Summary:

- Walmart’s stock performance has been strong, with a blended P/E ratio of 30.3x and expected EPS growth of 9% in 2025.

- The company’s strategic expansion, focus on price-sensitive consumers, and innovative technology integration have led to strong growth despite economic challenges.

- While the stock is fairly priced at the moment, potential 10-15% corrections could present good buying opportunities for investors looking for long-term growth in consumer staples.

Alexander Farnsworth

Introduction

The other day, I ran into the chart below on X (formerly known as Twitter), which was posted by financial markets expert Lawrence McDonald:

Bloomberg (via Lawrence McDonald)

He added the following information:

CPI inflation has been in the 3% to 9% range for most of the last three years, the net impact is consumers are scrambling into places like Costco COST, we have never seen this kind of retail divergence across large consumer discretionary players. – Lawrence McDonald

Over the past few years, I have read a lot of his research and believe we’re on the same page when it comes to the impact of persistent inflation on the consumer.

As we just saw, elevated inflation is creating a very unusual divergence between some of America’s largest consumer stocks – most of which moved in lockstep before the pandemic disrupted the global economy.

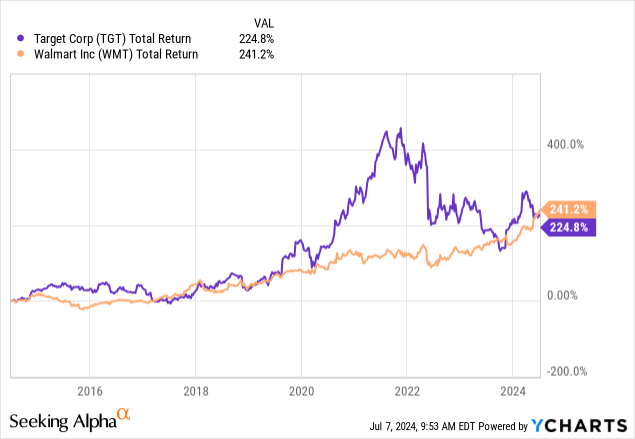

Another great example is the difference between Walmart (NYSE:WMT), the star of this article, and Target (TGT).

Although Target was the better choice until the consumer started to get hurt in 2021, Walmart’s total return over the past ten years is now 241%, 16 points higher than the return of Target.

While it helps that Walmart tends to cater to people with lower income than the average Target customer, the company is way more than that.

In addition to benefiting from price-conscious consumers in a challenging price environment, the company is expanding its empire, adding new capabilities, including omnichannel retail, international growth, and private brands.

My most recent article on what has become a $563 billion market cap giant was written on July 6, 2023. Back then, I went with the bullish title “Walmart’s Dividend Magic: Scaling New Highs, King Style.”

Since then, shares have risen by 37%, including dividends, beating the 26% return of the S&P 500 by a decent margin.

So, with all of this being said, it’s time for an update!

The ‘New’ Walmart Is Impressive

Usually, I show the valuation of a company at the end of my articles. However, in this case, I’m doing things differently, as I want to highlight one very important thing.

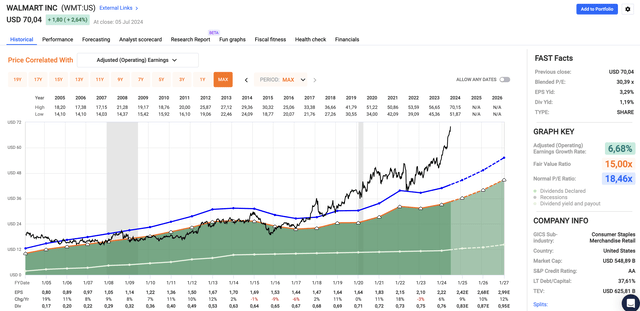

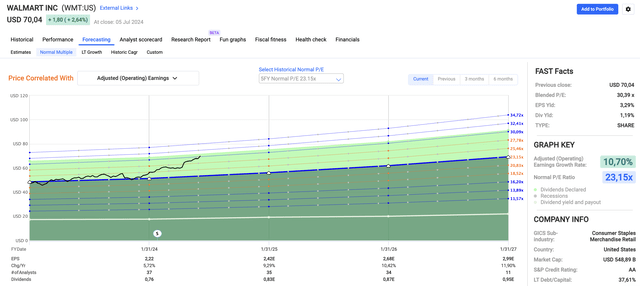

The strong performance of WMT stock has resulted in a blended P/E ratio of 30.3x. That’s a mile above its normalized P/E ratio of 18.5x.

In the first eight- to 10 years after the Great Financial Crisis, the company consistently traded below 18x earnings.

Furthermore, what’s interesting is that analysts expect the company to maintain a highly favorable growth profile, with 9% expected EPS growth in the current (2025) fiscal year, potentially followed by 10% and 12% in FY2026 and FY2027, respectively.

These numbers come from FactSet and can be seen in the chart above (although they are very small).

