Summary:

- The management team at The Walt Disney Company reported some really mixed, but mostly positive, results for the first quarter of the company’s 2023 fiscal year.

- Even though streaming saw some pain and both debt and cash flows weren’t great, revenue and profits surprised in a positive way.

- Management also revealed some massive developments that should add value for investors in the long run.

Julio Aguilar

Just when you think you have something figured out in the market, you are bound to be surprised by something. Such was the case when, after the close of the market on February 9th, the management team at The Walt Disney Company (NYSE:DIS) announced financial results covering the first quarter of the company’s 2023 fiscal year. Leading up to the earnings release, I had certain expectations. However, the company came in mixed on a number of issues. Given the general pessimism around that particular firm and the market more broadly, I would have anticipated a significant decline in share price in response. Instead, shares of the company moved down only modestly once the market opened. Between these new developments and the positive things that were announced during the quarter, I would make the case that the company still definitely offers some attractive upside. But the road to that upside could be a bit more tumultuous than expected.

Streaming took a hit… kind of

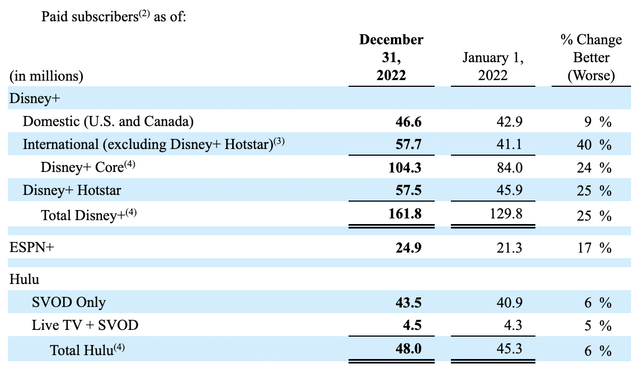

In an article I wrote leading up to the company’s earnings release, I mentioned that streaming numbers would be incredibly important. Honestly, I expected the company to report a continued increase in the number of subscribers for the Disney+ platform. But I was surprised by the exact opposite. The company actually saw the number of subscribers drop from 164.2 million to 161.8 million. Interestingly, however, this data is not all bad. First, though, we need to understand where the decline came from.

According to management, the number of domestic subscribers, those from the US and Canadian markets, inched up from 46.4 million in the final quarter of the company’s 2022 fiscal year to 46.6 million in the first quarter of 2023. In the international market, excluding the Disney+ and Hotstar tie-in subscribers, the number jumped from 56.5 million to 57.7 million. These, combined with the domestic subscribers, are referred to as the core subscribers for the company. In the course of just one quarter, this number rose from 102.9 million to 104.3 million, for a sequential gain of 1.4 million.

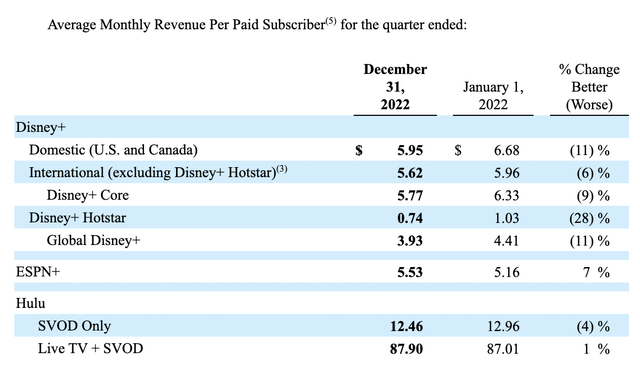

The weakness came from the Hotstar subscribers. This plunged from 61.3 million to 57.5 million. At first glance, this may be indicative of some pain for the company. However, the situation is not all that bad. I say this because we need to take into consideration the ARPU reported by the company. During the first quarter, the company experienced a decline in ARPU in both the domestic and international markets (the latter excluding the Hotstar tie-in). Domestically, the fall was from $6.10 per month to $5.95 per month. In the international market, it was from $5.83 per month to $5.62 per month. But when it comes to the Hotstar setup, the company actually reported a rise in ARPU from $0.58 per month to $0.74 per month. This may not seem like all that significant a move. But on its own, with the number of subscribers the company had as of the end of the first quarter, it would translate to an additional $84 million per year in revenue compared to if there was no rise in ARPU. This increase was actually enough to raise the overall ARPU for Disney+ from $3.91 per month to $3.93 per month. Given the number of global subscribers, this works out to an additional $38.8 million per year in revenue if we keep the subscriber count flat from where it ended the first quarter at.

