Summary:

- The Walt Disney Company is expected to announce financial results for fiscal Q3 2023, with revenue forecasted to increase by 4.9% compared to the previous year.

- Earnings per share are expected to be $0.05, down from $0.77 in Q3 2022, as the company focuses on cost-cutting initiatives.

- Disney’s streaming operations have seen mixed results, with Disney+ losing subscribers in the past two quarters, but revenue per user increasing for the core subscriber base.

- In all, there might be a few bumps along the way, but the overall Disney picture is positive for value investors.

RomoloTavani

Early in August (expected on 9 August), the management team at entertainment conglomerate The Walt Disney Company (NYSE:DIS) is expected to announce financial results covering the third quarter of the company’s 2023 fiscal year. Driven by a combination of factors such as runaway costs, the COVID-19 pandemic that is now behind us but still has left some impact on the company, and other challenges, shares of the company are still down 23.1% compared to where they were five years ago.

Last year, new leadership came into the company in the form of then-retired CEO Bob Iger with the hopes of reinvigorating the business. But that is not a process that will occur overnight. Given the changes taking place at the firm, combined with broader economic issues, investors would be wise to continue to monitor the company closely on quarter-to-quarter basis. And with the third quarter earnings release right around the corner, now is a great time to zero in on some of the key metrics that the market will weigh heavily and will use to determine the trajectory of the company for the next few months.

A look at the headline items

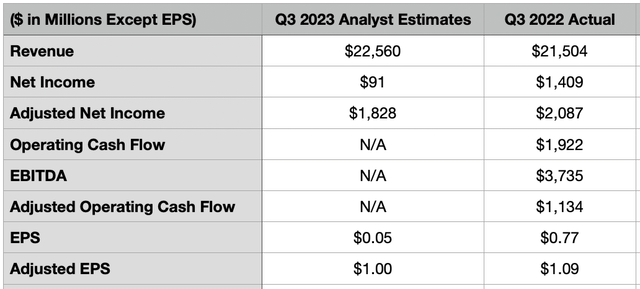

The first thing that market participants will focus on when management announces financial results after the market closes on August 9th will be the headline news items. At the very top of the list, we have revenue. The good news for investors is that analysts are optimistic on this front. They anticipate sales of $22.56 billion. This implies a 4.9% increase over the $21.50 billion the business reported during the third quarter of its 2022 fiscal year. A bit later, I would dig into a few items that I think will be contributing to this year-over-year increase. But as a large and complex company with many working parts to it, there likely will be aspects that show some weakening year-over-year.

On the bottom line, the picture is a bit more complicated. Earnings per share are forecasted to come in at only $0.05. That compares unfavorably to the $0.77 per share that Disney reported for the third quarter of 2022. Management is working hard on cutting costs, with the ultimate goal of cutting out around $5.5 billion in overall expenses. About $3 billion of this is forecasted to be non-sports content spending reductions. The rest will likely relate to general organizational costs. Cutting costs is not easy. It often requires large amounts being paid out in the form of severance costs and impairments. So it’s likely that analysts are pricing these initiatives into the picture. You can see this when you look at the fact that analysts are currently forecasting adjusted earnings per share of $1.03.

Analysts have not provided any estimates when it comes to other profitability metrics. But investors would be wise to pay attention to these. One of them is operating cash flow. For context, during the third quarter of 2022, Disney reported operating cash flow of $1.92 billion. If we adjust for changes in working capital, this number is a bit lower at $1.13 billion. In addition to this, EBITDA for the quarter was $3.74 billion.

Expect a mixed streaming picture

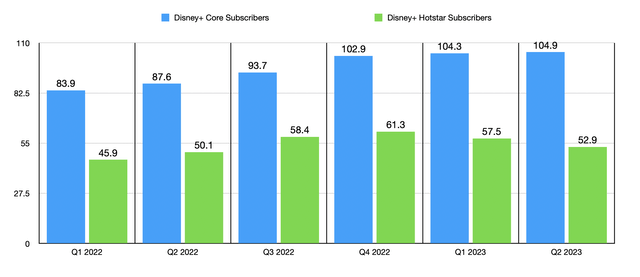

Some of the strongest growth experienced by Disney over the past few years has been attributable to its streaming operations. The company quickly became the largest streaming business on the planet after launching Disney+ in November of 2019. Over the past few quarters, however, streaming has been something of a mixed bag. While both ESPN+ and Hulu continue to grow, Disney+ has seen its number of subscribers decrease in each of the past two quarters. In that time, the number of subscribers has decreased by 6.4 million from 164.2 million to 157.8 million. As I pointed out in a prior article, however, this number is somewhat deceptive. The fact of the matter is that all of the losses that took place involved the low value subscribers under the Hotstar brand that the company has in India.

