Summary:

- NextEra Energy is well-positioned to capitalize on rising power demand, driven by AI, data centers, and industrial electrification, with a strong growth outlook.

- The company boasts a 29-year track record of dividend hikes, targeting 10% annual growth through 2026, making it attractive for income investors.

- Despite its premium valuation, NextEra’s operational efficiency and renewable energy focus provide a competitive edge, with potential upside if interest rates ease.

- Risks include higher valuation compared to peers, reliance on renewable energy, and financial unpredictability from natural disasters like hurricanes.

J Studios/DigitalVision via Getty Images

Introduction

“Three New York Cities Worth Of Power”

The line above was part of the title of a Wall Street Journal article about the massive impact of artificial intelligence on power demand, which is a topic we have discussed quite a bit since ChatGPT became mainstream last year.

While artificial intelligence is a great innovation, it requires power.

When cars became a good idea, roads and fuel were bottlenecks. The same goes for commercial jets. Coming up with the idea was the first step. Building factories and airports was the toughest part.

AI depends on infrastructure and power – lots of power!

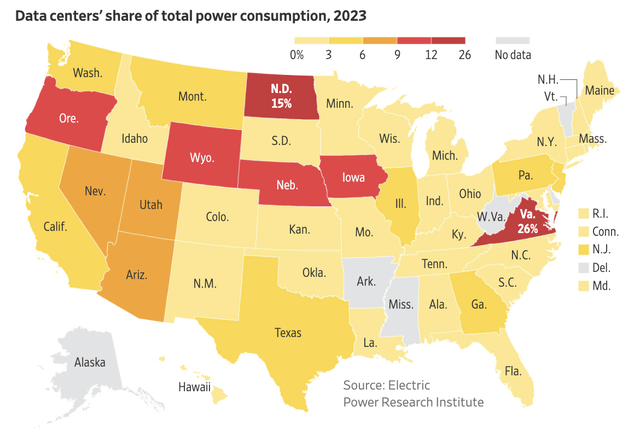

As we can see below, Virginia, which has become the data center hotspot, uses so much power for data centers that it accounts for roughly a quarter of its total power usage. The average in states like Nevada, Utah, and Arizona is close to 10%.

The Wall Street Journal

On top of that, the power infrastructure is not sufficient. The situation is so bad in some areas that data center operators are told the waitlist is at least a decade before a new data center can be built.

This trend is expected to continue, as an average ChatGPT task uses at least 10 times more energy than a Google search.

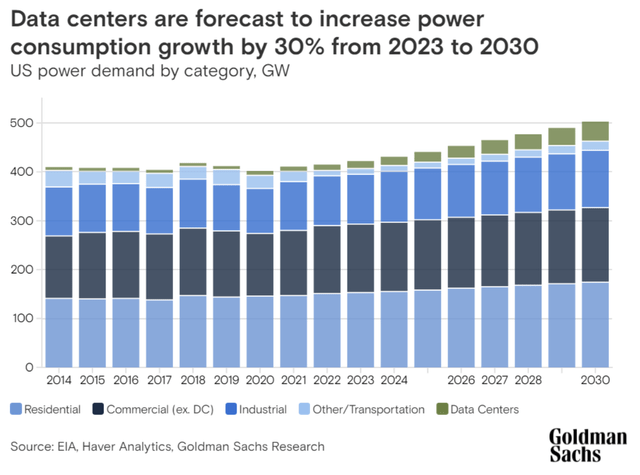

This ends a multi-year sideways trend of flat power demand in the United States. Through 2030 alone, data centers are expected to boost power consumption by 30% to 500 gigawatts per year.

Goldman Sachs

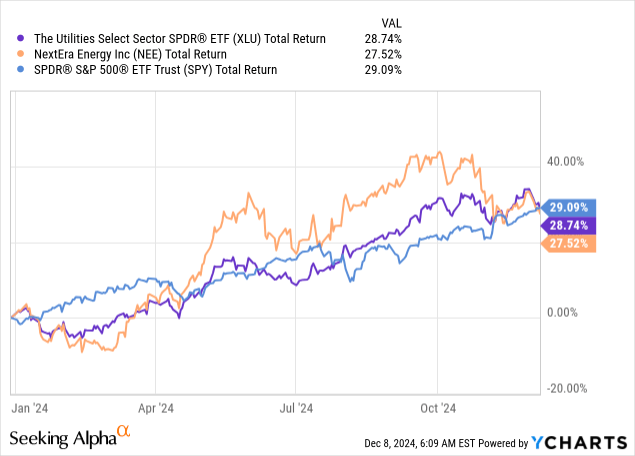

This turned into a massive tailwind for a wide range of companies, including utilities. Initially “left for dead,” the industry made a massive comeback this year, fueled by lower inflation, lower rates, and secular growth from rising power demand.

