Summary:

- WMT’s business model has historically thrived during economic downturns, as its focus on low prices, cost efficiencies, and everyday value appeals to budget-conscious consumers seeking necessities.

- WMT’s diversified store portfolio and strategic expansion in growth markets such as Mexico, Canada, India, and China provide stability and act as a buffer against domestic market challenges during recessions.

- WMT’s e-commerce investments and global partnerships enable it to reach cost-conscious customers during economic downturns and meet the growing demand for online shopping.

- The growing contribution of the grocery segment to WMT’s revenue (about 60%) offers stability during recessions, as groceries are considered essential goods and are less impacted by economic slumps.

- Based on a DCF valuation, WMT’s shares could be worth $180 in the event of a recession, with a reasonable assumption of 12% revenue growth, taking into account the company’s past recession performance and a larger share of the grocery segment in its business.

Torsten Asmus

In a recession, individuals often reduce nonessential expenditures. However, Walmart’s (NYSE:WMT) business strategy revolves around offering vital goods at competitive prices. As a result, even during a recession, individuals will continue to buy items such as groceries, personal care products, and household necessities from WMT. In this article, I will discuss why WMT is poised to succeed in a potential recession and why I anticipate WMT to outperform its performance in past recessions. Should a recession transpire, I estimate the shares to be valued at $180.

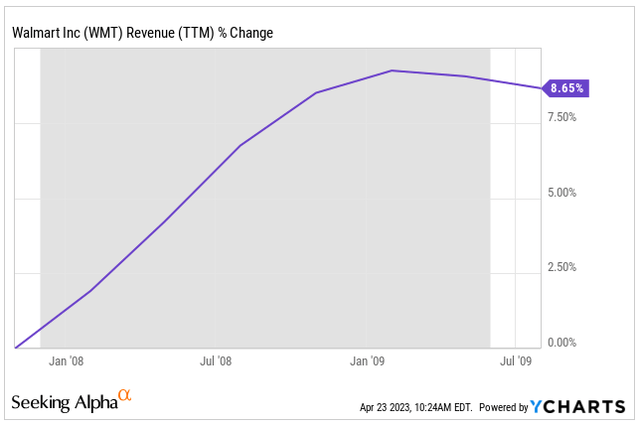

I think that WMT’s tactical approach and solid financial standing will allow WMT to outperform during a recession. Furthermore, I expect that WMT’s focus on affordable pricing, everyday value, private label brands, and digital commerce platforms to draw cost-aware customers aiming to cut expenses amid tough economic conditions. In fact, WMT’s sales increased by 8.7% during the 2008 recession, while other retailers struggled.

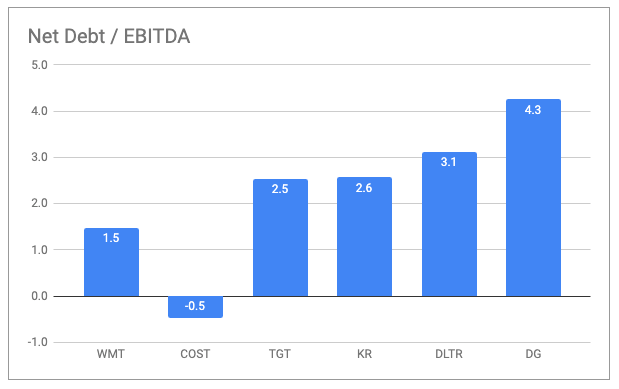

Besides, WMT maintains a robust financial position. The company possesses a strong balance sheet, characterized by controllable debt of $61 billion and a significant cash reserve of $8.6 billion. This enables WMT to better weather a recession in comparison to many of its competitors. As of January 2023, the company’s net debt amounted to $52.4 billion, signifying that its net leverage is one and a half times EBITDA – lower than most rivals.

