Summary:

- Walmart is a dominant retailer in the US market, with a large customer base and low prices.

- The company’s supply chain and logistics superiority contribute to its ability to offer attractive prices and readily available inventory.

- Walmart is actively pushing back against digital giants like Amazon and expanding its online presence to compete in the digital retail space.

- Walmart has demonstrated intelligent strategic execution and an open mindedness that enables adaptive innovation.

- It’s a fine choice for a conservative, value-oriented name within a diversified portfolio.

Justin Sullivan/Getty Images News

Introduction

Walmart (NYSE:WMT) is the pre-eminent traditional brick-and-mortar retailer in the US market. The company owns a huge footprint, with a dominant presence in large and small markets alike.

Walmart is a low-price leader that maintains and grows its massive customer base thanks to the dynamic infrastructure that enables those low prices and the consistently high availability of consumer items in its stores. The elements of that infrastructure include technology, an established supply chain and applied logistical smartness. Walmart pioneered barcode use on a large scale and focuses on excellent communication with suppliers through mechanisms such as shared and updated databases.

Walmart functions within a positive contradiction. It may appear as a conservative and even stodgy giant, but its strategies and tactics are rather flexible and adaptable. The focus on both large and small consumer markets is one example. Walmart could have linked superstores with large markets only, but it saw the potential of creating dedicated customer bases in small markets – then executed this bifurcated approach. The same strengths that work in big markets apply in smaller ones: Low prices and available inventory that rely on supply and logistical strengths to meet customer expectations.

The relatively new focus on omnichannel* is another example of Walmart looking forward and reacting to the challenge of massive digital retailing from Amazon and other players.

*Omnichannel describes a business strategy that aims to provide a seamless shopping experience across all channels, including in-store, mobile, and online.

Walmart’s strategies and execution tell a story of solidity combined with vision. It’s not a company to rest on its laurels. It stays true to its bread-and-butter revenue and earnings sources while continuously implementing changes to help it survive and thrive in the cutthroat retail space.

Walmart Business and Bull Case

Walmart features unrivaled scale compared to brick-and-mortar peers. With its broad footprint and loyal customer base, Walmart stores are a short hop away for most US consumers. Its wide variety of goods keeps its customer base interested and loyal.

The company operates a business strategy based on low-price value that’s enabled by smart logistics, well-organized supply chains and applied technology such as early barcode implementation on a mass scale. It has developed these structures and mechanisms and improves them constantly. Enhancements are calculated to reduce costs, ensure reliable supply and delivery of products to the consumer, and drive the low-cost paradigm.

It’s good to remember that retail is a tough space. Walmart faces challenges on multiple fronts, including from digital retail. Neither can Walmart dismiss its traditional competitors such as Target. Retail poses no switching costs to consumers – unlike sectors such as banking where the downsides of changing institutions often tie consumers to existing service providers.

Walmart, though, has proven itself a winner – in large part because of its pragmatic strategies and successful implementations of integrated functional pieces. That in turn prompts me to review how these supply, logistical and technological strengths play out in the real world.

The Walmart Supply Chain

Walmart’s 150 distribution centers have played a central role in building and supporting its business. Its distribution system is among the largest in the world and serves a large number of stores. It also caters to customers directly.

The distribution centers ship general merchandise, dry groceries, perishable groceries, and other specialty categories to consumers daily. The huge sourcing warehouses and supplier networks are integrated with Walmart transportation/logistics to bring goods to market on regular schedules. The ability to monitor where goods are, what is being shipped where – and what is in the stores – is helped by RIFD technology* and the shared database that both the company and its suppliers access.

Walmart also has kept six disaster distribution centers that are placed strategically across US…” The disaster distribution centers are both helpful, a sign of a corporate conscience, and a boost to Walmart’s image.

*Radio-frequency identification (RFID) uses electromagnetic fields to automatically identify and track tags attached to objects. When triggered by an electromagnetic interrogation pulse from a nearby RFID reader device, the tag transmits digital data, usually an identifying inventory number, back to the reader.

Logistics Management

Walmart owns a private fleet of trucks and employs a team of drivers. Its fleet is one of the largest and the safest. The company’s drivers travel 700 million miles every year to deliver to the stores and clubs (Sam’s Club).

With its large team of drivers, Walmart moves merchandise in a responsible and sustainable manner. The focus is on efficiency and reducing empty miles traveled. The logistical/transportation system boasts 6100 tractors, 61000 trailers and over 7800 drivers.

