Summary:

- Wells Fargo’s growth is restricted by an asset cap.

- The bank must enhance its practices and demonstrate consistent progress in quarterly reports, a process that could take years.

- Earnings per share growth is possible through share repurchases and improving operating results.

- Investors need patience, as the bank’s turnaround involves more regulatory issues than is typical.

- Obviously, given the past record, management risk is higher here than would normally be the case.

miromiro

Wells Fargo (NYSE:WFC) has a few past issues that actually dominate the earnings calls. Probably the biggest one is an asset cap that limits the usual growth avenue until this bank “gets its act together”. There is a lot more about the bank’s current situation with regulators than anyone can fit into an article because this bank was one of the worst offenders in the industry. To make matters even worse, it is a money center bank as well. In many ways the legal (or enforcement) side of the regulatory system has put this bank under strict regulation (a legal straitjacket in many ways) until the conforming practices are well in place and this bank shows that it can be trusted much more so than it was in the past. Therefore, unless there is something very dramatic in the quarterly earnings report, the market attention is far more likely focused on the bank’s progress as defined by the regulators.

Since growth in assets is out of the question for the time being, that means the bank has to run itself better. A bank this large has to put better practices in place and then those practices have to become significant enough to show through on the quarterly reports. That could take years. It has already taken years for this bank to come up to the expectations of regulators and that process is still not complete. That should spill into market expectations for the earnings of Wells Fargo.

This bank is likely to benefit from lower interest rates just like much of the industry. But record earnings and steady growth may be beyond the reach of this management for the time being. As far as turnarounds go, there is far more involved here than the typical turnaround. Therefore, any investor considering this investment needs to be very patient.

Earnings

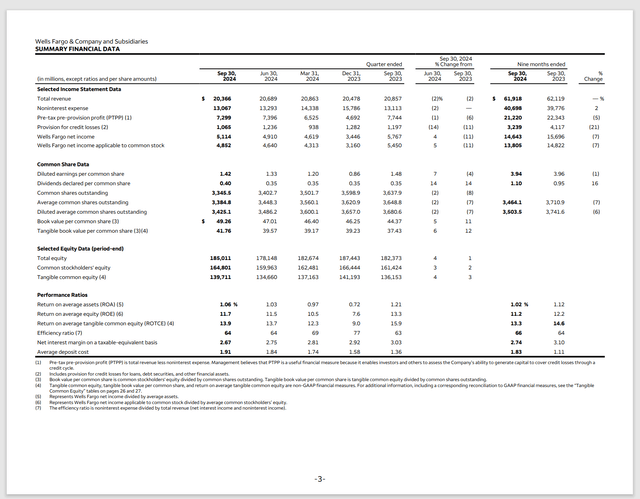

The third quarter earnings is more than reasonable as shown below:

Wells Fargo Third Quarter 2024, Financial Results Summary (Wells Fargo Third Quarter 2024, Earnings Supplemental Release)

Obviously, the asset cap rules out accretive acquisitions as a growth route. However, just bringing the operations into compliance could result in considerable improvement.

There is considerable improvement between the current results and what JPMorgan Chase (JPM) just reported. That should imply that earnings could grow considerably in the future. There is no need to worry about being at the top of the industry for some time to come. Just show quarterly improvements and earnings will respond.

The headwinds of course would be that the tech industry, which is located in the state where this company got its start is probably on the verge of a correction. Property values in some areas already reflect the layoffs. Now the diversification of the bank and much better operating procedures should see the bank through any weakness in any one area of the business. However, the West Coast business is worth watching as the tech cycle appears to be nearing an end.

The other consideration is that the bank is now highly regulated. But for investors, the main concern is that the bank needs to stay with all the implemented procedures and infrastructure once the regulatory environment begins to be lifted from the company. It is extremely dangerous to have a large bank do some of the things that this bank had done (and got away with). Unfortunately, old habits die hard though.

Share Repurchases

Management has been buying back shares. This may not be an expression of management’s belief that the stock is cheap because there is an asset cap. Rather it is more likely an expression by management that they have no use for more capital. Therefore, as long as the asset cap is in place, they will return (probably) more capital to shareholders than might otherwise be the case.

This is a way to return capital without having to defend the dividend during a downturn. Instead, a dividend is paid at a safe payout ratio that can be maintained throughout the business cycle while any extra money goes to share buybacks.

But this does provide an avenue for per share growth in addition to more efficient operations. These two things combined could well result in at least high single digit earnings growth per share over the long-term.

Obviously, this is a different story than the typical growth story. But for a large company like this one, this story could last for years ahead.

There are of course absolute limits to growth when the assets are not allowed to grow. But apparently this bank has a lot of work to do to bring operations in line with the expectations of regulators. That “lot of work” should lead to a significantly better return on equity.

Interest Rate Movements By The Federal Reserve

Banks are “all about” making money on the spread between the cost of funds and the income those same funds bring in. But when interest rates change (such as when the Federal Reserve recently announced a significant rate cut), then the matching done up until the current time can come somewhat undone.

That means that the bank has to move to re-establish the matching for those funds already accounted for. This can cost money or profit per share to shareholders. It is one of the reasons that the Federal Reserve moves slowly.

Generally, when interest rates change, one side of the match or the other experiences a new maturity curve because money moves before it was expected to move. Fortunately, there is also money that (relatively speaking) does not care and will remain on the original schedule.

This is one of the reasons that banks often prefer to sell long-term loans like mortgages to others that specialize in that situation. More short-term situations enable more flexibility to deal with interest rate volatility.

Much of the banking world could have a few quarters of volatile profitability until interest rates settle again. It all depends upon how this interest rate decline unfolds.

Summary

Wells Fargo is an unusual turnaround situation in that this company has got to comply with regulatory demands before management is again on equal footing with many competitors. The per share growth will come from better infrastructure as well as share repurchases combined with a management that complies with the regulatory environment.

There is a risk that when regulators release the bank, it may go back to its old ways that caused all the trouble to begin with. But it is probably far more likely that current management will run things better and more profitably than was the case in the past.

This bank is a buy for those that are patient enough to allow the current situation to continue to progress to the point where the bank is back in a situation that is the same as the rest of the industry. It is a hold for those investors who are unsure about the current management and what will happen in the future. Since the worst is probably over, the sell pathway has sharply diminished in importance.

I do own it, and it is in the higher risk section of my portfolio because of management’s past actions. So, for me it is a buy. However, if at any point there is a sign that management goes back to the “old ways” this will become one of the fastest sells around.

This is a higher risk situation in that this management requires a lot of monitoring by the investor. Therefore, this idea is not for everyone. Management needs a solid record showing the market that they will behave and not constantly get into trouble. That record is currently underway. But it will have far more significance when the regulators deem that this bank is not worth all the extra regulation currently in place.

Risks

The biggest risk is management. It takes a long time to change the management of a large institution like this one. That change is currently underway. But we will not know the success of the process until after the current period of extra regulation stops and the bank is “on its own” once again.

I tend to be an optimist about people and have invested. Others are free to disagree as there are plenty of examples of managements that went right back to where they were before and the business was either liquidated, broken up, or acquired by someone that really “cleaned house” and resolved the issues.

Sometimes the situation comes about because management really does not know banking very well despite the size of the institution. Therefore, rooting out certain abilities and attitudes may be necessary while replacing them with personnel more suited to the job. But hiring new people has its own risks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and Wells Fargo in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.