Summary:

- Walmart has been growing steadily, albeit with volatile profitability growth.

- The company has balanced cash flows and should absolutely be able to weather a weak holiday quarter if one does arise.

- Additionally, I believe that it is well-positioned to both retain as well as absorb more market share as consumers become more price-sensitive.

Wolterk

Overview

Walmart (NYSE:WMT) is a company that doesn’t need much introduction. Founded in 1962 by Sam Walton in Rogers, Arkansas, Walmart has grown to become a household name and a veritable behemoth. It has maintained its place as the largest company in the United States by revenue even as Amazon (AMZN) has continued its rapid growth. Throughout the last decade, Walmart has digitized itself and gained novel capabilities in order to stay relevant – and it very much has.

Nonetheless, Walmart is staring down economic headwinds of a different nature than before. With significant and ongoing inflationary pressures on the consumer, Walmart could start to feel the pinch. Since Walmart is a shopping destination targeting primarily middle and working-class customers, it’s fair to believe that its financial picture will be relatively sensitive to the vagaries of the overall consumer spending environment.

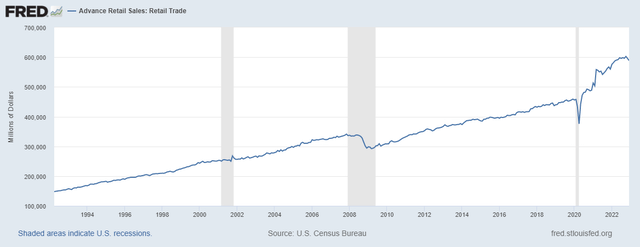

The recent Q4 2022 retail sales numbers indicate that these economic pressures are beginning to show up in earnest. The chart below shows that retail sales declined overall during the past holiday season, including both November and December. While we are not yet formally in a recession, many in the financial sector acknowledge that we aren’t far off – and may just be in one already.

Retail Sales Data St Louis Federal Reserve 1.19.22 Retail Sales Data St Louis Federal Reserve 1.19.22

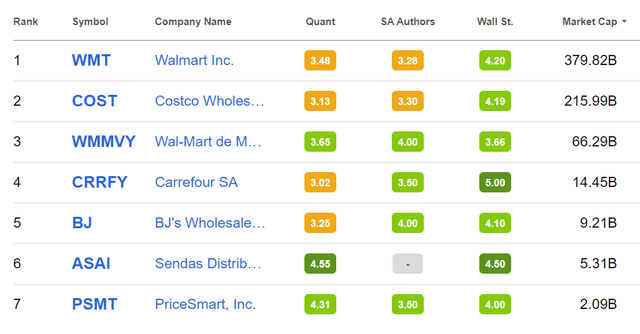

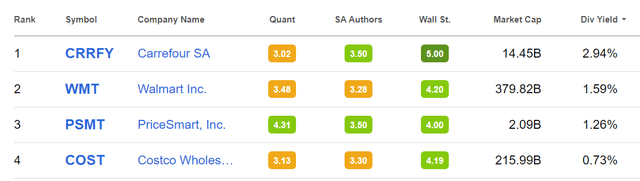

Nonetheless it is important to note that consumer spending is still up 5.3% YoY. While this dip is significant, we are technically still in a period of growth as to consumer spending. The year ahead may prove otherwise. This should have significant ramifications for both Walmart and its GICS Sector overall, a niche referred to as ‘Hypermarkets and Super Centers’. It includes 7 companies, with Walmart being the largest and Walmart Mexico holding down the 3rd spot. Even a cursory review of the market capitalizations show that Walmart is not just the largest player – it is well over 50% of the entire space by market value. Trends affecting Walmart will certainly be felt across these companies more broadly.

This article will review Walmart’s financials and valuation in order to determine how the company – and its stock – will continue to fare within the evolving economic context.

Financials

Since Walmart is a mature company, we have plenty of data to work with. A standard review of its operations and cash flows will yield a clear picture of its performance without too much extrapolation necessary.

