Summary:

- We recently wrote that we believed 2023 would be a solid year for Alphabet Inc./Google stock.

- Google recently posted its Q1 2023 results, which showed strong results – especially in Google Cloud.

- An historic price-to-EBITDA still exists, which may present an opportunity for Google investors.

JHVEPhoto

Background

We at Ironside Research have not been shy about our bullishness for Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) aka Google. Our January piece, “Google: A Recipe For A Dynamite 2023,” laid out our base case for why we thought the company would excel this year, and the stock has jumped 12% year to date. We also pointed out in February that an accounting change to Google’s depreciation would yield positive results in coming quarters.

On April 25th, Google released its Q1 2023 results, and they didn’t disappoint. In this article we’ll dive into the company’s earnings release and comment on our current outlook for the company.

The Results

Google reported top line revenue for the quarter of $69.7 billion versus $68 billion in revenue for the quarter ending March, 2022. The majority of this growth came from–surprisingly–good results in Google Cloud, which we expected to have a flat to slightly negative quarter. The segment reported $7.4 billion in revenue versus $5.8 billion in revenue from Q1 2022.

Before we discuss operating profits, a quick detour is in order. Earlier this year, we speculated that Google would announce layoffs, which it eventually did following suit with other large big-tech companies. We estimated that the company would spend roughly $2.3 billion. In its Q1 results, the company announced that it actually spent a combined $2.6 billion in headcount and office space reductions. This overspend took us by surprise, as we had estimated that the company was actually overestimating its headcount reduction costs.

However, looking under the hood tells a story more in line with expectations. Severance costs for the company came in just under $2 billion, while the office space reduction resulted in charges of $564 million.

However, the company did receive a tailwind from extending the useful like of its servers and network equipment to the tune of $988 million dollars, which provided $0.06 EPS of the company’s total reported $1.17 diluted EPS. (We previously wrote about this accounting maneuver on Google’s part and how it would have a positive impact here.)

In light of this accounting drag and boost, respectively, let’s assess Google’s operating margin. In Q1 2021, the company reported an operating income of $20 billion, representing an operating margin of 30%. In the first quarter of 2023, operating income was $17.4 billion, with a margin of 25%.

Reductions in operating margins are typically red flags, but knowing what we do about the one-time nature of the $2.6 billion charge for headcount reduction (assisted by the $988 depreciation reduction), we come to an adjusted operating profit of $20 billion–essentially flat on a dollar basis year-over-year.

Google Cloud

While AI was arguably the most dominant focus on the call, it should not be overlooked that Google’s Cloud offering achieved profitability in Q1, 2023. To drive home the sense of scale (and customer base) that Google Cloud has, CEO Sundar Pichai noted in the conference call that “nearly 60% of the world’s 1,000 largest companies are Google Cloud customers.”

CFO Ruth Porat discussed the specific numbers, citing operating income of $191 million, which represented an operating margin of 2.6%. While these numbers are quite small against revenues of $7.5 billion for the quarter, we remind readers that cloud migration is largely believed to still be in the early stages for most companies. Further, we believe that the customer mix of a cloud company is enormously important.

In a piece on Amazon.com, Inc. (AMZN) that we wrote in January (you may read it here), we highlighted the importance of customer mix in the cloud storage business–specifically the importance of having large, stable customers with the ability to ride out difficult economic conditions. Based on the color provided by Google executives, Google Cloud appears to be built on a solid customer base.

Stock Repurchases & Valuation

While it was not touched on in the Google earnings call, the press release contained an exciting note for investors that the Google board had authorized an additional $70 billion in stock buybacks of both the Class A and C shares.

We believe that, given Google’s status, these buybacks are almost akin to a dividend. Since buybacks are better advantaged tax-wise than dividends, we think that the additional authorization is a smart move.

We also believe that the buybacks come at a time when a historical price disconnect exists within the stock.

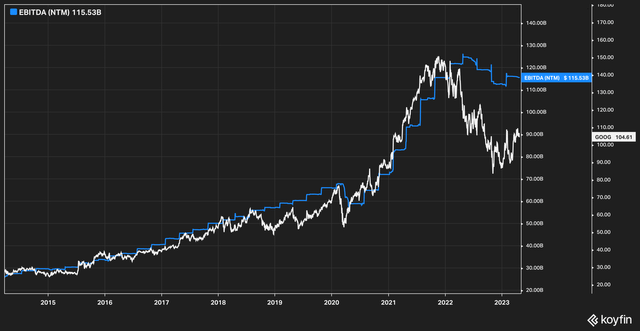

Above is a chart showing Google’s price going back ten years overlaid with its next twelve month’s EBITDA projections. We brought this chart up in our initial write-up of Google in January, and we bring it up again to point out that we believe the disconnect still presents a compelling case.

Given the results from Q1, and the fact that forward EBITDA estimates appear to have flattened (are no longer falling, in other words), we believe that the likelihood that the gap between price and forward EBITDA will close and restore the historic trend is quite good.

The Bottom Line

Google delivered a solid first quarter for 2023. Based on these results, we believe that our thesis on Google remains intact. Risks to our thesis are a deeper than expected recession, which would cause advertisers to pull back on their budgets meaningfully more than currently expected, as well as any significant legal or regulatory action being brought against the company.

For now, though, we believe that Alphabet, Inc. stock and the company will likely continue to perform well through 2023.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.