Seeking Alpha

Resilient Business Model in Challenging Economic Environments

WMT’s business model has demonstrated resilience in previous economic downturns, primarily due to its focus on low prices and cost efficiencies. In times of economic stress, consumers tend to become more price-sensitive, leading them to seek out value-driven retailers like WMT. WMT’s lean operating structure and focus on cost control measures also allow it to maintain profitability even in challenging economic environments.

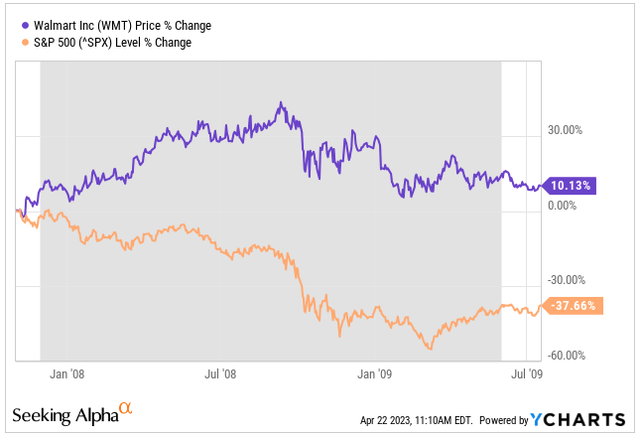

WMT stock tends to perform well during economic downturns. During the last 4 crises, WMT stock outperformed the S&P index. In 2008, WMT’s stock price went up by 10% while the S&P 500 index went down by 38%.

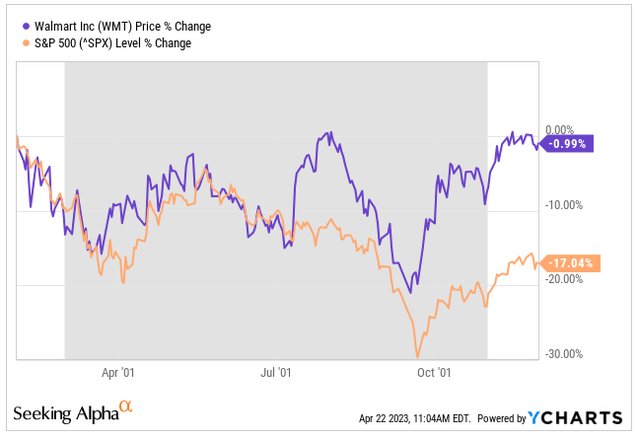

In 2001, WMT’s stock stayed flat while the S&P 500 index went down by 17%.

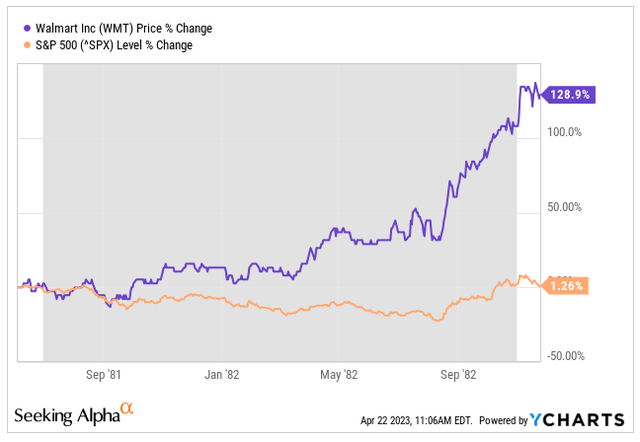

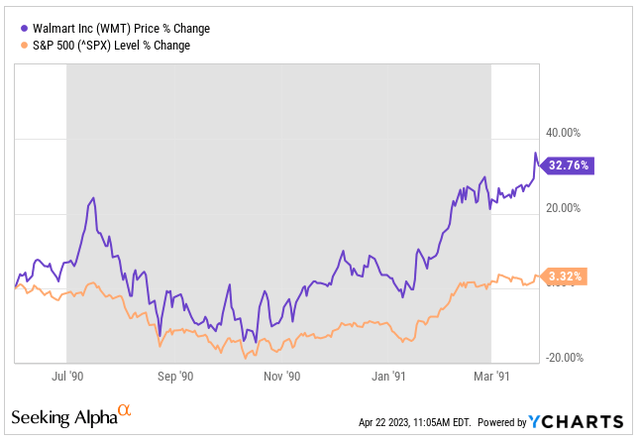

Even during the recessions of the 80s and 90s, WMT stock rose by 130% and 33% while the S&P gained 1% and 3% respectively.

