Summary:

- Walt Disney’s stock may underperform due to weak economic growth impacting its most profitable Experiences segment, despite stable EPS forecasts for 2024.

- The Experiences segment faces challenges from rising costs, weaker demand, and global economic uncertainties, leading to potential downward EPS revisions for 2025 and 2026.

- Analysts maintain a positive view, with 22 out of 31 recommending a ‘buy,’ but the target price has dropped significantly over the last three years.

- Valuation suggests Walt Disney is fairly priced, with its forward EV/EBITDA multiple aligned with pre-COVID levels, but no immediate growth catalysts are expected.

smckenzie

Walt Disney (NYSE:DIS) is one of the most famous entertainment companies worldwide. Its operations are divided into three segments:

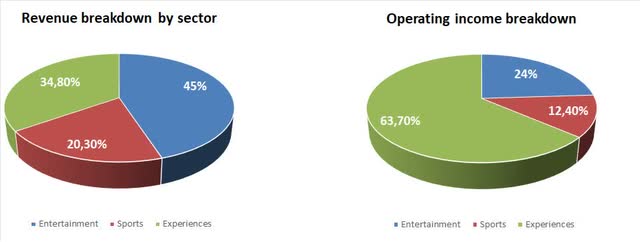

- Entertainment: It includes film production, linear networks (ABC, Disney, National Geographic), and direct-to-consumer services (Disney+, Hulu), excluding sports-related content. It also includes the sale or licensing of produced content to third-party companies. In the first nine months of fiscal year 2024, it accounted for 45% of revenue and 24% of operating income.

- Sports: It includes television and direct-to-consumer streaming services for sports content, both in the domestic market (ESPN) and internationally (with 40 local ESPN-branded TV channels). In 9M ’24 it contributed 20.3% of revenue and 12.4% of operating profit.

- Experiences: The Experiences segment includes theme parks, vacation and cruise services, as well as the sale and licensing of merchandise. The company operates parks in the USA (Walt Disney World Resort in Florida and Disneyland Resort in California) and internationally (e.g., Disneyland Paris, Hong Kong Disneyland Resort, and Shanghai Disney Resort). This is the company’s most profitable segment, contributing 63.7% of operating profit, despite representing only 34.8% of total revenue.

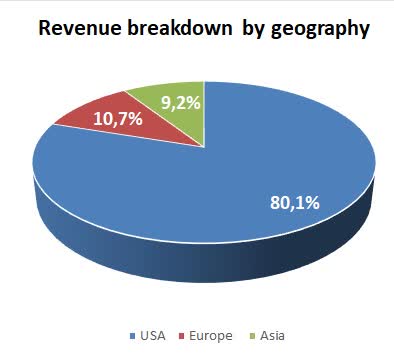

Despite a global presence, the company obtains 80.1% of revenue in the USA. Europe accounts for 10.7% of revenue and Asia for 9.2%.

Company’s data, RadaEcoWatch

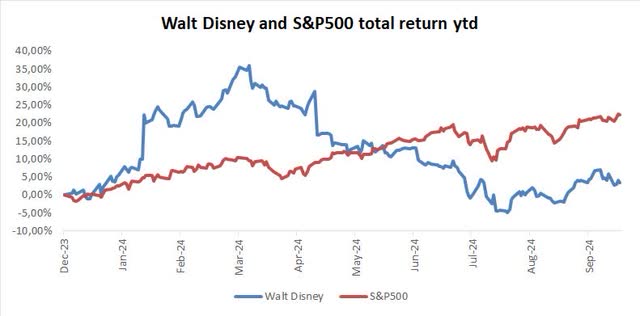

Following a strong start to the year, with a high of USD 122.82 on April 2, Walt Disney entered a downward trend, losing over 24%. It has underperformed the S&P 500 Year-to-date, with a total return of 3.5% against the S&P 500’s 22.3%. Walt Disney has also underperformed the S&P500 over the last five years, falling by 28.2%, while the S&P 500 has risen by 111%.

Over the last few months, Disney’s stock has been hurt by weaker-than-expected third-quarter fiscal year 2024 results in its Experiences segment. Revenue growth was modest at 2%, a significant slowdown compared to the 10% growth in the previous quarter, and operating profit fell by 3% due to rising costs. The company has also lowered its 2024 guidance for the Experiences segment. The Experiences segment is expected to contract by 5% year-on-year, impacted by weaker-than-expected demand in the USA and the negative effect of the Paris Olympics on attendance at Disneyland Paris.