As we can see below, year-to-date, the sector is up 29%, roughly in line with the performance of the S&P 500.

The largest utility in the United States is NextEra Energy (NYSE:NEE), the Florida-based giant with a market cap of $153 billion, roughly $60 billion above its second-largest peer.

My most recent article on the company was published on July 15, titled “NextEra Energy: The Sustainable Powerhouse Fuelling The Future Of AI.”

Since then, shares have returned 7%.

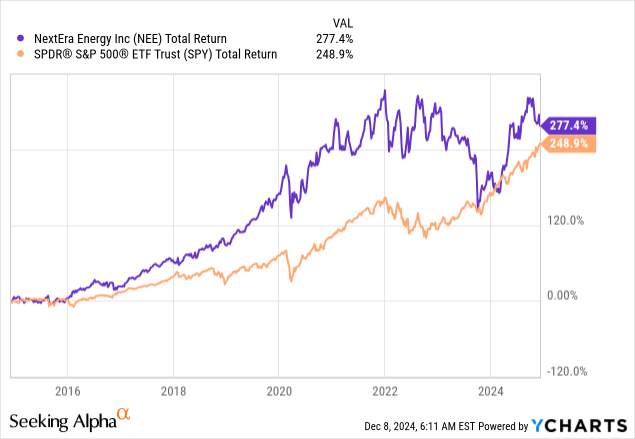

In this article, I’ll update my thesis and explain why this giant has more room to run, likely extending the market-beating 277% return of the past ten years.

So, as we have a lot to discuss, let’s get to it!

The Florida Giant Is Firing On All Cylinders

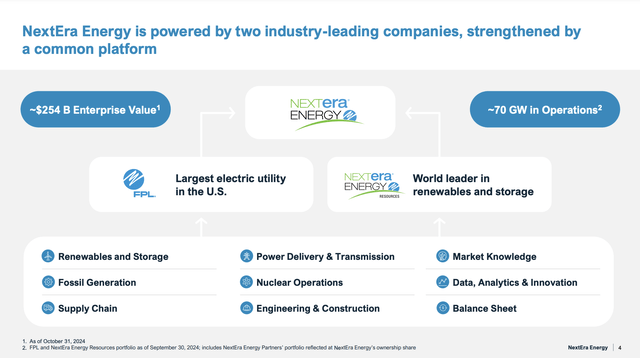

NextEra Energy is the largest electric utility company in the United States through its FPL subsidiary, and the world leader in renewables and storage through NextEra Energy Resources.

While I prefer to bet on natural gas, pipelines, and landowners to benefit from the AI revolution, as I believe they are much more effective than renewable energy sources, NEE is a “low-risk” way of benefitting, as it comes with a massive footprint in the anti-cyclical regulated electric utilities industry.

NextEra Energy

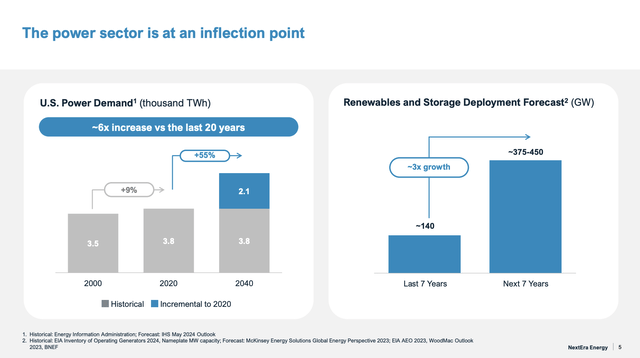

During its 3Q24 earnings call, it made clear it is preparing for a historic increase in power demand, expected to grow sixfold over the next two decades. As we just discussed, this is driven by data centers. However, other driving forces are manufacturing re-shoring and industrial electrification.

According to the giant, data centers alone are expected to add 460 terawatt-hours of new electricity demand by 2030, potentially requiring 150 GW of renewable energy and storage projects.

