Summary:

- Wells Fargo beat earnings predictions for Q2, but missed on net interest income.

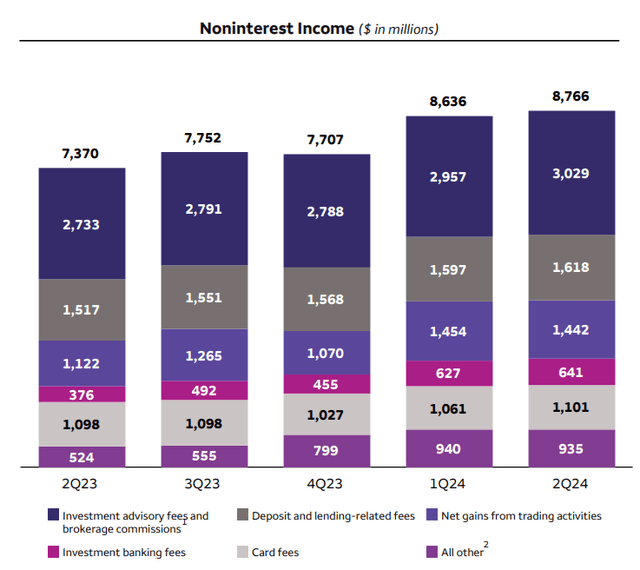

- The lender’s non-interest income was driven by strong investment banking activity, however. Balance sheet quality did not materially deteriorate.

- Commercial real estate exposure is a key area worth watching going forward.

- Shares continue to trade above the historical price-to-book ratio.

jetcityimage

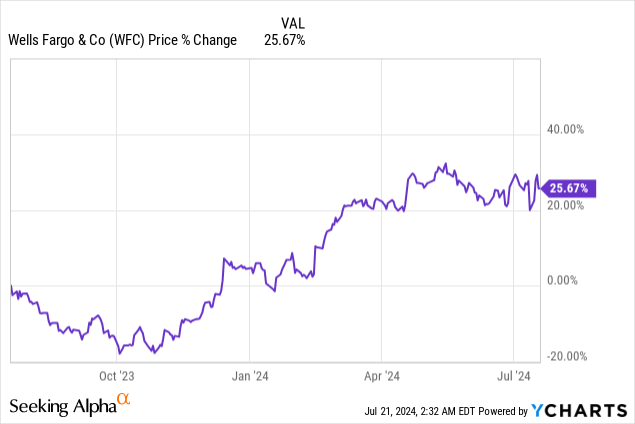

Wells Fargo (NYSE:WFC) beat average predictions for its top and bottom line for its second fiscal quarter earnings on July 12, 2024, yet missed on net interest income, a key measure for financial institutions. Wells Fargo’s net interest income, which measures the difference between its interest income earned from its loans and its interest expenses, dropped 9% year over year and the bank now expects an 8-9% decrease in net interest income this year. The lender did report stable balance sheet quality, however, and saw some strength in investment banking, just like Bank of America (BAC) last quarter. The NII outlook for FY 2024 remains weak, in my opinion, and I believe that the easy money for WFC has already been made!

Previous rating

I rated Wells Fargo a sell in April because shares of the bank traded at a significant premium to book value and were detached from the longer-term valuation average. Wells Fargo continued to guide for a significant year-over-year drop-off in its net interest income in the current fiscal year, which I believe will continue to pressure the bank’s bottom line and make it harder for WFC to sustain a premium valuation.

A solid Q2’24, driven by investment banking fees

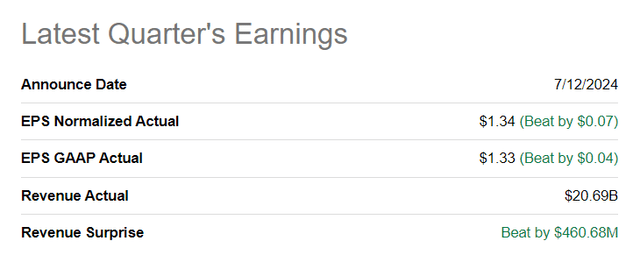

Despite weaker than expected net interest income, Wells Fargo was able to squeeze out both a bottom and top line beat for the second-quarter: the Wall Street Bank reported adjusted earnings of $1.34 per-share which beat the consensus prediction by $0.07 per-share. Simultaneously, Wells Fargo beat the top line estimate by $461M.

