Summary:

- DIS has decided to further intensify its streaming monetization efforts, by taking a leaf out of NFLX’s playbook with paid sharing from 2024 onwards.

- This is on top of the raised Disney+ Premium (ad-free) prices by +30% to $13, and Hulu by +20% to $17.99 monthly from October 2023 onwards.

- Our previous article has also predicted DIS’ eventual entry to the sports betting market as a strategic direction for renewed growth, thanks to the ESPN reorganization.

- While these efforts may boost its top and bottom line growth, it remains to be seen if they may bolster Disney+’s declining streaming US market share to 13% by Q2’23.

- In the long run, DIS’ well-diversified entertainment offerings across resorts, theme parks, cruises, and streaming, including ESPN and sports betting, may present a tremendous franchise flywheel indeed.

Talaj/iStock via Getty Images

The Streaming Investment Thesis Remains Viable, Thanks To Price Hikes & Advertising Revenue

We previously covered Walt Disney Company (NYSE:DIS) in July 2023, discussing its interesting partnership with Apple (AAPL) for the Vision Pro spatial headset, featuring Disney+ streaming content and interactive 4D gameplay experiences.

While the headset is only slated for early 2024 launch, we believe that the media company may enjoy a top and bottom line boost, thanks to the robust IP portfolio and increasingly diversified monetization opportunities.

For now, DIS has decided to further intensify its streaming monetization efforts, by taking a leaf out of Netflix’s (NFLX) playbook. From 2024 onwards, the media company will be exploring paid sharing. This is on top of the raised Disney+ Premium (ad-free) prices by +30% to $13, and Hulu by +20% to $17.99 monthly from October 2023 onwards.

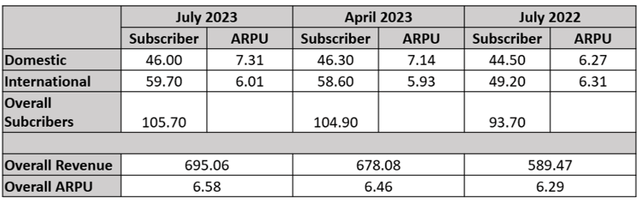

Disney+ Subscriber Base

This is an interesting choice indeed, since DIS may accelerate the decline of its domestic subscriber base, with 46M of Disney+ subscribers (-0.3M QoQ/ +1.5M YoY) reported by FQ3’23, down from its peak domestic numbers of 46.6M in FQ1’23.

Then again, its international paid subscribers have been growing tremendously to 59.7M (+1.1M QoQ/ +10.5 YoY) at the same time, with a net positive effect to Disney+ overall ARPU of $6.58 (+1.8% QoQ/ +4.6% YoY).

Depending on the eventual churn rate, the raised prices may further boost DIS’ D2C operating margins from the -9.2% (+2.7 points QoQ/ +11.7 YoY) reported in the latest quarter, allowing the streaming segment to reach profitability much earlier than previously projected.

Combined with the returning ad spend as reported by the advertising duopoly, such as Meta (META) and Alphabet (GOOG) (GOOGL) in their recent earnings call, we may see Disney+ achieve improved top and bottom line expansion ahead.

For example, NFLX has highlighted “incremental profit contribution” from its ad-supported tier with the “membership nearly doubling since Q1’23,” suggesting improved monetization thanks to the advertising dollars.

Unlike DIS, NFLX has yet to raise prices, but it has also quietly phased out the lowest-price ad-free plan, effectively raising their overall advertisement and subscription revenues through different strategies.

These are strategic developments indeed, since more subscribers are likely to convert to ad-supported tiers, due to the tightened discretionary spending, elevated interest rate environment, and raised ad-free streaming plans.

