Summary:

- Wells Fargo has outperformed other big banks over the past year, and I believe this trend should continue.

- Q1 results were favorable, and particularly so in comparison to some other large American banks.

- The bank’s risk management and loan book positioning, along with potential cost savings and regulatory relief, support my bullish outlook.

- The firm has excess capital and is buying back stock aggressively, which adds to the potential upside.

Alexander Farnsworth

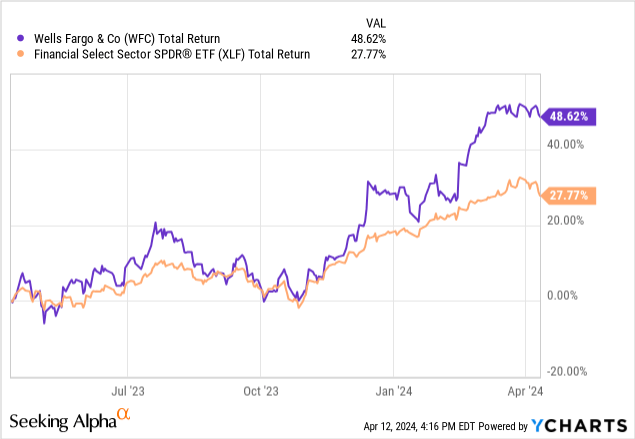

Over the past quarter, Wells Fargo (NYSE:WFC) has dramatically outperformed the other too-big-to-fail American banks, with shares rallying more than 20%. And over the past year, Wells Fargo shares have posted a nearly 50% total return as compared to a 28% increase in the Financial Select Sector ETF (XLF):

I believe my prior analysis is playing out for WFC stock. The bank has relatively favorable positioning for the current interest rate and economic environment and has structured its loan book in a way that should handle current conditions alright. Furthermore, Wells Fargo’s risk management appears on-point, as this quarter’s earnings results indicate.

Well Fargo reported Q1 earnings Friday morning, and they significantly topped expectations with the EPS number in particular coming well ahead of expectations; the bank’s $1.20 of EPS easily topped the $1.09 consensus estimate. Despite that, Wells Fargo stock merely traded flat on Friday.

It appears that the market is partially discounting Wells Fargo’s strong results. That is probably because the broader industry conditions seem less favorable. The largest firm in the space, JPMorgan Chase (JPM), reported underwhelming results and traded down 6% on the news.

Not surprisingly, people appear ready to sell the whole big banks category in response. And it’s true that the sector faces some challenges given macroeconomic concerns going forward. Despite that, and even after the significant rally over the past year, I am reiterating my bullish outlook for WFC stock. Here’s why.

Breaking Down The Q1 Earnings

Let’s look at Wells Fargo Q1 earnings in more detail. Headline earnings dramatically topped expectations. Revenues also beat expectations, but rose just 0.6% year-over-year.

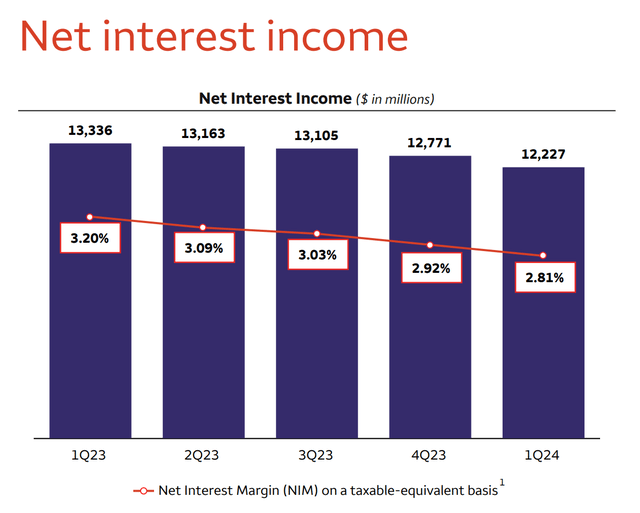

The bank produced substantial EPS beat because had Wells Fargo had lower credit losses and lower loan loss provisions than feared. On the one hand, this sort of earnings beat is not necessarily sustainable as loan losses and provisions tend to be volatile from quarter to quarter. Meanwhile, the bank’s loan book shrunk slightly and its net interest income dropped 8% year-over-year:

Wells Fargo net interest income (Corporate Presentation)

The bank’s net interest margin continues to decline as depositors switch to higher-yielding products. However, the erosion has been gradual as compared to many peer banks, and Wells Fargo maintained its prior full-year guidance for a roughly 8% decline in full-year net interest income. That’s not too bad considering the current shape of the yield curve. And the yield on the bank’s loans has risen 69 basis points year-over-year, topping 6%. This sets the stage for an expansion in NIM once the Fed eventually begins cutting interest rates.