Seeking Alpha

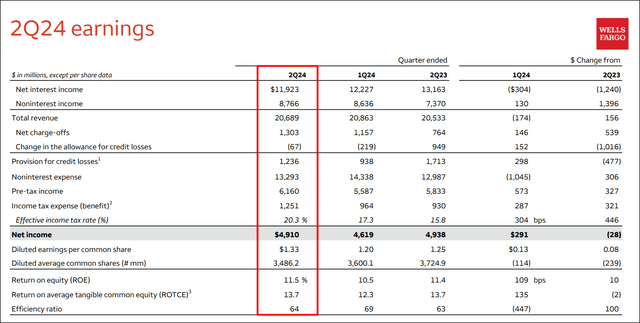

Although Bank of America saw an expected decline in its net interest income, the bank remained widely profitable in the second-quarter: Wells Fargo earned $4.91B in profits in Q2’24, showing a Q/Q increase of $291M, or 6.3%.

Wells Fargo

Earnings were driven mainly by a booming advisory and investment banking business. Investment advisory fees jumped 11% year over year to $3.0B, while investment banking fees surged 70% Y/Y to $641M. Bank of America has seen similar tailwinds in the second-quarter.

Wells Fargo

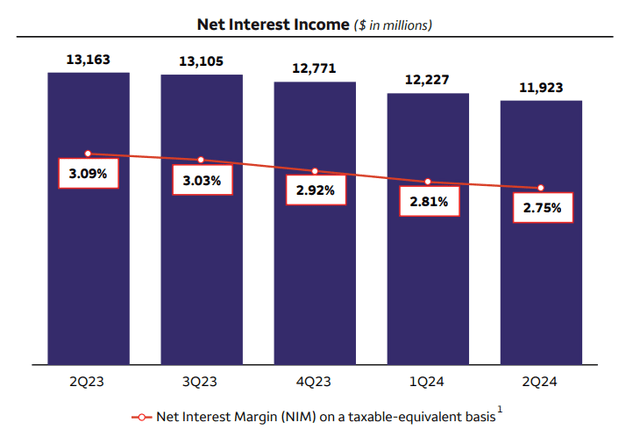

More important than investment banking fees, however, is the trend in net interest income… which for WFC is negative: Wells Fargo’s net interest income declined 2% Q/Q to $11.9B due to higher funding costs and customers seeking out higher-yielding investments. Wells Fargo’s NII came in below expectations of $12.1B. According to the lender’s net interest income guidance, Wells Fargo now expects an 8-9% drop-off in its net interest income compared to last year ($52.4B). In the last quarter, Wells Fargo expected a year-over-year decline rate of 7-9%, so the outlook slightly deteriorated here.

Wells Fargo

Balance sheet quality and CRE exposure

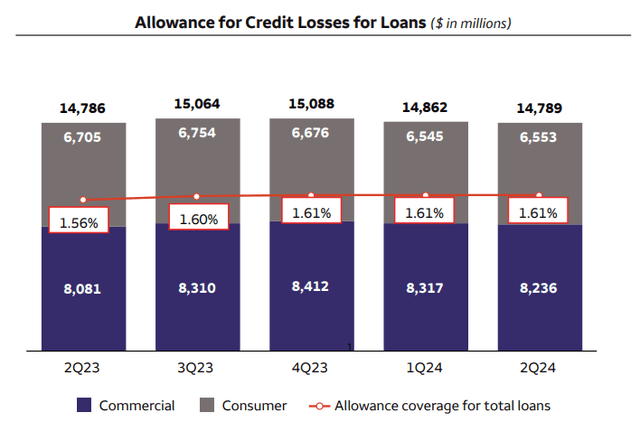

The loan and credit quality profile for Wells Fargo did not deteriorate in the second-quarter, however. In the second-quarter, Wells Fargo had an allowance for credit losses that equaled 1.61% of all loans, which was unchanged relative to the previous two quarters and practically did not change much at all in the last year. Stable balance sheet quality is the signature feature of a well-run commercial bank, and a rise in loan defaults and higher charge-off ratios would be a major concern for investors going forward.