If we remove this from the equation, then the core subscriber base for Disney+ increased by 2 million in that same six-month window. Regardless of where the growth has been, investors would be wise to continue to pay attention to the data that comes out. It’s also important to point out that, while many investors might fear a contraction of the business, some recent data in the streaming market has been quite positive. The company’s largest rival, Netflix (NFLX), recently reported financial results. And in those, it said that it added 5.89 million subscribers during the quarter. That’s up from the roughly 2 million that analysts were expecting.

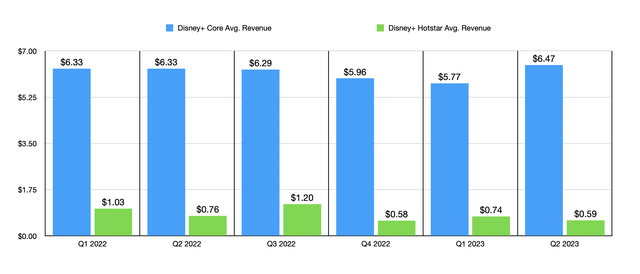

In addition to looking at the number of subscribers for Disney+, investors and market watchers should also be looking at the amount of revenue per user, on average, that the streaming platform generates each month. Those under the Hotstar banner fell very close to an all-time low during the second quarter of this year that totaled $0.59 per month. Meanwhile, the rest of the subscriber base shot up to $6.47 per month. That compares to the $6.33 per month reported one year earlier. Even though this may not seem like a large difference, the $0.14 per month when applied to the number of core subscribers the company has translates to an extra $176.2 million per year for the company.

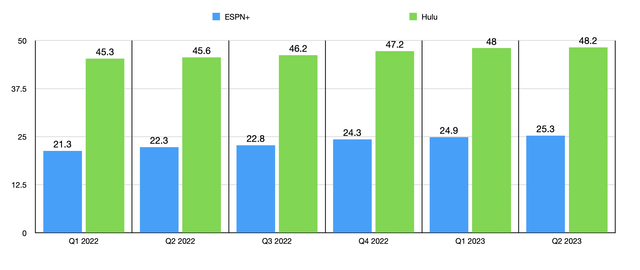

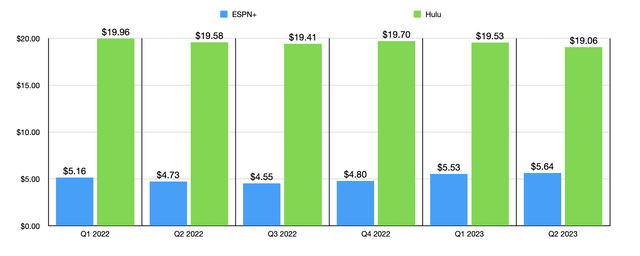

Even though most eyes will be focused on Disney+, investors should also be looking at what goes on with both ESPN+ and Hulu. As I mentioned already, both of those have continued to grow as well, though their growth rates have been substantially slower than what the core Disney+ numbers have been. But both pricing and subscriber numbers will be important.

There are also other considerations that could pop up during this time. As has been reported elsewhere, Disney seems to be talking with potential strategic partners that could help it add value to ESPN+. And as I wrote about in a prior article, the possibility of some major strategic transaction involving Hulu, whether that be a sale, merger, or something else, could be tantalizing.

Some odds and ends

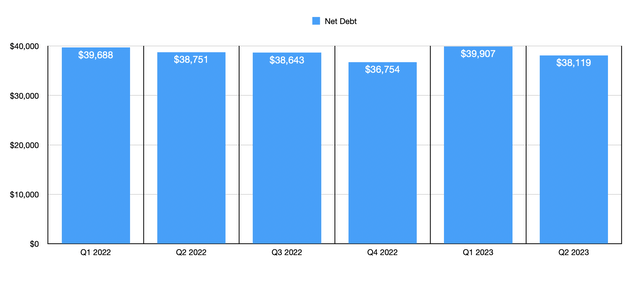

Outside of the streaming portion of the company, there are some other things that investors would be wise to watch out for. For starters, one thing that I would love to see the company focus on would be reducing its debt. As of the end of the most recent quarter, the company had net debt of $38.12 billion. While this was down from the $39.91 billion the company had as of the end of the first quarter, it was up from the $36.75 billion the company had at the end of 2022. In fact, overall debt for the company, on a net basis, has hovered in a fairly narrow range for at least the past six quarters. Seeing excess cash flows allocated toward this would be great.

