Summary:

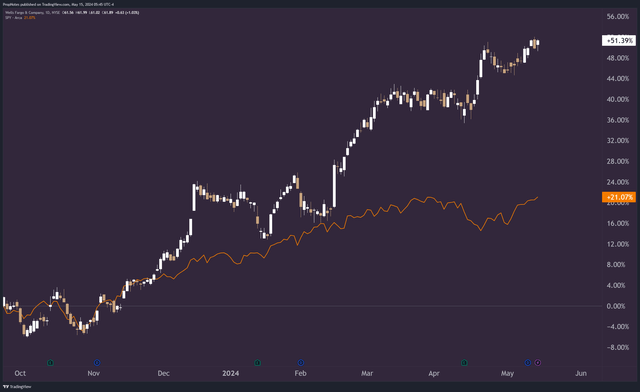

- Wells Fargo stock has returned over 50% since our initial ‘Buy’ rating, outperforming the S&P 500 by a wide margin.

- The bank’s return profile remains strong, with enough earnings power to back 7%+ combined annual capital returns in the form of buybacks and dividends.

- With a healthy balance sheet, improving control infrastructure, and trading at a fair price, it’s a compelling package.

- We reiterate our ‘Buy’ rating on WFC.

jetcityimage

Last September, we wrote an article about Wells Fargo & Company (NYSE:WFC) titled: “Wells Fargo Has The Makings Of A Cheap, Safe Dividend Monster“, where we talked at length about the company’s sound financial footing, attractive valuation, and consistent cash flow profile.

We argued that the stock could be a solid capital returns play for income-oriented folks that want to boost portfolio yield, or those seeking to add some exposure to the financial sector on the back of improving net interest margins.

Fast-forward to the present, and our ‘Buy’ call has worked out even better than we expected it would:

In that time, the stock is up more than 50%, which is well ahead of the S&P 500’s return, and the bank’s Capital Returns profile remains unchanged, with more potential dividend increases on the way, in combination with a ton of dry powder to put towards potential buybacks.

While the stock is a bit more expensive than it was last September, today we’ll be re-iterating our long thesis for WFC, covering new updates since our initial coverage, and explaining why we think the megabank still has potential upside in the foreseeable future.

Let’s dive in.

Our Initial Wells Fargo Thesis

In our first article, we covered a lot of different aspects when it comes to investing in WFC, but the core takeaways of our thesis were as follows:

-

Wells Fargo is a profitable bank with a healthy balance sheet. The bank’s top and bottom line results have been strong, and the company has a high deposit collateralization ratio. This means that the bank is well-positioned to weather a crisis or downturn. Additionally, a huge chunk of deposits are non-interest bearing, which gives WFC a low cost of capital to back higher-earning investments.

-

Wells Fargo is focused on improving its control infrastructure. The bank has acknowledged that its past problems were caused by internal complexity, and management seems keen on taking steps to fix operational problems. We think that this should make the bank more efficient and profitable in the future.

-

Wells Fargo is attractively valued and is returning capital to shareholders. The bank is increasing its dividend payouts and buying back shares, which should boost total returns for investors. It also makes WFC a solid-looking yield vehicle for income investors. Additionally, a historically cheap-looking valuation lowers the bar for entry and should boost the margin of safety.

New Updates With Wells Fargo

Looking at Wells Fargo today, many of these points still remain true.

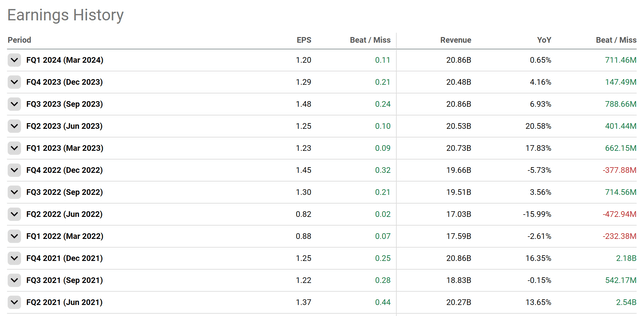

On the financial front, WFC has turned in three positive quarters since we last covered it, including beats across the board on both top and bottom lines:

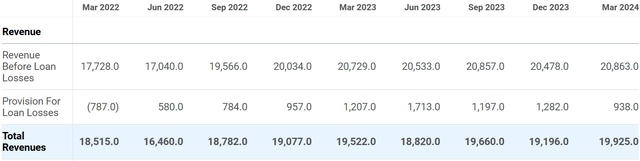

Top-line stability has been strong, quarter after quarter, which shows that WFC’s ability to generate NIM and fees from its capital base is consistent:

Remember, WFC’s strong NIMs are partially powered by non-interest-bearing deposits of over $350 billion. These deposits have declined throughout the last few quarters, but given the rate environment, it’s impressive that WFC has managed to hold on to as much of these as it has. These assets directly back some of WFC’s investment portfolio, which allows for a 100% spread margin between bank capital cost and investment revenue.

