Summary:

- Wells Fargo’s future investment potential is promising due to its low valuation, modernization initiatives, and potential for continued dividend growth.

- The bank’s regulatory scrutiny is slowly subsiding, allowing for improved profitability and potential dividend increases in the coming years.

- Once Wells Fargo gets out from under the asset cap, it can enhance its lending capacity, accept new deposits, and potentially benefit from acquisitions and small bank failures.

RiverNorthPhotography

Wells Fargo (NYSE:WFC) has faced significant challenges over the last several years, but there are a few reasons for cautious optimism about its future investment potential, including valuation, modernization initiatives, and the high probability of continued near term dividend growth. Moreover, the significant eventual future catalyst of getting out from under the enhanced scrutiny of the Federal Reserve continues to loom, and WFC shares are likely to substantially benefit from the eventual removal of its asset cap.

Potential Upside

Wells Fargo trades at a lower valuation than its peer banks, as well as its historical valuation. Much of that makes sense, because Wells Fargo got in trouble with Federal regulators for a lack of oversight that allowed for employees to create fake accounts, among other problematic practices. The bank continues to face regulatory scrutiny as well as some legal challenges, but it has also spent substantial sums on its risk management in an effort to address the concerns this scrutiny created.

While rebuilding trust with customers and regulators is a long-term process, it appears reasonably probable that much of the damage is now in the past, and the bank may soon begin to benefit from the capital expenditures it implemented as part of the process. In particular, there is a reasonable probability that the bank’s significant capital expenditures on creating a sufficient risk management system will slowly subside, and that those reduced costs will help improve profitability. Similarly, some of these modernization effectors may allow for the company to streamline its organization.

The banks existing regulatory scrutiny has caused Wells Fargo to forego certain maneuvers that it may have otherwise implemented. Beyond the asset cap, Wells Fargo must accept the Federal Reserve’s decision on its capacity to increase its dividend payout. Wells Fargo had to substantially reduce its dividend due to the scrutiny it faced, and continues to face, as well as the affect its actions had on its business, but the bank has been able to raise its dividend in 2023 and 2024. It appears probable that WFC shares withheld continue to receive annual dividend increases in 2025 and 2026, absent a significant economic downturn. Wells Fargo’s capacity to raise its dividend, as well as the level to which it may make those increases, will also depend upon the lifting of the asset cap.

Wells Fargo benefitted from the series of aggressive interest rate hikes that the Federal Reserve implemented in 2022 and 2023. The higher interest rates allowed the bank to generate much better net interest margins than it was prior to that. Many of the larger banks befitted from this, but the effect upon Wells Fargo was particularly strong due to the regulatory scrutiny it faced, and the measures it took in order to deal with the asset cap.

In particular, during 2020 and 2021, Wells Fargo divested itself of significant higher risk portions of its asset portfolio in order to stay under the asset cap and cleaner and lower risk portfolio that would be pleasing to the regulators. This left Wells Fargo with a higher percentage of lower duration and high quality assets that were less susceptible to declining valuations in the face of rising interest rates rates. Moreover, their shorter duration made it easier for Wells Fargo to roll them over into higher yielding short term Treasuries and related high quality paper as rates continued to climb.

Wells Fargo’s net interest income strength may have already peaked in 2023, but the current situation means that the bank has high quality holdings that it can deploy into new investments once it does get out from under the asset cap. Since the asset cap mandates that the Wells Fargo’s assets remain under $1.95 trillion, and the bank basically hovers just below that level, Wells Fargo must refrain from investing in anything that has the potential to increase in value, or it would have to divest of it, or something else equal to those gains.

On July 12, 2024, Wells Fargo reported second-quarter EPS of $1.33 per share, compared to $1.25 per share in the second quarter of 2023. Trading revenue reached $1.4 billion, and nearly an all-time high for the bank. Nonetheless, Wells Fargo’s return on tangible equity was 13.7 percent, which is below management’s target of 15 percent.

Given relatively flat short term rates and Wells Fargo’s increasing costs , as well as the possibility of declining rates later this year, it appears increasingly likely that the bank’s net interest income will continue to decline in the near term. The bank estimates that total 2024 NII may be as much as 9% lower than 2023’s total of $52.4 billion.

