Summary:

- Walmart’s high valuation and slowing growth rate make it a poor investment, despite its strong market position and profitability.

- Declining inflation and potential changes in low-wage labor dynamics pose risks to Walmart’s future performance and consumer base.

- Shareholder returns are limited by Walmart’s lofty valuation, with a dividend yield of 1% and share repurchases becoming less impactful.

- Walmart’s P/E ratio nearing 40+ suggests overvaluation, with most year-to-date returns from multiple expansion unlikely to continue.

Alexander Farnsworth

Walmart (NYSE: NYSE:WMT) is among the largest retailers in the world with a market capitalization of almost $700 billion. The company has benefited from a strong stock market plus shoppers looking to save costs in a high-inflation environment over the past four years. Despite that, as we’ll see throughout this article, Walmart has several risks at its lofty valuation, making it a poor investment.

Inflation, Migration, and a New Administration

Walmart benefited from high inflation rates in the market, as budget conscious shoppers turned toward the company.

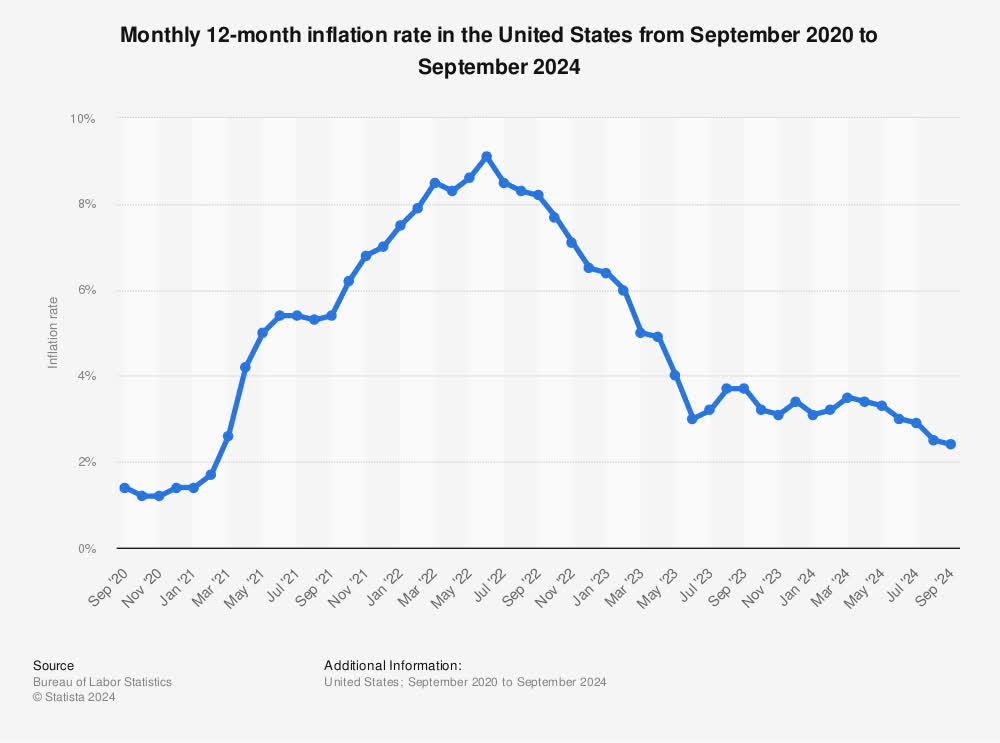

Monthly inflation rate U.S. 2024 | Statista

However, inflation rates that were once stubbornly high quickly dropped down and have remained low. Current inflation rates are back toward targets right around 2% and have been sub 4% for more than one year. The real median household income increased substantially in 2023, and as a result we expect budget conscious consumers to pay less attention to Walmart.

On top of a declining inflation rate, President Elect Donald Trump has backed a plan of mass deportation. Ignoring the politics for or against such a plan, the economic impact could be substantial. Immigrants who live and work in the United States normally take low-paying unskilled jobs, with an average salary ~70% of legal citizens.

The estimated economic impact of mass deportation is a ~$1.5 trillion decline in the U.S. GDP. A decline in the economy could push customers toward Walmart again, however, removing a number of low-income workers could increase demand for workers and increase wages. An estimated 50% of Walmart workers make <$15 / hour, and demand for them will increase.

A $1 / hour increase in wages will cost the company almost $2 billion annually, which will be a big impact to prices. While we do not know yet exactly what will happen to shoppers desires on wages, both present risks to an already expensive company.

Walmart Financial Performance

Walmart has seen growing revenue, however, that growth rate is slowing down.