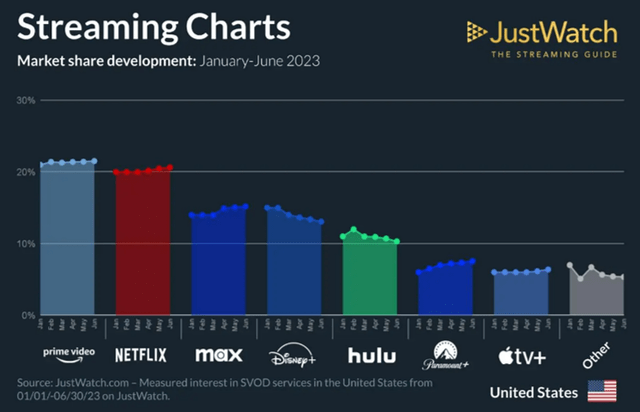

Disney+ Declining Streaming Market Share

Then again, DIS investors must also take note of Disney+’s declining streaming US market share to 13% by Q2’23 (-5 points from December 2022, +2 points YoY). We believe that the raised prices may potentially trigger more churn and market share losses, contributing to the stock’s volatility over the next two quarters.

Investors beware.

Sports Betting May Be One Of DIS’ Strategic Direction For Renewed Growth

Interestingly, we have previously posited that DIS may potentially enter sports betting in our February 2023 article, as a strategic direction for renewed growth, building upon Bob Chapek’s roadmap for a diversified streaming portfolio.

True enough, the media company has recently announced its 10Y deal worth $2B with PENN Entertainment (PENN), tapping into 16 US states where sports betting is legalized.

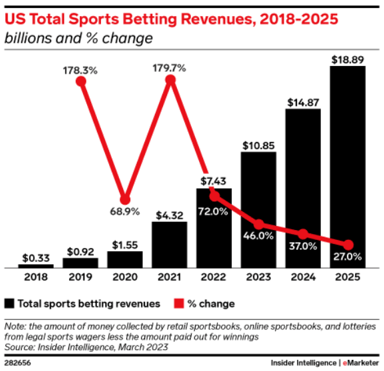

US Total Sports Betting Revenues

Insider Intelligence

Depending on how the deal is structured, DIS may also stand to receive a share in profits, with sports betting already accounting 12% of the US gaming revenues of $7.43B in 2022 and expected to further expand at a CAGR of +36.48% to $18.89B in 2025.

While PENN does not specifically break up its gaming revenues (comprising retail sports betting, iCasino, and online sports betting), it generated $5.16B of annualized sales in FQ2’23 (-2.2% QoQ/ YoY), comprising 77.2% of its overall top-line (-1.8 points QoQ/ -4.2 YoY).

Most importantly, the segment is highly profitable for PENN, with $2.32B of annualized operating income (-2.5% QoQ/ -4.9% YoY) and 45% in margins (+0.1 points QoQ/ -1.1 YoY) for the latest quarter, with the overall company being profitable, with an annualized EPS of $1.92 (+158.8% QoQ/ +51.7% YoY).

Therefore, it also made sense that DIS has opted to partner with PENN, instead of DraftKings Inc. (DKNG), since the latter has yet to generate sustainable profitability despite the top-line growth thus far.

For now, the same uncertain macroeconomic outlook has moderated ESPN’s subscriber growth in FQ3’23, with 25.2M of subscribers (-0.1M QoQ/ +2.4M YoY) and an average ARPU of $5.45 (-3.3% QoQ/ +19.7% YoY).

However, we believe the sports betting may potentially revitalize some of the top-line headwinds, with 34 states already legalizing some form of sports betting as of July 2023.

As a result, we maintain our previous investment thesis that DIS’ well-diversified entertainment offerings across resorts, theme parks, cruises, and streaming, including ESPN and sports betting, may present a tremendous franchise flywheel moving forward.

So, Is DIS Stock A Buy, Sell, or Hold?

DIS 5Y EV/Revenue and EV/ EBITDA Valuations

For now, DIS trades at NTM EV/ Revenues of 2.31x and NTM EV/ EBITDA of 12.26x, moderated compared to its 1Y mean of 2.52x/ 14.12x and pre-pandemic mean of 3.57x/ 14.63x.

DIS 1Y Stock Price

With DIS still trading below its historical averages, we believe there is still an excellent margin of safety for adding here, especially given the tremendous upside potential of +79% to our long-term price target of $160.

This is based on the stock’s normalized NTM EV/ EBITDA valuation and the market analysts’ FY2025 EBITDA per share projection of $11.48, expanding at a CAGR of +9.2% from FY2022 levels of $8.81. Much of the profitability tailwind may be attributed to its intensified streaming monetization efforts, as discussed above.

Therefore, due to the highly attractive risk/ reward ratio, we continue to rate the DIS stock as a Buy here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, META, NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.