Summary:

- The Walt Disney Company’s decision to invest $60 billion in international theme parks raises questions about its asset allocation and ability to address other pressing issues.

- The company’s lack of clear direction in dealing with streaming, long-term debt, and ESPN’s future is concerning to investors.

- Low birth rates and declining populations in the areas where Disney parks are located raise doubts about the long-term profitability of the investment.

Does Iger’s promise to tone down politics mean kinds will no longer have to wear gender pins to rate a Hi from Mickey? MrNovel

“The fault dear Caesar is not in our stars, but in ourselves. We are underlings…”

Wm. Shakespeare, Julius Caesar Act 1 Scene2

- If The Walt Disney Company (NYSE:DIS) CEO Bob Iger’s statement of “quieting the politics” rhetoric applies only to the steel cage match with the Florida governor, it means little to investors.

- Promised changes to date do not yet impress Mr. Market.

- DIS problems clearly go beyond “wokeism”–the decision to pour $60b into mostly international parks is a question not an answer.

Disney continues to sag from both macro and self-inflicted wounds. A pledge to pour $60b into its mostly internationally located theme parks expansion seems to us to pop more questions than it answers.

If you need any more evidence of a management that still doesn’t appear to get it, is its continuing flow of circular logic since its April shareholder meeting. Its nostrums to date should convince you to avoid either opening a position or adding to it.

Nearly six months after the shareholders meeting, we still have no clear sense of the direction management is taking to deal with the growing mess in streaming, long-term debt, a sensible approach to solve ESPN’s future— among other issues. But at least on the political wrestling match DIS began with the Florida governor we see a bit of light.

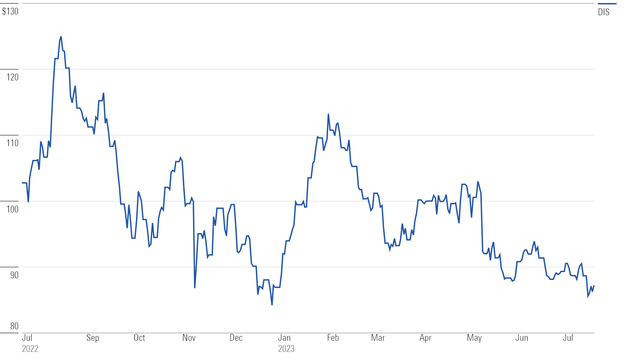

Above: Catalysts that count not yet in sight.

CEO Iger said last week that it was time to “quiet the noise” on politics, signaling at least a faint acknowledgment that the issue had to go away. That was good news—if—repeat if, he was alluding to the Florida contretemps and also the possible moderating on corporate virtue signaling across its IP.

Back in April, when concern about the woke policies were aired during the shareholder Q&A, Iger responded that DIS productions “should not be agenda-driven” and that the company’s primary mission was “the need to entertain…: Amen. Iger is on the clock on this one because between then and until now we’ve most had a doubling down on DEI love.

Far more telling this week was that DIS announced it was planning to pour $60b into the expansion and refreshment of its theme parks, principally those outside of the U.S. Like its competitor, Comcast (See our SA article this month) it was experiencing a softness in domestic parks, but international venues were up with strong attendance and average spend. And like Comcast, who has positioned $17b in its park and experiences business, DIS is following the trend.

If you pile this decision upon what we have already been told about layoffs, raised prices, ESPN, ad supported content, linear TV (Sell ABC? Probably not—who’d want it?) you come down to the same conclusion. At least I do, while accepting, of course, that many shareholders remain true believers in DIS correctives already announced. From many perspectives, I find the decision to put $60b into international theme parks highly questionable asset allocation. The program calls for next year’s Capex, including a portion of the $60b, of $7b including the piece for parks. DIS free cash flow (“FCF”) last year was $6b. Long- term debt sits at $44.5b.

