Summary:

- During the Great Financial Crisis, Walmart saw an increase in revenue, sales, and free cash flow due to the recession-resistant business model.

- The company also has a healthy balance sheet with a low Net Debt to EBITDA and Net Debt to Capital.

- Walmart outshined its peer Target during the recession as TGT earnings decreased from 2007 to 2008.

- If the country does enter into a recession in 2024, WMT is the stock you want to own due to its one-stop-shop format & low prices.

- The recent popularity of GLP-1 drugs continues to be a headwind for the retail giant.

Justin Sullivan

Introduction

In the last few weeks, there have been more talks of the economy entering into a recession. And while some say, “We’ve been hearing that for a while now,” you can’t help but wonder if it’s true. Surging oil prices, war, and the battle with inflation continue on. And in my opinion, I think the FED will raise rates at the next meeting. I assume by another .25 bps it’s hard to say. But it makes me wonder if it will be similar to the 1980’s. When inflation was running hot, and the FED raised rates so high to where it pushed the economy into a recession.

Do I think rates will get as high as they were then? No. But I do think raising them further could potentially push us into one. Likely. If we do, investors should be looking for quality dividend stocks that go on sale to help them navigate through rough waters. Let’s get into why I think Walmart (NYSE:WMT) is a great addition to any portfolio if we do slip into a recession.

How Did WMT Do During GFC?

Unlike many companies that had trouble during the Great Financial Crisis, Walmart thrived with its one-stop shop format and low prices. Due to financial tightening, cost-conscious consumers decided to spend their money with the retailer. WMT has most of the essential items needed to sustain everyday life and as consumers worry during tough times, this plays into the company’s strengths. As you can see below net sales increased 8.6% from $344,992,000 to $374,526,000 from ’07 to ’08. And by 7.2% from 2008 to 2009.

EPS also increased 7.6% from $2.92 to $3.16 and by 6% in 2009. Their free cash flow saw the largest increase during the recession, increasing 32.5% from ’07 to ’08 and more than doubling from $5.7 billion to $11.6 billion. So, I think it’s safe to say that WMT’s business model is relatively recession-resistant. Comparably, their peer Target (TGT) saw an increase in revenue, free cash flow, and sales, but EPS decreased from ’07 to ’08 by 14% from $3.33 to $2.86 before bouncing back over 13% in 2009.

Shareholder Returns

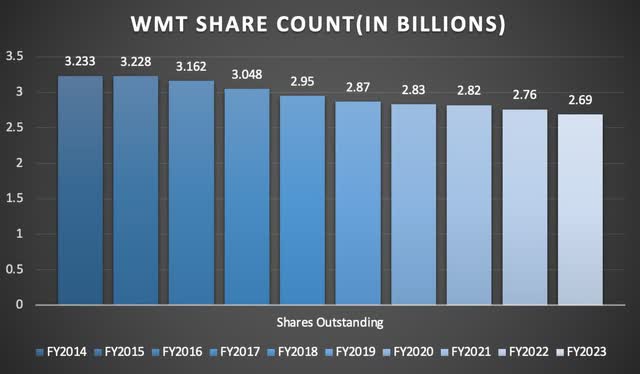

Over the past decade, WMT has also been generous to its shareholders. The retailer has had a positive return every year in the last 10 years with the exception of 2016 where total shareholder return was -19.8% due to negative impact on net sales. This was a result of foreign exchange headwinds. They’ve also managed to grow their dividend over the same period from $1.88 to $2.28. Here you can see Walmart buying back shares over the years:

The company slowed down in 2021 but has since picked back up in the last two years. In FY2021 WMT only purchased 19.4 million of its shares. In FY2022 they more than tripled this repurchasing almost 70 million shares and nearly quadrupling in FY23 with 73.9 million purchased. YTD, the retail giant has purchased a total of 8 million shares and returned $1.2 billion to shareholders in the process.

Recent Earnings & Future Growth

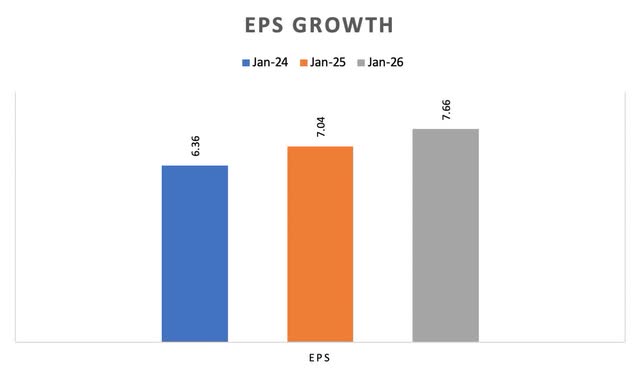

During Q2 earnings in mid-August WMT reported some good growth on both the top & bottom lines. Revenue was up 6.1% from $152.3 billion to $161.6 billion quarter-over-quarter. EPS was also up over 25% from $1.41 in Q1 to $1.84 in Q2. Both were also up year-over-year by 5.6% and 3.9% respectively. FCF grew exponentially year-over-year from $1.7 billion in FY23 Q2 to $9.0 billion due to an increase in operating cash flow. This was also partially offset by a $1.7 billion increase in CAPEX. This strong growth allowed management to raise guidance and they now expect EPS in a range of $6.36 to $6.46 and sales growth of 4% to 4.5%.