Between 2005 and 2014, Walmart increased logistical efficiency by 87.4% higher efficiency. Systematically reducing costs of production and delivering goods efficiently impact the bottom line positively and repeatedly.

Technology

Despite its image as an old-school brick-and-mortar stalwart, the company has applied technology in a targeted manner:

“It was a pioneer in terms of using barcodes and RFID for a better inventory management system. Inventory management is a crucial part of managing a great retail system…”

Inventory management refers or links to the supply chain. The ability to readily monitor in-store inventory is input for ensuing supply actions. Supply chain efficiency is furthered by the shared database model:

“A shared database between the company and its suppliers helps manage better supply of inventory. All the required information from PoS (Point of Sale) data to warehouse inventory and the retail sales data is stored in the shared database from where it is relayed to all the participants in the entire system.”

Walmart uses technology to strengthen all aspects of the chain. It’s important to mention that technology is very much a practical tool to monitor and improve supply chain, logistics and inventory performance. Those are requirements and facilitators for keeping costs low and consumers happy.

Omnichannel: A Proactive Expansion

Walmart is hardly immune to the threat that Amazon (AMZN) and other large digital competitors pose to it. The range, pricing and swift, convenient delivery of digital retail are attractive to many consumers. Amazon’s success presents an ongoing threat of structural cracks or failures for traditional retailers.

The digital threat is also an opportunity to build Walmart’s omnichannel strategy. (Walmart also offers its Walmart+ subscription service.) A successful company does not panic from such challenges. Instead, it relies on its track record and self-confidence to respond in a proactive, deliberate manner.

The shift to omnichannel also is recognition that a natural cap for US physical store presence is near.

This CNBC article from 18 October describes Walmart’s digital strategy and related execution.

“It was summer in Las Vegas – the temperature hit nearly 110 degrees that late August day – Doug McMillon, who leads the world’s largest retailer, took the stage and made a sales pitch to the smaller businesses and brands.”

“We hope you’ll choose to grow with us,” the CEO told the more than 1,500 attendees, invoking the memory of company founder Sam Walton, who was at one time a small-town entrepreneur. “We want you to bring great items to our marketplace. Our team is here to serve you.”

“Online sales for Walmart U.S. rose sharply the past two fiscal quarters, even as other major retailers such as Macy’s (M) and Target (TGT) reported declines. As shoppers at many stores, including Walmart’s own, skipped over discretionary purchases, Walmart’s third-party marketplace saw sales in some discretionary categories such as home and apparel rise by double digits in the most recent fiscal quarter.”

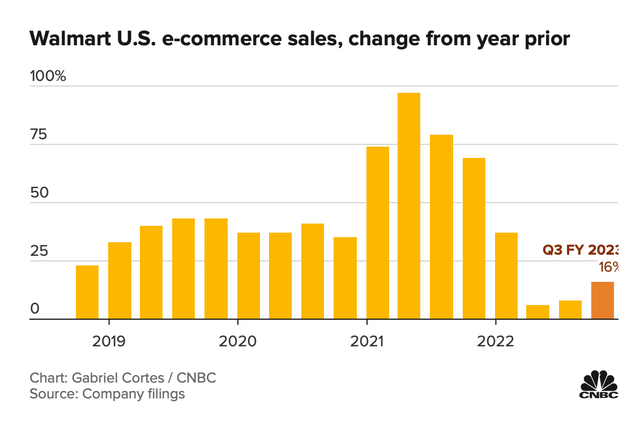

This chart displays the revenue trajectory for Walmart’s online effort:

Overall numbers still pale next to those achieved at the peak of COVID online purchase splurging.

“For Walmart, closing that large gap is an uphill climb, and also an opportunity, said Rick Watson, CEO of RMW Commerce Consulting, an e-commerce consulting firm…Amazon has never been known as the most seller-friendly place to do business,” he said. “Something I’ve seen recently is a lot of sellers actually cheering for Walmart because they want an alternative.”

Walmart has begun to offer fulfillment for sellers’ big or bulky items and multi-box merchandise such as canoes or patio sets. It added seller tools like local deliveries of specialty online orders and software to facilitate curbside pickup while simplifying the onboarding process for new marketplace sellers.

Walmart also is fine-tuning Walmart Fulfillment Services, which lets sellers pay the retailer to store inventory and pack and ship orders.