Google

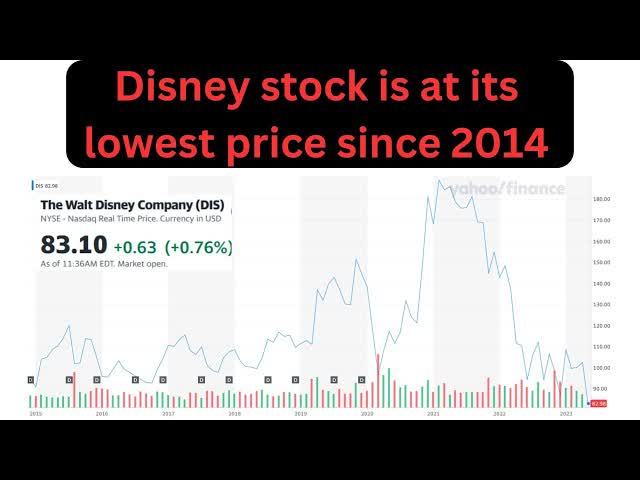

Above: It’s back to the future all over again unless Mr. Market sees action aimed at solving the gut problems of a once great company.

So, where is all this extra cash coming from? An anticipated rise in 2023 FCF? Perhaps—but what then is the forecast for streaming losses in 2024? More debt piled on, or reducing repayment schedules which until now—credit them— have shown serious attention with over $8b paid down over the last four years. Yet it is fair to assume there are more than dozens of lenders who would be delighted to take on DIS debt to finance park expansion. On fundamentals it seems sound, but is it?

Parks and Experiences for Disney represented $28.7b in revenue for 2022 of a total $82.7b, but of its total operating income of $12.1b, 65% ($7.9b) came from parks. This is, by far, DIS’ best business on paper. It easily seems worthy of corporate attention and potential lender happiness, doesn’t it?

The question remains, however: taking into account the seemingly yet unsolved dilemma of streaming losses to come, the recent so-so track record of DIS movies, challenges to the linear TV and tweaks in the ESPN business model, at best one is moved to ask: Does this $60b capex spend make any sense at all? In our view, shared by some on the Street, it does not.

One would assume that DIS number-crunchers donned their eyeshades, felt their underarms dripping with sweat, their red-ringed eyes fixed on flickering streams of masses of numbers came to the $60b conclusion through a deep dive vetting for management. The endgame, of course, was how much the new capex could generate in terms of operating income? And was it one of the core cures the company needed to act on to extricate itself from its longstanding self-inflicted as well as macro-based wounds?

Above: Still awaiting a real burst of positive catalysts to move shares to PT.

In reporting news of the parks spend, Yahoo Finance alluded to legit questions about the amount, but ameliorated the negative by mentioning that DIS movies were doing well. They noted that The Little Mermaid had taken in $570m at the box office, making it the seventh biggest grosser of the year to date. What they didn’t add was that at best, TLM was a breakeven project and perhaps even could tick a small loss. But cheerleading from the DEI jury. This is how even a portion of the financial media reflects mass media leanings that strike a positive note no matter what for DIS and is drenched DEI corporate brethren.

The fact is it looks to us like a diversion. Without answers to the 600lb gorilla challenges, DIS tries to do something that appears sensible and at the same time, focuses Wall Street off the creaky solutions thus far advanced to correct for macro problems. No one suggests it’s easy. But from the archives of Carl Icahn (pre-short mess), here’s the question he’d long asked CEO’s of target companies: What do you do for your giant paycheck? Why is your board only a collection of like-minded ideological frat brothers and sorority sisters?

One can imagine the spreadsheets ten feet long that ultimately at some point in the future, indicated a fat katching ring sufficient to convince management and its bobble head board members that this $60b was a great move.

That said, let’s take a quick look beyond the present at what the realities of the locales where the money will go. We did and we looked at the birth rates of every geographic area where DIS parks are located. They all had one gruesome fact in common relative to long-term investment in child-oriented entertainment: Low birth rates, to negative birth rates. Falling populations already in progress and getting worse.