The reason for WMT’s outperformance during recessions is its status as a low-cost retail giant. During economic downturns, consumers tend to cut back on discretionary spending and instead purchase necessities from discount retailers like WMT. Another strategy WMT uses to appeal to cost-conscious consumers during economic downturns is its focus on private-label brands. WMT offers a wide range of private-label products, which are often priced lower than comparable name-brand items. This allows them to offer even more affordable options to budget-conscious shoppers who are looking to cut costs.

Better positioned to outperform in the next recession

Although it is widely known that WMT’s stock tends to be a reliable investment during recessions, I believe it will perform even better in the next downturn. Over the past few years, WMT has fortified its position by enhancing its competitive edge, expanding its global presence, improving its e-commerce capabilities, increasing the grocery segment’s contribution to the overall business, and streamlining its operations.

Size, Scale, and Supply Chain Management

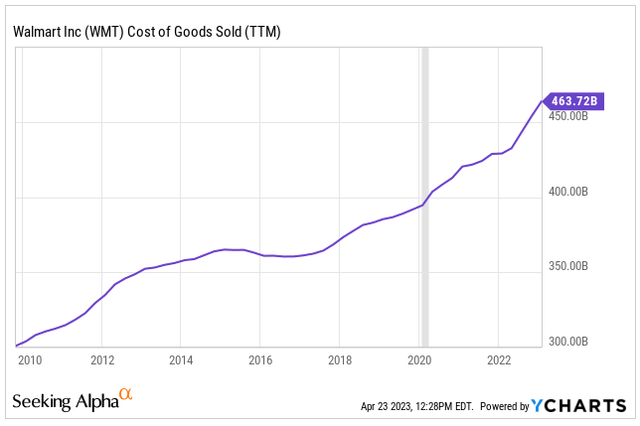

WMT’s magnitude and scope generate a formidable competitive edge, allowing WMT to capitalize on its buying power, supply chain, and distribution capacities. From 2009, the cost base has grown by 54% to $464 billion, augmenting WMT’s negotiating power with suppliers.

In order to preserve its competitive edge, WMT emphasizes supply chain management and cost-effectiveness. The company has employed advanced data analysis, inventory control systems, and other tech-based solutions to fine-tune its supply chain operations. Through process optimization and cost reduction, WMT can persistently offer affordable prices to its customers. This strategy has allowed WMT to attain lower product expenses, decreased inventory costs, enhanced in-store variety and options, and highly attractive pricing. WMT has established an intricate network of distribution hubs and cross-docking facilities, enabling the efficient and rapid delivery of goods to its stores.

Diversification and International Presence Provide Stability

WMT’s diversified store portfolio and international presence provide additional stability during potential recessions. In the previous recession, WMT operated in 14 countries outside the US; this number has since increased to 19. The company has strategically focused on core growth markets like Mexico, Canada, India, and China, while divesting from non-core operations in countries such as Argentina, Japan, and the United Kingdom. This approach allows WMT to concentrate resources on growth markets and its omnichannel strategy, bolstering its resilience in difficult economic situations.

WMT’s ability to adapt to local markets and integrate with them has been a significant factor in its success in these regions. Moreover, its international operations act as a buffer against challenges in the domestic market, helping maintain overall performance during economic downturns.

Additionally, WMT’s well-established global presence grants access to a vast customer base, making it a crucial distribution point for many leading manufacturers. As a result, WMT’s bargaining power with suppliers and vendors is considerable, giving it a significant competitive edge over its competitors.

