Summary:

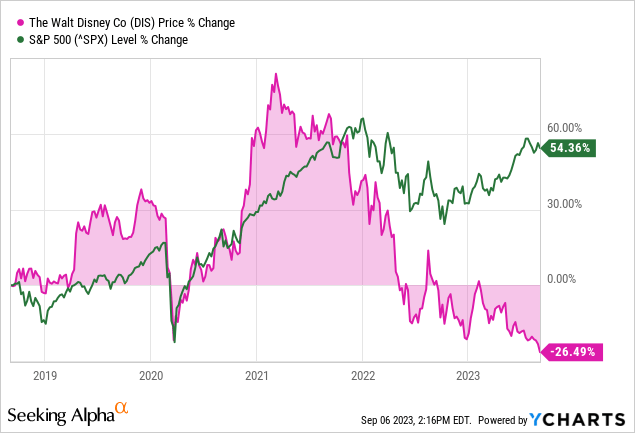

- The Disney stock was left way far behind the broader market as the “transformation period” has been rather a disappointment for investors.

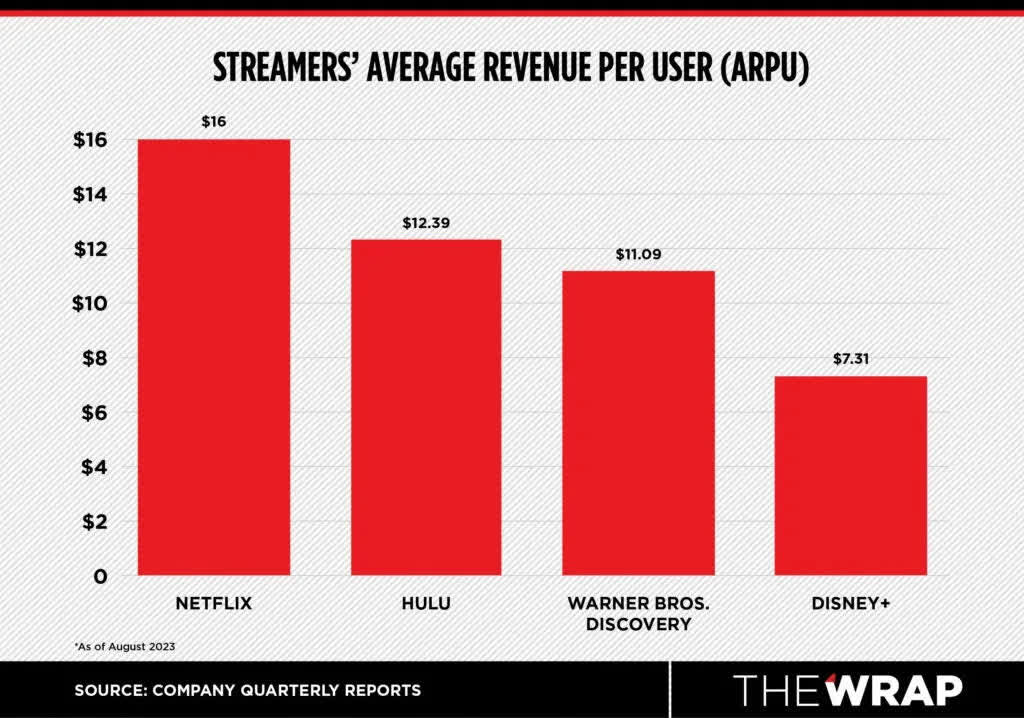

- Disney’s streaming business has faced a slowdown, with a decline in subscribers, but revenue and average revenue per user (ARPU) have increased.

- There is a lot of room for revenue growth in streaming as well as cost-cutting.

- The Parks segment has been a stable source of revenue and profit for Disney, and the outlook for the future is positive.

- I view DIS as a massively undervalued story.

Marc Piasecki

Main thesis

The Disney (NYSE:DIS) stock was left way far behind the broader market as the “transformation period” has been rather a disappointment for investors.

However, I see the current situation as the moment when structural changes can bring good results as the company has a very strong and unique position in the industry. Management will be able to use streaming as a key growth driver, and parks as the basis for further expanding the monetization of the valuable intellectual property.

