Summary:

- Wells Fargo stock has delivered a 41% total return since September 2023, outperforming the broader U.S. market.

- I am very cautious about Wells Fargo’s upcoming earnings release given the tight monetary environment which is likely to last for longer.

- WFC stock is still slightly undervalued, but I think that a 5% upside potential does not warrant the risk.

csfotoimages/iStock Editorial via Getty Images

Investment thesis

My initial bullish thesis about Wells Fargo (NYSE:WFC) has aged well as the stock delivered a 41% total return since late September 2023, substantially outperforming the broader U.S. market. Today I want to update my thesis in light of the upcoming Q1 2024 earnings release. There are a few temporary challenges in the macroenvironment that will likely continue to constrain the bank in the near term. Moreover, my valuation analysis suggests that after the massive rally over the last 12 months, the stock is now very close to its fair value. I think that a 5% upside potential is not worth the risk of buying before earnings and downgrade WFC to “Hold”.

Wells Fargo Q1 earnings preview

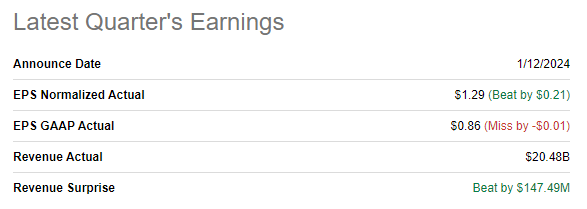

Before I begin to preview the upcoming earnings release, let me highlight the latest earnings release first. The bank reported its Q4 earnings on January 12 and surpassed consensus estimates. Revenue grew YoY by 4.2% and the adjusted EPS shrank from $1.45 to $1.29 primarily due to the weak net interest income.

Seeking Alpha

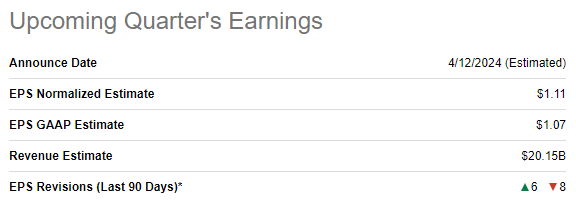

The upcoming earnings release is scheduled for April 12. Consensus estimates forecast Q1 revenue to be $20.15 billion, a 2.8% YoY drop. The adjusted EPS is expected to swing in the same direction by decreasing YoY from $1.23 to $1.11.

Seeking Alpha

I consider cautious consensus estimates to be fair given the challenging environment for banks. High interest rates continue to put pressure on the net interest income, and that is the primary reason I believe the probability of delivering massive beat in earnings or guidance is quite low. The interest rates are still high and the recent public speech of Jerome Powell suggests that the Fed is unlikely to be in rush to cut rates.

Indeed, the recent developments in the macro environment demonstrates formidable resilience of the U.S. economy. It grew faster than expected in Q4 2023, and the Q1 2024 growth forecast is still solid at above 2%. It looks like the Fed is doing great job as the inflation is gradually cooling down towards historical levels while the labor market remaining strong. America’s technological edge achieved by massive investments in innovation also contributed with the new wave of the digital revolution, which most people call “the AI revolution”. Corporate profits are at record highs even in the current tight monetary conditions. Therefore, I think that the Fed indeed does not have much reasons to be in rush to cut rates. This is a temporary, but still a headwind for WFC.

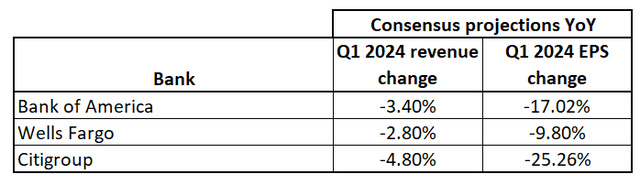

My cautiousness is also backed by consensus projections for the upcoming earnings releases of WFC’s closest peers: Bank of America (BAC) and Citigroup (C). In the below table we can see that all the three giants are expected to demonstrate revenue drop and EPS shrinkage.

