Summary:

- Nvidia Corporation’s recent earnings report revealed a significant slowdown in revenue and gross margin growth, resulting in a 7% drop in stock price.

- The company’s heavy reliance on data center revenue and concentrated customer base poses risks, especially if major clients reduce spending.

- Nvidia’s future growth outlook is bleak, with declining revenue growth and increasing operating expenses, making it difficult to justify its current valuation.

- Despite positive cash flow and share repurchase plans, Nvidia’s valuation is expected to drop, making it a poor long-term investment.

BING-JHEN HONG

Nvidia Corporation (NASDAQ: NASDAQ:NVDA) announced its Q2 earnings recently, dropping almost 7% after-hours, wiping out more than like $200 billion of market capitalization. For perspective, that’s more than the company’s entire valuation just a few years ago. As we’ll argue throughout the article, the company’s weakening revenue growth, and declining margins, the company is a poor long-term investment.

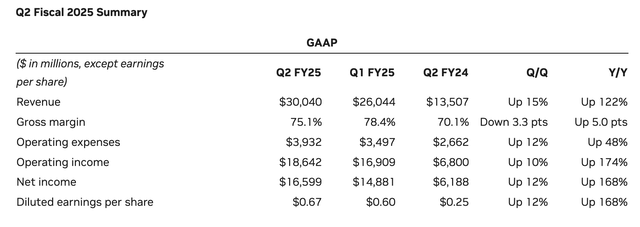

Nvidia Q2 2025 Summary

The company saw a substantial slowdown in both revenue growth and gross margin growth during the second quarter.

The company saw a more than 3% decline in its gross margin as its revenue increase declined to 15% QoQ. As a result, the company’s operating income only grew 10% and the company’s diluted EPS grew by only 12%. While those growth rates would be great for any other company, they’ve declined substantially.

The double whammy of slowing revenue and decreasing gross margin we expect will continue in upcoming quarters. As we discussed in our last article, the company has just a handful of core customers, and even they’re arguing that they might be spending too much. AI isn’t making much money for software companies.

Nvidia Segment Performance

The company’s segment performance show how it’s almost completely reliant on data center.

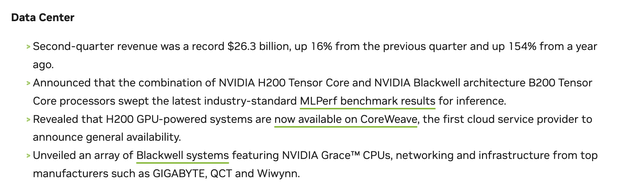

Almost 90% of the company’s revenue comes from Data Center, which increased 16% QoQ and 154% YoY, showing how it’s still driving the vast majority of the company’s growth. The company is continuing to see a potential delay in Blackwell, which is now expected to launch by the end of the year. However, the rumor is demand for the company’s GPUs remains strong.

