Summary:

- Walmart has recently joined the elite group of Dividend Kings, companies that have increased their dividends consecutively for at least 50 years.

- Dividend growth investors may complain about WMT’s low yield and slowed dividend raises in recent years.

- However, long-term investors should focus on its total shareholder returns, including buyback yields and earnings growth.

- Once these factors are included, it offers a very asymmetric reward/risk profile.

Phynart Studio/E+ via Getty Images

WMT: A Newly-Crowned Dividend King

In early 2023, the elite club of Dividend Kings welcomed Walmart (NYSE:WMT) as a new member. The Dividend Kings are those companies that have increased their dividends consecutively for at least 50 years. As such, members in this group are time tested. Their business model has been demonstrated to be resilient to offer growth in the long term.

Against this background, the thesis of this article is pretty straightforward. In the remainder of this article, I will explain why I see WMT as another textbook example of such resilience.

Since I opened the article with its induction into the Dividend Kings group, I will start by addressing some of the questions/concerns I heard about its dividends. These questions include the relatively low dividend yield (only about 1.4%) and the relatively slower dividend growth rates in recent years.

Walmart: Dividend in Focus

WMT started paying dividends 50 years ago at a payout of $0.05 per share. After 50 consecutive years of growth, the annual payout (on an FWD basis) now stands at $2.28 per share. These numbers translate into an annual growth rate of 8.0% – compounded over 50 years nonstop!

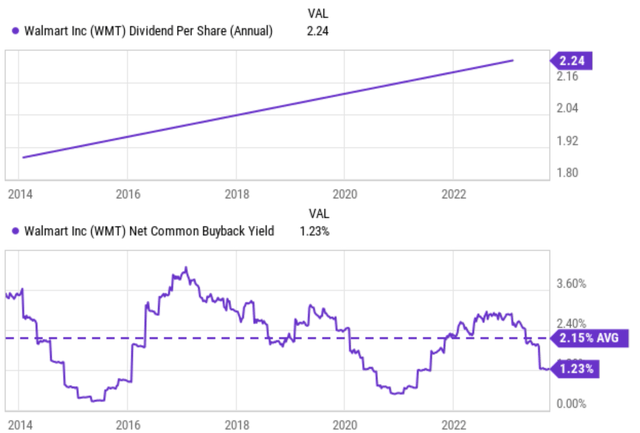

In recent years, the growth rates have slowed considerably given its size (see the top panel of the chart below). Over the past 10 years, the dividend payouts have increased at an average annual rate of ~4.5%. However, it’s still a very healthy rate and the consistency is superb, as seen.

Also, for long-term investors (which is the target audience we had in mind), the focus should be on total shareholder yield instead of dividend yield. When the total shareholder yield is considered, the picture changes quite a bit. As you can see from the bottom portion of the chart, WMT has been consistently buying back its own shares over the past decade. On average, its buyback yield is about 2.15% since 2014. Such consistent (and also rather aggressive in my view) buybacks have helped to appreciate the stock prices and add another driver to the total shareholder return besides organic growth.

Walmart: Everyday Low Price

So, what’s Walmart’s secret to maintaining consistent growth in front of stiff competition and still generating extra cash to afford share buybacks? In recent years, many of its retail peers have suffered tremendously given the rise of e-commerce and also impacts of the COVID-19 pandemic.

The key in my view is that its business model differentiated it from other retailers in a few key aspects. First, it enjoyed unparalleled economies of scale. As the world’s largest retailer, it can negotiate lower prices from its suppliers and pass those savings on to its customers. The scale also helps to optimize its supply chain, enabling it to get products from its suppliers to its stores quickly and efficiently. Secondly, it focuses on convenience and selection: It’s hard not to be impressed by the wide selection of products and services at its stores. It’s as close to a one-stop-shopping experience as I can get in my area (which is a quite populous area with many shopping options). The services/products include groceries, general merchandise, health products/services, home improvement, auto services, etc. I bet many other people are as attracted to this one-stop shopping convenience as I am.

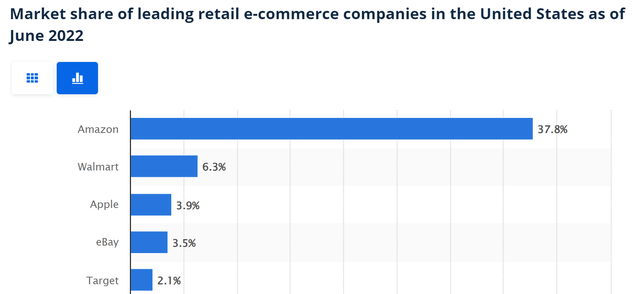

Finally, WMT has been active in the use of technology to evolve its business model and stay competitive. In the earlier days, it was one of the first retailers to use barcodes and electronic scanners. Today, it invested heavily in e-commerce and has become the second-largest online retailer in the world only after Amazon (AMZN), as you can see from the chart below.

