Summary:

- Positive trend in guidance upgrade.

- Walmart has robust momentum in revenue and operational efficiency.

- Strong performance across operating segments and comparable sales.

- Consistent operating cash flow and return on assets.

- Based on a forward P/E multiple, WMT stock looks overpriced compared to peers and historical averages.

Sundry Photography

Background

I wrote the article “Walmart: How High Is Too High?” on 28th August 2023, based on an investment thesis that Walmart Inc. (NYSE:WMT) has the potential for upside and outperforming the broader market. The stock was trading at $52.91 (adjusted for stock split 3:1) and now trading at $94.95 (~78% upside). My investment thesis was based on the strong momentum in the comps sales and e-commerce business, incremental operating margins, and strong operating cash flow provided an investment case for upside potential. Now, as we are heading into 2025, can Walmart deliver a strong return to investors? In this analysis, I will verify the investment thesis based on earnings and valuation multiples to see if momentum continues or if the stock is overpriced now.

Walmart engages in the operation of retail, wholesale, other units, and eCommerce worldwide. The company operates through three segments: Walmart U.S., Walmart International, and Sam’s Club.

Stock Catalysts

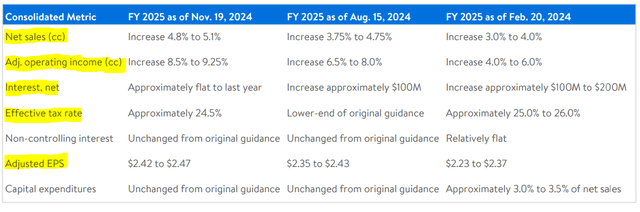

1. Positive Trend in Guidance Upgrade:

In the above analysis, we can see the FY 2025 guidance provided by management from Q1 2025 to Q3 2025. The most important trend for investors is to observe the upgrade in guidance for net sales, operating income, and adjusted EPS. The same data points I have highlighted in yellow for reference. This trend shows improving growth opportunities and operational efficiency during FY 2025. Furthermore, management is expecting to have similar interest expenses compared to previous year’s expenses, whereas in Q1 2025 and Q2 2025, the expectations were to increase up to $200 million.

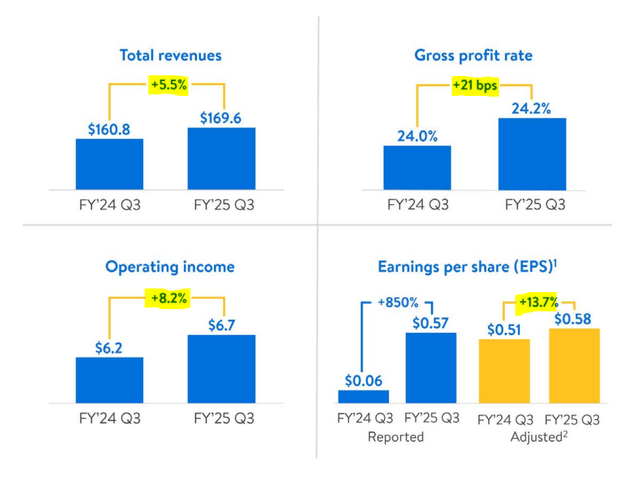

2. Positive Momentum in Revenue and Operational Efficiency:

Company Presentation (in $Billion)

Source: Company Presentation Q3 2025 (in $Billion)

Walmart generates the majority of its revenue from grocery and general merchandise. According to Future Market Insights, the global food & grocery retail market size is expected to reach USD 17.1 trillion by 2034, expanding at a CAGR of 3.3% from 2024 to 2034. This shows that the addressable target market for Walmart has a positive growth trajectory for the next decade. As a leading market player and with a strong presence globally, Walmart is in a strong position to achieve a stable growth rate. In Q3 2025, the company has achieved a growth rate of 5.5% driven by growth in Walmart U.S. and the Walmart International segment. The management is expecting to achieve a revenue growth rate of 4.8% to 5.1% in FY 2025. The street consensus, based on the average of 28 analysts, is expecting revenue growth of 5% in FY 2025, which is in line with management expectations. The growth in operating income of 8.2%, which is higher than revenue growth, signifies strong cost control measures in Walmart. Furthermore, management is expecting an operating income growth rate of 8.5% to 9.1% for FY 2025. Based on this analysis, we can conclude that Walmart is on a path of positive growth, and attaining operating efficiency will help to generate positive cash flows and higher valuation.

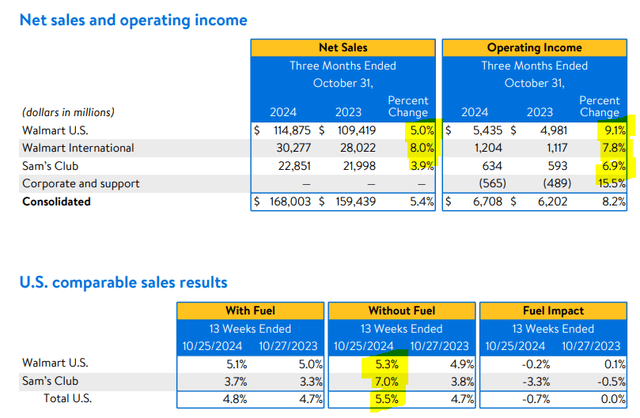

3. Strong Performance Across Operating Segments and Comparable Sales

Company Presentation (in $Billion)