NextEra Energy

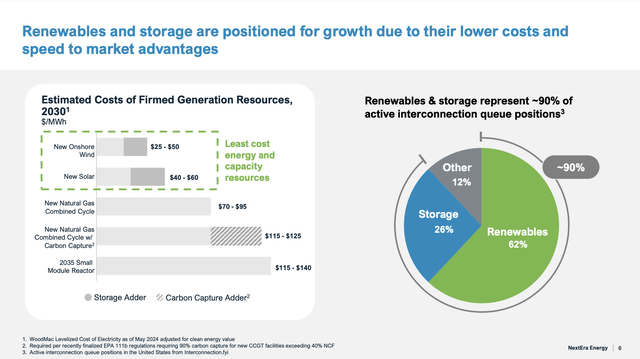

Although I prefer more reliable energy sources like natural gas and (eventually) nuclear energy to fuel rising power demand, renewables will play an important role, as solar and wind generation, combined with storage, are increasingly competitive, with solar projects being up to 40% cheaper than new gas generation, according to NextEra.

NextEra Energy

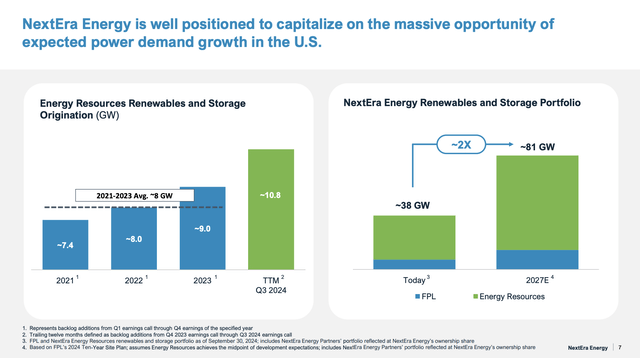

Hence, as one can imagine, that’s what NextEra will continue to bet on, as the company added 3 GW of new capacity to its backlog in the third quarter.

Since 2021, it has originated 33 GW of renewables and storage projects and brought close to 18 GW online. Over the past four quarters, it has averaged close to 11 GW in new origination. As we can see below, by 2027, the company expects to double its renewable capacity to 81 GW.

NextEra Energy

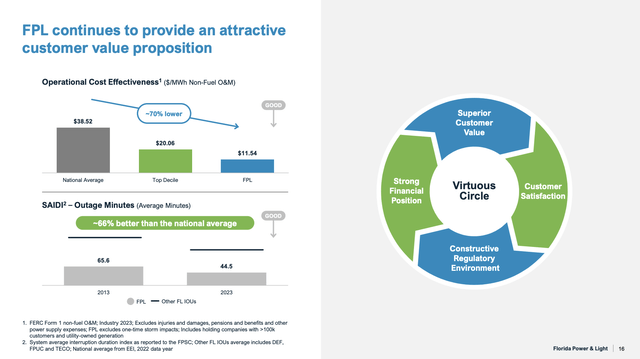

With that said, it also helps that NextEra has mastered the art of building renewable projects, as its operational efficiencies at FPL are 70% better than the national average, saving customers $3 billion in annual expenses. As we can see below, this is based on third-party data.

NextEra Energy

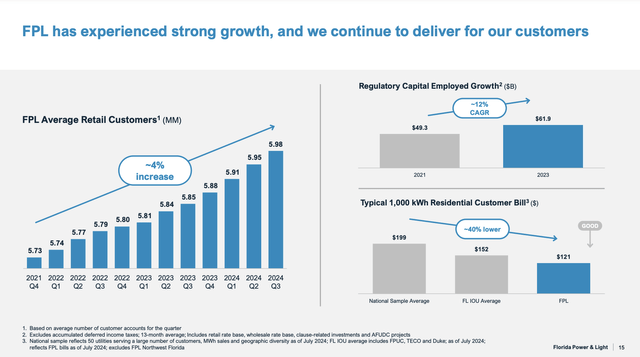

Essentially, this has allowed the company to remain competitive despite massive investment costs. The average FPL utility bill is almost 40% below the national average and comes with “top decile reliability.”

NextEra Energy

In general, there’s plenty to be upbeat about.

Great News For Shareholders

For this part, allow me to throw some numbers at you.