What’s so interesting is that Walmart is slowly but steadily turning into the company investors always hoped it would become: an Amazon (AMZN)-like consumer company that increasingly uses its existing footprint to add new capabilities.

During the recent NYSE/Bank of America London Investor Conference, Walmart made clear that its strong recent earnings are a good indication of a strong business model that attracts a broad consumer base.

Essentially, Walmart’s ability to gain market share even during economic fluctuations shows extreme resilience.

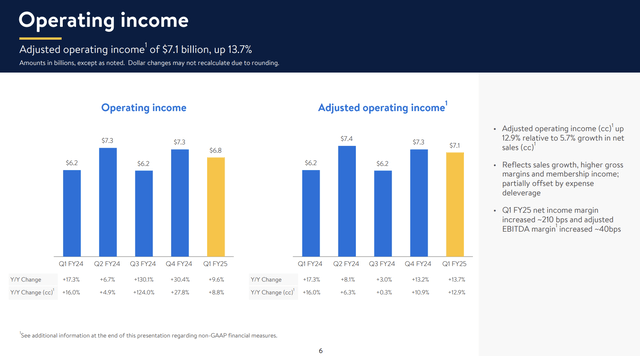

In the first quarter, the company reported 5.7% sales growth and 12.9% higher adjusted operating income on a constant currency base.

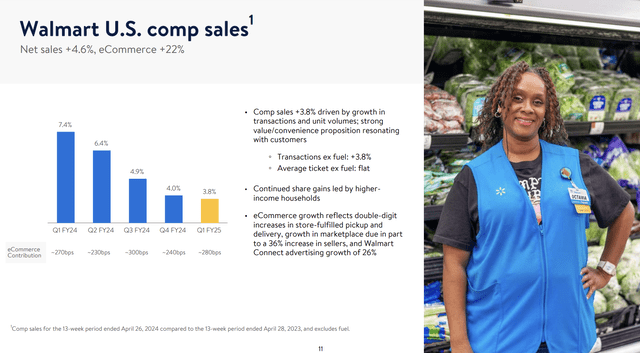

Even better, the company’s growth was not driven by inflation, as comparable store sales in the U.S. were up 3.8%, supported by transaction and unit volumes – instead of just pricing.

E-commerce sales contributed 280 basis points of this, which is yet another indication that the company’s online expansion is bearing fruit – especially when it matters most.

According to the company, it now has 420 million SKUs in its marketplace, which allows it to benefit from elevated growth in certain areas, including sporting goods and beauty products.

Moreover, as we just saw, operating profit growth was higher than revenue growth as the company grew its margins.

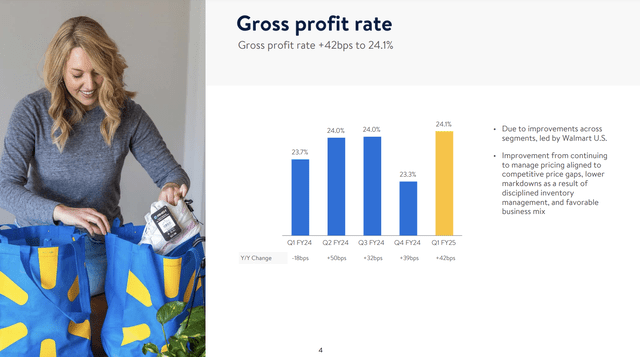

This was supported by brilliant execution, as the company achieved a 2.7% decline in global inventory, providing optimal stock levels, which allowed it to reduce markdowns.

Essentially, this strategy resulted in a 42 basis point increase in its gross margin.

Even better, the company has grown margins without hurting the customer. Not only is this supported by its same-store revenue growth performance breakdown but also by a total increase in rollbacks by 45% in the first quarter.

According to the company:

A Rollback is a temporary price reduction on an item in a Walmart store. A Rollback normally lasts up to 90 days before it is returned to its original price, usually noted on “Was/Now” signing.

This rollback strategy also allows Walmart to test how price-sensitive consumers are, putting it in a great spot to remain responsive to market trends without major delays.

Personally, I’m absolutely amazed by these numbers and developments, knowing how hard it is for a giant like Walmart to balance pricing, costs, and demand – let alone in a challenging economic environment.

To maintain this success, the company is implementing advanced technologies, including generative AI-driven product search, automated storage, and retrieval systems to improve its supply chain.

This also includes the introduction of on-demand early morning delivery and the rapid expansion of same-day delivery services.

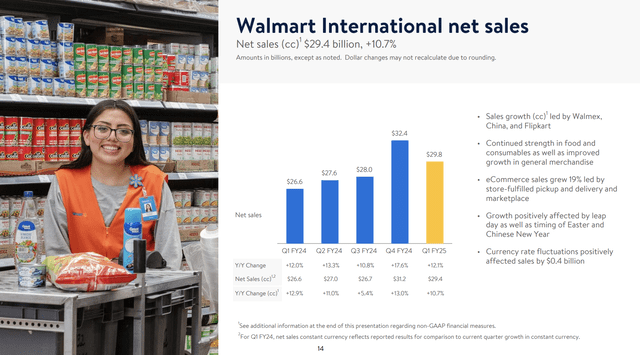

With regard to international sales, international constant-currency sales increased by 10.7%, driven by Walmex, China, and Flipkart, while international e-commerce sales rose by 19%.