Streaming’s still strong, seeking profitability

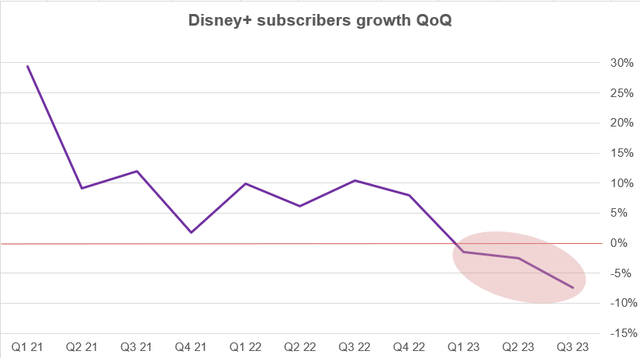

In 2023, Disney has been facing a slowdown in its streaming business. The company’s key service, Disney+’s subscribers decreased in the three last consecutive quarters.

The subscribers decline is perceived extremely negatively by investors. In Q3, Disney+ had 146.1 million total paid users (-7% QoQ). However, the main reason for this was the company’s inability to renew its broadcast rights to the Indian Premier Cricket League for the 2023 season, which is the most-watched event in the country. Because of this, many subscribers left Disney+ Hotstar and advertising revenues in India have noticeably dipped on the platform. At the same time, in other regions, the growth of subscribers continues, but at a slow pace. Excluding Hotstar, paid users increased by 800 thousand, which is not bad considering the release schedule.

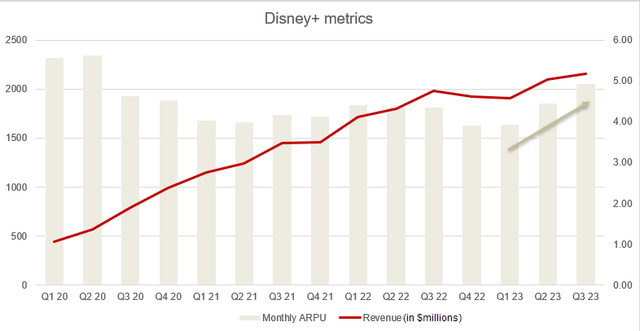

At the same time, even if we take the Hotstar segment into account, the service’s revenue rose 8.6% YoY in Q3 with ARPU growing for the last 3 quarters.

Disney continues to raise prices to achieve higher ARPU. This month, the company announced a 27% increase in the cost of a monthly subscription to Disney+ (No Ads) by 27%, from $10.99 to $13.99, and introduced Disney+ Premium and Hulu (No Ads) for $19.99.

Disney+ has plenty of room to grow revenue and increase subscription prices. The domestic ARPU is $7.3 while Warner Bros. (WBD) and Netflix (NFLX) have $11 and $16 respectively. The service has enough potential value proposition due to its scale and lots of very strong names in the portfolio:

- Star Wars

- The Simpsons

- The Marvel Cinematic Universe

- Disney Princesses/Princes (such as characters from Cinderella, Mulan, Frozen, Aladdin, and The Lion King)

- The Chronicles of Narnia Franchise

- The Pirates of the Caribbean Franchise

- Pixar Films (such as Toy Story, The Incredibles, and Cars)