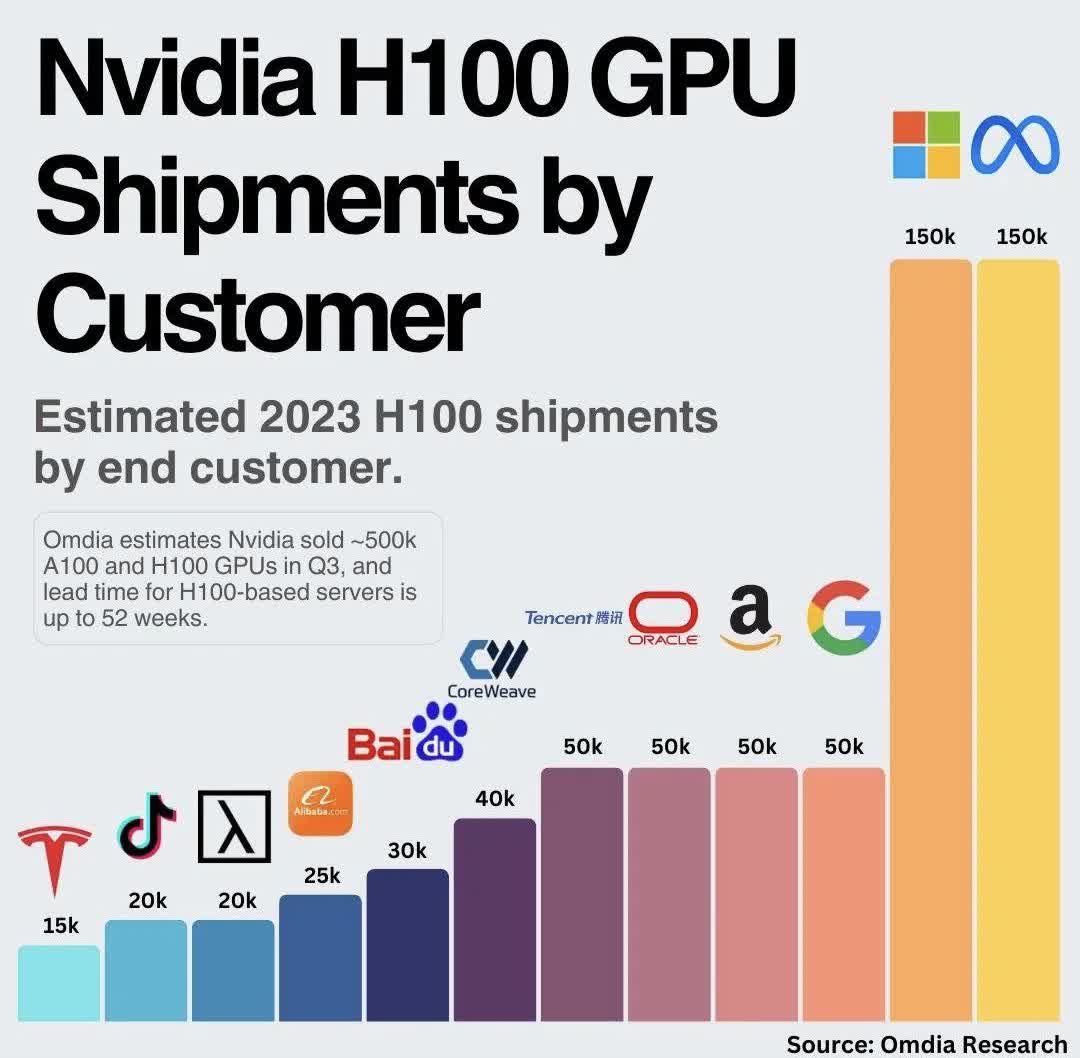

Omdia Research

However, it’s worth highlighting how concentrated the company’s largest customers are. Specifically, Microsoft (MSFT), the majority owner of Open AI that also has Azure and Meta Platforms (META) which is spending billions on its Reality Lab ambitions with minimal profits being seen from it. Other major cloud providers like Oracle (ORCL), Amazon (AMZN), and Google (GOOG) are also buying major amounts.

A key thing worth highlighting here is that these are all companies that can afford to spend $10s of billions on something not profitable, and they’ve effectively highlighted as such, arguing they might even be overspending. However, as they decide it’s not worth it, they’ll first put pressure on margins, followed by orders.

They can walk back their orders, and we expect the datacenter to slow down dramatically.

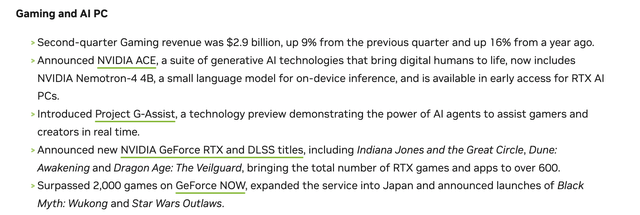

The company continues to operate a large gaming division as its second-largest source of revenue. However, it makes up less than 10% of the company’s revenue. The business only saw a 16% YoY revenue increase with $2.9 billion in revenue. The company is working to attempt to integrate AI into gaming to increase its moat there.

However, it’s facing not only competition from other businesses such as AMD, but it’s facing new competition from companies such as Intel that’re building GPUs. The business justifies a much lower valuation for Nvidia where it was pre-AI, and while we expect it to continue, it doesn’t justify anywhere near the current valuation by itself.

Nvidia Outlook

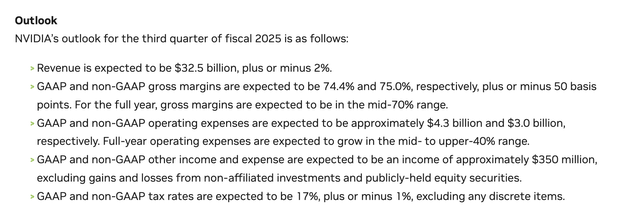

The company’s outlook shows continued slowdown in growth rates, which will hurt future shareholder returns.

The company grew from $26 to $30 billion revenue, 15% QoQ growth or $4 billion QoQ growth. The company is guiding ~$32.5 billion in revenue for 3Q 2024 +/- 2%, a relatively tight band indicating long-term contracts with a few key customers. The company expects margin to be ~74.7%, a less substantial QoQ decline but still a decline.

More importantly, the company is seeing QoQ revenue growth decline from $4 billion growth to $2.5 billion growth. It’ll be important to see the company’s 4Q 2025 guidance when it comes out, since it’ll likely include Blackwell. The company’s expectation is for FY operating expenses to grow in the mid-to-upper 40% range, which his concerning as revenue growth goes down.

The company’s outlook shows that it’ll struggle to generate the growth rates to justify its valuation.

Our View

Nvidia is generating positive cash flow, and it’s working to push that towards shareholder returns. The company is earning roughly $50 billion in annualized FCF, and it returned $15 billion to shareholders in 1H 2025. The company’s dividend yield remains negligible at 0.03% and the company’s annualized shareholder returns are <1%.

The company announced another $50 billion share repurchase authorization, <2% annualized returns, that would use its entire FCF for the year. With a massive slowdown in FCF growth, and a need to increase its FCF by 5x to justify its valuation, we expect the company’s valuation to drop back to normal.

That makes the company a poor long-term investment that we expect to decline much further. Investors can buy puts to bet against the company, but the value of those could decline to 0 (please fully understand all the risks of options before placing any trades). At minimum, we recommend selling your investment in the company.

Thesis Risk

The largest risk to our thesis is continued excitement around Nvidia. The company’s stock price has been mostly driven by market excitement, and the market can remain irrational larger than you can remain solvent. That can make it difficult to bet against the company profitably.

Conclusion

Nvidia remains the second-largest company in the world these days, behind Apple (AAPL) and just ahead of Microsoft. The company has growth dramatically over the last several years, as the artificial intelligence revolution has taken the world by storm. Investors who haven’t had numerous exciting opportunities have chased Nvidia.

However, Nvidia Corporation’s growth rate is slowing down. That’s evidenced from both its revenue growth rate slowing down along with the company’s margins declining. The company’s next quarter guidance is for that to continue, and we are keeping an eye on the company’s Blackwell launch. We see the company as dramatically overvalued per its valuation, making it a poor investment.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.