Summary:

- In this article, I revisit the life sciences “picks and shovels” market leaders Danaher Corporation and Thermo Fisher Scientific Inc.

- I will review changes since the initial comparative piece two quarters ago.

- Furthermore, I’ll review their executive compensation structures.

Sean Anthony Eddy

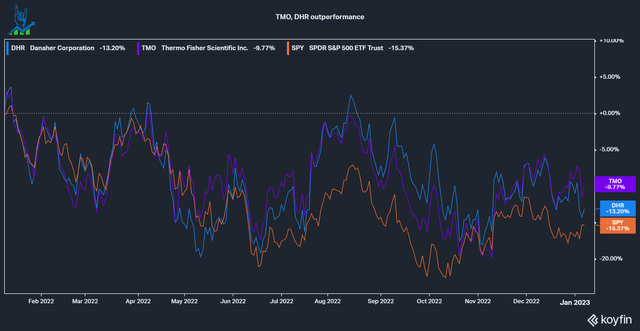

Danaher Corporation (NYSE:DHR) and Thermo Fisher Scientific Inc. (NYSE:TMO) are leaders in the life sciences and diagnostic space with excellent fundamentals and a culture of excellence. The companies generally trade roughly in line with each other, given the similar business segments and operating metrics. In June 2022, I started to cover Danaher and Thermo Fisher on Seeking Alpha with a comparative article. In this one, I will revisit the duo and dive into the executive compensation strategy in particular.

TMO, DHR outperformance (Koyfin)

What happened since the last comparison?

In the last comparison, we established that Danaher and Thermo Fisher are both high-quality companies with a proven track record of excellent operations and integrating M&A into their business strategies. Since the last article, both companies have reported two quarterly earnings and continued on their track record of beating estimates:

| Danaher | Thermo Fisher | |

|---|---|---|

| June EPS Surprise | 18.09% | 10.61% |

| June Revenue Surprise | 6.33% | 10.27% |

| Sep EPS Surprise | 13.54% | 5.50% |

| Sep Revenue Surprise | 6.93% | 7.83% |

Data from Seeking Alpha’s respective Earnings Surprise pages.

Both companies now beat EPS and Revenue estimates for 12 Quarters in a row, without any hick-ups.

From an operational perspective, there were two events worth mentioning: Danaher announced spinning off its Environmental & Applied Solutions Segment to increase its focus on its best segments. I wrote an article going over this spinoff shortly after it was announced.

Thermo Fisher acquired UK-based diagnostic products maker The Binding Site for $2.6 billion in an all-cash transaction. The company’s portfolio will expand the Specialty Diagnostics Segment with the Industry Leader in Oncology Testing for the Detection and Monitoring of Multiple Myeloma. Furthermore, it will complement the existing Specialty Diagnostics Offering with established Technologies delivering substantial clinical Value for Patients in a Rapidly Growing Diagnostics Segment. The deal does seem rather expensive, around 12 times sales for a company growing at 10% annually. At the time of the acquisition, TMO traded at just 6.5 times sales, growing faster than The Binding Site. The press release also did not mention any significant synergies to accelerate earnings growth.

Even though I do not think this deal looks like a great deal, management has the benefit of the doubt. Speaking of management, let’s look at the executive compensation structure at both companies.

Executive compensation

Executive compensation is a vital yet often forgotten part of analyzing a company. Investors want a capable management team focused on the long term with the same incentives as themselves. All the data provided in this section is pulled directly from the companies’ latest Proxy statements.

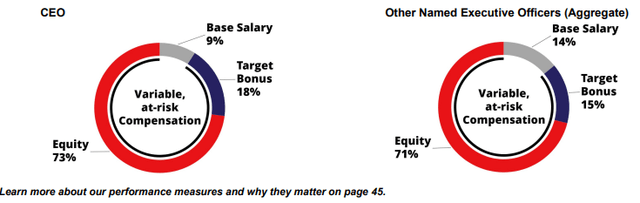

Thermo Fisher

First, let’s look at the compensation mix. We want a large part to be at risk, meaning the compensation depends on the company’s operational performance and stock. We can see that the CEO and other named executive officers (NEOs) have a large part of their compensation in equity and are tied to the business’s performance. This lays a good foundation. The next thing we want to look at is insider ownership. Ideally, we want the management and the board to own a significant part of the company. Sadly, Thermo Fisher insiders only own 0.4% of the company, a very disappointing number.

