Summary:

- I see Wells Fargo’s strong commercial momentum to continue and project that future upside is underpinned by strategic investments in growth areas, improved efficiency, and a competitive deposit franchise, amongst others.

- The bank’s robust capital position and attractive valuation support the argument for shareholder rewards, likely in excess of a 10% yield this year.

- I expect that a potential lifting of regulatory restrictions in 2024 could unlock a strong catalyst for share price upside, as investors reprice WFC’s growth outlook.

ablokhin

Wells Fargo (NYSE:WFC) has been experiencing a strong commercial momentum lately and is well-positioned for additional upside due to strategic shifts in its business operations, significant investments in growth areas, and an ongoing transformation under the leadership of CEO Charlie Scharf. As WFC continues to execute on strategic priorities, including (1) expansion and diversification of revenue, (2) pushing operational efficiency and (3) proving regulatory compliance, the bank is expected to generate about $23 billion of pre-tax income in 2024, and $25 billion in 2025.

The strong earnings power, paired with a solid CET1, should enable the bank to distribute close to 10% of market cap to investors, annually. Lastly, one of the most significant potential catalysts for Wells Fargo is the expected lifting of regulatory restrictions, including the asset cap imposed by the Federal Reserve. The lifting of these restrictions will enable the bank to expand its balance sheet and pursue growth opportunities more aggressively. While a date for the lifting of regulatory restrictions is still outstanding, I argue that it could happen within 2024. On that note, I reiterate a “Buy” rating for WFC stock.

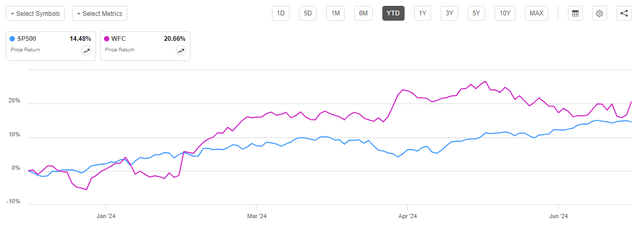

For context: Wells Fargo stock has outperformed the broader U.S. stock market this year. Since the beginning of the year, WFC shares are up by approximately 21%, compared to a gain of nearly 15% for the S&P 500 (SP500).

Strategic Shifts and Leadership Transformation

Since Charlie Scharf took over as CEO in 2019, Wells Fargo has undergone significant changes aimed at addressing past regulatory issues and positioning the bank for future growth. In that context, Scharf’s leadership has been instrumental in transforming Wells Fargo from a regional bank to a more competitive institution with a business mix closer to its larger peers like JPMorgan and Bank of America. The revamping of the leadership team, with 11 of 15 operating committee members hired after Scharf’s appointment, has brought in fresh perspectives and expertise, particularly in risk management and technology.

While addressing regulatory headwinds and risk management issues, Wells Fargo has made substantial investments in key, value-accretive growth areas such as credit cards, capital markets, and wealth management. For instance, the bank has significantly expanded its credit card portfolio, with card balances growing by 30% from FY19 to FY23. This growth is driven by new product offerings and a focus on high-quality customers, with over 80% of credit card customers having FICO scores above 660.

WFC Q1 2024 reporting

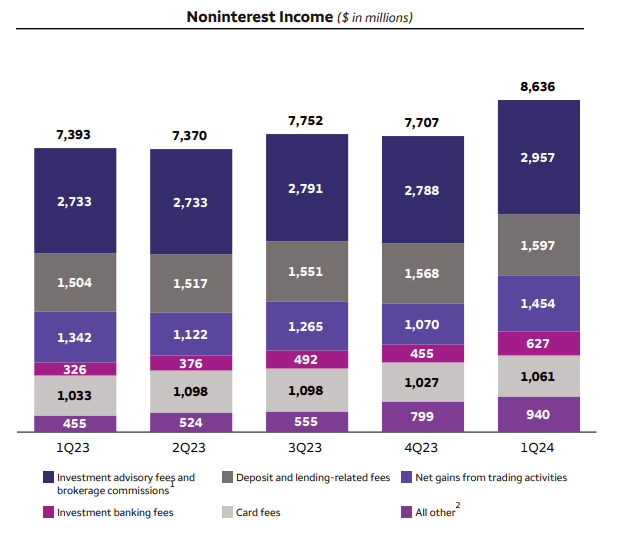

Meanwhile, in the capital markets sector, Wells Fargo has invested in enhancing its trading and investment banking capabilities. This includes structural changes in how the bank manages its capital markets and advisory businesses. This effort is reflected in a 10% increase in investment banking revenue YoY, reaching $2.1 billion in Q1, 2024. Additionally, trading revenues saw a 15% increase YoY, amounting to $1.8 billion for the same period. Notably, Wells Fargo achieved this growth while being compliant with its $2 trillion balance sheet cap.