On top of that, advertising revenue grew by 24%, driven by Walmart Connect’s 26% growth in the U.S. and 27% growth internationally.

Walmart Aims To Maintain Momentum

Going back to the NYSE/Bank of America London Investor Conference, the company noted that its strategy, coupled with current economic conditions, has increased its customer base to include higher-income consumers with salaries of more than $100 thousand per year.

According to the company, this demographic shift is largely driven by its improved convenience.

For example, the company’s network of 4,700 stores in the United States alone allows it to deliver goods within a 15-minute window to meet the needs of time-sensitive shoppers.

Moreover, in light of elevated inflation, Walmart has strategically increased its focus on private-label brands, which now account for roughly 20% of its total sales (and over 30% at Sam’s Club).

As one can imagine, these brands offer higher margins than national brands. They also do well in times of elevated inflation.

More importantly, according to my research, the private label brands are doing very well, as many tests (including the one below) show great results compared to more expensive alternatives.

The company is also improving the customer experience by remodeling 650 stores this year. Last year, it remodeled roughly 700 stores.

According to the company, this overhaul provides a better shopping experience and even supports e-commerce sales in surrounding areas.

Speaking of e-commerce, the company noted that while first-party e-commerce remains challenging, the integration of advertising, data monetization, fulfillment services, and memberships is creating a profitable ecosystem.

As aforementioned, advertising sales grew by double digits, fueled by its ability to support ads both digitally and physically. That’s a value proposition most online stores cannot offer.

Guidance & Shareholder Value

During the NYSE/Bank of America London Investor Conference, the company also discussed its long-term guidance, which is very favorable, as it expects to grow its revenue by roughly 4% per year over the next five years.

Operating income is expected to grow by up to 8% per year.

As I showed you at the start of this article, analysts are even more upbeat about the next two years, expecting double-digit EPS growth.

Unfortunately, as great as all of these sound, a blended P/E ratio of more than 30x is a tough pill to swallow.

Even using the company’s five-year average P/E ratio of 23.2x would imply that WMT shares are currently trading at fair value.

Analysts seem to agree with me, as the consensus price target is $72.80, 4% above the current price.

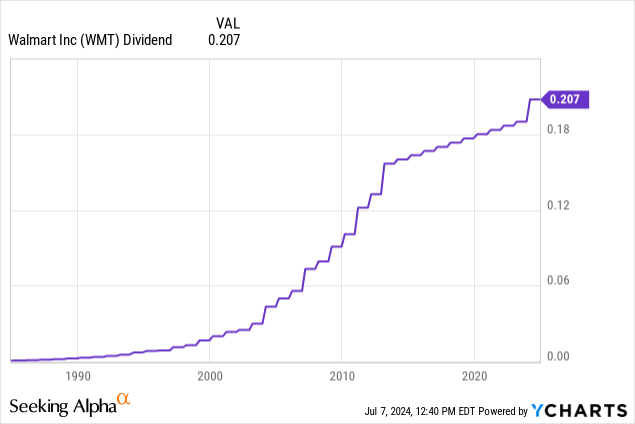

Even the dividend has become less attractive.

After hiking its dividend by 9.2% earlier this year, it currently pays $0.2075 per share per quarter. That’s 1.2% of its current stock price.

The five-year dividend CAGR is 2.6%. I expect that number to increase, as WMT has a low payout ratio of 33% and a strategy to maintain elevated earnings growth.

Hence, the latest (9.2%) dividend hike makes a lot of sense.

It also has hiked its dividend for 50 consecutive years.

All things considered, I’m impressed with WMT. Unfortunately, I’m not the only one, as its valuation does not leave a lot of room for error.

Hence, as much as I like what WMT is doing, I will give the stock a Hold rating.

Nonetheless, I’m long-term bullish, meaning 10-15% corrections will likely make for good buying opportunities for investors looking to invest in consumer staples with elevated growth potential.

Takeaway

Walmart’s transformation is nothing short of impressive. The company’s strategic expansion, innovative technology integration, and focus on price-sensitive consumers have driven strong growth – despite economic challenges.

With a blended P/E ratio of 30.3x, it’s trading above its historical average, which clearly reflects elevated investor confidence.

However, this high valuation means the stock is fairly priced, leaving limited room for error.

While I hold a long-term bullish outlook, I cannot do better than giving the company a Hold rating at this point.

However, keep an eye out for 10-15% corrections, as these could present excellent buying opportunities for those seeking to invest in this resilient and evolving retail giant.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.