The company generates the majority of revenue from Walmart U.S., followed by Walmart International and Sam’s Club. The Walmart U.S. segment includes its mass merchandising and eCommerce. In Q3 2025, the revenue has increased by 5.0% and operating income by 9.1% for Walmart U.S. This shows improving operational efficiency as a company is capable of generating more operating profit from revenue streams by reducing costs, optimizing processes, or increasing productivity. The increase of 9.1% in operating income is due to the expansion of gross margin and membership income, as well as reduced losses in eCommerce. Within this segment, the e-commerce sales increased by 22% due to store-fulfilled pickup & delivery, advertising, and the marketplace. The comparable sales growth of 5.3% in Q3 2025 is driven by an increase in transactions and unit volumes, supported by improved sales in grocery and health and wellness. The growth of 8% in Q3 2025 for the Walmart International segment was led by Flipkart (India), Walmex, and China. Furthermore, the transaction counts & unit volumes are up across markets. Flipkart’s The Big Billion Days event supported growth in Q3 2025 and will continue to positively impact growth in Q4 2025. According to the management, the growth in eCommerce sales and advertising business for 2H 2025 is expected to be similar to 1H 2025. The operating income growth of 7.8% against revenue growth of 8% again shows operational efficiency in the international segment and a controlled cost structure. The Sam’s Club segment consists of warehouse membership clubs in the U.S. and samsclub.com. The revenue growth rate of 3.9% is driven by growth across club and digital channels, led by food and health & wellness categories. The comparable sales growth of 7% is driven by transaction counts and unit volumes. The growth in operating margin of 6.9% signifies cost-controlled measures within the segment.

In summary, the company has consistent revenue growth in all segments supported by comparable sales. Furthermore, all segments are having operational efficiency, which is crucial to generating positive cash flow and maintaining the profits in a high inflation scenario. Based on segmental analysis, I have not noticed any significant red flag for existing investors that prompted them to sell off the positions.

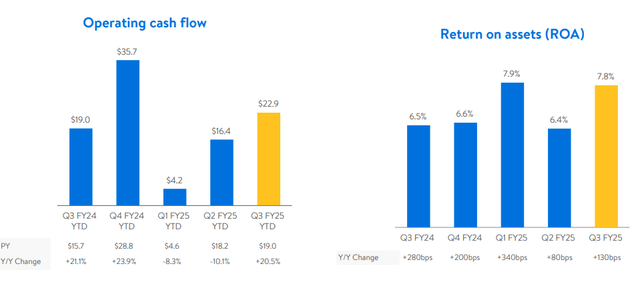

4. Consistent Operating Cash Flow and Return on Assets:

Company Presentation (in $Billion)

As discussed above, the company has achieved operational efficiency, and now we can see the result in positive and improving operating cash flow. The YTD operating cash flow is higher compared to the previous quarter and the same quarter of the previous year. In fact, if we exclude Q4 2024, which is always higher in the retail sector, the operating cash flow is higher since Q3 2024. Moreover, the company has delivered consistent return on assets.

5. Valuation Analysis

| Peers | Price | Forward EPS | Forward P/E Multiple |

| Walmart (WMT) | $93.83 | $2.48 | 38.63x |

| Costco Wholesale (COST) | $987.86 | $17.86 | 55.57x |

| Target Corporation (TGT) | $135.29 | $8.67 | 15.27x |

| Dollar General (DG) | $80.80 | $5.74 | 14.22x |

| Dollar Tree (DLTR) | $71.60 | $5.41 | 13.29x |

| Average | 27.39x | ||

| 5-Year Avg. | 24.82x |

Based on the above analysis, the 2025 forward P/E multiple of Walmart is higher compared to its peers. The multiple is even higher than the 5-year average multiple of 24.82x. Given its market-leading position in the retail industry and solid business, I believe Walmart should trade at a higher multiple compared to its peer’s median. However, presently it looks overpriced compared to peers and historical averages. I believe investors may want to wait for the PE multiple to normalize around 25x, which is the 5-year average, to buy this stock. This level provides a better margin of safety.

Final Thoughts

Based on fundamental analysis of the company and after analyzing recent financials from Q3 2025, we cannot see any significant risk or red flag that will change the strong uptrend in the stock price for long-term investors. It has a robust historical revenue growth and is expected to have positive revenue growth supported by its business model and addressable target market. Investors can hold this stock due to sustained comps sales, strong growth in e-commerce, better measures for cost control, operating margin expansion, and a positive cash flow.

Investment Strategy

- At current levels, the margin of safety is limited for investors. For new investors, it’s advisable to wait for the P/E multiple to normalize around 25x, as discussed above.

- However, for existing long-term investors, they can continue to hold and watch for a stock level of $100-$120 for accumulation with a forward EPS of $3.46 to $4.31. Furthermore, keep a close watch on key performance indicators in the earnings report.

- Brokers View: 25 Wall Street analysts have a strong buy rating, and 13 analysts have a buy rating out of 42 analysts (as data provided on Seeking Alpha). This shows 90% of analysts have a bullish view for Walmart. On the contrary, I believe the investors should be a bit conservative and analyze available data points rather than having a mindset of FOMO.

Risk Factors

Walmart is generating significant revenue from international operations and has a supply chain across the globe. The company needs to effectively manage the currency fluctuations and changing tariff structure to protect against supply chain disruption; both factors can adversely impact the revenue.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.