Improved Efficiency

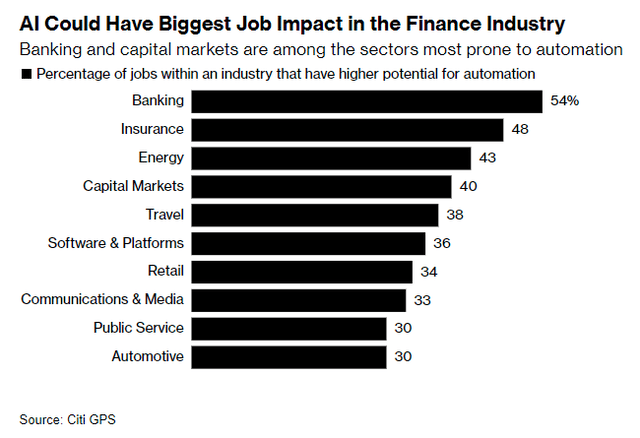

Another critical aspect of Wells Fargo’s long-term equity story is improving efficiency and managing expenses. The bank’s efficiency ratio is now below 70%, and may trend down to below 60% by 2026, according to consensus estimates collected by Refinitiv. In my view, as a leading retail bank, Wells Fargo is well positioned to drive enormous efficiency gains from the application of GenAI opportunities. Specifically, Wells Fargo has ample room to apply AI for reducing its bloated expense base in consumer facing (customer service) and back-office (compliance) labor costs. This positive outlook for streamlining operations, paired with topline expansion, should notably drive operating leverage and ROIC.

NII To Remain High …

Personally, I do not share concerns surrounding NII contraction on the backdrop of deposit cost pressure. Investors should consider that Wells Fargo has one of the best core retail banking and deposit franchises in the U.S., which is evident in its low cost of deposits compared to peers. In my view, this competitive advantage allows the bank to maintain a stable funding base and better manage its net interest income. In fact, over the past few quarters WFC has shown strong NII momentum from reinvesting maturing securities at favorable yields, while maintaining stable commercial deposits and funding. For FY 2024 and FY 2025, I project around $48-49 billion of net interest income.

… Offering A Strong Backdrop For Capital Generation And Distribution

In addition to NII, I project $28-30 billion of non interest income for both 2024 and 2025 (2025 likely higher end of the range due to falling rates). That said, with a 65% cost-to income ratio, Wells Fargo should have the earnings power to generate approximately $25 billion of annual pre-tax profit.

Wells Fargo’s strong capital position provides a strong backdrop for investors to expect capital distributions. The bank’s Common Equity Tier 1 (CET1) capital ratio currently stands at 11.2%, which is well above the regulatory minimum of 8.9%. This thesis of strong capital has been supported by the recent results of the Fed’s annual stress test. In fact, following the stress test results, which proved that WFC remains resilient even amidst severe economic distress, Wells Fargo management increased the quarterly dividend by 14%, to 40 cents per share ($1.6 per share annualized, close to 3% dividend yield). In addition to the dividend, WFC is on track to distribute close to $20 billion of capital through buybacks (almost 10% of market cap), after $6.1 billion of gross buybacks in Q1 2024, and a projected $5 billion of buybacks in Q2. Overall, investors in Wells Fargo shares may thus expect a >10% equity yield for 2024, which is well above (3x) the respective equity yield for the broader S&P 500.

Lifting of Regulatory Restrictions Within 2024 Increasingly Likely

One of the most significant potential catalysts for Wells Fargo is the expected lifting of regulatory restrictions, including the asset cap imposed by the Federal Reserve. The lifting of these restrictions will enable the bank to expand its balance sheet and pursue growth opportunities more aggressively. That said, recent analyses and reports suggest that Wells Fargo has made substantial progress in resolving its regulatory issues, which enhances the likelihood of the asset cap being lifted in the near future. In fact, during recent earnings events, CEO Charlie Scharf has stepped-up his commentary on increased confidence regarding the bank’s efforts to address gaps in risk controls, which is a positive signal towards lifting the restrictions. While a date for the lifting of regulatory restrictions is still outstanding, I argue that it could happen within 2024.

Investor Takeaway

I see Wells Fargo’s strong commercial momentum to continue and project that future upside is underpinned by strategic investments in growth areas, improved efficiency, competitive deposit franchise, and the anticipated lifting of regulatory restrictions. The bank’s robust capital position and attractive valuation support the argument for shareholder rewards: As Wells Fargo continues to generate strong earnings, also helped by ongoing NII strength, the bank is well-positioned to deliver superior shareholder returns – likely a greater than 10% equity yield. Lastly, a major potential catalyst for Wells Fargo is the anticipated lifting of regulatory restrictions, specifically the Federal Reserve’s cap on WFC’s balance sheet. Although no specific date has been set for lifting these restrictions, it is plausible that this could occur within 2024. “Buy”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.