Source: Largest online retailers in the U.S. 2022, Statista

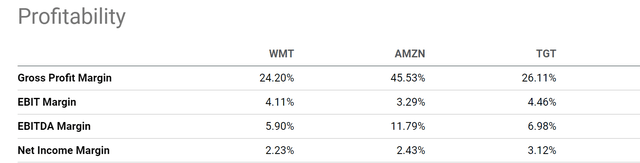

In the end, all the above differentiation factors translate into the most tangible benefit for its customers: Everyday low prices (“EDLP”): Walmart was one of the first retailers to adopt an EDLP strategy, which means that it offers consistently low prices on its products, rather than running sales and promotions. As a reflection of this strategy, you can see from the next chart that it has a lower margin than both online retailers such as AMZN, and offline retailers such as TGT. To wit, the table below compares their profit margins. And WMT’s EBIT margin, EBITDA margin, and net margin are all below AMZN and Target (TGT). However, in the retail business, low margins should not be automatically viewed as a disadvantage. I know it’s a bit counterintuitive. But think from the customers’ point of view, customers always are looking for the best possible value.

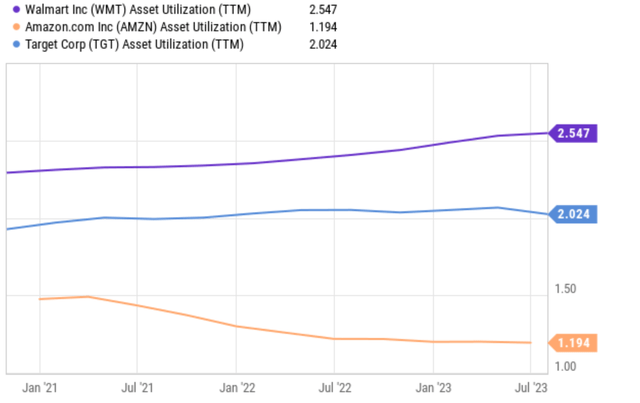

The key is to make a profit while keeping margins as low as possible. And thanks to its scale and differentiating business model, WMT has certainly demonstrated its mastery of this key. As one example, the next chart shows the asset utilization of WMT compared to AMZN and TGT in the past three years in the aftermath of COVID-19. For readers new to the concept, asset utilization measures a company’s efficiency in using its assets to generate revenue (for retailers, think of the foot traffic and sales per store). In the end, the margin itself is only one variable in the return on asset. The ROA is the product of net margin and asset utilization.

As seen, WMT not only has the highest asset utilization by far among this group. It also has managed to improve the efficiency of its asset utilization amid all the issues caused by the pandemic while the other two either stagnated or even suffered declines.

Outlook for Walmart stock

Now switch our perspective from long-term fundamentals to near-term catalysts. Looking ahead, I do see a few catalysts to create an upward potential in its stock prices in the near term.

First and foremost, I see the incoming holiday season as the most immediate catalyst that can help Walmart’s stock prices. The holiday season is usually the busiest time of year for retailers. Walmart of course is no exception. Secondly, saying it’s no exception is an understatement. I see WMT as well poised to benefit more than the sector average for several reasons. As aforementioned, the company has been investing heavily in e-commerce and omnichannel shopping experiences. I expect these investments to bear fruit in the income holiday shopping season. Furthermore, WMT also has been investing in the Walmart Connect platform, so it can enter the relatively lucrative digit ad platform. Its platform has grown advertising revenue at rapid rates (nearly 40% in the first quarter). And I anticipate the incoming holiday season as a good opportunity for the platform to gain further attraction.

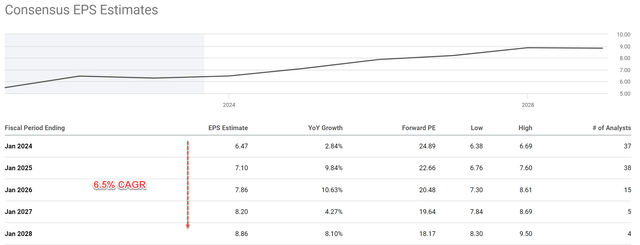

All told, I expect a robust earnings season ahead. And consensus estimates seem to share the optimism about its EPS growth, as shown in the chart below.

Risks and Final Thoughts

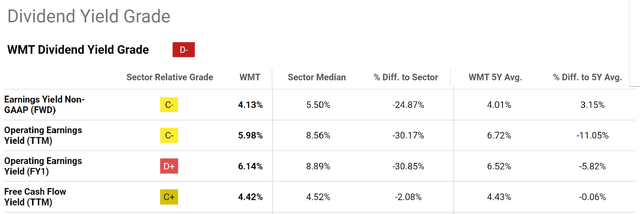

There are a few risks to my above thesis that are worth mentioning here. First, many retailers are impacted by shoplifting and WMT is having its share of this problem. However, WMT is better protected against shoplifting than the sector on average, in my view. Based on my own experiences (not as a shoplifter, but as a paying customer), Walmart has a good team of loss prevention personnel who are well trained. These personnel are typically stationed throughout the store, including high-value areas such as electronics. Even at the auto-check auto kiosk, they have been quite alert and helpful in identifying issues. Second, there’s no obvious discount on its valuation, as seen in the chart below. Although investors should be alarmed by the C and D ratings on its valuation. Given its competitive advantages analyzed above, the stock deserves a valuation premium above the sector average. And its current valuation multiplies are close to (or below) its historical averages. For example, its FWD earning yield of 4.13% is quite close to its 5-year average of 4.01%. And its free cash flow yield of 4.42% is exactly on par with its 5-year average of 4.43%.

All told, my overall rating for the stock is a buy. I view the risks mentioned above to be relatively minor compared to the strength and positive catalysts. I see a few key differential factors in its business model that set it apart from other retailers. To recap, the top factors include its economy of scale, the convenience and selection its store offers, and its active adaptation of technology to keep evolving its operations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.