Summary:

- Disney is expected to see strong earnings growth due to its Disney+ streaming service, which has grown a large subscriber base.

- The company could finally make significant progress deleveraging its balance sheet.

- A strong earnings outlook could fuel 18% annual returns moving forward.

Tomohiro Ohsumi

The Walt Disney Company (NYSE:DIS) remains an extremely popular stock due to its household brand name and strong performance over many decades.

But every company goes through rough patches. I discussed Disney’s deteriorating financials in 2021 when the company, fresh off its expensive Fox acquisition, was crippled by the pandemic.

You can read that note here. The stock has fallen by 50% since then, and I see a lot of doubt and negativity around Disney today.

However, now isn’t necessarily the time to throw in the towel on Disney. The company’s on the verge of monetizing its Disney+ streaming service, setting it up for strong earnings growth over the coming years.

Here is what you need to know.

Streaming is dragging Disney down… for now

Disney has thrown its weight behind its streaming service for the past four years. From a growth standpoint, Disney is thriving. The company owns Disney+ (157 million subs), ESPN+ (25 million subs), and a majority stake in Hulu (48 million subs). That makes Disney a big player in a crowded streaming industry.

But streaming (referred to as direct-to-consumer at Disney) has yet to begin paying the bills. The segment has accumulated $1.7 billion in operating losses through the first half of Disney’s fiscal 2023 year.

However, CEO Robert Iger is moving to monetize streaming now that it’s built a large subscriber base. The company is raising prices, lining up advertisers for ad-tier products, and condensing content from Hulu into the Disney+ app to improve the user experience.

Iger has iterated that he expects streaming profitability by the end of Disney’s fiscal year 2024. The company could see earnings growth accelerate as streaming becomes a bottom-line contributor.

Analyst estimates for The Walt Disney Company earnings-per-share (EPS) (Seeking Alpha)

Analysts believe the company’s earnings-per-share could grow from an estimated $3.81 in fiscal year 2023 to $8.60 in fiscal year 2027.

Earnings growth should finally help Disney deleverage

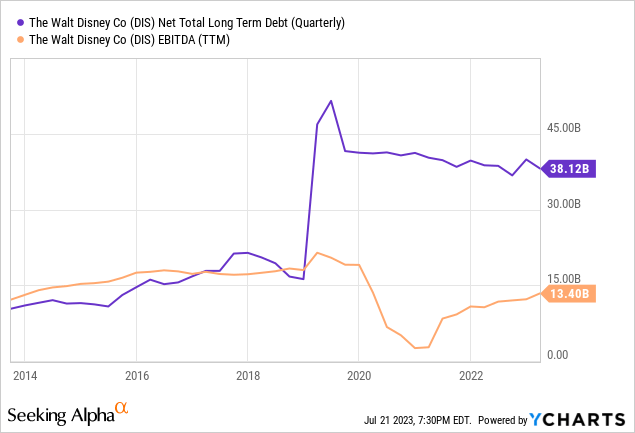

You can see below how much Disney’s debt load soared upon closing the Fox deal, and the company has chipped away at it over the past several years.

Investors should look for earnings growth to provide more cash to deleverage. Disney’s debt-to-EBITDA ratio currently stands at just over three but shrinking debt (numerator) while growing EBITDA (denominator) could quickly bring that down over the next several years.

As that happens, one could see dividend growth, stock buybacks return, and much-improved market sentiment toward the stock.

Solid investment returns ahead

The pessimism around Disney is setting up shareholders for some solid returns when looking ahead. Today, shares trade at a P/E of 22 against 2023 earnings estimates. That’s on par with what the S&P 500 trades at.

A financially healthy Disney might command a premium to the broader market on the back of its streaming business. For example, Netflix (NASDAQ:NFLX) trades at a forward P/E of 37 today on expectations for 23% annual earnings growth.

If Disney follows a similar trajectory up to 2027 — analyst estimates shown earlier point to such an outcome, there’s an argument for Disney trading somewhere between 25 and 30 times earnings.

To be conservative, let’s apply a lower valuation, say a P/E of 20 on 2027 earnings-per-share estimates of $8.60. That would double Disney’s share price between now and then, generating annual returns of approximately 18%.

Gauging risk in Q3 earnings

The path forward for Disney is clear. Investors will get a fresh look at Disney’s progress when the company reports its fiscal year 2023 earnings for Q3 in a few weeks.

What’s the key focus point? Investors should look for progress in bringing the direct-to-consumer segment to profitability. The segment posted $659 million in operating losses in Q2, so that should continue shrinking as Disney’s price increases and the advertising business continues having an impact.

Increased losses wouldn’t necessarily be a thesis-killer, I don’t like living or dying by a single quarter. However, the trend is important, and a potential reversal would be a red flag that would invite more scrutiny.

Wrapping up

Walt Disney possesses a war chest of intellectual property and has positioned itself as a streaming leader to complement a lucrative parks business. Few will argue that Disney is a great business, but the financial warts from earlier years have tarnished its name on Wall Street.

That should soon change, which could make now the time to begin circling back on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.