This is one of the competitive advantages of being so large.

Additionally, WFC has begun to wind down how it counts ‘institutional’ deposits, which means that the bank recently crossed the $1 Trillion mark on interest-bearing deposits. This puts the bank’s total deposits at ~1.4 trillion. This scale is impressive and allows WFC to earn auxiliary revenues from its capital base, including service fees, trading revenues, and investment banking fees.

WFC’s ~$1.4 trillion in deposits are also backed by more than $1.9 trillion in assets, which makes the risk profile of the bank extremely low.

Overall, this balance sheet safety, combined with the ability to generate revenues and profits from net capital, means that WFC’s ability to reward shareholders is robust.

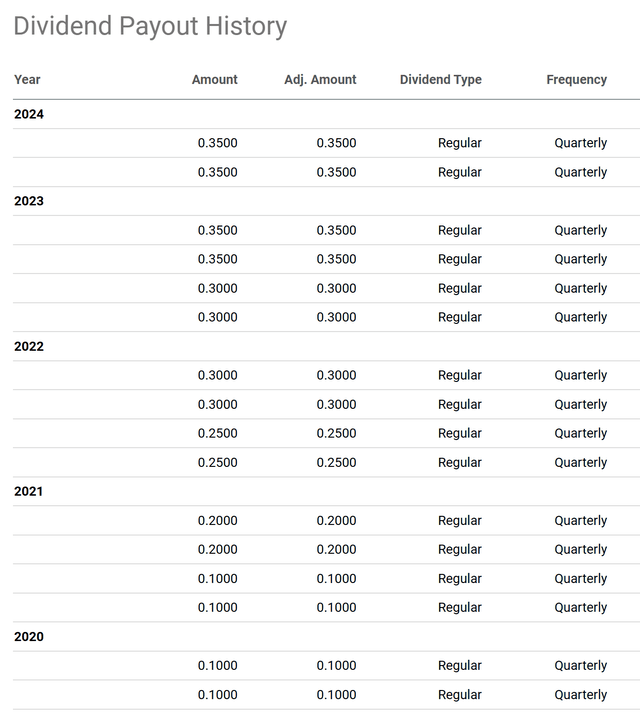

The bank has been re-vamping the dividend after cutting it by ~80% in 2020, and payouts have grown back to $0.35 per share per quarter:

This still lags the bank’s pre-Covid payout of $0.51 per share per quarter.

However, last quarter, the bank earned $4.6 billion in net income, which more than covers the $1.4 billion the bank paid out in total dividends. In this case, and with a payout ratio of less than 30%, we believe that there’s ample room for WFC to continue boosting the yield back to, and above where, it used to be before the pandemic.

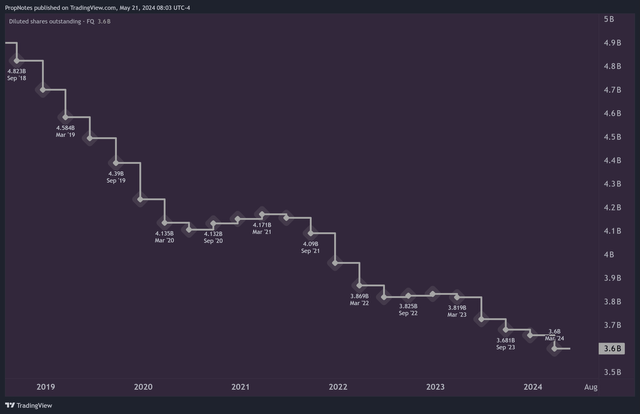

This goes double for buybacks, which have been continuing apace.

After pausing for a bit during Covid, the bank has begun re-purchasing shares from the open market, to the tune of nearly $14 billion per year, as of TTM figures last quarter:

At this rate, and with a Market Cap of $211 billion as of writing, the company is on track to buy back 6% of outstanding shares per year going forward. Even if this dips somewhat to 3%-4% should share prices increase or the buyback budget drop somewhat, it’s still a solid way for management to compound capital for shareholders.

Between the buybacks and dividends, it appears as though WFC is poised to return 7%+ capital to shareholders annually via buybacks and yield for the foreseeable future, which is a very strong return profile, given the low liquidity & solvency risks associated with the company.

Wells Fargo Value

That said, what is WFC worth?