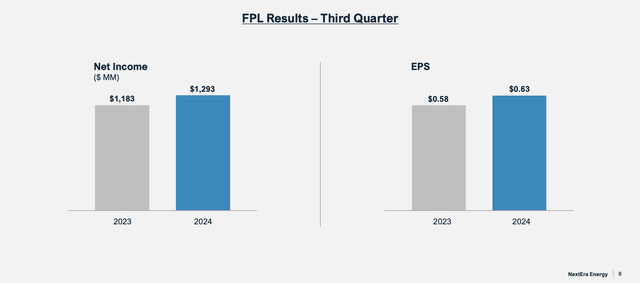

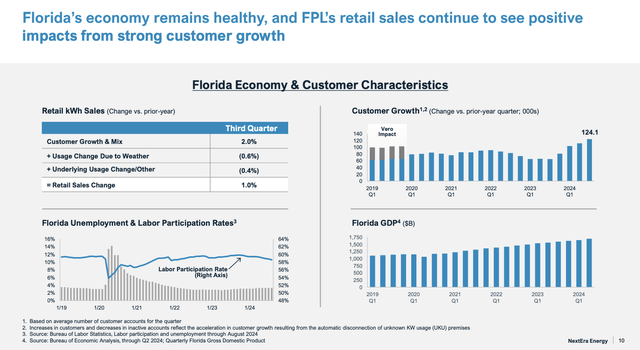

For example, in 3Q24, FPL generated 1% retail sales growth. Adjusted for weather headwinds, that number would have been 1.6%, indicating steady demand growth. Regulatory capital employed rose by 9.5%, while quarterly EPS growth rose by 8.6% compared to 3Q23.

NextEra Energy

Moreover, general customer growth remains strong, supported by strength in the state’s GDP and employment indicators.

It also encountered close to $1.2 billion in hurricane-related costs, which are expected to be recovered through surcharges to customers next year – subject to regulatory review.

NextEra Energy

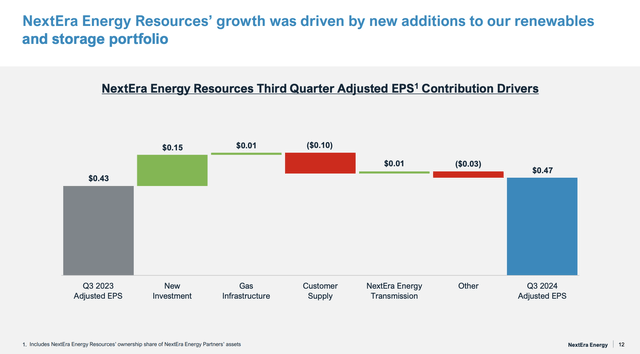

Meanwhile, Energy Resources posted adjusted earnings growth of 11% year-over-year, with a $0.04 per share increase in EPS. The segment significantly benefited from ongoing growth in its renewables portfolio, with contributions from new investments that added $0.15 per share, which was partially offset by a decrease in customer supply and trading margins, as we can see below.

However, these headwinds are merely a normalization from last year’s unusually strong performance according to the company.

NextEra Energy

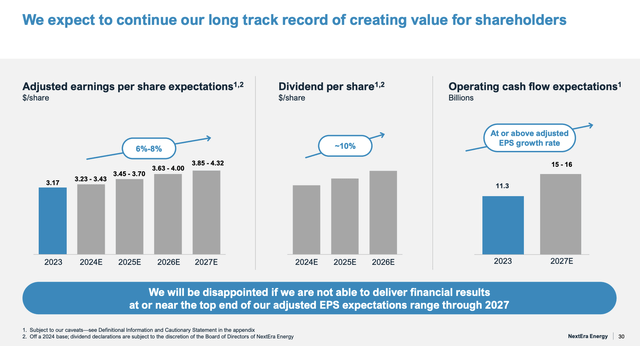

Going forward, the company expects adjusted EPS growth at the top end of its ranges through at least 2027, and operating cash flow growth above EPS growth. This implies 6% to 8% annual EPS growth, with a 2027E range of $3.85 to $4.32.

NextEra Energy

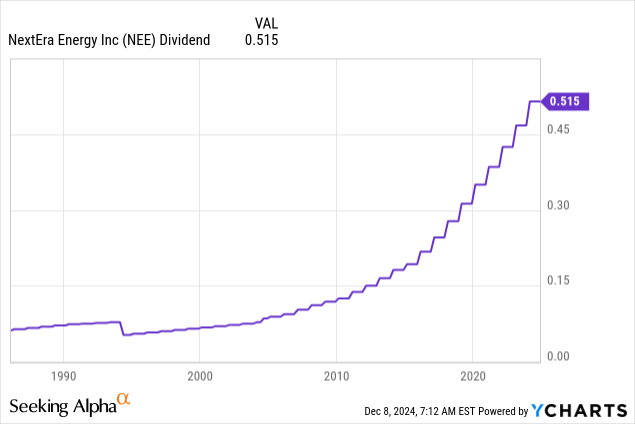

As part of this favorable outlook, it targets annual dividend growth of at least 10% through 2026 – and likely beyond.

