Summary:

- Wells Fargo has surged to near all-time highs while still facing asset cap restrictions and limited capital returns to shareholders.

- Due to the Fed stress test results, the large bank announced an increase in stress capital buffer while still hiking the dividend to $0.40.

- Despite being relatively cheap, the stock is trading close to peak price-to-tangible book value and may not produce market-beating returns in the near future.

matdesign24/iStock via Getty Images

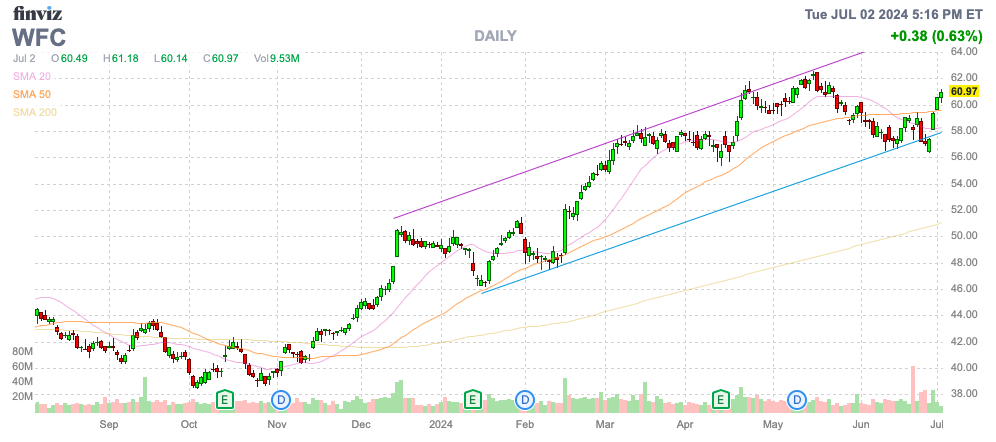

In an unexpected move, Wells Fargo (NYSE:WFC) has soared to $60 and near all-time highs. The large bank still faces asset cap restrictions from the Fed and huge capital restrictions preventing aggressive capital returns to shareholders. My investment thesis is more Neutral on the stock after the big rally from below $40 at the end of last year to over $60 now.

Source: Finviz

Fed Stress Test

As the years have passed since the financial crisis, the Fed stress test results have lost importance. The large banks have requirements for far higher capital now, and the financial crisis was never as likely to repeat again under the stricter capital requirements from bank regulations.

Wells Fargo recently announced the 2024 Comprehensive Capital Analysis and Review (CCAR) stress test process. The company expects its stress capital buffer (SCB) to be 3.8%, which represents a percentage amount of incremental capital the company must hold above its minimum regulatory capital requirements.

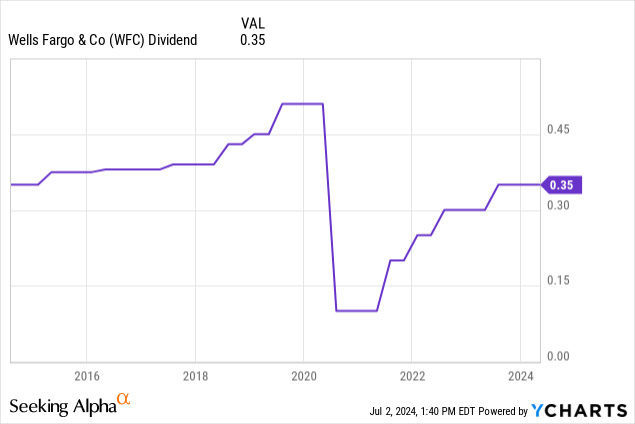

Following the results, Wells Fargo announced a 14% hike to the quarterly dividend to $0.40. The dividend was previously $0.35 and has slowly risen following the last major cut after Covid.

Since the stock has run to $60+, the dividend yield has dipped down to only 2.7%, even after the upcoming hike. Additionally, Wells Fargo announced the large bank has the capacity to repurchase shares, but the company didn’t announce any specific amount as restrictive capital requirements continue to crimp the ability of the bank to return capital to shareholders.

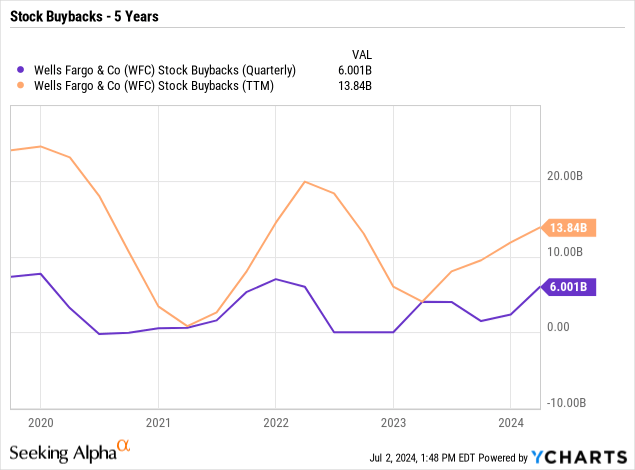

The bank repurchased $6 billion worth of shares during Q1 and has now repurchased nearly $14 billion over the last 12 months. For a bank with a market cap still only slightly above $200 billion even after rallying to all-time highs, the stock buybacks are very material.

