Summary:

- We review card payment economics.

- We discuss Walmart’s prior legal issue with Synchrony Financial.

- Lastly, we highlight our thoughts on WMT’s tactics vs. Capital One.

Justin Sullivan

Credit Cards & Walmart

Payments

One can think about the payment cycle like this:

- A consumer (i.e., Joe) with a Visa credit card looking to transact

- Joe can be shopping at a physical merchant or online

- The merchant acquirer enables a merchant to accept credit cards

- Also, the acquirer works with merchant’s bank for daily funding

- The payment gateway (i.e., Visa) moves the transaction between parties

- The issuing bank approves Joe for the transaction, based upon his LoC

- This entire process can be handled in 2-3 seconds

While this looks and sounds straightforward, it is much more complicated and can involve four to five different entities/parties.

The consumer perspective: Accepting cards is expected by consumers, and most expect card transactions to occur in a matter of seconds. We demand convenience and the option of paying with our desired card (debit, credit, prepaid, mobile phone).

The merchant perspective: Whether using traditional plastic, with its 60-year-old magnetic stripe, or mobile-based payments (like Apple Pay), the process for merchants to accept card payments is fairly easy. They benefit by receiving almost immediate access to their funds (in their bank account), without the risk of cash disappearing (i.e., theft). Most simply want the process to occur seamlessly and fast and are fine with absorbing the modest card acceptance costs. Some larger merchants push back on the card industry for the fees involved, especially those with low margins. When we discuss Walmart (NYSE:WMT) later in the article, keep this point in the back of your mind. The reality is that card acceptance has a cost, and we’ll now break down those payment economics.

Payment Economics

On a typical $100 credit card transaction, a merchant will receive $97.50 into their bank account and there are roughly $2.50 of fees taken out.

Payment Economics (Manole Capital Management)

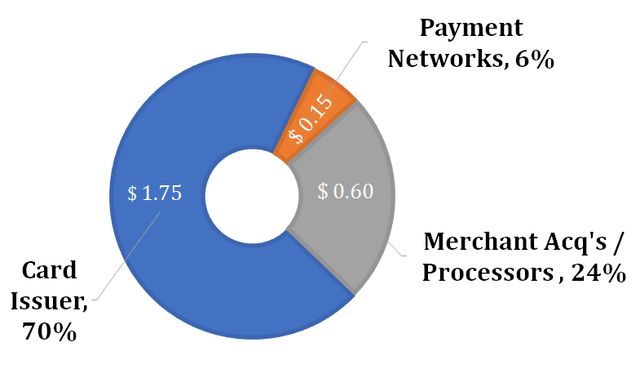

We’ve broken these fees into three main buckets, to show which entities earn these payment economics. The card issuer is the bank or financial institution that has granted a consumer a line of credit. The payment network is the specific rail that the transaction runs along, from beginning to end. The merchant acquirer and its chosen payment processor are handling the authorization, clearing and settlement of that card transaction.

Once again, this attempts to simplify a very complicated process, but it’s “close enough” for our purposes.

Card Issuers

Let’s assume you are a bank or financial institution providing credit to consumers. If you grant a mortgage, you are able to demand 20% cash down and you have collateral in a house (to foreclose). If you issue an auto loan, you can demand a certain amount of cash down, plus you have collateral in the car (to repossess). If you provide a credit card to a consumer, you don’t get any cash down and you are exposed to an open line of credit with no collateral. This is exactly why we don’t invest in the card issuers (i.e., the banks providing credit cards).

As you can see on our pie chart on page one, the vast majority of the payment economics goes to the card issuer for providing a line of credit to the consumer. Card issuers take the risk and therefore should earn the majority of the economics, in the form of interchange. The card issuer earns $1.75 (70% of the $2.50) in fees but has material offsets to that revenue. Card issuers have losses and delinquencies to deal with, as well as significant marketing costs (i.e., miles, points, rewards, ads, etc.). In our opinion, the 70% card issuers receive is entirely justified, as they are ultimately taking the customer and credit risk associated with a card transaction.

When the market is healthy and unemployment is low, there are few delinquencies. When the cycle turns and the job market stumbles, card issuers often have to deal with losses. Once a consumer doesn’t pay the amount charged, these entities can get late fee penalties and charge high APRs (annual percentage rates), ranging from the mid-teens into the mid-20%, on unpaid balances. In the fourth quarter of 2022, the average APR was 19.07%, which is a very large annual increase (primarily due to the Fed’s eight interest rate hikes). Just last month, US bankruptcies hit a 13-year high. With these bankruptcies, the card issuer and bank have no collateral to seize, and the outstanding loan must be written down to $0 (i.e., a total loss). In our opinion, the March 2023 banking crisis will lead to a tightening of lending standards and make the granting credit cards even more challenging going forward.

Merchant Acquirers & Payment Processors

Merchant acquirers and payment processors earn the next highest amount of income, as they do the “heavy lifting” of a transaction. For authorizing, clearing, and settling a transaction, these payment companies earn healthy economics (24% of the $2.50 in fees or $0.60). These companies benefit through scale economics and are able to generate impressive FCF and operating margins.