Currently, NEE yields 2.7%. This dividend comes with a sub-60% payout ratio, a Dividend Aristocrat track record of 29 consecutive annual hikes, and a five-year CAGR of 10.5%.

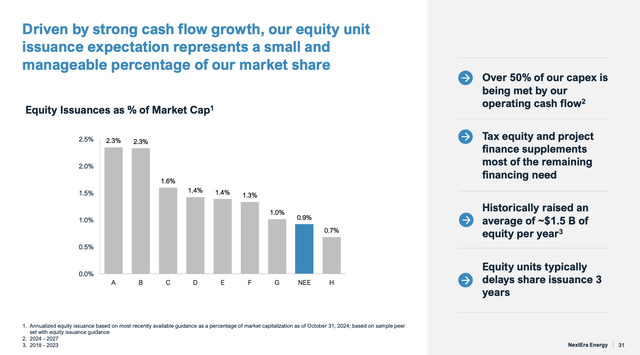

On top of that, it enjoys an A- credit rating. Analysts expect the leverage ratio to remain close to 5.0x in the years ahead, meaning aggressive investments do not result in higher leverage.

Moreover, when it comes to issuing equity, the company has been very conservative, meaning shareholder dilution risks are very subdued.

NextEra Energy

So, what about its valuation?

Valuation

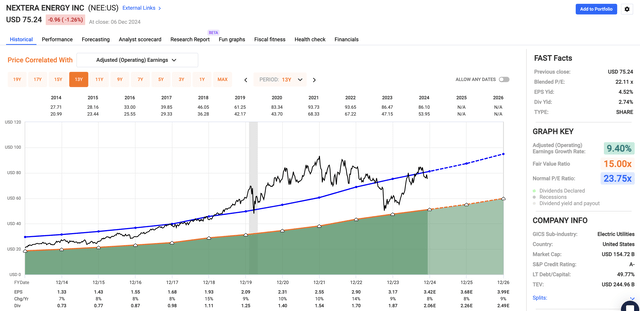

NEE trades at a blended P/E ratio of 22.1x, slightly below its 10-year average of 23.8x. While the average industry multiple is close to 19.0x, NEE has elevated growth expectations.

Using the FactSet data in the chart below, analysts expect 8-9% annual EPS growth in both 2025 and 2026, which is the upper bound of the company’s guidance.

FAST Graphs

Applying its current multiple, we get an annual return of roughly 10-11%.

I expect a potential decline in interest rates to boost that number. Rising rates could pressure the return.

All things considered, I consider NEE a buyable pick for growth and income, making it a good investment for a wide range of different investor types.

Takeaway

NextEra Energy remains a solid pick for growth and income, especially as the demand for power skyrockets due to AI data centers and other secular tailwinds.

While I prefer riskier natural gas and related investments, NextEra’s renewable push – combined with its efficiency and scale – positions it to benefit from the energy revolution.

Moreover, the company’s steady growth, solid dividend track record, and low payout ratio make it an attractive option for long-term investors.

Despite its “premium” valuation, I see continued upside, especially if interest rates ease.

Pros & Cons

Pros:

- Strong Growth Outlook: NextEra Energy is in a great spot to capitalize on the rising demand for power, driven by AI, data centers, and industrial electrification.

- Reliable Dividends: With a 29-year track record of dividend hikes, a sub-60% payout ratio, and a target of 10% annual dividend growth through 2026, NEE is a solid choice for income investors.

- Operational Efficiency: The company’s ability to keep costs low and maintain top-tier reliability provides a competitive edge.

Cons:

- Valuation: At a P/E ratio of 22.1x, NEE is slightly below its historical average and higher than industry peers. The premium valuation may limit the short-term upside and keep it from outperforming its peers if it does not achieve its targeted growth rates.

- Renewable Energy Risks: While NextEra’s bet on renewables is promising, I still prefer more reliable energy sources like natural gas for long-term stability. Solar and wind can face volatility in certain market conditions.

- Hurricane Costs: Although the company recovers costs through surcharges, natural disasters like hurricanes add financial unpredictability, as seen with the current $1.2 billion in hurricane-related expenses.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.