Summary:

- Walmart has successfully navigated multiple, near-existential challenges over the past six years.

- Company executives outlined their thoughts on what will move the company forward at a recent investor day.

- We outline what we think were the three most important takeaways.

Joe Raedle/Getty Images News

Retail Goliath

Walmart (NYSE:WMT) is, in our opinion, having a bit of a moment. The company has seemingly fended off the years-long fear that it would have its lunch eaten by Amazon (AMZN) in a new world of digital shopping. It has adapted about as well as any organization could expect to in the pandemic, launching new services such as grocery delivery with Walmart+, curbside pickup, and a robust online offering. Management adroitly avoided the pitfall of accumulating too much inventory as the pandemic moved along – a trap which snared rival Target (TGT) – and the company’s wholesale brand Sam’s Club continues to grow at an impressive clip, posting 43% growth over the last three years.

Today, with a potential recession on the horizon and inflation levels still elevated, Walmart appears to once again be poised to capitalize as consumers become ever-more price sensitive.

The company recently held an investor day, and in this article we will discuss the highlights and outline our case for why we think the company should be considered for a spot in investor’s portfolios.

1. The Omni Trend

The memory of the market is famously short, and so it seems like ancient history to say that back in 2017, it was quite popular to believe that Amazon would mercilessly strafe the retail landscape, eliminating all competitors in its path. There was even a Death By Amazon Index, which tracked retail companies and how they were faring in their (certainly futile) battle to survive.

Looking back, the concern seems antiquated. Of course, several retailers did fall victim, but these were largely specialty retailers with bloated capital structures and, quite often, management who underestimated the threat of online shopping.

Walmart, to its credit, never underestimated the threat. As a result, today it arguably possesses a greater advantage than Amazon when it comes to day-to-day retail. After all, Amazon’s attempts to muscle in on what has been traditionally Walmart’s turf (physical stores and groceries, I.e., Amazon’s Whole Foods acquisition) have largely fallen flat.

The pendulum of sentiment, then, is swinging back towards omni-channel (or e-commerce plus physical) retail. In this area, Walmart appears to be the undisputed king.

At the investor day Walmart executives pointed out a staggering figure when they pointed out that 90% – 90%! – of the population in the United States lives within a 10-mile drive of a Walmart location. The natural thought here is that it’s very easy for customers to visit a Walmart, which is true, but executives smartly pointed out another angle from which to view this fact. Put another way, they said, “delivery drivers need to only drive 10 miles or less to reach 90% of the U.S. population.”

Now that catches our attention.

This is enormous – Walmart’s locations, which are effectively fulfillment centers – can and are being utilized to deliver items to customers at an incredibly rapid pace; a pace no other retailer can come close to.

The message is clear: whether buying online or in-store for delivery or curbside pickup, Walmart has the infrastructure and the systems in place to deliver for customers.

2. Private Brands

Anyone who has shopped at Walmart is likely to have noticed that beside most name-brand items sits a similarly packaged item with a label like “Great Value” for, typically, a slightly lower price. These are Walmart’s private label brands, and they drive much higher margins for the retailer than name-brand products.

The power of these brands was brought up a few times during the investor day. In discussing the growth and sales volumes of these high-margin items, executives stated that “[p]rivate brands now account for more than 20% of our sales at Walmart and over 30% in Sam’s Club… in departments such as home, private brands are growing 4.5x faster than branded products.”

The size of Walmart’s private brands business in the United States alone would dwarf the revenue of many sizable companies. To this end, John Furner, the CEO of Walmart U.S., noted that Walmart currently has twenty-two private brands that each generate over $1 billion in revenue per year.

The Member’s Mark private brand – which is sold in Sam’s Club – is also doing exceptionally well, with its private label apparel up 30% year over year. Executives also detailed how members drive decisions within Member’s Mark as the company draws on the collective opinion of roughly 40,000 select members to provide better products.

The relevance of these private labels is only expected to grow as customers become more price sensitive with inflation remaining high and a potential recession on the horizon.

3. Automation

The robot-ification of the supply chain has been buzzing around headlines for so long that readers can be forgiven for their eyes glossing over when they hear an executive tout the steps their company is taking towards automating their supply chain.

However, Walmart is taking a novel approach which investors are likely to be interested in.

Shoppers at Walmart have likely noticed employees with blue carts carrying handheld computers who walk the aisles of the store and pick items. These employees are shopping for customers who have ordered online for pickup or delivery. These employees then take the orders to an area where they are picked up either by the customer or the delivery driver.

This picking and fulfilling of orders, however, is costly in terms of both employee labor and the physical space taken up by an employee who is effectively shopping alongside other customers.

Walmart’s solution to this is the create special fulfillment spaces within stores, either by segmenting off a portion of the existing store or building onto it, and stocking this fulfillment space with frequently-ordered items. The company calls these ‘Market Fulfillment Centers,’ and the current plan calls for the picking of orders from these centers to be automated in time.

The Bottom Line

Walmart has shown itself to be an extraordinarily resilient company, able to navigate incredibly difficult environments and still come out on top.

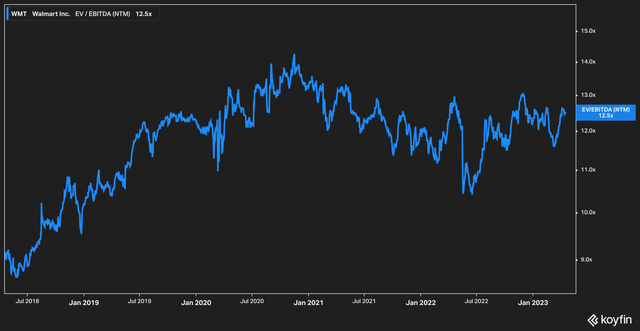

Today, the company trades at 12.5x forward EV/EBITDA, which seems to us to be quite cheap for what this company is and what it is becoming. As much as Walmart has been a staple of consumer life, it is only becoming more so with its ever growing reach throughout virtually every channel of retail.

With a blueprint for the future laid out, we believe that Walmart should be given serious consideration from long-term investors looking to make additions to their portfolios.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.