Adoption of these aspects is still in early stages. The challenge remains daunting. I believe that Walmart is leveraging resources, experience and energy to ramp up its online presence significantly.

The Walmart Moat: Broad and Powerful

Walmart’s greatest single strength may be its moat. This moat includes powerful brand recognition, easy store accessibility, reliable low-price leadership and intelligent supply, logistical and inventory management. Walmart is the largest US retailer, boasting more than $420 billion in annual sales and more than 4700 domestic locations.

The company does not stand pat. Strategies such as establishing its presence in a variety of markets, building out its infrastructure and moving toward subscription (Walmart+) and omnichannel approaches reflect a deceptive dynamism and clear long-term determination.

Walmart stores are well ahead of competitors such as Target in maintaining in-store inventory and in the number of SKUs. Goods that are both cheap and available raise satisfaction and keep the Walmart flywheel turning. Note the percent of visits to Walmart stores out of the total for the retail category – nearly 60% in 2022. Sales per square foot were $600 per square foot against $446 for Target over the past two decades.

The Walmart moat is an essential component of the company’s success and prosperity. It may be seen as a virtual corollary to the impressive, practical daily mechanisms of the Walmart infrastructure. Together, they drive revenues and profits while fending off “live” threats in a most competitive space. They buttress the power of the brand and produce a high level of consumer loyalty.

Walmart Metrics

Walmart’s metrics reflect a powerhouse that executes its strategy deliberately. Share price performance is solid though not spectacular. Revenue has enjoyed incremental increases year after year.

EPS also has displayed steady growth, though it stalled in 2022. Projections are for a resumption of healthy growth.

Valuation levels are reasonable, given that the company enjoys a slight premium for its moat and customer loyalty patterns. While growth is somewhat sluggish, profitability measures are exceptional. Momentum also is on Walmart’s side, eclipsing average momentum stats for the S&P 500.

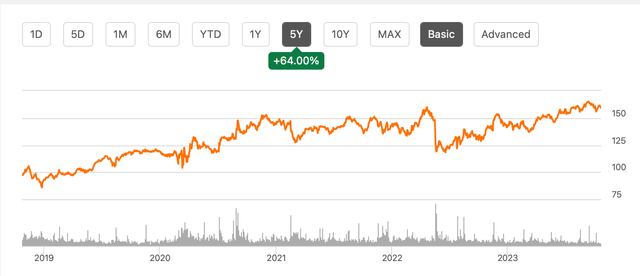

Share Price Performance

I like five-year charts for stocks. I think this is an adequate period in which to measure company performance outside the voting machine limitations tied to smaller time frame. Since many investors seem to hold individual stocks for short periods, it is also “fits” better than a 10-year chart.

Walmart has shown a modest but consistent share price rise of 60% over five years. While this may disappoint aggressive growth investors, WMT has a different role to play in a portfolio – as a conservative name that fits a somewhat defensive slot.

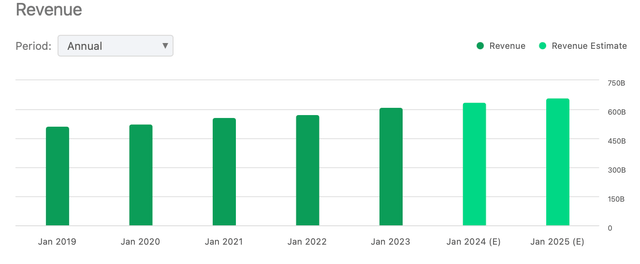

Revenue

Walmart’s revenue moves relentlessly if modestly higher each year. Revenue levels already have reached $600 billion per year and are projected by Seeking Alpha to hit $662 billion by the start of 2025. This reflects massive size, a huge and loyal customer base, and continued supply chain and logistical enhancements. The potential of Omnichannel to further this trend is genuine if mostly unrealized.

