Summary:

- Occidental Petroleum is a major upstream company with a $50 billion valuation.

- Brent Crude prices have dropped below $80/share, impacting the company’s ability to outperform the S&P 500.

- Occidental Petroleum’s strong asset portfolio could lead to future shareholder returns if oil prices recover and remain high.

jetcityimage

Occidental Petroleum (NYSE:OXY) is one of the largest pure-play upstream companies in the country, with a valuation of roughly $50 billion. We last discussed Occidental Petroleum in May, rating the company as a BUY, at a price 7% above its current one. Since then, Brent Crude prices have dropped below $80/share, and while the company has impressive assets, its ability to outperform the S&P 500 is low. That hurts its ability to drive future shareholder returns.

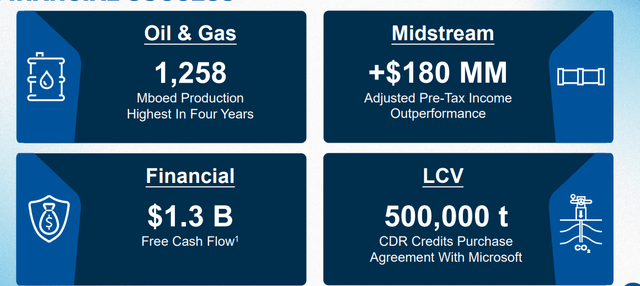

Occidental Petroleum 2Q Highlights

The company had an impressive 2Q as it’s continued to ramp up production and drive shareholder returns.

Occidental Petroleum Investor Presentation

The company had more than 1.25 million barrels / day of production, generating $1.3 billion in FCF. Annualized, that’s just over $5 billion in FCF, giving the company just barely a double-digit FCF yield. The company has continued to build up a strong low carbon business and has seen its midstream income grow.

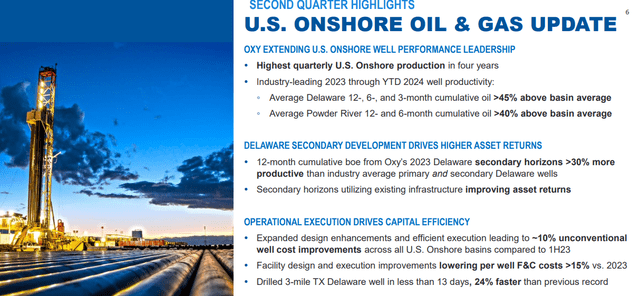

Occidental Petroleum Investor Presentation

The company’s dominant segment remains its onshore U.S. oil and gas. The company has achieved the highest quarterly production here in 4 years and has continued to be a leader in technology and production in the basin. That’s because the company has the integrated acreage for long laterals and strong expertise.

The company has managed to improve well costs by ~10% YoY and continued to lower F&C costs. It’s continued to drill incredibly long laterals, which helps achieve maximum efficiency.

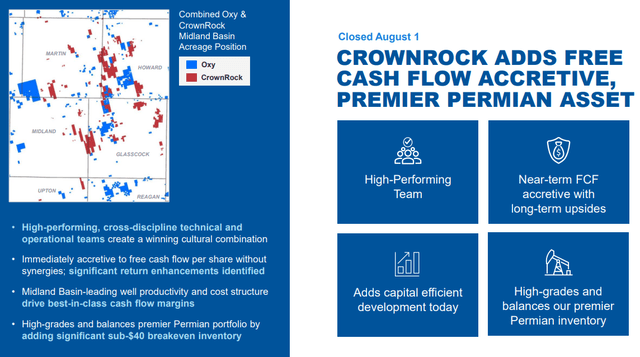

Occidental Petroleum CrownRock Overview

Among the company’s assets include its recently closed CrownRock acquisition, which has strong overlap in the company’s acreage.

Occidental Petroleum Investor Presentation

This is part of the substantial consolidation that the industry has seen in recent years. The massive $12 billion acquisition should provide immediate FCF generation, though if oil prices were to crash, it’d become something of a pattern for Occidental Petroleum after large acquisitions. Fortunately, this is a situation it can comfortably afford this time.

The asset provides strong integration with the company’s existing acreage, enabling it to continue lowering prices and increasing margins.

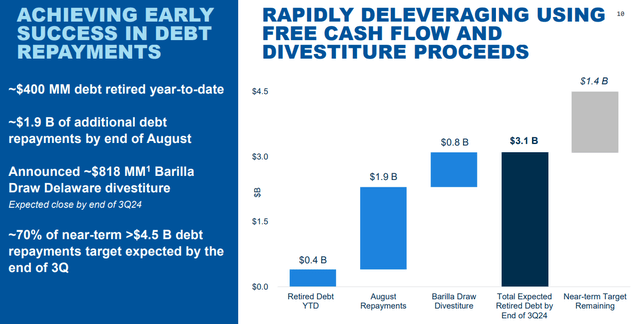

Occidental Petroleum Financials

Overall, the company continues to rapidly deleverage, improving its overall asset portfolio in a high interest rate environment.

