Summary:

- Disney’s recent financial performance, particularly in free cash flow and operating income, indicates a strong turnaround, making it an attractive investment opportunity.

- Bob Iger’s return as CEO has stabilized DIS, with strategic initiatives driving positive results and positioning Disney for continued growth.

- Upcoming content releases and cost-cutting measures are expected to support Disney’s financial revival and attract new streaming subscribers.

- Despite lingering negative sentiment and potential short-term challenges, Disney’s key metrics look undervalued, presenting a significant buying opportunity.

HAYKIRDI

My last article on The Walt Disney Co. (NYSE:DIS) (NEOE:DIS:CA) was in late October 2022. A very quick gain of around 10% was surrendered before a near 17% gain into April 2024. This time I am betting that the upside will be larger due to the company’s recent performance.

Predictions of Disney’s demise are overdone

Disney has struggled in recent years with the pandemic lockdowns shuttering its theme parks and hurting its staffing levels. The company’s content has also come under fire for straying too far into politically correct areas. Boardroom turmoil has also been prevalent, with Bob Iger replaced as CEO by Bob Chapek, only to return in 2023. Activist investor Nelson Peltz was seeking to take control of the company after claiming it had gone “too woke” and was failing shareholders. However, Iger won the support of shareholders in a vote earlier this year.

Despite some recent turmoil, the Disney brand is still a big draw and a recovery would boost the potential for investors further. It is also not the first time that the company has been under pressure to deliver new ideas. “The Dark Ages” refers to a period from 1981 to 1988 when Walt Disney’s story ideas had been exhausted and the company had to move on from its founder.

“The Renaissance Era” of 1989 to 1999 ushered in one of the most successful periods in the company’s history, which included films such as Beauty and the Beast, The Little Mermaid, Aladdin, and The Lion King. The brand is still a moat and has access to assets such as Star Wars. As with previous eras, Disney is navigating a period of change and management will have to get back to basics on content. That is a story for another day, as the recent financial performance may be going unnoticed by some investors who have been scared away by the drama surrounding the company.

There is big value in recent free cash flow

The financial basis of my long call on Disney is the company’s growing free cash flow (FCF) and the valuation that analysts have given the company.

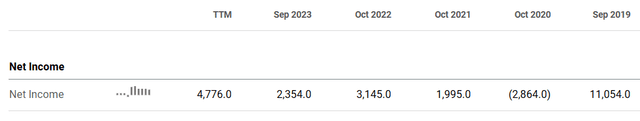

Bob Iger’s return as CEO brought a turnaround plan, which started to take shape in early 2024. The company is now on course for the company’s best net income since the pandemic, with a trailing twelve-month figure of $4.77 billion. That is still lower than the $11 billion registered pre-pandemic, but the stock price is down almost -40% since the 2019 high and -53% from the 2021 highs.

Walt Disney & Co. Net Income (Seeking Alpha)

Iger understands the company’s moat and is putting the company on a more sound financial path:

“When you consider all of our businesses as a whole, from Entertainment to Sports to Experiences, it’s clear that no one has what Disney has. The turnaround and growth initiatives we set in motion last year have continued to yield positive results, and we are executing against our ambitious strategic priorities with both speed and determination,” Iger said in the company’s Q2 2024 results.

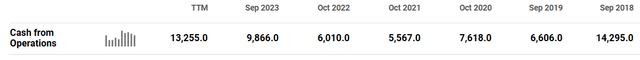

Disney is also delivering strong results in the company’s cash flow. Cash from operations at the firm is now near 2018 levels at $13.255 billion.

Walt Disney & Co. Cash from Operations (Seeking Alpha)

The company’s free cash flow is also at levels not seen since 2018.

Walt Disney & Co. Free Cash Flow (Seeking Alpha)

The value proposition in my investment thesis is that the company’s current valuation is not yet pricing in this turnaround.

The cash from operations figure is now 85% higher than the company’s 5-year average and more than 4,500% higher than the sector median, according to Seeking Alpha data. The company’s free cash flow margin is now also 14% higher than its 5-year average.

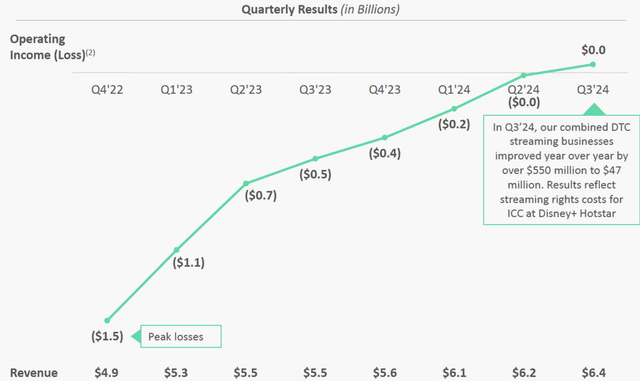

An important contributor to the company’s recent financial strength is a move to profitability in combined streaming.

Combined Disney Streaming Results (Walt Disney & Co.)

Subscribers have also increased 8.8% from Q3 2023, with revenue now at $6.3 billion. Disney cut hundreds of executive jobs last week as the company continues on a $7.5 billion cost-cutting drive.

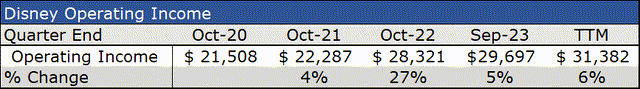

Disney’s operating income is now back to its pre-pandemic levels and, on a trailing twelve-month basis, is averaging 10% annual growth.

