Summary:

- Wells Fargo surpassed earnings estimates in Q4 2023 and Q1 2024, driving a 14.94% stock price increase.

- Despite regulatory constraints, Wells Fargo remains undervalued, with a fair price of $71.49 and a future projection of $123.41, offering 19.5% annual returns through 2029.

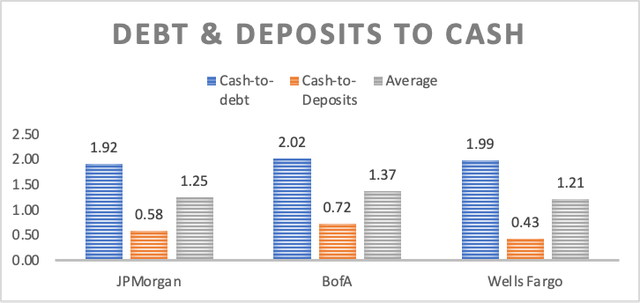

- While lagging in deposit coverage compared to JPMorgan and Bank of America, Wells Fargo remains solvent and capable of meeting its debt obligations.

RiverNorthPhotography/iStock Unreleased via Getty Images

Thesis

In my previous article covering Wells Fargo & Company (NYSE:WFC), I assigned it a buy rating citing that the estimated fair price stood at around $54.73, which was a 10.6% upside from the then stock price of $49.50, and that the estimated fair price for 2029 stood at around $94.86, which translated into annual returns of 18.3% throughout the projected period 2023-2028.

In Q4 2023 earnings (released on January 12, 2024), Wells Fargo reported an EPS of $1.29, which was 18.34% higher than the estimated PES of $1.09. The company also reported revenues of $20.48B, which was $100M greater than what was estimated. This caused the stock price to climb to $56.90, which represents a 14.94% gain since the previous article. Then, Wells Fargo reported Q1 2024 earnings on April 12, 2024, where it again beat EPS estimates by 15.59% and revenue estimates by $710M.

After re-evaluating the stock, I concluded that the stock remains undervalued, the fair price stands at around $71.49 (which is 25.6% above the current stock price), and the future stock price for 2029 stands at $123.41. This last one implies annual returns of around 19.5% throughout 2029. For this reason, I upgrade the stock from “buy” to “strong buy”.

Overview

Growth Plan

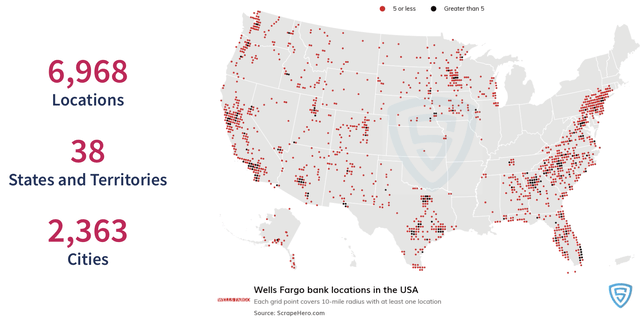

Wells Fargo’s growth plan is to comply with regulators in hopes that the $1.95 asset cap (imposed by the FED in 2018) is removed. Wells Fargo expects the asset cap to be in place throughout 2025. This means that, currently, Wells Fargo can only do the following things: 1) Share buyback programs, 2) increase dividends, and 3) Cut expenses as much as possible to boost net income. To do this, they may close poor-performing branches and open new ones in places where they think they could perform better.

How does Wells Fargo Compare against Peers?

Wells Fargo is currently the least financially strong among its peers JPMorgan Chase & Co. (JPM), and Bank of America Corporation (BAC). The bank can currently cover 43% of deposits with its cash reserves, whereas JPMorgan can cover 58% and Bank of America 72%. Nevertheless, in what concerns debt, the three banks can cover almost the entirety of their debt.