E-commerce Growth and Expansion

For the previous recession, WMT’s e-commerce presence was poor but now is the second largest e-commerce player in the US. WMT has made significant investments to grow its e-commerce capabilities, including acquisitions of companies like Jet.com (which it later discontinued), Bonobos, Moosejaw and Hayneedle. WMT’s emphasis on unified commerce and the merging of its virtual and physical locations have aided in broadening its digital presence while enhancing customer service. The purchase of a 77% share in Flipkart and a stake in China’s online grocery store DadaJD Daojia in 2018 further demonstrates WMT’s dedication to boosting its digital competencies and global outreach. In the event of a possible economic downturn, WMT’s online presence can support sustained sales and customer interaction, as shoppers progressively opt for digital shopping due to convenience and savings.

Moreover, WMT’s Store No. 8 tech incubator functions as a means for WMT to innovate and delve into groundbreaking technologies with the potential to revolutionize the retail industry. This approach enables WMT to access novel technologies with minimal investment, thus reinforcing its digital commerce prowess. Store No. 8 is an in-house technology incubator created to nurture fledgling enterprises. It partners with venture capitalists, startups, and educational institutions to advance cutting-edge retail technologies in fields like robotics, virtual and augmented reality, machine learning, and AI.

WMT’s online commerce platform has also substantially contributed to its capacity to attract budget-minded customers during financial declines. As digital shopping gains popularity, WMT can provide even more competitive prices on a broader selection of items. They also extend free two-day shipping on qualifying products for purchases above $35, which is another appealing aspect for frugal consumers.

Furthermore, WMT’s recent decision to allow in-store returns for products acquired on its digital platform improves convenience and consumer confidence. This also enhances the value of WMT’s online commerce platform for third-party vendors.

Robust Grocery Offering Enhances Stability

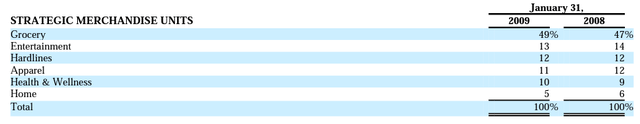

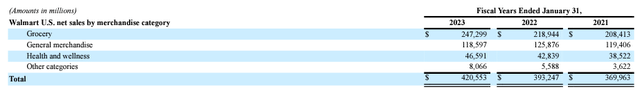

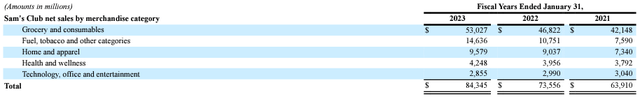

In the US, grocery sales make up about 60% of WMT’s revenue, offering stability during economic slumps. Furthermore, the grocery sector has been expanding more rapidly than other business segments. From 2019 to 2023, the annual growth rate for groceries was 8.4%, compared to 6.7% for the rest of the business. Since the last recession, the grocery segment’s share of WMT’s total business increased from approximately 49% in 2009 to 59.5% in 2023.