Outside of Disney+, the entertainment conglomerate reported some other positive developments. ESPN+, for instance, saw its number of subscribers grow in the course of one quarter from 24.3 million to 24.9 million. With this came a rise in ARPU from $4.84 per month to $5.53 per month. Meanwhile, the number of Hulu subscribers rose from 47.2 million to 48 million, with the monthly ARPU climbing from $19.18 to $19.53. These improvements were instrumental for pushing annualized streaming revenue for the company up to $20.53 billion. That compares to the $19.98 billion we get if we use data from the fourth quarter of the 2022 fiscal year. What this means is that, while streaming may not have reported growth like I anticipated, overall revenue and cash flows under it should increase.

Pain points have improved

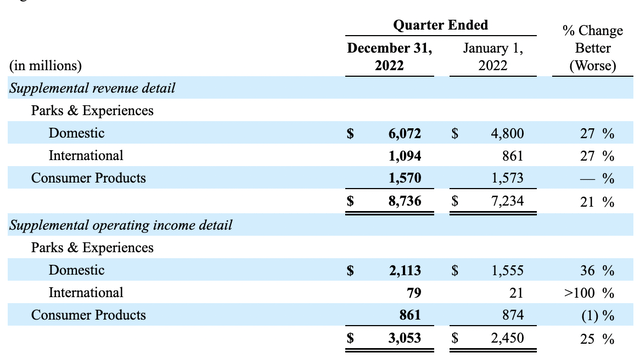

Over the past year or so, Disney has been under attack for being ‘woke’. The belief of many of its critics is that this will ultimately hurt its business model. Irrespective of your own personal belief on these matters, there is no denying that the company is showing amazing strength in other aspects of its operations. The most notable involves its parks, resorts, and other related assets. Under the Parks & Experiences segment, the company reported domestic revenue in the latest quarter of $6.07 billion. This is 26.5% higher than the $4.80 billion reported only one year earlier. Internationally, meanwhile, revenue jumped 27.1% from $861 million to $1.09 billion.

It wasn’t just the revenue that came in strong on this front. Profits were also better year over year. In the domestic market, Parks & Experiences reported an operating profit of $2.11 billion. That’s 35.9% higher than the $1.56 billion reported one year earlier. Meanwhile, international profits skyrocketed from $21 million to $79 million. That’s a year-over-year improvement of 276.2%. All combined, revenue under these operations jumped 26.6% while operating profits expanded by 39.1%. Clearly, there is high demand for the company’s parks, resorts, and other related assets. In addition to the parks being hit by the COVID-19 pandemic, the theatrical distribution side of the company was also slammed. This has also shown tremendous improvement over the past year. In the first quarter, sales came in at $1.14 billion. That’s materially higher than the $529 million reported one year earlier.

Other important notes

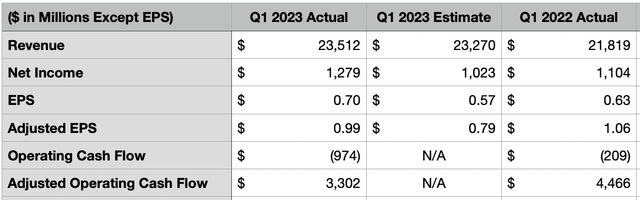

On top of the aforementioned improvements and challenges the company reported for the first quarter, it also reported some other interesting data points that are worth mentioning. For starters, revenue came in stronger than expected, totaling $23.51 billion. That was actually up from the $21.82 billion reported the same quarter one year earlier and it was $242 million more than what analysts anticipated. On the bottom line, earnings per share came in at $0.70. That compares to the $0.63 per share from continuing operations at the same time one year earlier. That brought net income up from $1.10 billion to $1.28 billion. Adjusted earnings per share, meanwhile, came out to $0.99. This was actually down from the $1.06 per share, but it beat expectations set by analysts by $0.20 per share.

