Summary:

- Walmart should benefit from the Economic Slowdown.

- The retailer should have several cost-cutting and ecommerce initiatives that should drive additional growth moving forward.

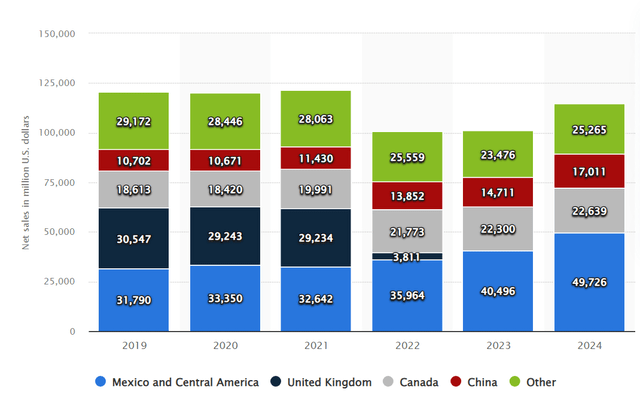

- The company’s international divisions are beginning to grow again.

Alexander Farnsworth

There is an old saying that sometimes it is better to be lucky than good. While management teams and corporate decisions obviously matter, the operating environment is often more important than what the leaders of companies can control.

Walmart (NYSE:WMT) has benefitted significantly from the inflationary environment that we have seen in the US and globally since March of 2021. As consumers looked to trade down, the retailer was able to gain market share without having to use any significant promotions or discounts.

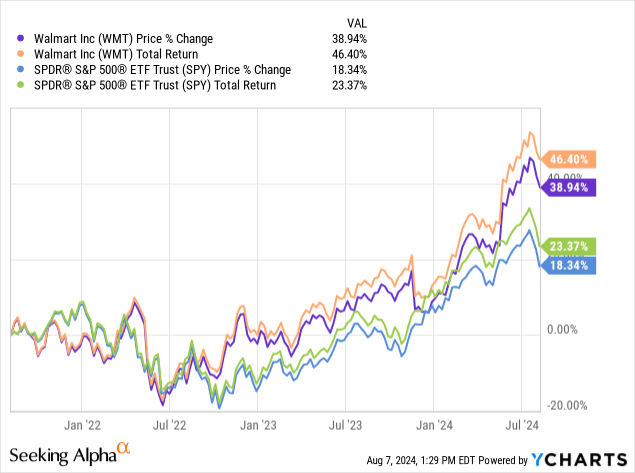

Walmart has offered investors total returns of 46.4% over the last three years, while the S&P 500 is up 23.37% during this same time period.

Today, I am upgrading Walmart from a hold to a buy. I last wrote about the leading retailer in March of this year, and I rated the company a hold. The economic environment has also become and should remain more favorable for the retailer, the company should be able to expand margins for multiple reasons. Walmart’s current valuation looks cheap as well.

Walmart beat first-quarter earnings expectations on the top and bottom lines. The retailer reported EPS GAAP actual of $.63 a share, beating expectations of $.52 a share. Management also reported revenue of $159.94 billion, beating expectations by $1.67 billion. The company saw gross profit rates increase by 42 basis points, e-commerce sales increase by 22% at Walmart stores, membership at Sam’s Club stores increase by 13%, and impressive 12% growth from international Walmart stores.

The leading retailer had not seen significant e-commerce or international growth for some time, the first quarter report shows that management’s strategies in the phases of the business are finally starting to become more successful.

Walmart International Revenues (Statista)

Even though the company’s international revenues were lower than 2021, in part because of forex headwinds, the retailer appears to have reversed negative overseas trends.

Walmart’s increased investment in e-commerce is also working. The company’s investment in Flipkart has bolstered international sales, and management also took a majority stake in India’s digital platform PhonePe. The retailer has also significantly increased delivery options by adding on-demand morning delivery and more at-home ordering options as well. The company is now offering more express deliveries and continues to acquire companies to help with e-commerce such as Parcel.

Walmart also has a multi-year cost control plan to streamline supply chain issues and build out margins that the company is successfully implementing, the company’s already impressive profitability levels should continue to rise. The retailer expects 65 percent of stores to be serviced by automation by the end of 2026, and the company is also using AI-operated forklifts and other equipment in the supply chain as well.

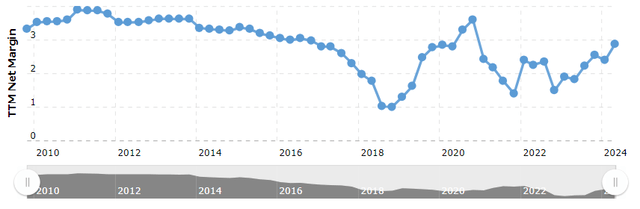

Walmart’s Net Margins 2010-2024 (Macrotrends)

Walmart’s net margins have risen from 1.49% in late 2022, to 2.88% in the first quarter of this year. These profitability levels are also still far short of the company’s 10-year peak margins of 3.87%, the retailer should continue to be able to effectively cut costs.

Consumers have been trading down because of high prices, and slowing inflation has not changed overall price levels in the economy. There is also now significant evidence that consumer spending is beginning to noticeably slow down, with recent concerning reports from major retailers such as Target and Restaurant franchises such as McDonald’s (MCD). Prices remain high, and the economy continues to weaken, Walmart should be able to retain the significant amount of customers the company gained over the last several years. The retailer’s discounts will also likely have more appeal to many individuals who are increasingly looking for added savings as well.

This is why Walmart’s valuation looks undervalued at current levels as well. Even though the retailer currently trades at 27.54x expected forward earnings estimates, which is above the company’s average 5-year valuation level of 25.80x forecasted forward earnings estimates, the company is operating in a far more favorable economic environment today than the retailer has for most of this timeframe. Walmart has a recession-resistant business model, and analysts expect the company to be able to grow the core business at a high single-digit rate over the next six years. The retailer has also consistently been able to significantly exceed analyst estimates over the last two years.

Not all good investments have the same upside. While Walmart isn’t likely going to offer investors the same potential returns as tech companies such as Apple (AAPL) and NVIDIA (NVDA), the company should be able to deliver consistent growth and solid returns. Walmart’s management team is also committed to maximizing shareholder returns with buybacks and dividends as well, patient investors in this retailer should be rewarded.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.