Summary:

- Wells Fargo’s Q2 earnings showed a slight top-line and bottom-line beat, with an unchanged NII guidance that led to an initial market drop that recovered throughout the day.

- Net interest income has declined every quarter since Q4 22, but with Q2 drop rates decreasing and probabilities of rate cuts increasing, it suggests that this may be the bottom.

- Despite several risks and WFC being the underperformer among major banks over the past year, I have changed my rating from ‘hold’ to ‘buy’

Anne Czichos/iStock Editorial via Getty Images

Around two months ago, I analyzed Wells Fargo & Company (WFC) and gave them a hold rating. After that analysis, the stock price hasn’t had material movements, and the rally experienced from November to May, which appreciated up to 57.38%, has calmed down.

Seeking Alpha

Last week, WFC and other major banks started the Q2 earnings release season, and in this analysis, I will go through their results to assess the situation exhibited in Q2 and determine if there is a change in my hold rating.

Before starting, let me give you a brief introduction of the four major segments of Wells Fargo, and their revenue attribution achieved in Q2.

1. Consumer Banking and Lending (44%)

2. Corporate and Investment Banking (23%)

3. Wealth and Investment Management (19%)

4. Commercial Banking (15%)

Market Reaction After Earnings

Although Wells Fargo achieved a slight top-line and bottom-line beat in Q2, the market responded with an initial drop of -2.75% that completely recovered throughout the trading day, in combination with the SPDR S&P Bank ETF (KBE) gaining 3.63%, and the SPDR S&P 500 ETF (SPY) dropping -0.86% on Thursday, as well.

What markets didn’t like initially was the unchanged full-year guidance in terms of net interest income, despite the rise in probabilities for rate cuts. According to the FedWatch Tool, the September 25 bps rate cut probability stands at 91.6%, significantly higher than the probability exhibited a month ago at 62.0%. This increase is predominantly due to cooling inflation data from June and commentaries from Powell stating that they won’t wait for inflation to hit 2% to start cutting. Competitors, such as JPMorgan (JPM), also maintained their full-year net interest income guidance unchanged, and the initial market reaction was bearish.

Wells Fargo’s Q2 Earnings

Now digging into the results themselves, WFC achieved a total revenue of $20.689 billion in Q2. Out of which $11.923 billion (58%) came from net interest income and $8.766 billion from non-interest income (42%).

The trend situation of the last quarter continued, with NII dropping and non-interest income increasing. In Q2, NII stood -9% lower than a year ago, and non-interest income saw a YoY increase of 19%, with strength in Investment Banking Fees that alone grew 70% YoY. Nonetheless, from a QoQ perspective, Investment Banking Fees only rose 2%. Yet, the major non-interest income contributor, Investment Advisory and Other Asset-Based Fees saw an important QoQ growth of 4% and 12% YoY, bringing $2.415 billion in Q2 revenue.

From the side of net-interest income, the Consumer Banking and Lending segment is by far the largest NII contributor. Here, on a percentage basis, the NII declines have been more moderated and were down -6% YoY. Nonetheless, it seems that the continuation of NII drops in this segment is cooling as the QoQ drop was only -1% versus the -7% from Q1. I think this is bullish.

In terms of provision for credit losses, these were down -28% from a year ago but climbed 32% from the previous quarter. This is superior to the numbers exhibited by competitor JPMorgan, which saw provision for credit losses increased 5% YoY and 62% QoQ.

Key Metrics From Q2

With WFC’s average deposit costs getting more and more expensive (also in Q2), the net interest margin marked its fifth consecutive quarter of NIM drop. Currently, the NIM is sitting at 2.75%, which could be compared to the 3.20% from Q1 ’23, when big banks were still enjoying higher interest rates without higher costs of funding affecting their NIM expansion. Two years ago, for example, Wells Fargo had an average deposit cost of 0.04%. But things have changed, and now in Q2, they paid 1.84% on average to mitigate effects from further deposit outflows flying to higher-yielding products.

Regarding deposit costs, CFO Mike Santomassimo said in the Q2 earnings call that customers’ shift towards higher-yielding products still exists, but they have seen that the pressure of these has eased.

On the consumer side, this migration that’s been happening now for a while from checking into savings or CDs is still happening, but at a slower pace. And you can see that over the last couple of years as it’s been pretty stable the last quarter or two, but it’s definitely slowing as you look at the quarter. And so I’d anticipate you’d still see more migration, but continuing to slow as we look forward.