Executive compensation mix (TMO Proxy )

Compensation structures are often split between a cash salary, a short-term equity incentive, and a long-term (often rolling three years) equity incentive. This is the case for both companies here as well.

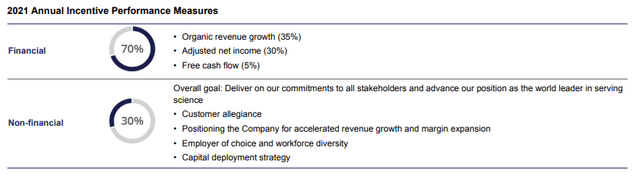

Below we can see the short-term incentives for TMO management, split between 70% financials, with a focus on Organic revenue growth, Adjusted Net income and Free cash flow and 30% non-financial targets regarding essential issues like capital deployment, market positioning and customer relationships. Adjusted net income should raise some warning signs for investors, but in this case, it adjusts mainly for acquisition-related accounting practices, fair value adjustments and tax benefits. This is an example of reasonable adjustments, in my opinion. Overall, this is an exemplary incentive model, focusing on top-line growth and profitability.

TMO Incentive Performance Measures (TMO Proxy)

Long-term incentives are often structured more easily, as is the case for TMO. The compensation is split 50/50 between organic revenue growth and adjusted EPS growth targets and then multiplied based on which quantile the total shareholder return (TSR) of TMO stock is against its peer group. This decent incentive focuses on the same metrics as the short-term incentive. What I’d love to see here is an additional ROIC or ROCE metric, given the M&A culture at Thermo Fisher. Overall, TMO does a lot of things right in its compensation.

Danaher

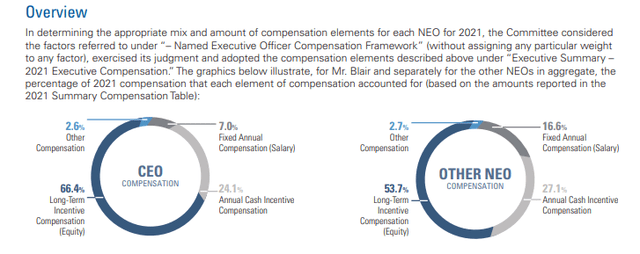

Let’s now look at Danaher’s compensation. We see a similar picture here, with most of the compensation mix being at risk and in equity. Insider ownership looks much better for Danaher, where insiders own 11.2% of the company. This is split mainly between the Rales brothers, who founded the company and are still on the board of directors with 4.9 and 6.1% of the company each.

DHR Compensation mix (DHR Proxy)

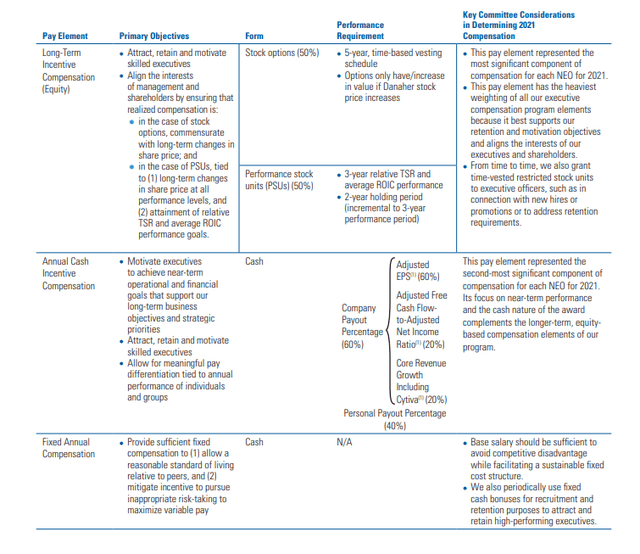

Danaher supplied us with a good overview of its structure. We can see that the annual short-term incentives are split 60/40 between the company and personal goals for each executive. The company goals are similar to TMO, with the most weight in Adjusted EPS (similar adjustments due to M&A accounting). What I love to see here is the adjusted free cash flow (“FCF”) to adjusted Net income ratio, or in simpler words, the Free Cash Flow conversion: How much of the Net income can be converted into Free Cash flow?