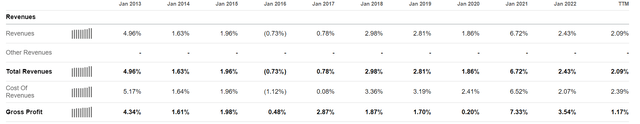

Looking over the past decade, we see that Walmart revenues have continued to grow. While there was a small dip in fiscal year 2015 (January 2016 numbers), the trend reversed itself and the last 5 years have seen reasonable levels of growth – including a nice 6.72% uptick for the 2020 pandemic year. The slowdown period can be chalked up to what was then a full court sprint as to digitization, as noted in a corporate release at that time. As Walmart fully established this capability it was able to leverage the ongoing secular trend of growth in online retail spend, which it has continued to do.

SeekingAlpha.com WMT 1.19.22 SeekingAlpha.com WMT 1.19.22

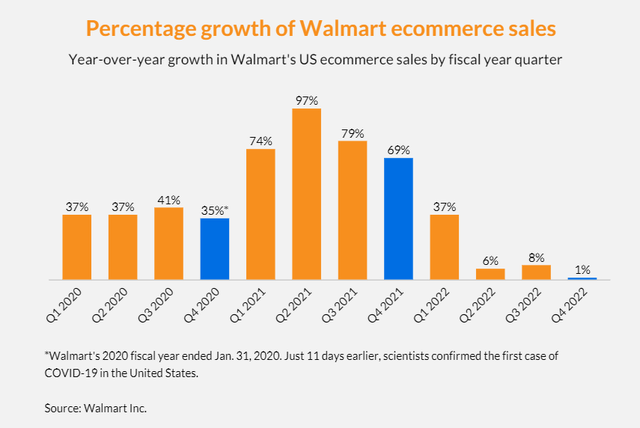

While a deeper dive into the split between Walmart’s retail and online sales is beyond the scope of this article, it is worth noting that growth in this area has slowed materially. The firm’s overall sales growth rate has overtaken sales growth within the online channel as of last quarter. This could very well be a new era or ‘phase shift’ for Walmart and should be an interesting trend to continue paying attention to; it is too early to draw any conclusions from this emerging trend. Ultimately, Walmart is not Amazon; online sales that it generates could very well be considered as substitutes for sales that would have occurred in-store.

Walmart Investor Relations 1.19.22

To reiterate the trendline here, Walmart is still growing its sales at a reasonable level for a company of its size. While e-commerce growth has slowed to a trickle, putting up 2% yearly sales growth is nothing to sneeze at for a company of this size. While I see some things to be concerned about on the horizon, the data don’t paint anything too worrisome as to statistical baselines at present.

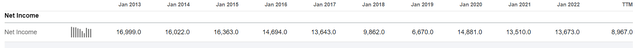

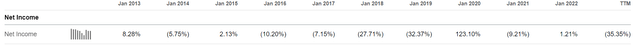

As to cash flow and profitability, the trendline here is certainly less clear. The reorganization that Walmart had to take on in order to evolve into a hybrid retailer appears to have drained its net income significantly over the last decade, and the numbers are volatile. For 2022, the company still needs to generate 35% of its 2021 yearly net income just to get to baseline – a fairly tall order. This means that even a 1-2% dip in sales may result in a declining level of net income for the past quarter and thus the year overall. While this is clearly quite common for this company, it is obviously not ideal.

SeekingAlpha.com WMT 1.19.22 SeekingAlpha.com WMT 1.19.22

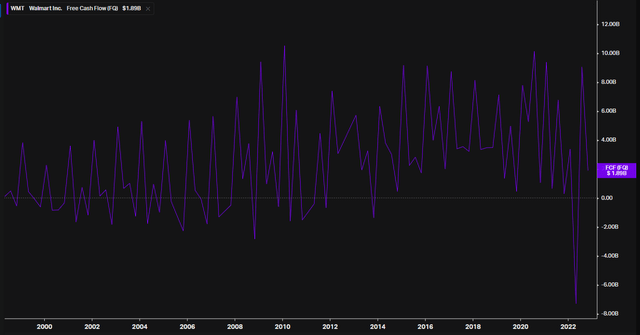

Additionally, Walmart’s cyclical cash flows tend to be highest after the holiday quarter; the peaks indicated below occur primarily after Q4 results. A weak season could crimp these numbers and create more cash flow pressure, which would be unfavorable after a quarter in which the firm expended more cash than it ever has before (Q1 2022, -$7.32B).