On the merchant acquirer front, most investors have heard of Square (now called Block), which works with merchants of all sizes to accept debit and credit cards at their POS (point of sale). On the payment processing side of the business, few have even heard of companies like Fiserv (FISV) that acquired First Data in 2019, or Fidelity National Information Services (FIS), that acquired Vantiv/World Pay in 2019. Most have never heard of other companies like Global Payments (GPN), as it does not need to spend money on building a well-known and costly brand. We bundle these payment companies together, but each brings something valuable to the transaction. We invest in this segment of the payment market, as the companies are typically quite profitable. After wonderful performance in 2019, 2020 and the first half of 2021, many of these names have languished. Most are now buying back significant amounts of their own stock, trade at attractive FCF yields and are now trading at P/E valuations below their growth rate. We are excited for many of these businesses to thrive in 2023 and beyond.

Networks

Lastly, the networks earn the smallest amount of money, just 6% of the $2.50 in fees or $0.15. The payment networks are the “rails” that a transaction runs across. For building powerful brands, with global payment acceptance, the networks earn recurring revenue and unbelievable margins. While they earn the smallest amount on each card transaction, the networks earn predictable fees on billions of transactions covering trillions of dollars of purchases.

For example, Visa (V) posted operating margins in the fourth quarter of CY ‘22 of 69%. Can you name any company that boasts operating margins this sustainably high? If you do, please let us know; we’d love to quickly become shareholders. There are good businesses and there are great businesses. We would argue that both Visa and Mastercard (i.e., the payment networks) are examples of fantastic business models, with high barriers to entry, large moats around their franchises, wonderful margins, and prolific FCF.

To summarize, we like two of the three key parties in our earlier pie chart. We own names in the merchant acquiring and payment processing space, as they capture the same opportunity and secular growth of the overall payments industry. We continue to own the payment networks, as well as payment gateways (enabling eCommerce transactions). The area we do NOT own is the card issuers, that take all of the risk associated with a card transaction. As we explained, these banks earn the vast majority of the payment economics, but those come with credit risk, that we try to avoid.

Now that we have detailed the payment economic landscape, we thought we would quickly address the biggest news in the credit card industry last week.

Walmart & Cards

Back in 2019, Walmart sued Synchrony (SYF) to terminate their co-branded card. We try to simplify the complicated. The best way to think about co-branded relationships is that Walmart is the strong brand on the front of the card, while Synchrony is the card issuer (i.e., the bank and provider of the line of credit).

A few years ago, Walmart claimed that Synchrony was refusing to underwrite clients because they had weaker credit profiles. Due to its tighter underwriting standards, Walmart sued Synchrony for $800 million. Ultimately, the lawsuit was dropped. We believe that Walmart’s real goal was to terminate their co-branded card with Synchrony and find a new partner. Following that 20-year Synchrony partnership, Walmart decided to partner with another leading card issuer – Capital One (COF).

Capital One signed a deal with Walmart and began issuing new co-branded cards in late 2019. After paying a handsome fee, Capital One became the exclusive issuer of Walmart private label and co-branded credit cards. As of the end of 2022, Walmart represented $214 million or roughly 3% of Capital One’s net income and 2.7% of its loans ($8.3 billion).

Recent News

On April 6, 2023, Walmart decided to sue Capital One to terminate their credit card issuing relationship despite the fact that their contract doesn’t expire until 2026. After absorbing all of the upfront costs of launching this program, Capital One is now facing the loss of a large and important client. As these co-branded programs scale up, the vast majority of profits come in the later years. This is referred to as “the seasoning” of a portfolio. Unfortunately for Capital One, this is occurring right as this portfolio was beginning to show some profit. If one reads Capital One’s issued 8k, it stated the earliest Walmart’s book could be transferred to a new issuer would be January 2025. Despite the delay, this clearly isn’t a positive for Capital One.

Capital One works with lower and mid-FICO scoring customers, so Walmart couldn’t claim that this contract should end because of tighter underwriting (like it did with Synchrony). This time around, Walmart’s lawsuit alleges that Capital One didn’t meet certain terms of its card contract. Walmart says it is terminating its deal with Capital One as a result of the SLA (service level agreements) failures. It cited that “the SLAs are essential to preserving the quality customer service at the core of Walmart’s brand.”

Specifically, Walmart is claiming that Capital One “didn’t provide the customer service it was obligated to offer, such as replacing lost cards promptly” and that Capital One didn’t promptly post some transactions and payments to cardholders’ accounts. While we don’t own Capital One, it does have a history of solid collections, good payment infrastructure, decent analytics, and they know how to price risky credit card accounts (i.e., low FICO clients). We highly doubt that Capital One wouldn’t be able to meet typical performance metrics in a standard SLA, like timeliness of transaction posting and replacing a card within five business days.