Occidental Petroleum Investor Presentation

The company expects to repay $3.1 billion in debt by the end of the current quarter and expects to repay an extra $1.4 billion. This is debt partially due to the company’s CrownRock acquisition along with its existing portfolio of debt. The company has also announced a $4.5-6 billion divestiture plan that it plans to complete by mid-2026, to help pay down the debt.

The company’s financial position remains much stronger than when it acquired Anadarko Petroleum, and we expect FCF to remain strong.

Occidental Petroleum Shareholder Returns

Occidental Petroleum has the ability to drive strong shareholder returns, although we have some concerns around its valuation.

Occidental Petroleum Investor Presentation

The company is announcing an increased quarterly dividend at $0.88 annualized. That’s a ~1.5% dividend yield, still well below the company’s historical dividend yield. The company is slowly ramping up its dividend, but the current level of ~$750 million annualized is a level the company can comfortably sustain. The company is also maintaining an investment grade credit rating.

The company is continuing to reduce debt, with >$4.5 billion in near-term debt reduction and a divestment plan after closing on CrownRock. That will enable the company to negate the impacts of the acquisition. The company currently has a FCF yield sitting at around 10%. The company currently trades at a ~10% DCF yield.

Our concern with the company is oil production remains high, with Brent Crude at just under $80 / barrel. The IEA continues to expect a massive oversupply in oil as new sources continue to be found as demand maxes out. Without global instability, we expect renewables, already the fastest growing energy source, to continue growing, and no spike in prices.

That combines with being later in the economic cycle, with continued fears around a recession. At the current share price, there’s a lot of risk for the stock, and minimal upside with nothing driving up oil prices. For a return close to the S&P 500, there’s not a substantially tempting reason to invest right now.

Occidental Petroleum Sell Rating

We have three primary reasons for switching our rating to a SELL.

1. Growth

Occidental Petroleum’s production has remained roughly flat. The company is increasing it slightly, setting new records, but the CrownRock acquisition at $193 / barrel sold (on an annual basis) is the first significant increase in the company’s production in years. The company continues to target mid-single digit production growth, and we expect that to be the case for the long term.

2. Macroeconomic Supply

The macroeconomic supply remains high. Major producers in the Middle East are seeing minimal stability threats (despite all the rhetoric the Gaza-Israel war has not meaningfully changed Iran’s production) and other major producers in OPEC+ have cut production. Saudi Arabia alone continues to cut 1 million barrels / day of production.

Similarly, the Russia-Ukraine war has not meaningfully declined Russia’s production recently and the U.S.’s technological and economical might mean that 2023 was a record year for the country’s oil production. Major low risk international projects in Brazil and Guyana continue to ramp up. Overall, the sources of production remain incredibly strong.

3. Emerging Threats

We see two major emerging threats to oil prices.

The first is the growth of renewables. Renewable energy added 510 GW in 2023, a 50% YoY growth in capacity increases, and 14% YoY growth. Renewable energy is expected to triple by 2030, which is expected to cause declining oil demand. Government policy is ramping up as many governments target lower emission targets.

The second is macroeconomic pressure. Oil demand and supply are notoriously inelastic, creating a scenario where slight changes in demand and supply can rapidly move prices. In 2008, the recession caused a mid single-digit decline in oil demand. As markets continue to jitter around the Fed’s first potentially successful soft-landing, any weakness in demand could lead to a rapid reduction in prices.

Valuation

This all combines with Occidental Petroleum’s valuation.

The company has a DCF yield of just under 10% ($5.2 billion annually on a $54 billion valuation). This is with Brent Crude prices at around $80 / barrel, and as we discussed above, there are several factors that could change that. That’s roughly in line with the 10.3% historic returns seen with the S&P 500.

Obviously, investing with diversification in the S&P 500 is a much better deal at any specific level of returns. Therefore, combining the risks we discussed above, minimal growth rate chance, and current valuation, we see Occidental Petroleum as overvalued and are changing our rating to SELL.

Thesis Risk

The largest risk to our thesis is that Occidental Petroleum has an incredibly strong portfolio of assets. Should something cause oil prices to recover and remain higher for longer, that could enable the company to generate strong shareholder returns.

Conclusion

Occidental Petroleum is a strong company that’s continuing to reduce costs and improve cash flow. The company’s acquisition of CrownRock was an intelligent decision in the Permian Basin and will enable DCF to remain strong. Divestitures and directing cash flow to dividends will help keep returns high and debt low.

However, the company still can’t avoid the macroeconomic environment. We are late in an economic cycle, and oil is no longer the cheapest source of energy. The company’s current DCF yield is in line with the S&P 500, making now not a great time to invest. Let us know your thoughts in the comments below.

Analyst???s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.??

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.??

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.????