Most demographers publish such data heavily weighted to long out years. Example: China’s birth rate is falling so fast that the estimate is that in 2022 they experienced the first year ever of population decline in modern history. Of course, the draconian numbers don’t kick in for at least 25 years (estimated from 1.4b now to under 800m by 2050), but current labor shortages there linked to shrinking labor force potential has given Beijing the willies already. Part, of course, is the legacy of the one child policy, but mostly, it is due to the general feeling of younger generations not particularly enamored of large families.

Above: One would think an endless supply of kids can’t be stopped starting with a population of 1.4b. But nothing is forever, say demographers.

Low birth rates, fewer kids age 5 to 14 for starters—around the corner including fewer indulgent parents.

France and most nations of Europe face the same facts. The U.S. is somewhere around even—but no new baby boom is anywhere in sight here as well. If it appears DIS faces a marketplace with less kids in the near future and amortizing an investment of that size is not exactly coining money overnight, where’s the logic?

We cite this understanding that DIS has naturally set out an ROC Parks schedule that sees visions of earnings spikes dancing in their heads long before these scary forecasts really gain steam. But it isn’t correct. We do not imply that suddenly parents will disappear from theme park lines. We do believe in refreshing assets long in place of course. However, it seems to us that DIS has its priorities wrong here. At that to us is a direct reflection on many of the meh policy initiatives DIS has taken to date to reduce its losses in streaming and build its stronger verticals.

Investors and current holders cannot wait forever to see the kind of dramatic changes in direction that appear to be needed by DIS to rebuild its net income that ultimately translates to a northward ramp of its shares.

The hard choices ahead will get harder if delayed

Though I have spent more hours over the years listening to pitches from A-list investment bankers and top shelf consultants than I ever wanted, I readily confess that those pursuits are way above my pay grade. My consulting practice is limited to gaming, but my long experience in entertainment is also part of my c-suite life. I ‘m speaking as a green light executive watching a Capex presentation and despite the cheery multiple charts and diagrams, I remain unconvinced.

Streaming

Like sports betting, (with which it has much in common) streaming is fundamentally a bad business with terrible margins that just eats money. It packs multiple operators with easy access to content that mostly is repetitious, copycat, or fancier or alternatively cheaper versions of whatever is catching eyeballs. No moat here—IP is fungible.

It is a business built off the caprices of consumers, not their dead or alive needs. The journey through streaming is a trip taken daily by millions of customers. You sign on either a free or reduced price trial. You watch the show you love. When the last episode has ended, you may or may not, depending on this or on that, or a shrug, a crapshoot or a whim, decide to stick with the service or cancel it. But for those folks who like lots of diverse stuff you keep signing on. Then one month they take a long look at their bill, and nearly have a coronary. Then they start pressing all kinds of cancel buttons.

Endgame: Streamers, no matter what they do, or what their bag of marketing tricks holds, become victims of their own success and watch their churn rates climb. So what do they do? They simply repeat the process. They tell investors they will create content the “consumers will love.” They do from time to time, but the key is that they ALL do.

After a while, customers learn that they do not need to subscribe to ten services to satisfy their family entertainment needs. So the new subscriber rolls begin to decline. Send for the fire department is the word. Out comes a plethora of new content. A crime series with at least two murders and four opening sex scenes per episode debuts. On and on it goes without a clear direction as to where it will all end.

It seems to me there is an endgame. And that is that streamers will become just a more modern form of broadcast television. Here’s the supreme irony: neither DIS nor some of its peers is facing it squarely. On the one hand there is a case to be made to unload your linear TV assets. At the same time you are reforming your streaming business model to look more and more like old broadcast TV than ever. You have programs supported by ads. Subscription income is a floating crap game, so its end game is just as soon a loser than a winner. Ad supported is safer. Ads on TV, copycat programming—welcome folks, its 1960 all over again.

Whether DIS ever decides to unload ABC, or move on HULU it must confront the possibility that the vertical might have more value as a mature legacy business to someone else than it does figure in your future.