Given current management’s conservative forecasting, it is reasonably probable that NII will not decline by that much. Further, it appears likely that NII could be in a bottoming process, and that Wells Fargo’s has the capacity to increase its net interest income in 2025 and 2026. Much of this capability will be dependent upon the lifting of the asset cap, and without its removal, NII may continue to decline in 2025.

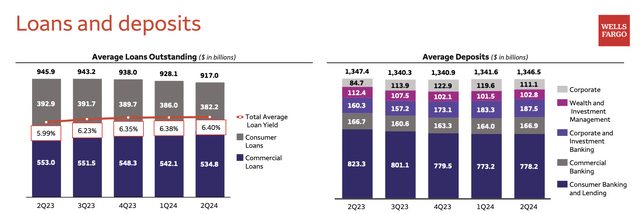

As the below charts show, Wells Fargo’s loans and deposits have been incredibly flat over the last several quarters. Much of the reason for this flatness is due to the asset cap.

Wells Fargo’s loans and deposits (WFC’s Q2 2024 investor presentation)

Once Wells Fargo gets out from under the asset cap, its capacity to issue more loans, and also to accept new deposits will be substantially enhanced.

Another potential source of future increases to Wells Fargo’s assets could come from acquisitions and smaller bank failures. Wells Fargo’s capacity to benefit from weakness in small banks was essentially removed by the asset cap. This is not likely to be an immediate effect, but makes it a potential beneficiary in the case of a future bank crisis.

Similarly, Wells Fargo had no real capacity to make a significant acquisition. Once the asset cap is removed, these capabilities should return. If the new version of Wells Fargo could ingratiate itself to the regulators, it may end up being a preferred destination for financial assets, much like JP Morgan (JPM) currently appears to be.

Wells Fargo has made significant investments in technology in order to enhance the customer experience, improve efficiency, and develop a state of the art risk management system that will please regulators. Beyond getting a thumbs up from regulators, the development of a compelling risk management system should slowly become a compelling advantage, where Wells Fargo now still suffers from a poor image due to its prior risk management failures. Continued modernization of its operations should eventually unlock new revenue streams and reduce costs. Further, the costs of modernization should eventually subside.

Risks

Wells Fargo is certainly not without risk, including all of the standard risks that banks generally face. In particular, any serious economic downturn, or a recession, is likely to lead to an increased level of defaulting loans, as well as reduced asset valuations and significant weakness to banking net interest margins.

Other risks include the possibility of cybersecurity threats. If Wells Fargo were to suffer a sophisticated cyberattack in the near future, that would not only damage their reputation and potentially cause an exodus of client assets, but it could also keep it under the purview of the Federal Reserve’s scrutiny and asset cap. Similarly, banks sometimes suffer from operational errors that would likely have a similar effect upon Wells Fargo here.

Another major risk is that of potential regulatory changes, which could depend upon political posturing, or follow the failure of a peer bank. Changes to financial regulations can substantially impact the banking business model, or simply cause reduced profitability. While it is hard to imagine Wells Fargo having increased regulatory oversight, given the numerous consent orders from multiple government agencies it has faced over the last several years, that oversight could continue longer than anticipated.

Wells Fargo also has to continue rebuilding trust with customers. Where the bank was once viewed as one of the more trustworthy and conservative banks within the market, the scandals it faced over the last several years made in seem like a more shady operator. The process of regaining consumer confidence is a long-term challenge that requires a sustained effort and continued positive actions. Any further revelation of past impropriety, or the disclosure of a new scandal, will undoubtedly slow down this process.

Conclusion

Wells Fargo shares remain substantially undervalued compared to its historic valuation, as well as the current value of large peer banks. Wells Fargo is likely to finally get out from under the Federal Reserve’s asset cap in early 2025, and such a revelation is likely to cause shares to be revalued higher. Shares of Wells Fargo recently declined with the broader market, and they are likely to soon appreciate back to the $60s, as investors anticipate a forthcoming rate cut cycle, as well as the lifting of the asset cap. Given this setup and current valuation, Wells Fargo appear to present a strong value at risk that is likely to appreciate along with the start of a rate cut cycle in late 2024, and then gain from the probable lifting of its asset cap in the first half of 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.