For a behemoth like Walmart, you’d think they would have limited growth opportunities but the retailer is expected to post some stellar growth over the next few years. EPS is expected to grow by double-digits next fiscal year to $7.04 and by 8% from $7.04 to $7.66 in 2026. FCF is also expected to post some good growth from $13.56 billion to $16.1 billion by 2026 as well. Two ways the company plans to achieve this are by continuing to build out its healthcare services with clinic expansion and prioritizing omni-channel.

Additionally, the international segments have been growing as well and the company plans to continue this going forward. This year saw Walmart open its first automated e-commerce fulfillment center in Canada. This expanded two-day shipping to 97% of households there. They also saw India continue to lead the largest digital transformation where their subsidiary Flipkart (FPKT) is also the leading marketplace in the country.

PhonePe, a digital wallet & online payment app, and subsidiary of Flipkart, continues to post strong and consistent growth. Annualized TPV or total payment volume surpassed $1.15 trillion, and for the first time, passed 5 billion transactions in a single month. Furthermore, WMT plans to use artificial intelligence to make shopping easier and more convenient for their customers & members. They also plan to unlock value for its shareholders through a combination of physical automation work & intelligence software.

Healthy Balance Sheet

One thing WMT has done along with its growth over the last decade is maintain a strong balance sheet. The company has an excellent A credit rating from all three major agencies. In the last 10 years, Walmart has managed to decrease its debt from almost $59 billion to $50.4 currently. They’ve also managed to increase cash on hand from $8.7 billion to almost $14 billion during the same period. WMT currently has a Net Debt to EBITDA of 1.31x, well below 3x, which is the preference for consumers. They also have a Net Debt to Capital of 0.38x. This is extremely important in the current macro environment. Businesses that highly depend on debt to fund their operations are more likely to run into trouble in a higher for longer environment. In comparison to its peer TGT, WMT is in a much better financial position for the current high interest rates with more cash on hand and lower debt. TGT currently has a Net debt to EBITDA above 2x and a Net debt to Capital of 0.60x.

Risks

Due to the recent popularity of GLP-1 drugs, WMT has seen a decline in food, consumables, and health & wellness sections. But the company expects them to grow as a percent to the total in the back half of the year. Management stated they are very optimistic about growth in these categories going forward due to trends shown over the first half of the year. These drugs have impacted several businesses that have high exposure to food and beverages. Further adoption of these could continue to be a headwind for companies in the industry in the foreseeable future.

Another risk WMT could continue experiencing is a slowdown in foot traffic at its stores. Although inflation is moderating somewhat, rising energy price, student loan repayments, higher borrowing costs, and tightening lending standards continue to put pressure on consumers. In Canada, consumers are starting to feel the higher interest rates with their shorter-term mortgages. Although sales were up 5.15% in the quarter, operating income decreased.

Depending on when interest rates start to subside, this will also continue to put pressure on Canadian consumers in the near to medium term. Also, holiday shopping is around the corner, and WMT, which normally sees an increase in online sales, might experience a slowdown here as well, especially if the FED decides to raise rates again. Sales are expected to increase by 4.8% year-over-year to $221.8 billion but may come in lower due to tighter consumer spending and credit card debt, totaling $1.031 trillion recently for Americans.

Is It A Buy, Hold, Or Sell?

Although WMT’s price has appreciated double-digits over the last year to a 52-week high above $165, the stock has recently seen its price decline over the last month. Even with the recent pullback, the stock’s dividend yield is slightly below its 5-year average. I think most of this is due to economic uncertainty. But with treasury bonds trending higher in the last month, this has caused the stock and some of its peers to sell off. WMT and other low-yielding stocks that are considered recession proof are starting to look unattractive as investors rotate into safer, fixed-rate investments.

If rates continue to increase, I expect stocks like WMT to continue to show some weakness in price, and investors should take advantage, especially those with a long-term outlook. At the time of writing, the stock offers roughly 14% upside to its price target, making it a buy in my opinion. But as mentioned earlier, I expect the retailer to show some share price weakness if treasuries trend higher like they have been recently. If the price falls below $150, I think investors should back up the truck.

Conclusion

If we enter into a recession, I expect WMT to continue posting strong growth similar to the GFC. However, if rates continue to climb, I expect consumer spending to become even more tight, especially in Canada where consumers are feeling the environment more due to shorter-term mortgages. If rates remain higher, WMT will most likely experience a slowdown over the next few quarters, and the company may end up missing its online sales forecast as a result of mounting credit card debt for Americans.

The company has a healthy balance sheet and continues its path to growth with expansion of its healthcare clinics and expansion in India. No company is without risk but I expect WMT to navigate the current macro environment just fine, and investors looking to start or add to their position should dollar-cost average here and continue to add on any sign of share price weakness. Due to the recent pullback and low susceptibility to economic downturns, I rate the stock a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.