ESPN: Nothing we’ve seen to date begins to approach the core problem here IMHO. In short, ESPN is going to continue getting wet under a DIS umbrella. It has value that is slowly diminishing yet enough to make it attractive at a price for a buyer. The alternative, keeping in under that DIS umbrella as a streamer, or tied in with a sports betting quality vertical like Penn Entertainment (PENN) is shortsighted.

The platform can still fetch a hefty sale price from a buyer much deeper into the sports sector than DIS. That won’t last forever, especially if the DIS plan to go streaming on it doesn’t become a blow out success. The sand in the hourglass in our view is turned upside down and in full deposit mode. What sounds better to us is this: Sell it now, take the bundle you get, and slash the debt load by 30% with part of the cash and pivot the balance to make a beginning on the theme park upgrade. And if you can find a logical buyer somewhere for ABC, put that on display as well, take the best offer and run. You get all this cash. You take a chunk of it to finance the Parks projects on a smaller scale until you see a significant turnaround in your overall business.

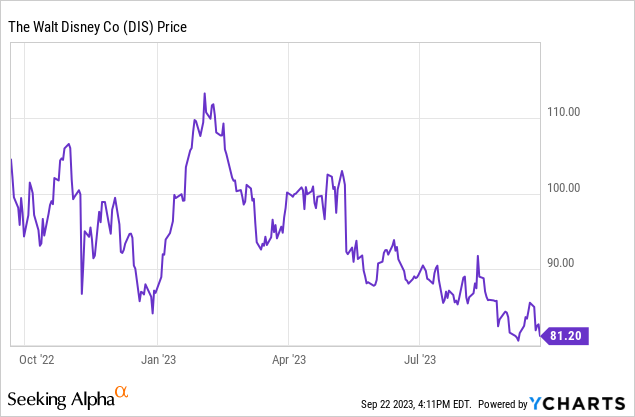

The stock: The Park announcement keeps us sold on: SELL

Price at writing: $82

Analyst PT: $101

Our PT: $63 to $74.50 Where we differ: I stipulate that I can see the bull case analysts who cover the stock have made. I assume much of it is ground out from good analytics projected against assumed macro trends from FED action to weather. But the reason I substantially differ in taking a far more bearish view of the shares it entirely based on my appraisal as a long time c-suite management person of what lies ahead. I am no Cassandra. Nor are any of the bulge analysts who construct forward revenue and earnings outlooks.

Of all the moves we know to date that DIS management has made or intends to make, I find very little to build conviction that they will substantially fuel positive recovery sentiment on the stock. DIS key challenges are still unmet by the solutions proposed to date. There is far too much debt lingering. It is not because I fear insolvency. DIS can deal with it from most any contingency.

What is crippling, I believe, is the annual interest expense (ttm) $1.9b, an amount averaged at around 4.5%. The company’s maturities over the next five years are reasonably handled, but you are looking at perhaps $7b in total interest payments ahead including a worthy sequential reduction in total debt, it represents a drag on earning I see bigger than others. The massive cash infusion from asset sales could chop this down big time. DIS will not suffer, and its investors would likely reward the company with a higher share price if in trimmed itself down to fighting weight by selling some assets.

Conclusion

On many metrics, DIS has been over time an investment-quality stock with an established sales and earnings growth arc. It has also been paying reasonable dividends. To be brutally frank, it no longer has that treasured quality. To me, it is hard now to make the case that it is worth near double of Comcast (CMCSA), 8X Warner Discovery (WBD) 12X Paramount Global (PARA). It faces headwinds linked to events no one can control as well as those it has conjured inside.

Until we see changes in direction that really count, we remain bearish on the stock, looking for a 25% downside risk. If, on the other hand, we see positive moves on streaming, debt hangover and a rational approach on asset sales, we see buy signals coming fast and entry points we like a lot.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

For in-depth and deep dive research on the casino and gmaing sector, subscribe to The House Edge. New: Free excerpts from our book in progress “The Smartest ever Guide to Gaming Stocks” – free to existing members and new subscribers.