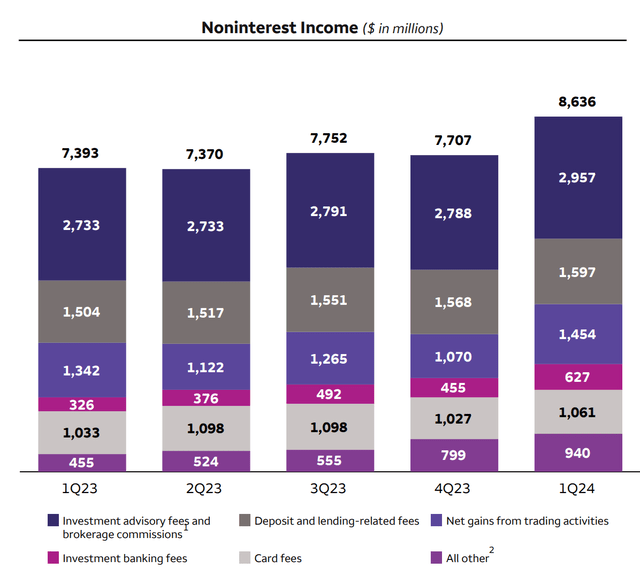

Furthermore, Wells Fargo’s jump in noninterest income has, at least so far, fully offset the drop in net interest income.

Wells Fargo noninterest income (Corporate Presentation)

This quarter was particularly strong on the non-interest income/investment banking front, with the bank recording strong growth in investment banking, investment advisory fees, and trading activity profits among other categories.

And while the bank is dealing with declining NIM at the moment, we could also read into this quarter’s results that Wells Fargo has done a good job of managing its loan book. It deserves praise for avoiding some of the risky areas that have tripped up other peer banks. I’d also note that there was a 6 cent per share charge related to the FDIC assessment to cover the losses from last year’s regional bank failures, so Wells Fargo’s recurring earnings are slightly stronger than reported after accounting for that exogenous charge.

On the interest income side of the equation, this was not a great quarter for Wells Fargo, but it wasn’t bad either given the structural headwinds facing the industry. And, at least for now, strength on the investment banking and advisory side of the shop is keeping total revenues steady.

Wells Fargo’s Longer-Term Outlook

My longer-term outlook for Wells Fargo remains bullish. I believe there are more cost savings to be achieved as the firm puts its past scandals behind it. This will lower its SG&A, and in particular its legal expenses leading to an improved efficiency ratio and higher profitability. CEO Charlie Scharf noted that:

“[W]e have added approximately 10,000 people across numerous risk and control related groups and we’re spending over $2.5 billion more per year than in 2018 in these areas”.

While not all of that spend will ultimately disappear, I’d guess that it can be meaningfully pared back once the company completes its regulatory and remedial work in relation to past matters.

The bank should also see further regulatory relief over time — it got another OCC consent order lifted in early 2024, this one dating back from 2016 regarding sales practices misconduct. This is the sixth consent order that Wells Fargo has successfully resolved since 2019, and this continues to lead toward the eventual removal of the asset cap on Wells Fargo’s business.

In the meantime, the asset cap has had a silver lining. As Wells Fargo wasn’t adding assets over the past few years, it didn’t feel overly compelled to invest in low interest rate treasury securities or risky parts of the commercial real estate market to chase yield. Wells Fargo has largely sidestepped the problems that tripped up various regional and national scale banks over the past year. That’s reflected in this quarter’s results.

Over time, I believe Wells Fargo will have at least $6.00 per share in annual earnings power. Depending on how much costs can be wrung out and the speed of the company’s share buyback program, potentially it could earn even more than $6.00 per share annually within the next few years. On the buyback specifically, management highlighted it as a key priority in the company’s conference call Friday:

“Our capital position remains strong and returning excess capital to shareholders remains a priority. As we stated on our last earnings call, we expect to repurchase more common stock this year than we did in 2023. In the first quarter, we repurchased a total of $6.1 billion in common stock and our average common shares outstanding declined 6% from a year ago.”

The bank has a significant pile of excess capital. According to one analyst on the conference call, by their modeling, Wells Fargo has approximately $12 billion of capital beyond what is needed for regulatory compliance today. That, plus the additional profits that the firm generates each quarter, should give it plenty of room to follow through on that buyback target mentioned above.

The company also pays out a reasonable dividend, with the yield currently at 2.5%. Last summer, Wells Fargo raised its dividend from 30 cents to 35 cents per quarter. Given the firm’s strong capital position and favorable profitability picture, I wouldn’t be surprised to see another solid dividend increase this summer as well.

In any case, let’s get back to my baseline assumption that Wells Fargo has a core earnings power of at least $6/share once it gets out of its current regulatory doldrums. A 12x P/E multiple on this projection suggests a low-to-mid $70s stock price within the next couple of years.

In conjunction with the dividend, that sets up a favorable outlook for WFC stock. Shares aren’t nearly as discounted as they had been previously, but the pieces are still here for further outperformance.

That said, I wouldn’t be surprised if Wells Fargo stock merely treads water over the next several quarters before resuming its climb. The yield curve appears to be moving unfavorably, as inflation has remained hot and now traders are greatly dialing back their assumptions around how much and how soon the Federal Reserve can cut interest rates. While that is a real near-term headwind, over the longer-term, Wells Fargo’s recovery story remains robust, and the large share buyback program combined with cost-cutting should lead to steadily higher profitability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.