- The Winnie the Pooh Franchise

- The Indiana Jones Franchise

- Many successful ABC shows

The WRAP

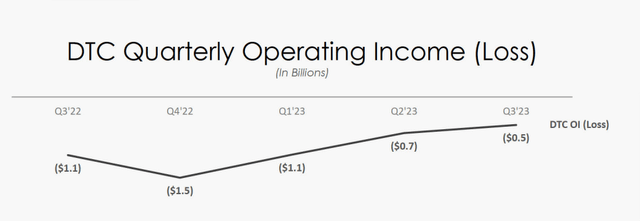

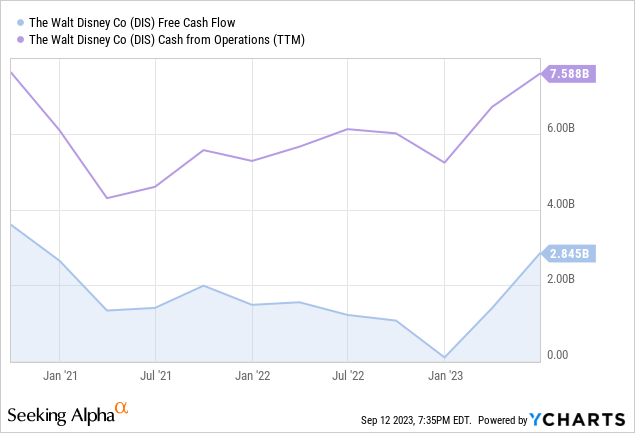

The streaming is expected to achieve sustainable growth and operating profit by the end of FY2024. The operating loss of the segment decreased by 52% last quarter, so the management is delivering on its promises to reduce losses here as over the past 3 quarters, it managed to reduce losses almost by $1 billion from $1.5 billion (in Q4’22).

Disney’s solid foundation

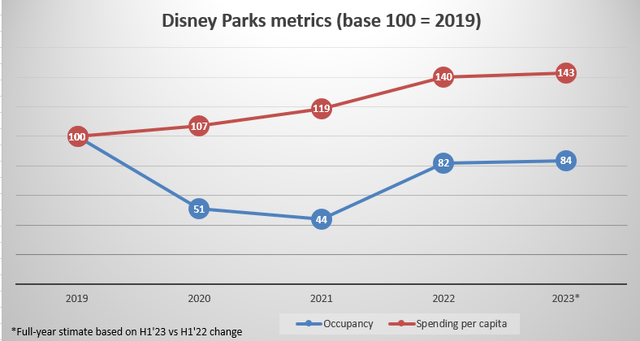

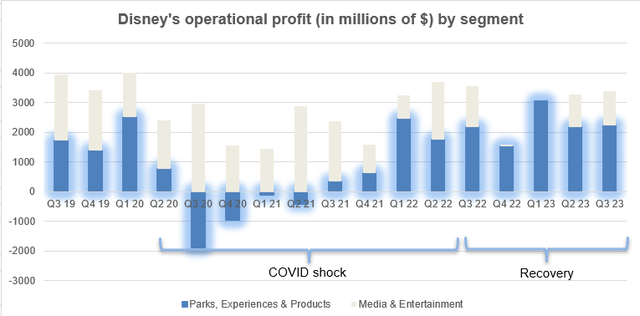

While the media segment looks unstable, Disney has always had a stable footing. Of course, I am talking about Parks. Theme park segment revenues reached pre-COVID levels at the start of fiscal 2022 and have remained strong since then. Since restrictions have been lifted, the number of tourists hasn’t fully recovered but average spending per visitor is now 40% above pre-crisis levels.

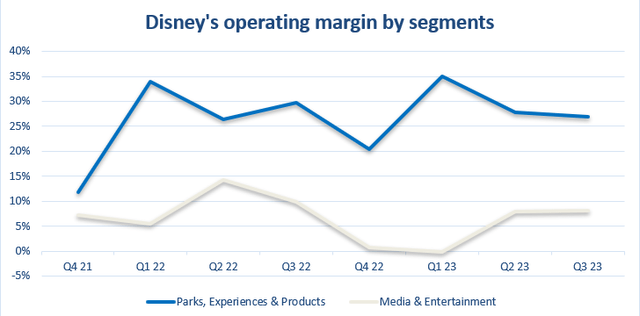

In the post-Covid period, the Parks, Entertainment & Products (PE&P) segment has been the main thing keeping the company afloat. It is generating only 37% of revenues, but over 66% of total operating profits.

Thus, Parks’ operating margin is 4x that of Media & Entertainment. So the transition process in the company actually affects only 34% of current operating profits, while the PE&P segment remains incredibly profitable.

The company now intends to prioritize visitor comfort and, to improve the visitor experience, plans to reduce peak visitor attendance by 20% compared to pre-Covid levels. Disney also remains flexible in terms of pricing – the choice of tickets and fares is very wide with different categories of access. In the next two years, new thematic zones will open in the parks – a Moana franchise zone in Florida, a Frozen franchise zone in Hong Kong, a Zootopia franchise zone in Shanghai, etc.

It is important to understand here that Disney holds onto the best-in-class portfolio of brands, which the company uses to attract fans and increase parks’ value proposition. And most importantly, most of the fans are a younger audience who will still be fans when they get older. This is an incredible advantage that, of all the media giants, only Disney has.