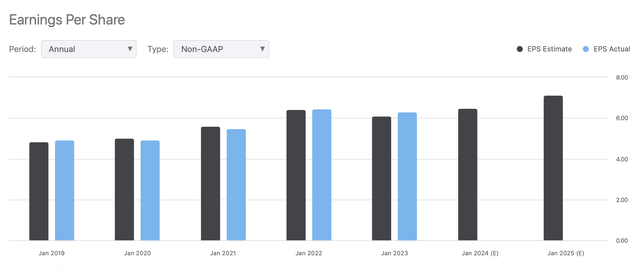

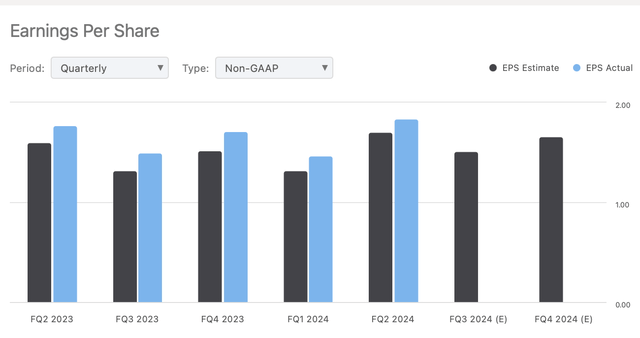

Earnings Per Share

The multi-year EPS view also indicates a positive trend. While the yearly results are more uneven than revenue path, the growth is strong – from $4.91 in January 2019 to a projected $7.11 in Jan. 2025. The EPS slowdown in 2022 may owe to factors including capital expenditure for supply chain, logistics and omnichannel.

Q2 2023 results show a nice boost from Q1 of this year. This quarterly view of EPS progress is reassuring evidence:

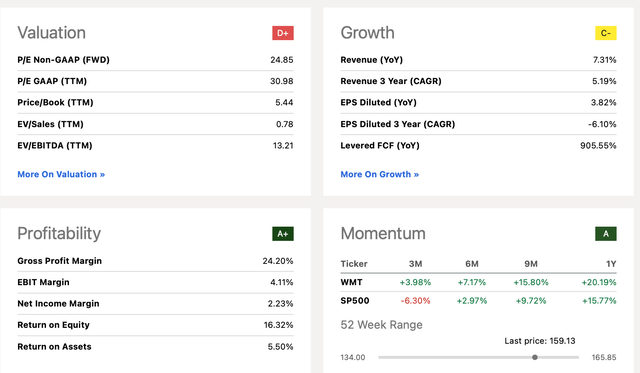

Valuation/Growth/Profitability/Momentum

Next is a composite view of valuation, growth, profitability and momentum.

Valuation is the most challenging metric of the four. Price/earnings ratios, whether GAAP or non-GAAP are relatively high for the retail category. I think that an ‘F’ grade here does not reflect a fair assessment of realistic valuation. Walmart enjoys a persistent premium in P/E ratio because of its reach and demonstrated success in the manner of a Costco (COST) or Apple (AAPL).

Growth is modest at first blush. It’s hard to grow quickly when your company is gigantic. Revenues have indeed been solid. It’s the uneven EPS from 2022 that hurts the growth score.

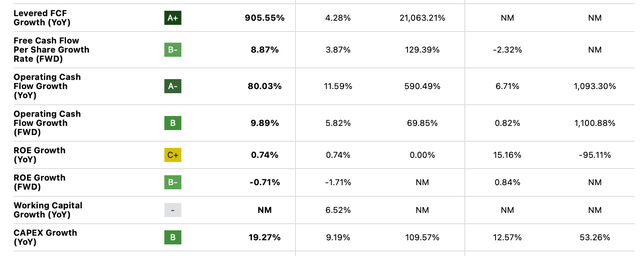

A deeper look at growth emphasizes positive figures in levered FCF growth, operating cash flow growth, return on investment and capex:

Profitability

Profitability is exceptional. Measured against its competitors in the retail space, Walmart has a tremendous gross profit margin and an excellent return on equity. I think that both revenues and profitability can be linked directly to the intelligent supply chain, logistics and technology that Walmart boasts.

Momentum

Walmart receives an ‘A’ for momentum, whether we’re talking about three months, six, nine or one full year. It’s beating the S&P overall momentum score by about 6% (average per period).

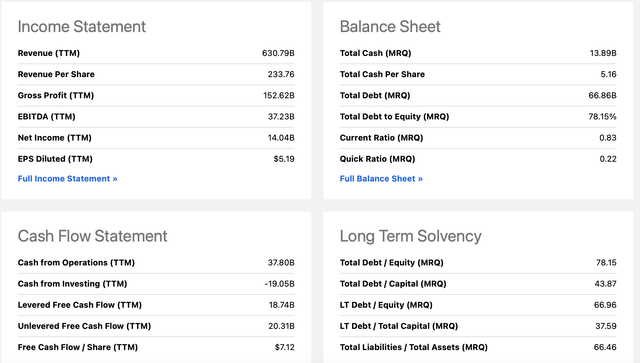

Income, Balance Sheet, Cash Flow and Solvency

This Seeking Alpha chart is a combined view of income, balance sheet, cash flow and solvency.

