Summary:

- Over the past 12 months, Walmart has landed over $600B in sales. For the math lovers out there, that works out to more than one million dollars per minute!

- Low prices create a flywheel of sorts whereby low prices increase sales, increase scale, increase negotiating power, allowing them to lower prices once again.

- Comparable sales, excluding fuel, are forecasted to increase by just 5% at Sam’s Club. Full-year consolidated sales are expected to increase by just 2.5-3%, this is lower than inflation expectations.

Kativ

Introduction

Walmart is a beast of a company (NYSE:WMT).

Over the past 12 months, they’ve landed over $600B in sales. For the math lovers out there, that works out to more than one million dollars of sales per minute!

While most of this business is indeed, very low-margin, it speaks to the size and reach of Walmart which has expanded to nearly all corners of the country, and even around the world.

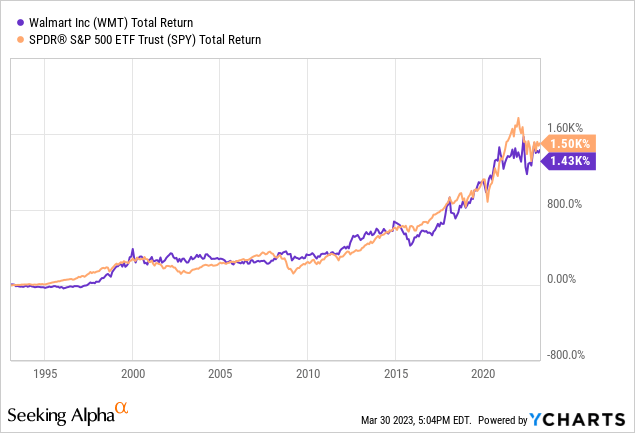

As one might expect in such a mature company in a stable industry, as an investment, Walmart had relatively low volatility, usually tracking the market.

Since 1994 both Walmart and the S&P 500 have both increased by around 1500% with the S&P narrowly taking the victory over Walmart having increased by 70% more over that huge time period.

But the grocery market has changed since the nineties, companies like Walmart have continued to grow, albeit at a slower pace, while low-cost innovators like Costco (COST) and Aldi threaten its established business siphoning off value-conscious customers.

Within this article, I’ll provide my commentary on the industry, Walmart’s financial performance, and whether I believe WMT stock is a buy, hold, or sell based on my analysis.

Grocery Retail: A Notoriously Difficult Business

Let’s start with a discussion about the industry Walmart operates in to get some more context about the competitive landscape.

Grocery stores sell everyday goods including food, drinks, and cleaning items from brands like Coca-Cola (KO), Hormel (HRL), and Clorox (CLX) but because of strong competition, most grocers don’t actually make a lot of profit off of each individual sale.

On average, grocery stores make a profit margin in the low single digits, which has helped to contribute to the many grocery store failures over the years.

Another thing that weighs on margins is managing inventory. Unlike clothing stores where items may be on the shelf for months, groceries often have a short shelf life, so the inventory has to be constantly managed to make sure that items don’t go bad. This can be a costly and time-consuming process.

Grocery stores also need a lot of employees to operate (cashiers, stockers, butchers, and bakers) making labor a significant portion of a grocery store’s expenditures.

This balancing act of managing proper staffing levels with adequate service has resulted in the grocers differentiating their offers by the level of service. For example, some grocers like Aldi, have few staff on hand and offer a bare-bones, value-driven experience. While other grocers, like Erewhon, focus on delivering exceptional service and aim to hire staff with exceptional knowledge about its locally-grown, and/or organic offerings.

The Low Price Flywheel

Large grocery store chains are able to operate and sell at scale, which means that their operating costs are lower, allowing them to pass those savings on to their customers by way of cheaper products. Because grocery stores compete so hard on price, it’s hard for new entrants to the market because they lack the same scale that would allow offering goods at the same price as competitors.

Low prices create a flywheel of sorts whereby low prices, increase sales, increase scale, increase negotiating power, allowing them to lower prices once again.

Despite how low the margins may be, the grocery business remains an attractive target due to sky-high revenue, with Americans spending hundreds of billions on groceries annually. This has prompted retail giants Amazon and Walmart to grow their food business, with Amazon recently expanding its online grocery delivery service, Amazon Fresh, to more areas in the US.

Quarterly Update

In its latest quarterly earnings presentation, Walmart shared some interesting tidbits about its business performance. While I won’t rehash what has already been said, I do think that there are a couple of important pieces of information worth reiterating that were highlighted in its presentation.

