Summary:

- The Walt Disney Company is one of the largest entertainment conglomerates, but the share price has been under pressure in recent months.

- Despite year-over-year revenue growth, the company still can’t handle the churn of paid Disney+ subscribers.

- Unlike Walt Disney, the number of paid subscribers of Netflix, one of its key competitors, amounted to about 232.5 million, up 10.86 million from the previous year and 1.75 million QoQ.

- On June 20, 2023, it became known about the departure of Latondra Newton as the chief diversity officer and senior vice president of the company.

- We initiate our coverage of Walt Disney with a “hold” rating for the next 12 months.

Hu Chengwei/Getty Images News

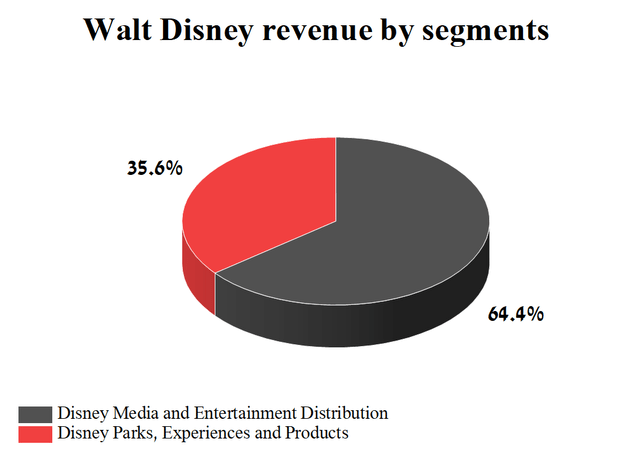

The Walt Disney Company (NYSE:DIS) is one of the largest entertainment conglomerates operating in two main segments. The first of these is Disney Media and Entertainment Distribution (DMED), which focuses on the development and subsequent commercialization of television episodes and films through television networks such as ABC, ESPN, Disney, National Geographic, Freeform, FX, and more.

In addition, Walt Disney continues to invest hundreds of millions of dollars to develop content for Disney+, a subscription-based direct-to-consumer service that offers millions of viewers video streaming of various family, entertainment, and sports programs. Despite the growth in revenue in this segment, the company still cannot cope with the outflow of paid subscribers of this streaming service, which casts doubt on the ability to increase the total subscriber base to 215-245 million by the end of 2024 and which ultimately creates additional pressure on the company’s share price from short sellers.

Walt Disney’s second segment is Disney Parks, Experiences, and Products (DPEP), which operates world-famous theme parks and resorts such as Disneyland Resort in California, Shanghai Disney Resort, and Disneyland Paris, and brought in about 35.6% of the company’s revenue for the second quarter of fiscal 2023. We believe that thanks in part to the DPEP business, which is once again becoming a cash cow after the end of the COVID-19 pandemic, the company’s margins will begin to grow at a faster pace from 2025, which will increase its investment attractiveness in the eyes of the most conservative investors.

Author’s elaboration, based on 10-Q

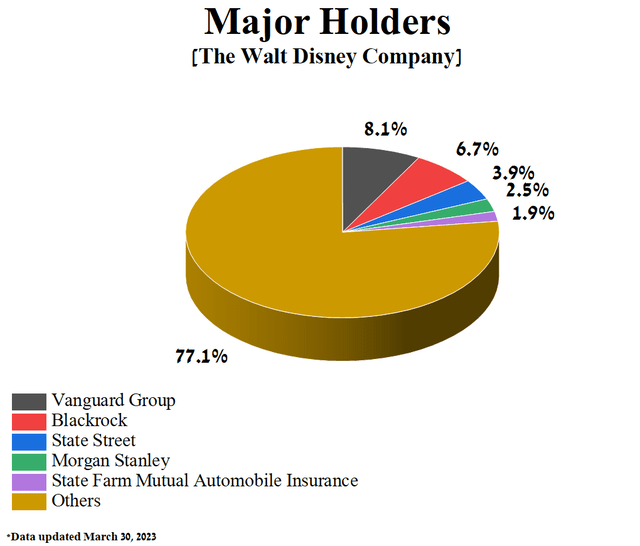

At the same time, Wall Street mastodons such as Vanguard Group, BlackRock, State Street, Morgan Stanley, and State Farm Mutual Automobile Insurance have long been the five largest shareholders of Walt Disney for a long time.