To summarize, given the current monetary environment, it is difficult to expect a bombastic earnings release from WFC. The bank is expected to perform better than its closest peers in Q1, but still, key metrics are poised to shrink. I do not expect sharp changes in the monetary policy as long as the economy is strong and fueled by record-high corporate profits and a resilient labor market, with unemployment rates still close to historical lows.

WFC stock valuation analysis

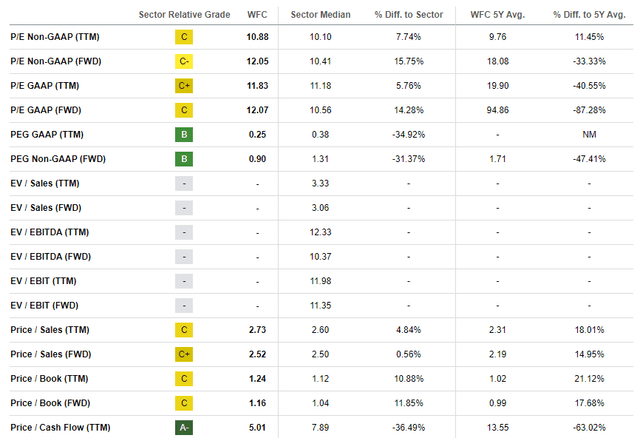

WFC rallied by 54% over the last twelve months and had a solid +15% YTD. The bank significantly outperforms both the broad U.S. market (SPY) and the Financial sector (XLF) in 2024. Valuation ratios look mixed against WFC’s historical averages, meaning that the stock is now approximately fairly valued.

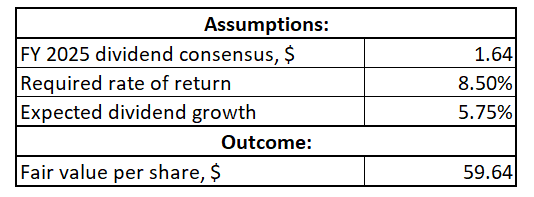

In my previous analysis I relied on the dividend discount model [DDM] approach to derive WFC’s fair share price and arrived at around $59. Since the last close is not very far at $56.7, I think I should use the DDM again and update the input data in line with the changed environment. I am using the same 8.5% required rate of return, which is in line with the recommended by valueinvesting.io range. I update the current dividend to FY 2025 consensus estimate of $1.64 since I am calculating the target price for the next 12 months. Dividend growth is always tricky to project and last time I have used 6%, which is a relatively aggressive assumption. Given the notable uncertainty regarding the Federal funds rates cuts timing and extent, I incorporate a slightly lower dividend growth projection of 5.75%.

Author’s calculations

According to my DDM simulation, I upgrade my target price to $60. This indicates a 5% upside potential from current levels, which I cannot call as “attractive valuation”. Moreover, if we look at WFC’s share price chart over the last 10 years, we can see that $60 is a strong resistance level and the stock currently trades to its early 2022 highs.

Risks to my cautious thesis

Making investment decisions before earnings is risky for both bulls and bears. We all know that even shares of large companies and banks like WFC can move double digits in either direction after the earnings release. There is always a possibility that there might be an unexpected and sudden strong earnings beat or more optimistic than expected guidance changes, which might cause the share price to spike. In this case, my cautious thesis is highly unlikely to age well.

The bank’s management has demonstrated solid determination to preserve value for shareholders via stringent cost control. WFC laid off almost 5% of its workforce in 2023, which is a massive move from the management, highlighting strong commitment to sustain profitability. Some additional minor layoffs were already announced in 2024. That said, I believe there is a probability that the management might introduce new notable layoff rounds. This will lead to an upward revision of long-term EPS expectations from Wall Street analysts and highly likely will boost the share price.

Is WFC stock a buy/sell/hold?

The first time I shared my bullish thesis about WFC, it was a nice deep value opportunity which emerged due to the panic in the U.S. Financial sector last year, after several regional banks collapsed. This play turned out well, but my valuation analysis suggests that after the massive rally over the last several months, WFC is very close to its fair value. There are still some challenges for the bank to expand its growth and improve profitability, which are temporary, but I believe they will persist in 2024. Buying before earnings is inherently risky, and I am cautious about WFC today, with a rating downgrade to “Hold”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.