First, membership revenue declined YoY by 3%, this is noteworthy as it indicates Sam’s Club may be facing greater challenges compared to BJ’s (BJ) and Costco. Compared to the same quarter of the prior year sales are up 7.3%, this is roughly in line with inflation.

Comparable sales, excluding fuel, are also forecasted to increase by just 5% at Sam’s Club. Full-year consolidated sales are expected to increase by just 2.5-3%, this is lower than most forecasts of inflation for the year.

In short, growth is stalling, revenue is forecasted to grow slower than inflation, and Sam’s Club is showing signs of weakness.

Not a great setup.

Financials

Now that we’ve covered the industry and the latest earnings let’s take a look at Walmart’s financial performance over the long term compared against its peers: Target (TGT), Costco, and Kroger (KR). The metrics I’d like to highlight are revenue, earnings, margins, and returns on invested capital.

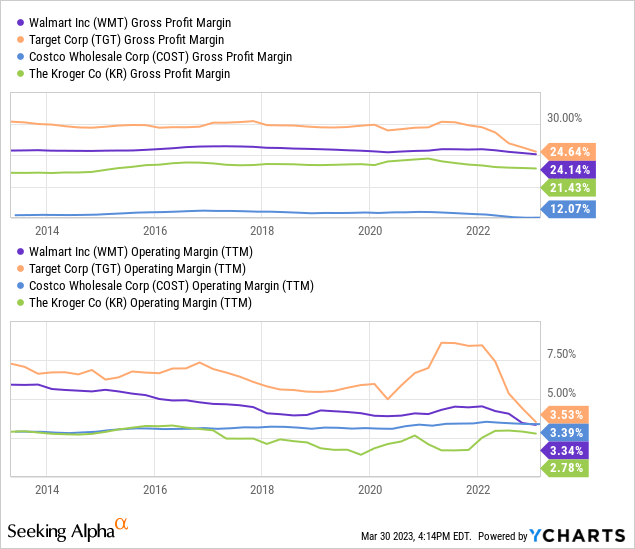

Margins

As I mentioned earlier in the article margins in grocery retail are quite weak this is evidenced in the chart above. While some companies, like Target and Walmart for example, have relatively strong gross margins (around 25%) they all have very low operating margins (2-4% range). Historically Walmart and Target have both had higher margins but those have been on the decline over the past decade perhaps as a result of increased competition (Aldi and Costco) and managing inventory in the face of strong inflation.

Walmart once had an operating margin of around 6%, today that number is just 3.3%, Costco on the other hand has maintained, if not slowly grown, its operating margin of around 3.4% in the same time period.

Given the heightened risk of recession and the effect inflation is having on consumers, one can likely expect a shift toward value shopping.

In the past, this would have been very bullish for Walmart, after all in the great financial crisis, consumers flocked to Walmart to save money, but nowadays the competitive landscape is very different. Companies like Aldi and Costco beat Walmart on price for a variety of goods due to their unique business models, Aldi’s bare-bones shopping experience, and Costco’s subscription model.

If you’re interested in learning more about Costco and why I believe their business model is counter-cyclical and SaaS-like I would refer to you my write-up on the company.

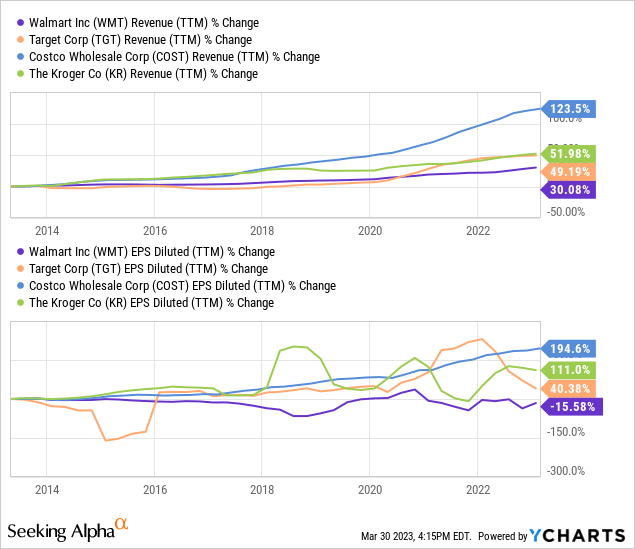

Revenue and EPS Growth

Compared to the largest grocers in the US, Walmart’s sales and earnings growth have both faltered. With just 30% revenue growth and EPS actually declining over the past decade, Walmart clearly leaves growth investors wanting for more.