Author’s elaboration, based on Yahoo Finance

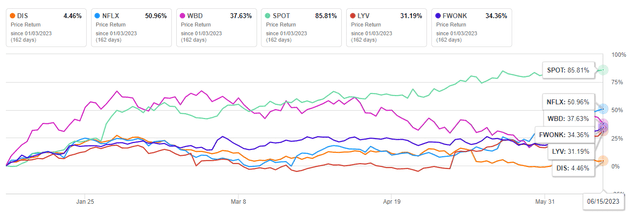

On May 10, 2023, Walt Disney released financial results for the second quarter of fiscal 2023, which were very close to analysts’ expectations and, at the same time, were able to demonstrate revenue growth in the company’s two main business segments year on year. However, due to the ongoing downward trend in the EPS, since the beginning of 2023, Walt Disney’s share price has shown growth of only about 4.46%, well behind main competitors in the communications sector such as Netflix (NFLX), Warner Bros. Discovery (WBD) and Spotify Technology (SPOT).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Walt Disney with a “hold” rating for the next 12 months.

The Walt Disney Company’s Financial Position

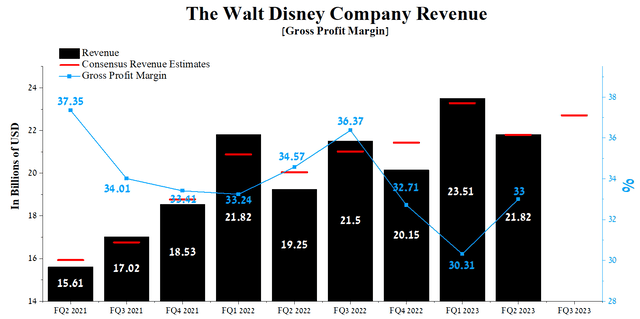

Walt Disney’s revenue for the first three months of 2023 was $21.82 billion, down 7.2% from the previous quarter and up 13.4% from the second quarter of fiscal year 2022. Despite the change of CEO at the end of November 2022 and the return of Robert Iger in this role, and the increase in theme park attendance after the end of COVID-19, which led to a significant increase in the revenue of Disney Parks, Experiences and Products segment, the company’s actual revenue beat analysts’ consensus estimates in only four of the last nine quarters.

Author’s elaboration, based on Seeking Alpha

At the same time, the revenue of the Disney Media and Entertainment Distribution segment, which brought 64.4% of the company’s total revenue for the second quarter of fiscal year 2023, amounted to about $14.04 billion, an increase of 3.1% compared to the previous year. Despite the growth in sales of this segment, the revenue from linear networks continues to decline from year to year, and in particular, the negative trend is noticeable in the International Channels business due to a decrease in advertising revenue caused by a decrease in the number of impressions and also the strengthening of the US dollar against the Indian rupee, the Chinese yuan, and the euro.

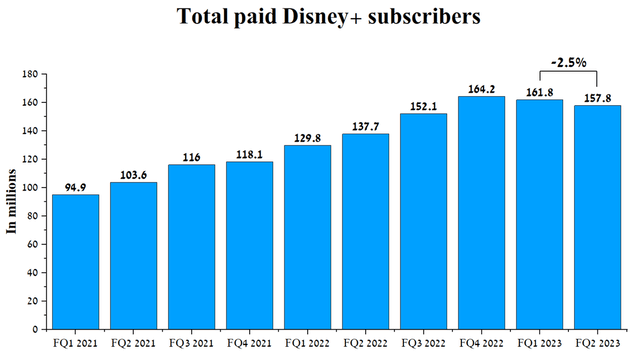

One of the most important businesses for the company is the Direct-to-Consumer business, whose revenue is generated from subscription fees and advertising sales and generated approximately $5.51 billion in Q2 FY 2023, up 12.5% from the previous year. Despite year-over-year revenue growth, the company still can’t handle the churn of paid Disney+ subscribers. Their total number was 157.8 million on April 1, 2023, down 2.5% from the previous quarter. Moreover, the outflow of subscribers has been observed since the fourth quarter of the financial year 2022, which, firstly, creates threats in not achieving the goal set by the company’s management to increase the total subscriber base to 215-245 million by the end of 2024. What’s more, the lack of an established trend towards an increase in their number over the past six quarters calls into question the effectiveness of Disney’s business model in increasing its share in the fast-growing streaming industry.

Author’s elaboration, based on quarterly securities reports

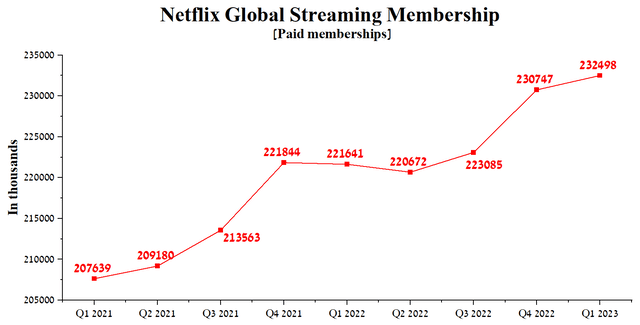

Unlike Walt Disney, the number of paid subscribers of Netflix, one of its key competitors, amounted to about 232.5 million, up 10.86 million from the previous year and 1.75 million from the prior quarter.