10-K filing 10-K filing 10-K filing

Valuation

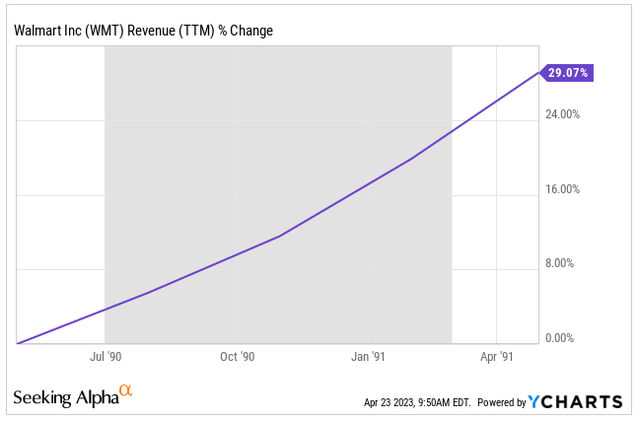

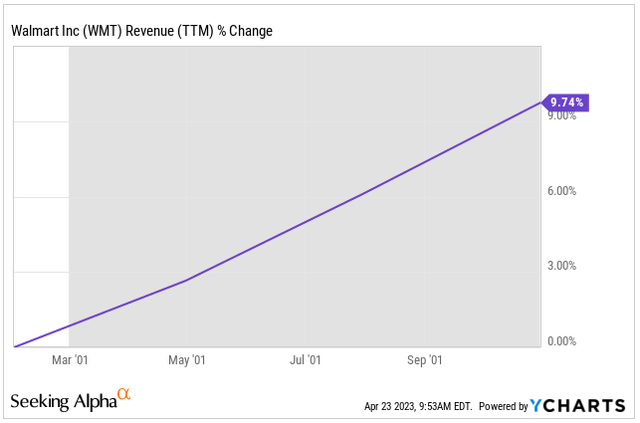

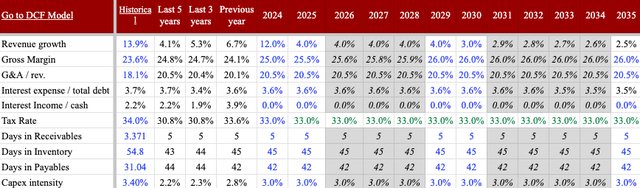

I value WMT’s share at $180 based on a DCF valuation, using a 6.5% cost of capital derived from a revenue-weighted unlevered beta of 0.77. In the event of a recession, I anticipate revenues to grow by approximately 12%. During the last three recessions, revenue growth ranged from 9% to 29%.

WMT’s revenue grew 9.7% during the 2001 recession

WMT’s revenue grew 8.7% during the 2008 recession

During the 2008 recession, revenues grew 8.7%, given that groceries now account for a larger share of WMT’s business than in 2008, a 12% growth appears reasonable.

As for margins, I expect a modest improvement as most efficiency gains will likely be passed on to customers through lower prices, which in turn supports revenue growth. Here are the key assumptions I used:

Author estimates & company filings

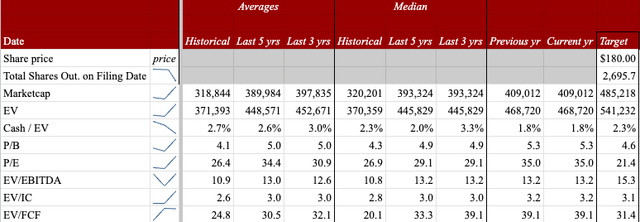

At $180 per share, the shares would be trading around the historical ranges.

Seeking Alpha, company filings & author estimates

Risks

The risks associated with WMT include the rapidly changing retail landscape, competition, social and regulatory risks, and economic and policy risks. WMT’s ability to adapt to the evolving retail environment and maintain effective execution across channels is crucial for its success. External factors, such as Amazon’s (AMZN) distribution scale and intense competition, may impact WMT’s competitive advantages and profitability. Social and regulatory risks, including public backlash and potential workforce unionization, could impose reputational and financial costs. Finally, WMT is not immune to the impact of wage laws, trade policies, and global economic conditions, which could affect its profitability in a potential recession.

Conclusion

WMT’s business model, strategic approach, and robust financial position make it well-equipped to excel during a recession. WMT’s emphasis on low prices, everyday value, private label brands, and e-commerce platforms positions it as an attractive choice for budget-conscious consumers looking to reduce expenses during economic downturns. Additionally, WMT’s diversified store portfolio and international presence provide stability, while its efficient operations and cost control measures help maintain profitability. With a history of outperforming the market during previous recessions and a strong potential for growth in the next economic downturn, the shares could be worth $180 if a recession occurs.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Investment Idea For A Potential Recession competition, which runs through April 28. This competition is open to all users and contributors; click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in WMT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.