Target managed to grow its sales by 20% more than Walmart focusing on delivering a more premium experience, while Kroger outgrew Walmart focusing on delivering a superior grocery experience with fresh produce and meats. Costco outgrew them all having tripled earnings and more than doubling its revenue showing Walmart may be losing value-oriented shoppers to Costco and the like.

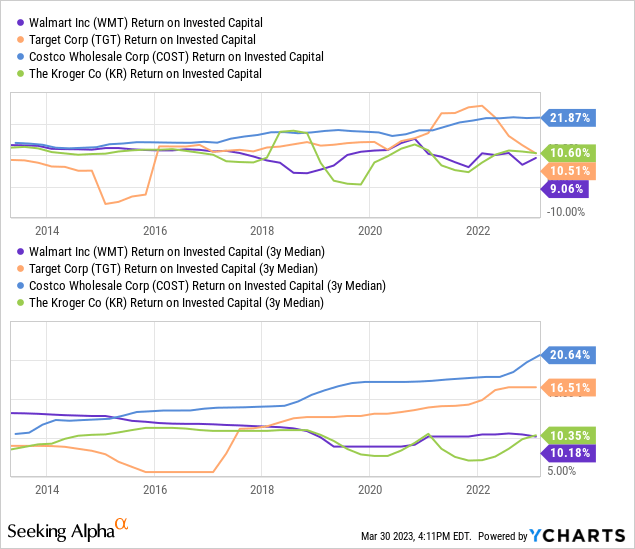

Return on Invested Capital

Once again, Walmart trails its peers, with just a 9% return on invested capital Walmart has the worst track record for allocating capital over the past decade. It appears this problem is only getting worse for Walmart as their returns on invested capital have declined, while others like Costco are on the upswing.

It’s worth noting, however, that Walmart is not alone in its challenges, Target has recently shown massive weakness in its returns on invested capital and earnings growth.

Valuation

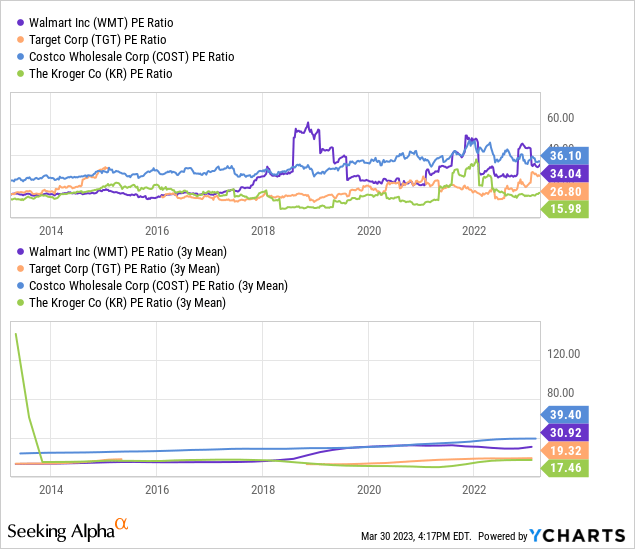

Walmart’s PE ratio has expanded over the past decade, historically they’ve traded around 20x earnings over the past decade, but now it seems that the market is rewarding them with a premium valuation (30x-plus). Given the weakening performance, I’m not sure that the premium is warranted, I understand there has been a flight to safety, and yes, Walmart should benefit from that, but a 50%+ increase seems overdone to me.

Conclusion

Stagnating revenue growth, declining earnings, and poor returns on invested capital make investing in Walmart shares a difficult prospect.

The company seems to be at a bit of a crossroads whereby it needs to really define its position in the market, are they going to be the low-cost champ, like Aldi, or do they want to sell higher margin goods like Target, or do they double-down on its subscription model (Sam’s Club)? It feels to me like there is a lack of direction leaving Walmart in a state of stagnation.

Based on the average analyst expectation for $6.12 of earnings this year, shares currently trade around 24x forward earnings, an earnings yield of just ~4.16%. Given the increasing challenge of managing inventory in the face of unpredictable inflation and its average (at best) track record, I would rather invest in short-duration treasuries and wait for a better opportunity.

I rate Walmart a Sell.

Disclosure: I/we have a beneficial long position in the shares of COST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Please note that this article is for informational purposes only and should not be construed as investment advice. It is important to do your own research and consult with a financial advisor before making any investment decisions.