Disney Income (Seeking Alpha)

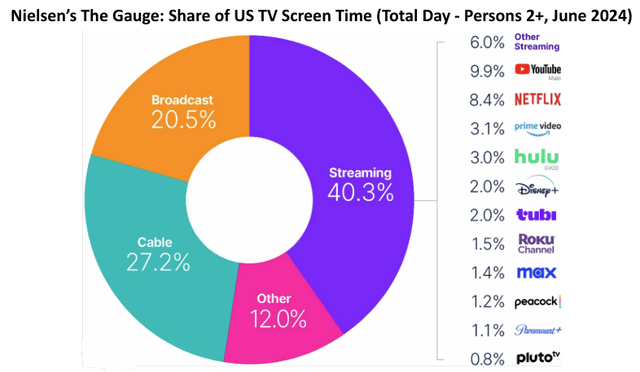

As a comparison, operating income at Netflix (NFLX) was $2.6 billion in Q2, with a Q3 projection of $2.7 billion. Netflix is still leading by a wide margin in daily U.S. screen and one of Disney’s goals should be to close that gap, which would be hard to do on a short-term timeframe due to content filming requirements.

Streaming Time U.S. (Netflix, Neilsen)

New content can support financial growth.

Disney has seen recent success in its content delivery with Inside Out 2, Kingdom of the Planet of the Apes, and Deadpool and Wolverine combined for $2.8 billion at the box office.

Another Disney era, known as the “Revival Era,” produced titles such as Zootopia and Moana. Disney executives are likely aware of previous turnaround periods as upcoming titles include Moana 2, and Mufasa: The Lion King, and Zootopia 2.

Next year also brings films Avatar 3 and Captain America films, with 2026 bringing a new Star Wars film and Toy Story 5. This slate of films should support the company’s continued revival over the next two years.

Inside Out 2 was the highest-grossing animated film of all time, which Disney said drove 1.3 million Disney Plus subscribers and drove 100 million views worldwide. The strong content list through 2026 could see similar successes and support the direct-to-consumer segment.

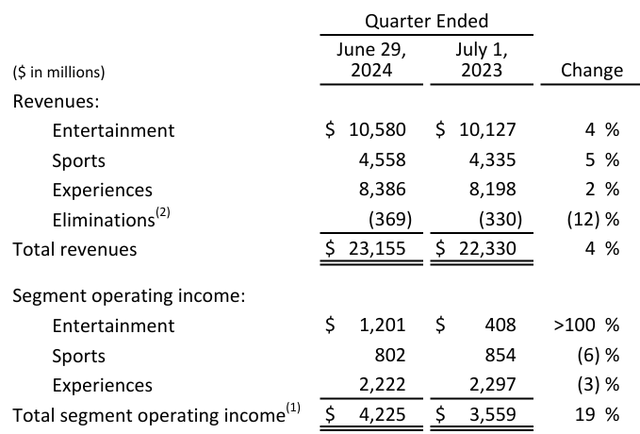

Year-over-year growth in entertainment was 4%, sports was 5% and experiences was 2%. The key to the recent earnings was the +100% y-o-y improvement in operating income in the entertainment segment, due to the Disney Plus profitability. After being a drain on the company’s finances during the tough lockdown period, that segment is now catching up to experiences and can provide stability over the duration of the investment.

Disney Segment Income (Walt Disney & Co.)

Finally, higher costs due to inflation have been hurting the theme parks and experiences, and those should start to recede in line with falling inflation. The continuing crackdown on password-sharing should also normalize subscriptions, and strong content can drive new subscribers.

Disney’s current price/earnings ratio (Non-GAAP FWD) is 18.95x, which is -55.23% lower than the company’s 5-year average of 42.33x. The recent turmoil at the company has stabilized with the return of Iger and investors can capitalize on that discount ahead of his eventual successor.

Risks to the investment thesis

The negative sentiment that has surrounded Disney as a company may still be lingering around the stock, which could limit the upside potential.

The upcoming Q4 earnings may also be subdued, as guidance predicted Disney+ Core subscribers would grow modestly.

Management also said that “demand moderation” seen in the experiences segment in Q3 “could impact the next few quarters.” Disneyland Paris is expected to see reduced footfall due to the Olympics, and China’s weak economy is another headwind.

Despite this, there is a strong focus on costs and another strong quarter can boost the opportunity, which, I believe, is undervaluation at current levels of performance.

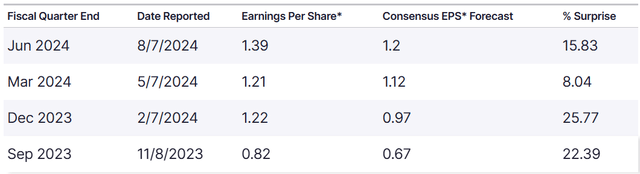

The upcoming earnings expected on 13 November are expected to show EPS at $1.11 and revenue at $22.49 billion. Those are down from $1.39 and $23.16 billion in the most recent quarter, for the reasons noted above. This could pressure the stock in the next quarterly release, but continued profitability at Disney + would improve this. The company has beaten earnings expectations by between 8-25.77% in every quarter since Iger’s return.

Quarterly Earnings Surprise (Nasdaq)

Conclusion

Walt Disney & Co. has had a tumultuous few years with the lockdowns shuttering the company’s theme parks at a time when Disney + was losing money. Those issues have now been resolved, and the company is performing well on operating income and free cash flow. I believe this has gone unnoticed by some investors due to the recent boardroom issues. Disney’s key metrics are trading at discounts of up to 55% based on the company’s 5-year averages, and I believe this is a great time to load up on a household name with a strong consumer brand.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.