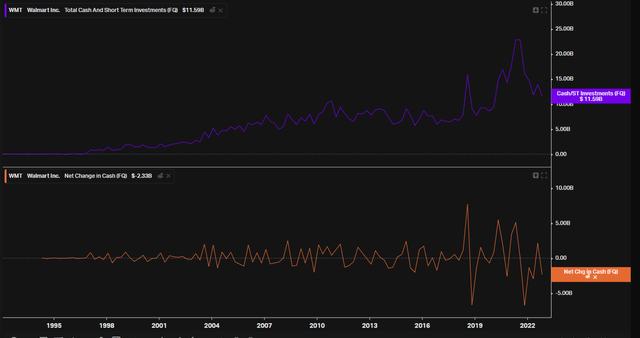

Even then, a weak holiday print would likely not change too much. The company still has $11.6B cash on hand as of last quarter, with a large quantity of cash relative to historical levels. Something interesting to note here is the company’s cash flows have actually become more volatile in recent years, with much larger peak-to-trough measurements occurring since 2019. This means – literally – that the company’s cash flows have become more sensitive. It is unclear what’s driving this at present.

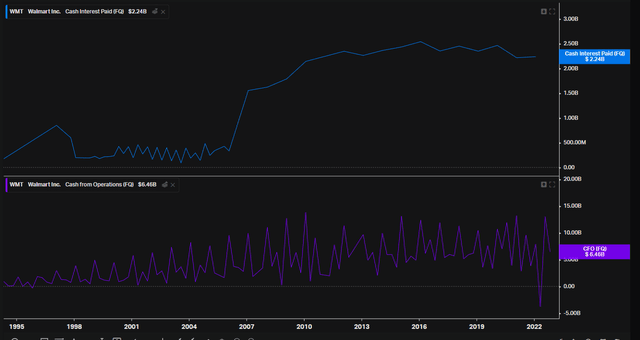

I don’t have too much concern about a weak quarter with the level of cash that the company has on hand. While the company is now in a structural position to be paying around $2.25B a quarter in interest, it continues to generate significant cash from operations. While debt service is eating up somewhere between 15-25% of cash from operations a quarter, there is still plenty of money left over. This is, however, what’s driving the less-than-stellar net income performance of the firm. Nonetheless, it looks to net out to ‘steady’. If the cash on hand numbers start to drop and the interest payments increase – a possible scenario – then I would be concerned. This hasn’t happened as of yet, however.

Overall these financials are fine. This isn’t the most exciting set of books, but they balance out. While profitability isn’t growing in the most steady fashion, and could very well dip, this company is going to continue earning for its shareholders.

Conclusion

Even if Walmart has a weak holiday quarter, it has the cash on hand to keep going steady. This is far from assured, however; we must consider that an increasingly price-sensitive consumer could actually gravitate to Walmart and increase their relative spend there. As such, there is a case to be made for Walmart actually being quite well positioned in the current consumer context. I think the Q4 numbers for 2022 should be a strong leading indicator for which trend will dominate.

As to valuation, Walmart is in line with sector averages. As noted above, Walmart in many ways is the sector. What makes it stand out somewhat is that you’re still going to get a 1.59% yield, guaranteed. This is the 2nd highest yield in the space, from the largest player; I would venture that it is thus the most secure.

Considering the situation as a whole, I am personally inclined to think that Walmart will be a relative outperformer in the current consumer context. Simply put, it’s the place for price. This, combined with its massive size, should allow for it to maintain a robust position no matter where the economy is headed; I am calling it a buy.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.