For long-term incentives, DHR uses 50% time-based options (not ideal) and 50% performance-based stock, with TSR goals similar to TMO and the three-year change in ROIC, where a 200 basis point improvement is the maximum modifier. Overall, I slightly prefer DHR’s compensation structure due to its long-term focus on ROIC and significant insider ownership. Both companies showcase exemplary alignment with shareholders, though.

DHR Compensation structure (DHR Proxy)

Valuation

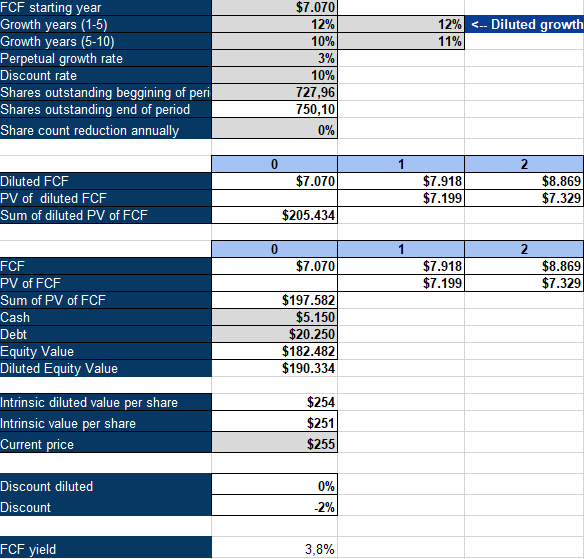

To value both companies, I use an Inverse DCF (discounted cash flow) analysis with a 10% discount rate/required rate of return, 3% perpetual growth rate, and assuming a 0.3% dilution due to acquisitions. Let’s start with Danaher. With its current free cash flows of over $7 billion, Danaher’s price suggests an implied growth rate of 12% in the first five years, followed by 11% in the following five.

DHR Inverse DCF (Authors model)

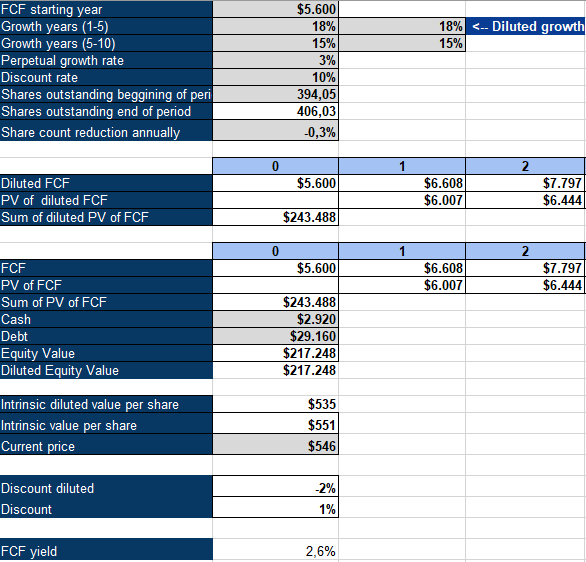

Thermo Fisher has seen its FCF decline in recent quarters from a peak of over $8 billion in 2021. Generally, TMO’s business has a higher capital requirement, with roughly double DHR’s Capital Expenditures. TMO hasn’t done as good of a job managing its operating margin compared to DHR, and it looks quite a bit more expensive right now on an FCF basis. This price implies an 18% growth for the first five years, followed by 15% for the next five. This is significantly higher than for DHR.

TMO Inverse DCF (Authors Model)

Conclusion

Both companies have very strong fundamentals, a strong management team aligned with shareholders, and should do well over the long term. At this current price and due to the seemingly expensive acquisition Thermo Fisher did, I prefer Danaher over Thermo Fisher, and I recently purchased more Danaher shares just last week.

Both of these companies are great, but right now, there is a winner: Danaher Corporation.

Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: What do you think about these fantastic businesses? Do you own any, both or neither? Do you agree that Danaher is the better buy right now? Let’s continue the discussion in the comments below.