Summary:

- Wells Fargo has faced multiple scandals and asset caps imposed by the FED, but its stock has doubled the returns of the S&P 500 YTD.

- The company had strong 1Q earnings, with revenue increasing and net income of $4.6 billion, resulting in a low P/E ratio of ~13.

- Wells Fargo continues to run a major business with diversified consumer and commercial loans, maintaining strong credit quality and the ability to generate substantial shareholder returns.

ablokhin

Wells Fargo & Company (NYSE:WFC) is one of the largest banks in the world, with a market capitalization of more than $200 billion. The bank has been forced to face scandal after scandal, and has had a cap on its assets imposed by the FED. The company expects asset caps to remain through next year and Berkshire Hathaway Inc. (BRK.A) (BRK.B) has disposed of the last of what was once a large stake.

Despite that, as we discussed at the start of the year, the company has doubled the returns of the S&P 500 YTD, and it has the ability to continue growing. As we’ll see throughout this article, the company’s reorientation and building of a strong long-term business make it a valuable investment.

Wells Fargo 1Q 2024 Earnings

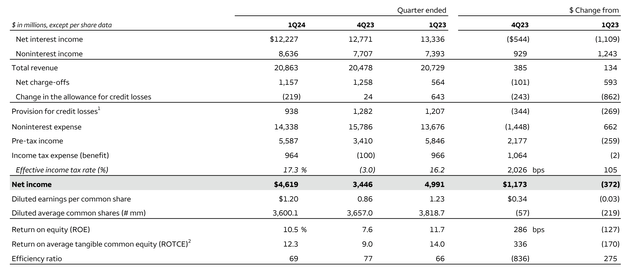

The company had reasonably strong earnings in the 1Q with revenue increasing by ~0.5% YoY and ~2% QoQ. That’s despite the expected weakness in net interest income.

Wells Fargo Investor Presentation

The company had a total revenue of $20.9 billion. Subtracting net charge-offs, which have increased YoY and expenses, the company saw $4.6 billion in net income. That resulted in EPS that decreased slightly YoY but increased QoQ to $1.2. That puts the company’s P/E at ~13, a low double-digit multiple for a company with strong financials.

The company’s strength in share buybacks is also visible, with its share count down 219 million YoY, or an almost 6% decline. That combines with a 2.3% dividend yield to push annual shareholder returns to more than 8%.

Wells Fargo Investor Presentation

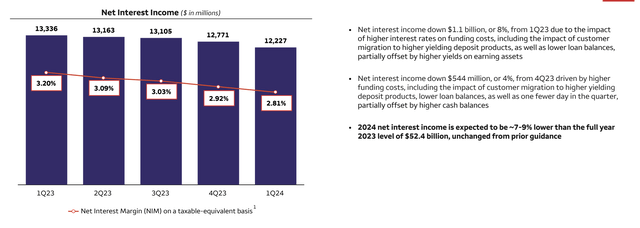

The above shows the breakdown of the company’s net interest income. Net interest income was the biggest source of an earnings decline for the company, down 8% YoY to 2.8% from 3.2%. That’s not particularly surprising, given that the company has had to deal with increased competition in a high-yield environment, as customers get used to a higher return on deposits again.

Wells Fargo Investor Presentation

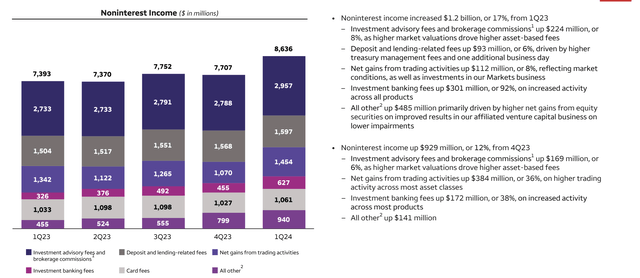

From a non-interest rate perspective, the company had a blowout quarter, supported by an almost 50% increase in revenue from trading activities QoQ along with a substantial increase in revenue from investment advisory fees. The company benefited from a more expensive market, along with gains in its equity securities.

That strength has drifted to the company’s bottom line and represents a strong business.

Wells Fargo Loans and Deposits

The company continues to run a major business, with a focus on both diversified consumer and commercial loans. Anecdotally, the company’s new BILT card remains one of the most popular in our circles for renters.