Considering financial ratios, in Q2, Wells Fargo saw an acceleration in its return on tangible common equity to 13.7% and an improving efficiency ratio that fell to 64%. Finally, its CET1 capital ratio dropped slightly to 11.0%, but it’s still a few basis points higher than a year ago. All of these metrics continue to be far away from JPM with them achieving a ROTCE of 28%, an efficiency ratio of 47%, and CET1 of 15.3%.

Loans and Deposits

Concerning loans, their falling demand due to higher interest rates has continued to hit the balance sheet. For example, Q2 was the fifth consecutive month of loan balance decrease, which ultimately affects revenue from net interest income, as well. On the other hand, deposit drops seemed to have hit a bottom, as in Q2 they hit their third consecutive month of QoQ growth, although all these increases have been diminutive. From a YoY perspective, for just -0.07%, deposits weren’t able to grow, but this rate remains far away from the -6.80% deposit decline of Q2 ’23.

Multiples & Historical Valuation

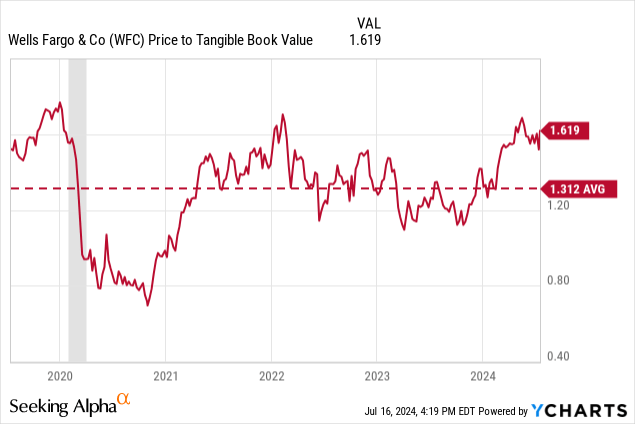

Based on the tangible book value per common share of $39.57, and a stock price of $60.25, their price-to-TCE marks at 1.52x. This is inferior to the 2.30x of JPM that justifies a premium to other major banks due to its higher return on tangible common equity, and inferior to Citigroup (C) at 0.77x, with a ROTCE of just 7.2%. Last, Bank of America (BAC) trades higher than WFC at 1.73x with an inferior ROTCE of 13.15%.

When looking at WFC’s price-to-tangible book value history, the situation is the same after the earnings release. The stock trades slightly higher than its five-year history, which to an extent has been affected due to sanctions from past scandals.

Earnings Takeaway and Rating Change

What I see from these results is that from the side of net interest income drops, it seems that they have hit the bottom or are pretty close to it based on the drop rate decelerations. On top of that, imminent rate cuts in September, and probabilities for three consecutive cuts this year, relax the bank’s funding costs and potentially their NIM, with potentially growing demand from loan originations to expand net interest income.

From the side of non-interest income, although that is what has been helping revenues and earnings not to decay aggressively, it is currently exhibiting great momentum. Rate cut effects are more uncertain to non-interest income and are more dependent on market valuations for Wealth Management & Investment Management and deal activity from Investment Banking. Therefore, dropping a conclusion here is harder.

Now, pondering things out, I will change my hold rating to a buy despite WFC’s valuation sitting higher than its historical average and an NII guidance that wasn’t raised despite higher probabilities for cuts.

Risks of the Bullish Thesis

Despite the change to a bullish rating, some risks in this thesis include things such as.

- Q2 not being the net interest income bottom.

- A stock entry point that is approximately 3% away from all-time highs.

- Adding the underperformer of the four major banks of the last twelve months.

- A decrease in post-September rate cut probabilities.

- A deceleration in investment banking activity, cutting out potential gains from net interest income recovery.

- Active managers becoming less risk averse and switching allocations from big banks to punished regional banks. Where over the last 5 days the SPDR S&P Regional Banking ETF (KRE) has been up 10.55%.

- Drop from elevated US election “certainty”, with front-running candidate currently soaring in winning probabilities. Based on analysts from the same WFC, the soar in probabilities is boosting stocks within heavily regulated sectors, including banks.

In this situation, I think that the upside potential from monetary policy expectations that could boost loan demand and lower the costs of funding, outweighs the mentioned risks, and the stock is worth a change in rating to a bullish one.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.