multiple today, as certainty about its opportunities in digital is at an all-time high. However, it’s important to remember that Walmart is still a slow-growing company. While the company’s scale has a lot to do with it, let’s not forget that Amazon is nearly the same size and is still growing at a double-digit pace.

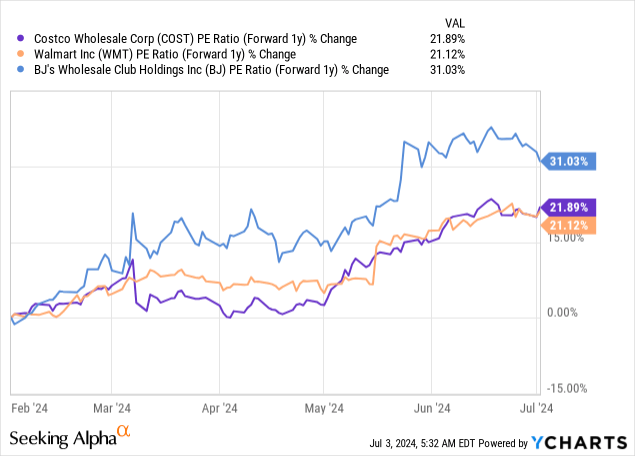

Another thing that’s worth noting is that several of Walmart’s peers, which don’t have a similar digital story, are also trading at peak valuations, with Costco and BJ’s Wholesale Club (BJ) 38% and 24% above their 5-year average.

One way to look at it is saying that Walmart’s e-commerce success actually isn’t priced. Another way to look at it is by saying that the market is extremely enthusiastic about the retail landscape in a somewhat unsustained manner.

In my view, I think that Walmart could easily fetch a 30x forward multiple if it continues to execute at this level, which I think it will, supported by the recently upgraded guidance.

That would put the fair price at $72.9 per share, reflecting a lackluster 7.1% upside. With that in mind, I prefer Amazon here, but still find Walmart a very decent Buy.

Conclusion

Walmart is showing that executing and innovating at a large scale (more specifically, the world’s largest scale), is possible.

The company is way ahead of its brick-and-mortar peers in E-commerce and advertising, which are also Walmart’s main drivers for future growth.

In addition, Walmart has reached a tipping point in terms of optimizing its legacy businesses, through restructuring and consolidation.

I expect high-single-digit EPS growth for the foreseeable future, in line with consensus, and estimate a fair multiple at 30x, considering Walmart’s competitive advantages and resiliency.

That means a Buy rating, despite the relatively low near-term upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.