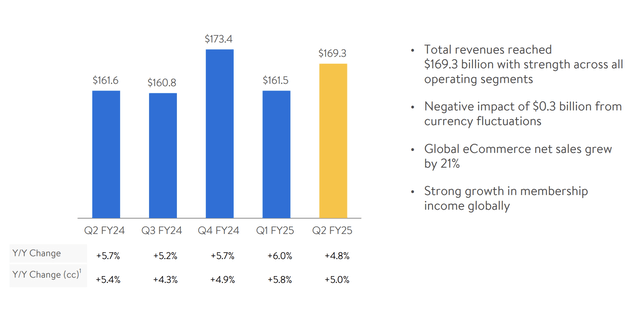

Walmart Investor Presentation

The company grew its revenue by 4.8% year-over-year, a slowing down growth rate for the company. That’s not surprising given the inflation details that we discussed above. The company has continued to see strength across all of its segments including in membership, and the company is building up a more robust e-commerce portfolio.

However, with inflation sitting at ~3%, the company’s growth ahead of inflation is <2%, indicating effectively a market matching growth rate.

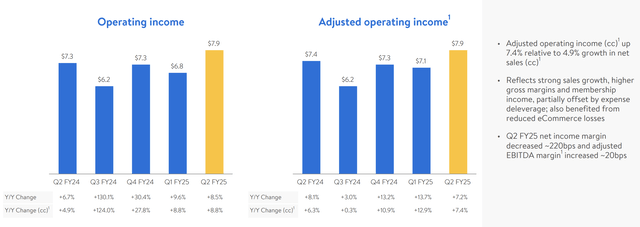

Walmart Investor Presentation

The company’s operating income growth (adjusted for one-time items), as also seen growth rates slow down to ~7.2%. The company’s margins have continued to improve, however, margin point improvements are in the 20-30 bps improved YoY as the company already runs very efficient operations with minimal room for improvement.

The takeaway here is that we expect the company’s growth rate to slow down dramatically.

Walmart Shareholder Returns

The company’s shareholder returns are limited by its lofty valuation.

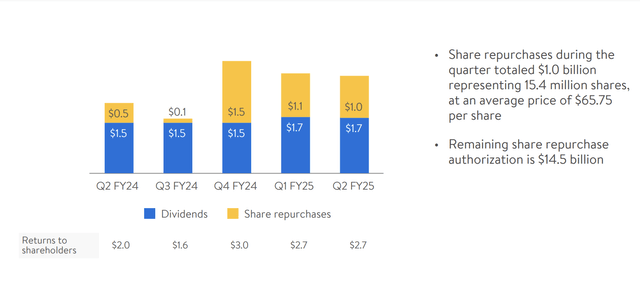

Walmart Investor Presentation

The company’s dividend yield sits at around 1% and costs the company $1.7 billion on a quarterly basis. The company’s net income is just under $5 billion a quarter and the company repurchased ~$1 billion in shares in the most recent quarter at $66 per share. The company has just under $15 billion in its remaining authorization, which is ~2.5% of its market cap.

Higher share prices will make it more difficult for the company’s continued repurchases to have the same impact.

YCharts

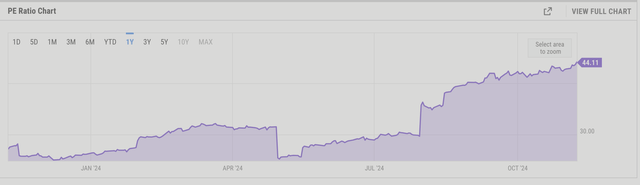

Walmart’s share price has outperformed year-to-date, increasing almost 60% and a substantial part of that increase was multiple expansion. The company’s P/E has increased from <30x to almost 45x. That increase is important for two reasons. The first is that it’s unlikely to continue as the company moves toward what the market thinks is a fair P/E.

The second is that, should the market change its opinion and award the company a lower multiple, it could quickly see its share price decline with no changes in profits. That’s worth paying close attention to.

Thesis Risk

The largest risk to our thesis is that Walmart is a profitable and quintessential American company with substantial staying power. The company continues to generate strong profits which means there are no catalysts that would force a massive share price decline, just a souring of the market. That could take a substantial amount of time.

Conclusion

Walmart is a fantastic company that provides great value to its shareholders. However, with its P/E approaching 40+, the company is becoming overvalued. The majority of the company’s year-to-date returns have been from multiple expansion, which we don’t expect to continue, and the company’s share repurchases will have a smaller impact.

At the same time, the company has the risk of a potentially declining low wage worker population along with lower inflation meaning shoppers care less about saving. Going forward, combined with a lofty valuation and minimal growth, that makes Walmart a Sell, in our view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.