Bob Iger’s reforms & stock undervaluation

At the end of 2022, the post of Disney CEO was taken over by Robert Iger, who replaced Bob Chapek in this post. Iger, who previously led Disney for 15 years, has way more experience to guide the company through its next period of transformation. In just a few quarters, Iger announced changes in top management, massive layoffs, and large-scale reductions in operating costs, as well as a possible return to the previous dividend policy in the near future.

The organizational structure has been changed to three segments: Disney Entertainment (Disney and Hulu), ESPN, and Parks, Experiences & Products. The new structure will be reflected in the financial statements by the end of the current fiscal year. Regarding the creation of new content and the costs associated with its production, decision-making is placed in the hands of creative directors and creative teams, who are much more knowledgeable about this issue than senior management. Reorganization of senior management, redistribution of responsibilities for better coordination, and a more transparent, clear, and simple organizational structure should improve efficiency and reduce unnecessary administrative costs.

The CEO announced a massive plan to cut operating costs by $5.5 billion over the next few years. It is planned to reduce costs not related to content creation by $2.5 billion, of which $1 billion in fiscal 2023 and $1.5 billion in fiscal 2024. As for the costs of content creation, they will be reduced by $3 billion over the next few years. Management expects content creation costs (including ESPN), to be just over $30 billion in fiscal 2023 and remain around that level in subsequent years. The CAPEX forecast for fiscal 2023 was lowered to $6 billion from $6.7 billion.

Thus, operational efficiency in different segments may increase by 10-15% in FY2024. As said earlier, the company has already proved its ability to squeeze costs and there are lots of opportunities to continue to do so.

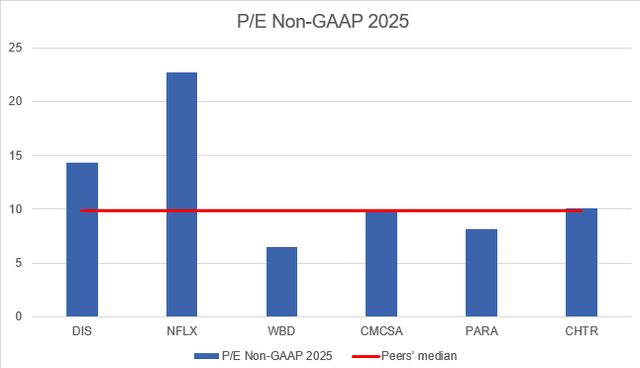

However, the stock is still at 9-year lows despite industry outperformance this year. So are the valuations. If we look at the median forward 2025 P/E among Disney’s industry peers, Disney looks expensive.

However, the “traditional” content makers and streamers do not have anything close to this scale and competitive moats. Disney is now a combo of parks, streaming, and problematic but still strong linear television. In all segments, the company has an incredible advantage due to its long history and portfolio of brands (and Disney as its strongest brand). This translates into greater economies of scale and higher efficiency.

I believe Netflix is the real competitor Disney is facing. Netflix has proven to be much more effective in the streaming segment, continuing to attract subscribers in recent quarters and increasing APRU and overall efficiency. But still, the whole Media & Entertainment segment at Disney makes up 34% of the operating margin, while parks account for the rest and are as healthy and strong as they’ll ever be. Moreover, the company is showing success in reducing costs in streaming, and revenue from its flagship Disney+ continues to grow. Yet, Netflix’s valuation is 58% higher. Thus, I view DIS as a massively undervalued story.

Risks

The “bear case” for Disney, in my view, can happen due to a slowdown or decline in the streaming business. The market is way too overcrowded. The company is battling Warner Bros. Discovery, Paramount (PARA), Apple (AAPL), Google (GOOG) (GOOGL) with its YouTube, and Amazon (AMZN) with its Prime. In conditions of macroeconomic instability, users may cancel subscriptions to all services except one. Thus, many users may switch from Disney+ to just Netflix or Apple TV, given that each of the competitors still has its own set of advantages.

Final thoughts

Disney today is a combo of streaming, parks, and declining but still strong linear. If the company continues to reduce streaming losses at the same pace, the company will have almost no weak spots left. The company is at the stage of transformation, so we should not expect immediate good results from it yet. But under Robert Iger’s leadership, it can be expected to overcome challenges and build a strong foundation for long-term growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.