This is not to say that all the fundamental data provided by the company was great. Operating cash flow was problematic. This came in negative to the tune of $974 million. By comparison, the same time one year earlier it totaled negative $209 million. Even if we adjust for changes in working capital, it would have fallen from $4.47 billion in the first quarter of the company’s 2022 fiscal year to $3.30 billion the same time this year. This weakening in cash flow resulted in the company’s debt picture growing somewhat worse. Net debt for the quarter came in at $39.91 billion. That’s up $3.15 billion from just one quarter earlier.

Some major developments

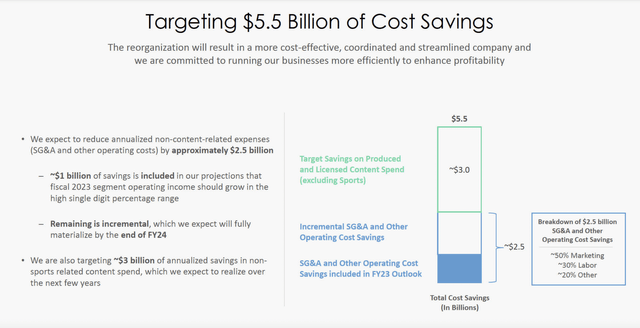

Based solely on the aforementioned results, I would have actually anticipated a decline in share price for the company. However, management came out swinging and unveiled some major plans. Perhaps the most significant is a $5.5 billion cost-cutting initiative. $2.5 billion of this is expected to be non-content related costs, with about 50% of that amount coming from marketing initiatives, 30% coming from labor reductions, and 20% coming from other miscellaneous sources. Of this amount, approximately $1 billion in savings is included in the company’s projections for the 2023 fiscal year. The rest of it will be incremental but is expected to fully materialize by the end of the 2024 fiscal year. The company is also targeting around $3 billion in annualized savings in content spending reductions. This excludes spending on sports. Beyond that, we don’t have much to go on.

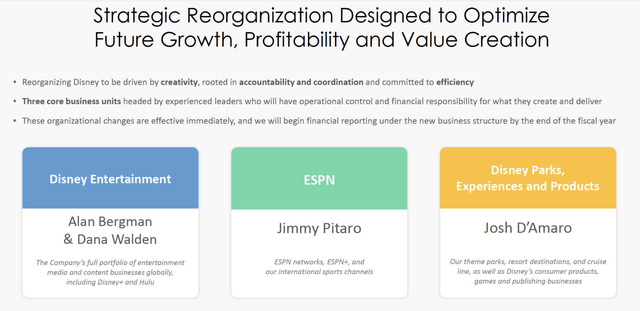

To kick off this cost-cutting plan, the company did say that it was slashing its workforce by 7,000. For those worried that this may mean no dividend in the future, the company said that it plans to reinstate the dividend by the end of the 2023 calendar year. That is also another positive that’s likely helping to push shares higher. And finally, the company has also decided you know to restructure its operations into three different segments. The first of these will be ESPN, which will include ESPN Networks, ESPN+, and all of its international sports channels. For a long time, analysts and investors alike have questioned whether this will lead to the spinoff or sale of that enterprise. But management has indicated that unlikely to happen. The second segment will be called Disney Entertainment and will include the company’s portfolio of entertainment media and content businesses globally, including both Disney+ and Hulu. And finally, we will have Disney Parks, Experiences and Products, which will include the company’s theme parks, resort destinations, cruise line, and its consumer products, games, and publishing operations. It’s likely that this restructuring will be the key driver of the aforementioned cost-cutting that the company is going through.

Takeaway

All things considered, I am happy with how the market perceived the financial data reported by Disney. But to be perfectly truthful, I am a bit surprised. In addition to reporting a contraction in subscriber count for Disney+, the company saw net debt increase and cash flows worsen. More than offsetting these negatives, however, was a significant improvement in the portions of the business that were hit hard by the COVID-19 pandemic, continued growth in its other streaming operations, stronger than expected revenue and profits, news that the dividend will eventually return, and a massive restructuring initiative that should save shareholders billions of dollars annually once completed. When taking all of these things together, I understand why the market is still very enthusiastic about the company and its prospects. And it’s because of what these developments mean that I’ve decided to keep the ‘strong buy’ rating I had on the stock previously.

Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!