Author’s elaboration, based on quarterly securities reports

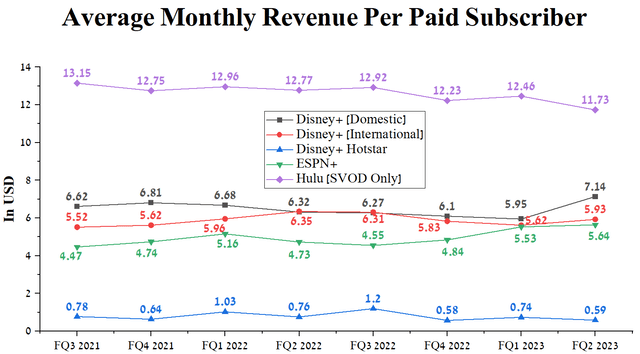

However, the Disney+ subscriber churn was offset by an increase in average monthly revenue per paid subscriber following a significant increase in the price of streaming services in early December 2022. Thus, the average monthly revenue per paid subscriber in the Domestic Disney+ segment, which includes the US and Canada, was $7.14, an increase of 20% compared to the previous quarter. On the other hand, ESPN+’s average monthly revenue per paid subscriber was $5.64, up slightly from Q1 FY 2023.

Author’s elaboration, based on quarterly securities reports

Walt Disney’s Q3 FY 2023 revenue is expected to be $22.04-$23.26 billion, up 4.2% from analysts’ expectations for the first three months of 2023. Despite the expected growth in revenue, it is no longer as impressive as it was in 2021. On the other hand, Disney Parks, Experiences, and Products segment revenue will continue to generate billions of dollars, and we expect it to grow by 8.5% CAGR through 2025 due to increased volume and growth in park visitor spending as the global economy recovers after the end of the COVID-19 pandemic.

It should also be noted that future revenue growth rates will be affected by the continued trend to reduce Disney+ Hotstar’s average monthly revenue per paid subscriber, a trend that started in Q3 FY 2022. The service is available in Malaysia, India, Thailand, and Indonesia and offers subscribers numerous TV shows, sports, movies, and more. The critical risk that will continue to put pressure on margins and the lack of a sharp increase in DMED revenues is not only the inability of Walt Disney management to attract new subscribers from India, a fast-growing market, at the meager price of streaming services but there is a decline altogether. So, for example, the number of Disney+ Hotstar subscribers was 52.9 million in the second quarter of fiscal year 2023, down 4.6 million from the previous quarter.

Walt Disney’s gross margin was 33% in Q2 FY 2023, recovering from an abysmal previous quarter, but is still below 2022 levels due to rising production costs for TV series and movies for international channels, ESPN+ and Disney+. Moreover, this financial indicator is significantly lower than that of the communications sector, which is one of the factors that reduce the investment attractiveness of Walt Disney. On the other hand, the company’s gross margin is higher than that of competitors such as Live Nation Entertainment (LYV) and Spotify Technology.

We predict that by 2023 Walt Disney’s gross margin will reach 34%, and by 2024 this figure will increase slightly to 35.2%, thanks to higher prices for hotel rooms, theme park tickets, and lower inflation in the US, Europe, and China.

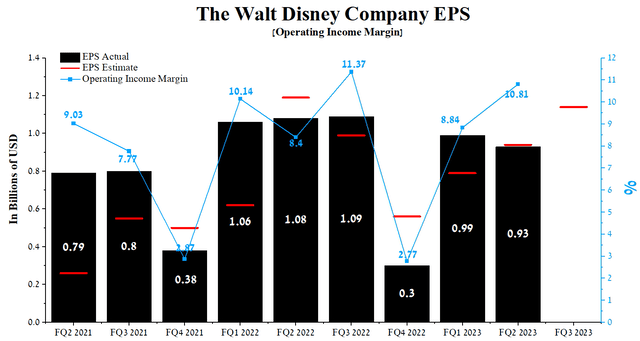

Walt Disney’s Q2 FY 2023 operating income margin was 10.81%, continuing the growth since Q4 FY 2022 and well above its median of 8% between January 1, 2021, and the end of March 2023. That being said, 2023 will be a transitional year for the company, and we expect Walt Disney’s margins to improve dramatically from 2025, thanks in part to revenue growth from the company’s DTC business, which continues to increase subscription prices year on year.

The company’s earnings per share (EPS) for the first three months of 2023 was $0.93, down 6.1% quarter-on-quarter, and just as importantly, it beat analyst consensus estimates in five of the last nine quarters. Moreover, Walt Disney’s Q3 FY 2023 EPS is expected to be in the $0.96-$1.37 range, up 21.3% from the Q2 FY 2023 consensus estimate. At the same time, Walt Disney’s Non-GAAP P/E [TTM] is 27.95x, which is 91.94% higher than the average for the sector and 0.56% less than the average over the past five years.