Wells Fargo

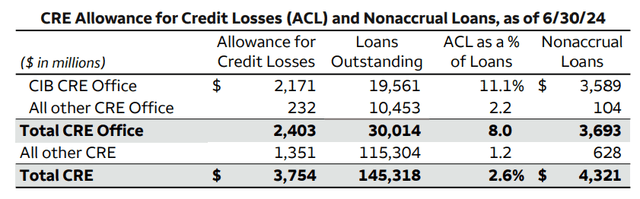

One area that I am monitoring going forward is the bank’s commercial real estate exposure. CRE has been a bit of a problem asset class lately, as high interest rates and weakening performance trends in the office market have resulted in an increase in problematic commercial real estate loans across the banking sector.

In the most recent quarter, Wells Fargo had allowances for credit losses equal to 8.0% of its commercial real estate office loans ($2.4B). In the year-earlier period, 6.6% of loans were on non-accrual, representing a total allowance value of $2.2B. This is not to say that Wells Fargo is imminently at risk of having to write down the value of its commercial real estate portfolio — although its allowances for credit losses increased 10% year over year — but it shows that the CRE loan book is a potential risk factor for Wells Fargo going forward, especially if the economy were to experience recession conditions.

Wells Fargo

The big money has likely already been made

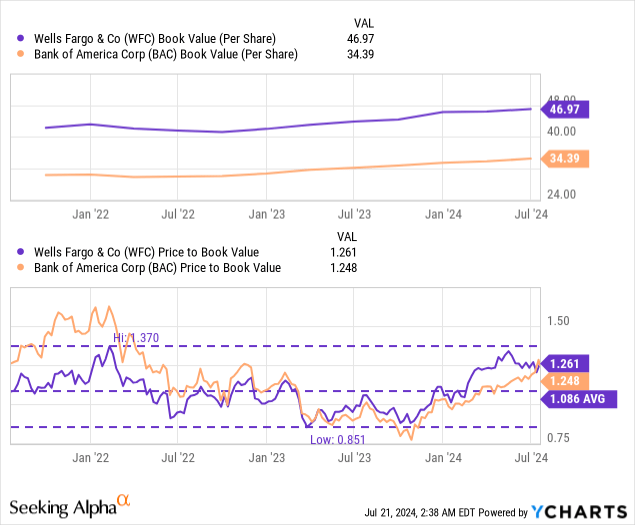

Wells Fargo has revalued higher in the last year in expectation of the Fed’s rate pivot, which has been in the cards for almost a year now. Shares of Wells Fargo are currently trading at a price-to-book ratio of 1.26X, which puts the commercial bank into the same valuation category as Bank of America, its closest rival in the banking sector. Bank of America has a price-to-book ratio of 1.25X.

The big money in the banking sector has likely already been made, in my opinion, and with the Federal Reserve set to change its stance on the Federal Fund rate in the coming months, banks may have a much harder time trading at above-average premiums to book value. Shares of Wells Fargo are up 20% year-to-date and currently trade well above the longer term P/B valuation average: the average price-to-book ratio for WFC in the last three years was 1.09X, implying a premium of 16%. Given that Wells Fargo’s net interest income guidance for FY 2024 also slightly deteriorated, I believe valuation headwinds for the bank are growing. My fair value estimate for Wells Fargo is $46.97 which is the bank’s book value.

Risks with Wells Fargo

The contraction in net interest income is what continues to make me cautious about Wells Fargo. Banks in general are set to face a weaker net interest income prospect once the Federal Reserve stops kicking the can down the road and finally opts to bring rates down. The market widely expects one Federal Fund rate cut this year, which is set to kick off a series of subsequent rate cuts that are going to be a weight on Wells Fargo’s net interest income and valuation. What would change my mind about Wells Fargo is if the Fed were to delay its pivot yet again and create a higher-for-longer rate environment.

Final thoughts

Wells Fargo submitted a mixed earnings sheet for the second fiscal quarter, but the bank failed to provide any new impulses that would justify a major change in my investment rating. Wells Fargo missed NII expectations and expects to see an 8-9% decline in its net interest income this year (compared to a 7-9% drop before) due to the Federal Reserve’s upcoming rate pivot. On the positive side, Wells Fargo still has good balance sheet quality, although the commercial real estate exposure is worth watching going forward. Since the Fed is nearing its pivot point, I don’t see any major reason for a change in my investment recommendation. I believe the big money has already been made with WFC, as well as in the banking sector more generally, and my rating remains sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.