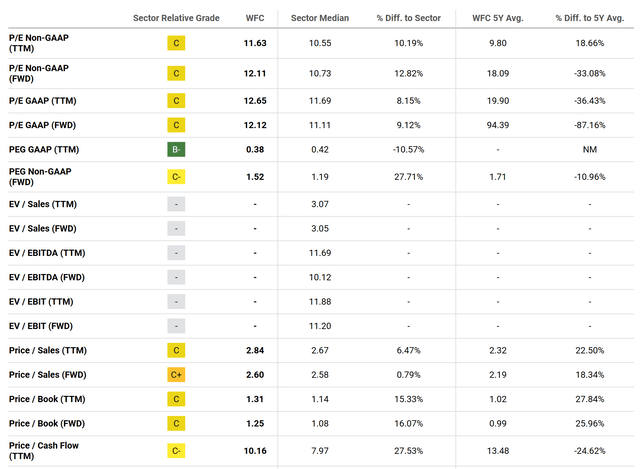

Right now, the bank is trading at around a $211 billion Market Cap, which works out to roughly a 2.8x sales multiple:

Many prefer to look at price / tangible book ratios and other more traditional metrics when looking at banks, but we like knowing how much the bank is trading for when NIMs & fees have all been stacked up. This isn’t the case with all banks, but with something as safe as WFC, we’re not particularly worried about the bank’s book multiple.

For us, looking at revenue, this does mean that the bank is getting more expensive, but not overly so. Right now, this 2.8x sales valuation is right in line with the industry, and is only trading at a slight premium to where WFC has traded over the last 5 years.

On the bottom line, additionally, WFC is only trading at a 12x net income multiple, which is in line with the industry and where the stock has been historically.

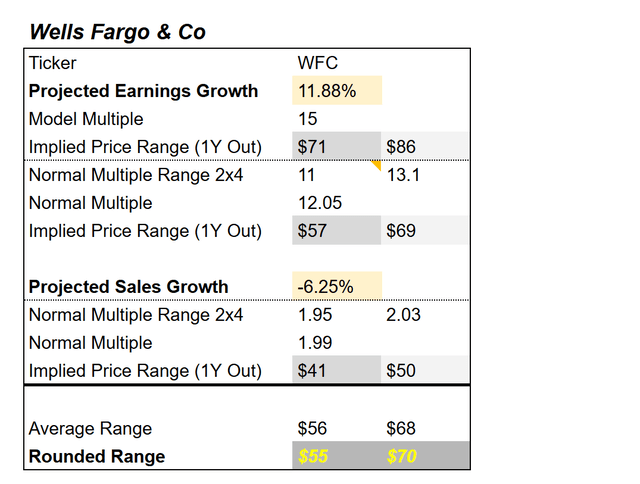

In our view, when you also factor in top and bottom-line expected growth rates and historical multiples, WFC could be best seen as ‘Fairly Valued’ in this environment, if you project out multiples and growth together:

Right now, we estimate WFC’s Fair Value range to be somewhere between $55 and $70 per share, which is right around where the stock is currently trading, at $60.

Thus, while WFC may no longer have substantial upside on multiple fronts, it does appear as though the bank has organic upside when it comes to capital returns to shareholders.

Risks

This long thesis does have some risks, chief among them multiple-related.

When we first pointed out WFC back in September, the stock was trading at a much lower multiple, which increased the margin of safety for this idea. Now, with shares trading much closer to our ‘Fair Value’ range, there’s more downside.

Whether slower growth hurts investor sentiment, or margin compression from lowering rates takes a toll on EPS, the higher WFC flies, the further it has to fall.

Right now, this risk doesn’t appear to be too large, but it has increased since our first article.

Additionally, traditional risks that we first outlined with WFC still apply, including regulatory risks around the consumer banking franchise. Given WFC’s poor track record here, it’s a material threat, but one that timing the stock ‘better’ does not ameliorate. Thus, it’s just something that must be considered as a part of the package.

For their part, management still puts the following passage near the top of their quarterly reports, which indicates that it’s still front-of-mind for the C-suite:

Wells Fargo’s top priority remains building a risk and control infrastructure appropriate for its size and complexity.

Thus, while regulatory and complexity risks do exist, we do see them declining over time as a result of management efforts.

Summary

Overall, while there are some risks associated with holding WFC in the present market environment, and the multiple has inflated somewhat from our initial ‘Buy’ rating, we think that the prospect of solid 7%+ capital returns per year, plus organic growth, should be enough to entice shareholders to climb aboard this fairly valued megabank.

Thus, we reiterate our ‘Buy’ rating on the stock.

Cheers!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.