This brings me to another item that should be on every investor’s list. At the end of the day, the value of almost any investment is determined by the discounted cash flows that the investment generates over its lifetime. Between growing revenue and cost cutting initiatives, it is highly probable that operating cash flow will improve year over year. And you definitely need positive cash flow to reduce debt meaningfully. In the first half of the 2022 fiscal year, operating cash flow for the company was $1.56 billion. That number jumped to $2.26 billion the same time this year. If we adjust for changes in working capital, the increase was more modest from $4.67 billion to $4.84 billion.

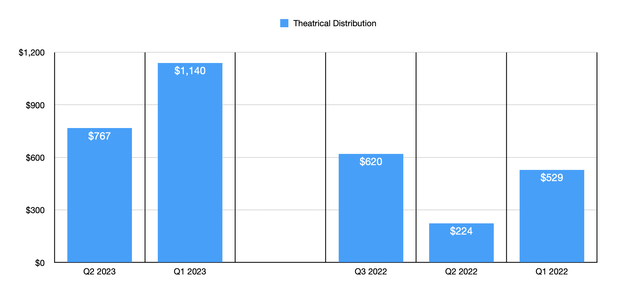

Another hot ticket item will be the Theatrical Distribution portion of the company. This is the part of the business responsible for the blockbuster releases that management has ultimately endorsed. When Bob Iger came back to the helm, he made clear that his goal was to return a lot of the decision making in the company to those in charge from a creative perspective. It’s unclear what kind of timeframe we need for that to fully become reflected into the company’s content since movies and shows do you take sometimes years to go from start to finish. Likely, it is too early to see any significant changes on that front. But we do know that there is ample data that shows that the box office is slowly coming back to life.

At this point, data has been somewhat mixed. On the positive side, Disney is neck-and-neck regarding the market share for box office receipts so far this year. That number comes out to 21.6% overall box office revenue. Universal, which is owned by Comcast (CMCSA), is only narrowly ahead with a 21.9% share. For context, the third-largest player at this time is Sony Pictures, a subsidiary of Sony Group (SONY). It has a market share of only 12.5%. In terms of overall revenue, we are seeing signs of life as well. Theatrical Distribution revenue in the second quarter of this year for Disney came in at $767 million. That’s more than triple the $224 million reported one year earlier. There have been some market pundits who have said that the company is losing money on films this year. That is unclear at this time. We do know that the Content Sales/Licensing and Other segment of the company that includes Theatrical Distribution did generate an operating loss of $50 million during the most recent quarter. That compares to the $16 million profit reported one year earlier. For context, profits in 2019 were $2.69 billion. But again, the box office has not yet staged a full recovery following the COVID-19 pandemic.

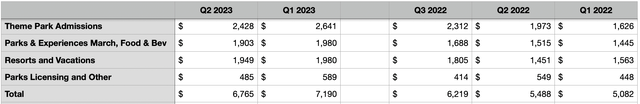

Lastly, investors should be paying attention to what goes on at the company’s theme parks. I would argue that performance on this front is far more important than performance when it comes to movies. So far this year, the picture has been very positive for the business. Excluding revenue associated with its Merchandise Licensing and Retail Operations under the Disney Parks, Experiences and Products segment, revenue in the most recent quarter totaled $6.77 billion. This is up nicely from the $5.49 billion reported one year earlier. In the second quarter of this year, Theme Park Admissions revenue totaled $2.43 billion. That’s up about 23% compared to the $1.97 billion generated one year earlier. This has been driven by a 17% surge in attendance year-over-year and by an 8% increase in per capita ticket revenue.

It’s unclear what impact, if any, recent weather conditions might have had on the business. But absent anything extreme, I believe that further year-over-year improvements are highly likely.

Takeaway

I understand that The Walt Disney Company is one of the most controversial companies on the market right now. A massive political divide exists because of certain stances the company has taken over the past couple of years. To me, much of that is a sideshow that will have little to no substantive impact on the company and its prospects. What really matters is the fundamental picture. And while I do think that it’s possible The Walt Disney Company could get a few bumps and bruises in the near term, I suspect that when data is reported on August 9th, the overall picture will be quite positive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!