Wells Fargo Investor Presentation

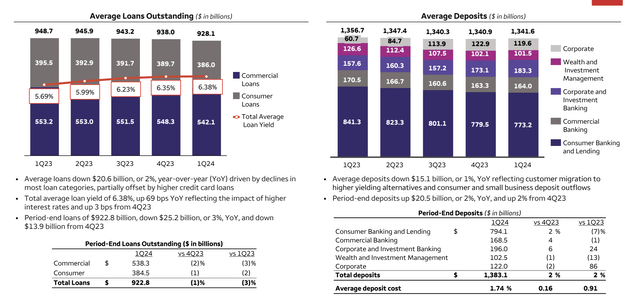

The company has just under $930 billion in loans outstanding at a yield of almost 6.4% showing the impact of rising rates. These long-term loans could help the company earn more cash flow in the long run. The company’s loans are down a mere 2% YoY and most of that is reflective of continued volatility in the industry.

The company has also managed to keep average deposits quite high at $1.34 trillion, down 1% YoY. That’s despite substantial consumer deposit declines from depositors migrating to higher yield opportunities. The company has managed to grow deposits in other segments of its business and has managed to grow overall deposits QoQ despite consumer migration.

Wells Fargo Credit Quality

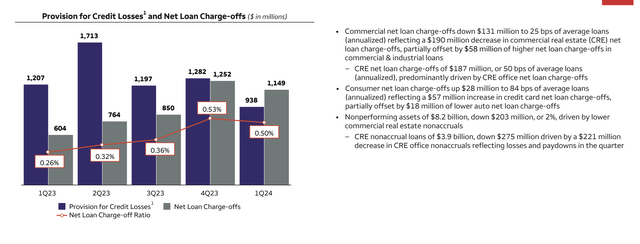

The company maintains strong credit quality in its business, but the growth in interest rates has impacted charge-off rates.

Wells Fargo Investor Presentation

The company saw $1.15 billion in net loan charge-offs for the quarter, with a $940 million provision. The company’s net loan charge-off ratio was 0.5%, a relatively low level, especially in a high-interest rate market. So far, the market shows no substantial weakness from higher interest rates, and we’re hoping that that can continue.

That’s especially exciting to see given that not only are interest rates higher, but the company continues to face the rollover impacts of COVID-19 on businesses such as commercial real estate.

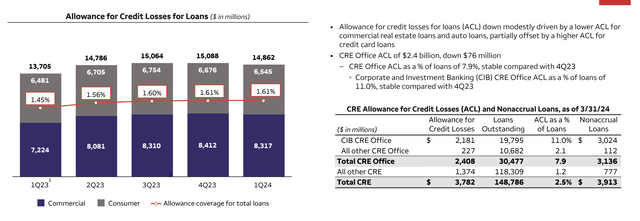

Wells Fargo Investor Presentation

The company’s total allowance for credit losses for loans has ticked up modestly, but continues to stay fairly steady at 1.6% or $14.8 billion, roughly evenly split across commercial and consumer loans. The stable CRE office ACL and decline QoQ show how that black swan event is seeing lower impact, which will help keep overall credit allowances lower.

Overall, the company continues to have high quality credit.

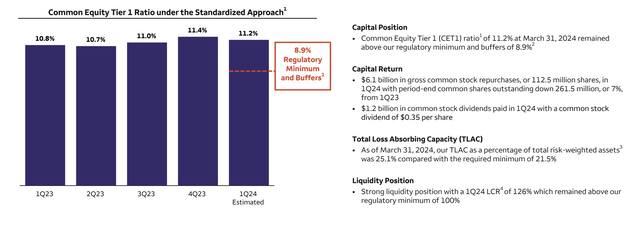

Wells Fargo Shareholder Return Potential

Wells Fargo has the ability to continue generating substantial shareholder returns.

Wells Fargo Investor Presentation

The company has an 11.2% Common Equity Tier 1 ratio, well above regulatory minimum buffers. That enables continued substantial shareholder returns, the company repurchased a massive $6.1 billion of common stock in the 1Q leading to maintaining its dividend of 2.3% along with an annualized repurchasing rate of 12%.

In the past decade, the company has repurchased a third of its outstanding shares, increasing the value of existing shares. We expect the company to continue driving substantial shareholder returns.

Thesis Risk

The largest risk to our thesis is whether Wells Fargo has truly solved its reputational crisis, both with the consumer and with regulators. Even if it has a path forward with regulators, that doesn’t mean that it has solved the crisis of confidence with customers. That could cost the company more in the long run.

Conclusion

Wells Fargo was once one of Berkshire Hathaway’s largest investments, before the scandal caused the long-time position to be dumped, resulting in the company now having a substantial cash position it’s struggling to invest. However, Wells Fargo remains an undervalued investment committed to long-term shareholder returns.

The company is continuing to aggressively repurchase shares and has a modest dividend of more than 2%. Despite its growth in share price, the company is still undervalued with a unique ability to generate long-term returns. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.