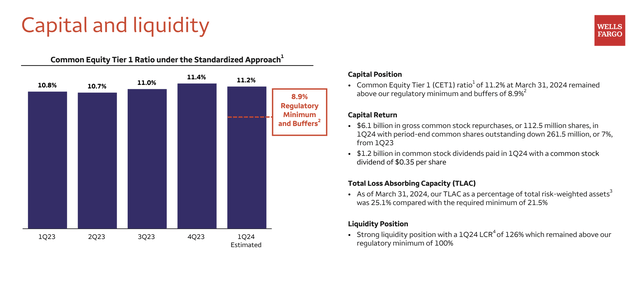

The stress tests add to the capital requirements of the bank. The SCB moved up to 3.8% from only 2.9% prior to the stress test results.

Wells Fargo ended Q1 with a CET1 ratio of 11.2% under the standardized approach, with an 8.9% regulatory minimum. The bank was estimated to have ended Q1 with $12 billion in excess capital and Wells Fargo is highly profitable adding additional capital on a quarterly basis, but the higher SCB ratio will reduce the capital available for share buybacks in the next year.

Source: Wells Fargo Q1’24 presentation

Relatively Cheap

Even after the big rally, Wells Fargo is relatively cheap. The bank still has the asset cap restricting the ability of the bank to grow, but analysts are forecasting EPS jump from $5+ in 2024 to over $6 in 2026.

Wells Fargo repurchased 112.5 million shares during Q1 and in total reduced the share count by 7% YoY. The bank automatically sees a 7% boost to EPS from this lower share count.

Our prior research highlighted how the EPS could jump to nearly $7 based on limited revenue growth and substantial share reductions over a 2-year period. The average diluted share count was down to 3,600 million in Q1’24 from 3,819 million last Q1 and the target for 2025 was only 3,350 million.

The bank still has the asset cap at $1.95 trillion from over 5 years ago. The management team still suggests a realistic target for removal is 2025.

For the next few years, Wells Fargo has the potential to grow EPS via share buybacks, though the company won’t repurchase as many shares with the stock up at $60 and not back at only $40.

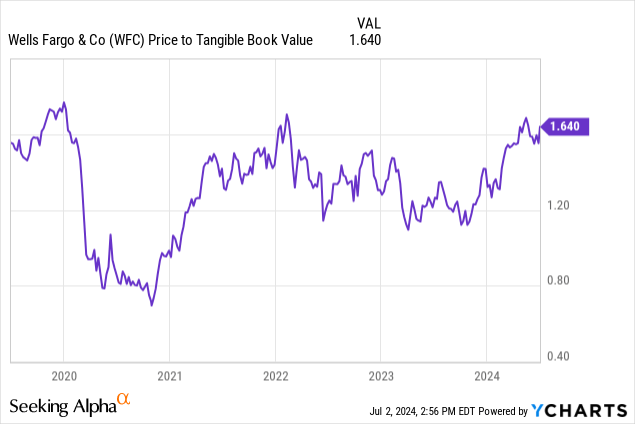

The stock trades close to the peak P/TBV of the last 5 years. Wells Fargo hasn’t ever maintained trading over 1.5x TBV over the period, suggesting a more Neutral view around $60 is reasonable.

Credit costs are probably the big unknown in the investment story. Current economic weakness could lead to additional provisions, with the Q1’24 credit costs below $1 billion.

The EPS forecast has already assumed the amount jumps to $5.5 billion annually and Wells Fargo continues to produce far lower credit losses. The large bank only had net charge-offs of $1.2 billion during Q1 and Wells Fargo already has a massive allowance for credit losses on loans of nearly $15 billion, with the key allowances for CRE Office loans actually declining during the quarter.

Takeaway

The key investor takeaway is that Wells Fargo isn’t as exciting of an investment, with the stock up to all-time high levels and the Fed asset cap still in place. The stress test results don’t really help the large bank with capital returns either, but Wells Fargo should continue repurchasing shares to help boost EPS in the short term while growth is restricted.

Investors should consider unloading some shares here with the easy gains over. The stock could provide solid long-term gains going forward along with a decent dividend yield, but Wells Fargo is unlikely to produce market beating returns now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start July, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.