Summary:

- Capital One’s Credit Default Swaps are surging in price, indicating a significant decrease in investor confidence.

- Capital One has more available for sale securities than equity, putting themselves in a similar position to Silvergate and Credit Suisse.

- EPS on a diluted level decreased 33.5% year over year in 2022.

Bruce Bennett/Getty Images News

Investment Thesis

I believe Capital One (NYSE:COF) could potentially be the next big bank in line to fall with Silvergate (SI) and Credit Suisse (CS). When looking to Capital One’s price for their credit default swaps, one can see a startling increase reminiscent to that of Credit Suisse default swaps earlier this week. Additionally, Capital One finds themselves in a similar position to CS again with their exceedingly high assets held for sale when compared to equity in an increasing interest rate environment. Lastly, the company saw a large quarter over quarter decrease in Diluted EPS of 33.5%.

Credit Default Swaps

One metric that predicted the fall of Credit Suisse was the surge in prices for their credit default swaps. A large and swift increase in the credit default swap telegraphs that investors have significant worries surrounding the future of the company. As of 3/20, Credit default swaps for Capital One have risen from $30 to $76 in a matter of days, representing a 153% increase.

Bloomberg Terminal

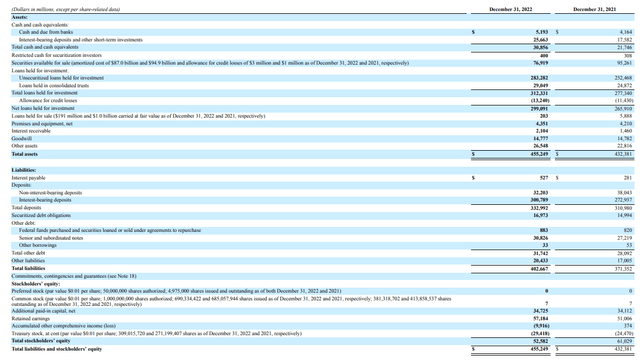

Available for Sale Securities

If we learned one thing from Silicon Valley Bank (SIVB), it was their large available for sale securities and held to maturity securities vs their value of equity. When looking just to Capital One’s available for sale securities, you can see Capital One has 46% more available for sale securities than equity. Considering this debt is yielding 1-3%, the pricing of this debt will be sensitive to increases in the federal funds rate. If Capital One starts to see runs on their banks, they will be forced to sell available for sale securities first to meet liquidity needs. The problem is, much like Silicon Valley Bank, is that the bank is over leveraged on available for sale securities. This can lead to large realized losses, hitting retained earnings and flowing through to equity. I believe Capital One could face problems meeting their solvency covenants and need an equity infusion, further diluting stock earnings.

10-K

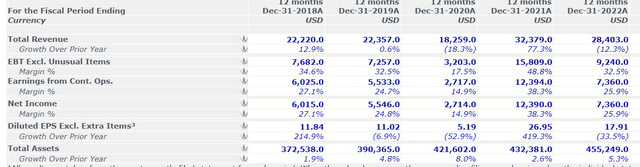

Profitability

Capital One has shown strong historical earnings growth, but has seen struggles in 2022. Mainly, Capital One has seen a 12% decrease in revenue from 2021 to 2022. This decrease was reflected in decreased net income, as well as a decrease in net income margins by nearly 13%. To make matters worse, Capital One on a diluted per share basis saw decreases of 33.5% year over year. Capital One has seen its roughest year in a while in 2022, and I think problems have a chance to continue to grow given the state of the banking industry today.

CapIQ

Risks

Several risks can arise that would change my rating from strong sell to hold or even buy. One risk is the discount window provided by the Fed. During the first week of the month, the fed rolled out The Bank Term Funding Program which allows the Fed to make deposits/loans of up to 90 days. This BTFP program can cause Capital One to stay artificially afloat and prevent the stock from tanking.

Additionally, Capital One could see a pause or decrease in interest rates from the Fed. Credit events, like this bank collapse, are historically deflationary in nature. Given the Fed has already raised interest rates so much and signs of inflation slowing down, a pause or decrease in interest rates could potentially happen soon. A decrease in interest rates would improve the banks available for sale security position and would make the risk to equity and their solvency ratios obsolete.

Summary

I think Capital One has shown several red flags that it could be the next bank to take a tumble in the upcoming weeks. The most startling metric to come across is the skyrocketing Credit Default Swap index for Capital One, reminiscent of Credit Suisse earlier this week. Additionally, Capital One also faces interest rate risk regarding their available for sale securities. Lastly, Capital One has seen large losses year over year on a diluted earnings per share basis. All of the reasons mentioned above I believe are warning signs to sell Capital One.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.