The first category, Income Statement, shows very healthy revenue, gross profit and net income numbers.

Balance sheet metrics include a very healthy total cash figure of $13.9 billion, reasonable total debt and debt to equity figures, and a reasonable liquidity ratio (0.83), measuring a company’s ability to cover its short-term obligations with its current assets.

Cash flow reveals very impressive cash from operations and levered free cash flow numbers.

Long-term solvency metrics are solid, including key ratios such as debt to equity and debt to capital.

GuruFocus: Financial Strength Summary

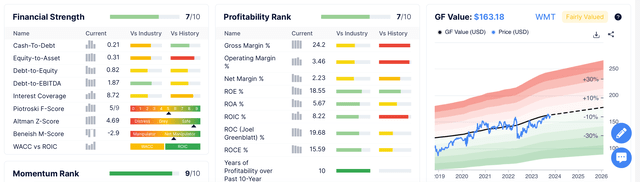

This GuruFocus summary chart indicates moderate to good financial strength and modestly attractive valuation that at present sits slightly below fair value.

One of the key benefits of the GuruFocus metrics is compilation of financial safety scores. These are displayed in the chart at the bottom left:

- The Piotroski F-Score, a straight measure of financial strength, is fair,

- The Altman Z-Score, which predicts the likelihood of a company falling into bankruptcy or insolvency, rates WMT as very safe, and

- The Beneish M-Score, a mathematical model that uses multiple financial ratios to determine whether a company has manipulated its profits, assigns WMT a non-manipulator rating.

A quick summary assessment of Walmart’s financial metrics displays a reassuring consistency, enormous scale, growing revenues and excellent profitability. Revenue growth is machine-like.

EPS unevenness in 2022 looks to be a decidedly short-term phenomenon. Income, balance sheet and cash flow are all impressive.

Walmart’s metrics fit the picture of a retail powerhouse with proven, systematic efficiencies, a solid strategy and a surprising level of tactical flexibility.

Risks

I believe that the risks associated with investing in WMT are modest and manageable. And risk does not make sense without reward, something Walmart has provided both consumers and investors.

Still, Walmart is not without attendant risks. Among these are:

- Competition from other large-scale brick-and-mortar retailers. These would include Target, which fights for many of the same customers. If we consider risk for Walmart in this regard, it appears to be low. Walmart sits in a dominant position with its low-price strategy, mass presence and excellent inventory management.

- Competition from giant digital retailers, with Amazon as the prime suspect. This risk could also be formulated as that of generic encroachment of digital forces upon classical, physical retail. Consumers are definitely habituated to online purchasing with its delivery conveniences. The digital threat is probably the greatest risk to Walmart’s future. However, the company is actively developing its online presence. Its devoted customer base provides it with breathing room to deal with this challenge. I rate this threat as moderate but significant. It is important that Walmart succeed with its omnichannel strategy to reduce it.

- A macro disaster due to a Black Swan, the oft-predicted imminent recession or geopolitical challenges. Certainly, something on the scale of a COVID pandemic will take down all names. In any potential recession, people spend less. Increasing geopolitical uncertainty also is a macro risk. Against all these, the staples that Walmart sells are vital to many consumers. A company like Walmart is better equipped to ride out macro trouble than most. In such a scenario, investors may swap out dynamic names for a Walmart.

Summary

Walmart is a great choice for a conservative stock in a portfolio precisely in part because the associated risks of ownership are low. Its growth is steady, as reflected in revenue and earnings per share trends over significant periods of time.

Walmart is not only the dominant brick-and-mortar retailer in the United States, but it also is innovative. This is not the splashy innovation of a high-tech startup that’s the first to bring a specific technology to market. Instead, it’s practical innovation through enhancement of supply chains, logistics channels and inventory management. It includes integrated communications with suppliers through mechanisms such as use of a shared database.

Walmart’s logistical arm is both large and finely tuned, connecting the supplier network with the point of sale – the stores of various sizes and heterogenous locations.

Walmart looks forward. It’s a confident company with many positive attributes. WMT is an excellent choice for a value-oriented investment that fits well in a diversified portfolio.

Good luck to all.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I also own COST shares.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.