Despite the disappointing results, the EPS forecast for 2024 remains unchanged from a year ago at USD 4.94. However, analysts have significantly lowered their estimates for the following two years. Compared to a year ago, the EPS forecast for fiscal year 2025 dropped from USD 5.81 to USD 5.19, and for 2026, from USD 6.90 to USD 5.79.

Investment Case

We believe that Walt Disney could continue underperforming the broader market in the coming quarters due to the absence of positive catalysts. We see the parks segment as the main source of concern as it may be heavily impacted by the global economic slowdown.

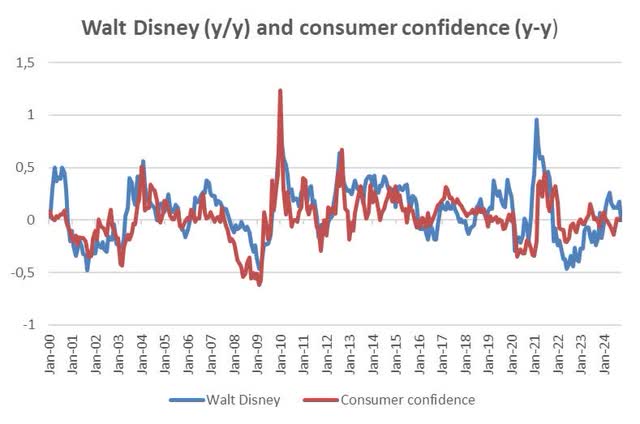

In the USA, consumer confidence has shown signs of weakness. The Conference Board’s Consumer Confidence Index fell in September to its lowest level in three months, close to the year’s low recorded in April – an unfavorable signal for personal spending. Moreover, the slower-than-expected decline in September’s CPI data published on Thursday, October 10, suggests that cost pressure may persist, negatively impacting profit margins. As shown in the following graph, Walt Disney’s stock price has been highly correlated with consumer confidence over the last few years.

International parks may also be impacted by the uncertain economic outlook. European parks could suffer from the deteriorating growth outlook, while Asian parks face challenges from China’s still fragile economic situation. In our view, weakness in the Experiences segment is unlikely to be offset by improvements in other areas of the business, given its significant contribution to overall financial results.

In the medium term, the launch of two new cruise ships – Disney Treasure in 2024 and Disney Destiny in 2025 – and innovations in existing parks (with around 50 new projects announced at the “D23 Ultimate Disney Fan Event“) could provide a positive boost. However, no immediate catalysts are expected to drive short-term growth, as we do not think that the improvement in the Entertainment segment, particularly with upcoming releases like “Moana 2” in November 2024, the sequel to the 2016 hit that grossed USD 650 million, could offset Experiences segment weakening.

In this scenario, we believe Walt Disney’s EPS estimates for the next two years may still face downward revisions, which could weigh on the stock price.

Valuation

We value Walt Disney using multiples analysis.

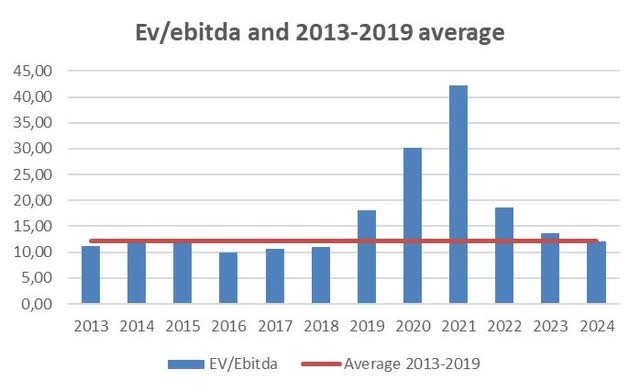

Given the strong impact of the COVID-19 pandemic on the stock during the 2020-2023 period, we believe current financial ratios should be compared to pre-COVID levels. Using the forward EV/EBITDA multiple, which now stands at 12.11x, it is perfectly aligned with the 2013-2019 average of 12.17x. This suggests Walt Disney is fairly valued at its current price.

The view from the street

Despite the stock’s weak performance over the last few months, equity analysts covering it maintain a positive view. Of the 31 analysts covering it, 22 have a ‘buy’ rating, 8 have a hold recommendation and only 1 analyst has a sell rating. However, they have significantly reduced the target price over the last three years. The consensus target price was USD 204 at the end of 2021, and it is now at USD 111.19.

Conclusion

We believe that the lack of positive catalysts and weakening economic growth could continue to penalize Walt Disney in the short term. We believe that the worldwide economic slowdown could weigh on the Experiences sector, leading to a downward revision of the EPS estimates for 2025 and 2026. In this scenario, we would not have the stock in our equity portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.