Banks

Following the collapse of Silicon Valley Bank and the major banking volatility and crisis of last month, we wonder why any firm would look to get into the lending or banking business. However, over the last decade, Walmart has made several attempts to becoming more “bank like”.

In 2005, Walmart applied for a bank charter from the FDIC (Federal Deposit Insurance Corporation), to operate an ILC or industrial loan company. Once that faced significant opposition from community banks, the application was withdrawn. Instead of creating its own bank, Walmart has partnered with various firms to provide banking services.

For example, Walmart offers its MoneyCard, which is a pre-paid debit card for purchases or ATM withdrawals. Its partner on this product is Green Dot (GDOT). Walmart also offers paper check cashing services, for customers that don’t necessarily have access to traditional banks. Through a partnership with MoneyGram (MGI), Walmart offers global money transfer services. Through its GDOT relationship, Walmart offers a low-cost checking account called GoBank. In December of 2022, CNBC reported that Walmart was backing a FINTECH firm, to get into the emerging BNPL (buy now, pay later) business. Walmart said it’s looking “forward to bringing our customers a new credit card option that provides meaningful benefits and rewards soon.”

As you can see, Walmart has created or partnered with numerous firms to offer most banking services that customers can get from Bank of America, Wells Fargo, Citi, or Chase. If a typical Walmart generates 4% operating margins (FY’23 adjusted operating margins of $24.7B / Total revenue of $411.3B) selling food or goods, we can only assume Walmart is attracted to the higher margins associated with financial products and services. We aren’t too attracted to companies that are only able to generate a measly 4% off of over $600+ billion in sales and aren’t surprised to see them venture into more lucrative financial services.

Last month, we wrote a 7-page research note discussing the CFPB’s (Consumer Finance Protection Board) proposal to limit the card industry’s late payment fees to just $8. We believe that is another regulatory over-reach, but we’ll let the courts figure that out. Will card issuers push fees onto merchants? Will they lower revenue sharing to their brands? We’ll wait and see, but it looks like Walmart is getting a head start on this process. We believe that Walmart would be foolish to issue its own credit cards and provide loans to their clients (in this volatile and economic environment). It sure looks as if Walmart is trying to get out of its Capital One contract early and possibly migrate its co-branding card relationship to another vendor.

Conclusion

This lawsuit by Walmart is laughable and a terrible use of time for the US District Court for the Southern District of New York to have to review. Maybe we are totally wrong on Capital One’s processing capabilities, but this tactic by Walmart seems very reminiscent of the one with former partner Synchrony.

Just like it did before, Walmart is looking to re-negotiate the economic terms of its existing card partnership and achieve more favorable revenue sharing economics going forward. Why is it OK to use our court system to renegotiate contractual terms? Unfortunately, it is another example of a large company taking advantage of the legal system and the fact that they employ hundreds of in-house attorneys.

Warren Fisher, CFA

Founder and CEO

Manole Capital Management

DISCLAIMER:

Firm: Manole Capital Management LLC is a registered investment adviser. The firm is defined to include all accounts managed by Manole Capital Management LLC. In general: This disclaimer applies to this document and the verbal or written comments of any person representing it. The information presented is available for client or potential client use only. This summary, which has been furnished on a confidential basis to the recipient, does not constitute an offer of any securities or investment advisory services, which may be made only by means of a private placement memorandum or similar materials which contain a description of material terms and risks. This summary is intended exclusively for the use of the person it has been delivered to by Warren Fisher and it is not to be reproduced or redistributed to any other person without the prior consent of Warren Fisher. Past Performance: Past performance generally is not, and should not be construed as, an indication of future results. The information provided should not be relied upon as the basis for making any investment decisions or for selecting The Firm. Past portfolio characteristics are not necessarily indicative of future portfolio characteristics and can be changed. Past strategy allocations are not necessarily indicative of future allocations. Strategy allocations are based on the capital used for the strategy mentioned. This document may contain forward-looking statements and projections that are based on current beliefs and assumptions and on information currently available. Risk of Loss: An investment involves a high degree of risk, including the possibility of a total loss thereof. Any investment or strategy managed by The Firm is speculative in nature and there can be no assurance that the investment objective(s) will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. Distribution: Manole Capital expressly prohibits any reproduction, in hard copy, electronic or any other form, or any re-distribution of this presentation to any third party without the prior written consent of Manole. This presentation is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use is contrary to local law or regulation. Additional information: Prospective investors are urged to carefully read the applicable memorandums in its entirety. All information is believed to be reasonable, but involve risks, uncertainties and assumptions and prospective investors may not put undue reliance on any of these statements. Information provided herein is presented as of the date in the header (unless otherwise noted) and is derived from sources Warren Fisher considers reliable, but it cannot guarantee its complete accuracy. Any information may be changed or updated without notice to the recipient. Tax, legal or accounting advice: This presentation is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any statements of the US federal tax consequences contained in this presentation were not intended to be used and cannot be used to avoid penalties under the US Internal Revenue Code or to promote, market or recommend to another party any tax related matters addressed herein.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.