On the other hand, the Non-GAAP P/E [FWD] of 23.26x is one of the factors indicating that the company is slightly overvalued in the current period of fierce competition in the streaming market.

Author’s elaboration, based on Seeking Alpha

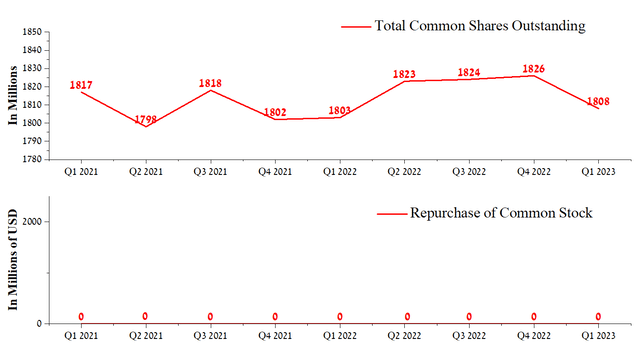

Since the emergence of vaccines against COVID-19 on the market and until now, there has been no upward trend in Walt Disney’s EPS and, moreover, it is significantly lower than pre-coronavirus levels. One of the reasons for this is the reluctance of the company’s management to spend cash flow on buying back Walt Disney shares. We believe that this is the right decision in the long term due to the need to improve the financial situation after the end of the pandemic and invest billions of dollars to create content for streaming platforms. However, in the short term, Disney does not have the necessary financial leverage to reduce the influence of short sellers on the price of the company’s shares.

Author’s elaboration, based on Seeking Alpha

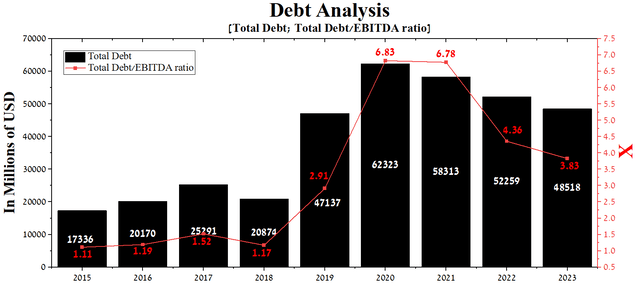

At the end of the first quarter of 2023, Walt Disney’s total debt was about $48.52 billion, down $9.8 billion from 2021. However, it is still higher than pre-COVID levels as the company borrowed heavily in 2020 to stay afloat during the lockdowns that have hurt Walt Disney’s net income. Moreover, thanks to a significant increase in EBITDA in recent years, the total debt/EBITDA ratio has decreased from 6.78x to 3.83x.

Author’s elaboration, based on Seeking Alpha

Although Walt Disney’s total debt/EBITDA ratio is still above 3.5x, which at first glance may be a red flag, the company has a stable cash flow that will increase in the coming years, thanks to the DPEP business, which is once again becoming a cash cow after the end of the pandemic. Ultimately, the company can redeem the senior bonds without any severe difficulties.

Conclusion

The Walt Disney Company is one of the largest entertainment conglomerates operating in two segments such as DMED and DPEP, which operates world-famous theme parks and resorts such as Disneyland Resort in California, Shanghai Disney Resort, and Disneyland Paris.

As the number of COVID-19 cases declines and various restrictive measures are lifted, the company’s revenue continues to grow yearly. However, we are concerned about the lack of a growth trend for Walt Disney’s EPS, and it is not only significantly lower relative to pre-Covid levels but also only sometimes meets analysts’ expectations for recent quarters.

We are dubious about claims by Walt Disney management that the total Disney+ subscriber base will reach 215-245 million by the end of 2024, as subscriber churn continues. Moreover, the number of paid subscribers of Netflix, one of Walt Disney’s key competitors, amounted to about 232.5 million, a significant increase year-on-year and quarter-on-quarter. As a result, this calls into question the effectiveness of Walt Disney’s current business model and could force the company to increase production costs so as not to lose share in the fast-growing streaming market.

On June 21, 2023, it became known about the departure of Latondra Newton as the chief diversity officer and senior vice president of the company, which may be another signal of the necessary ongoing transformations in management to improve the financial position of Walt Disney.

2023 will be a transitional year for the company, and we expect Walt Disney’s margins to improve dramatically from 2025, driven by increased volume and growth in park visitor spending, the company’s DTC business revenue growth, and continued price increases for Disney+ subscriptions year on year.

As stated in the previous article, we expect the S&P 500’s price to decline as the current AI hype cycle fades, which should lead to a correction in Walt Disney’s share price to a strong support zone around $83-$84 in the next three months. We initiate our coverage of Walt Disney with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.