Industry Outlook

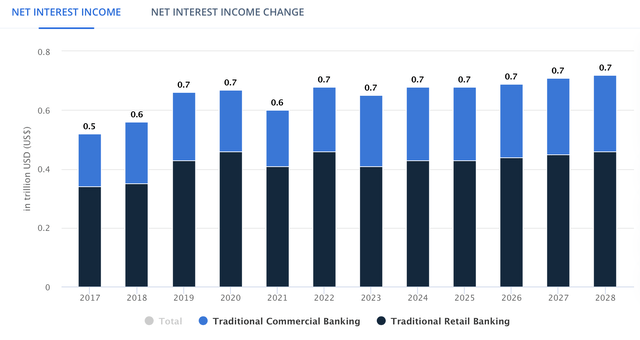

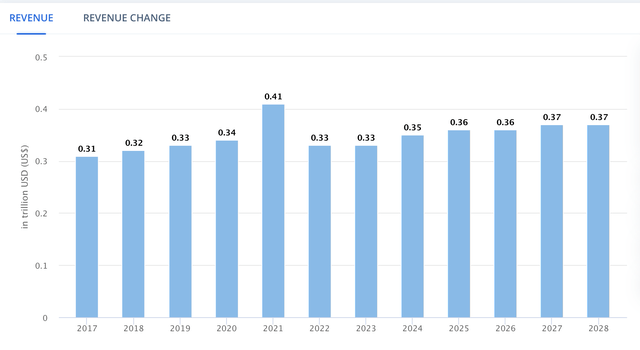

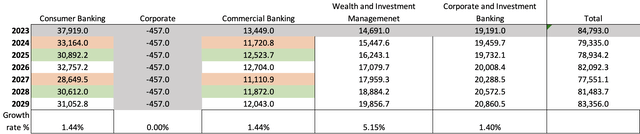

The Traditional US Banking Market is expected to grow at an annual rate of 1.44% throughout 2028. This market includes retail banking and commercial banking. Then, global investment banking is expected to grow its market volume by 1.4% annually throughout the same period. When summing up both markets, the addressable revenue to be made stands at around $1.03T.

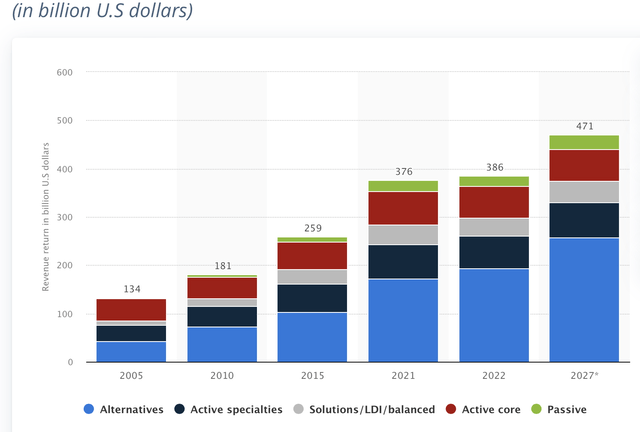

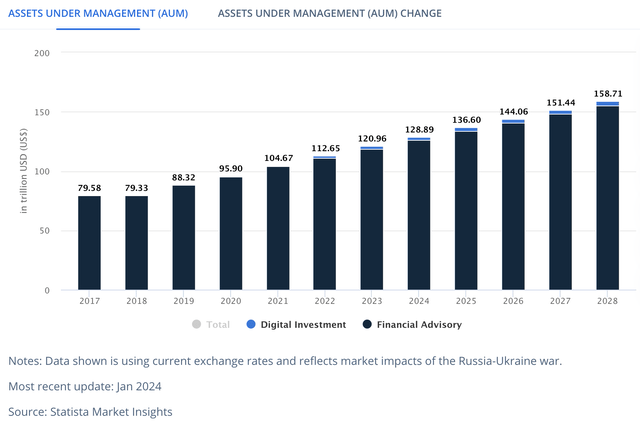

The Worldwide Asset Management and Wealth Management, are estimated to grow at an annual pace of 4.40% and 5.90% respectively. The addressable revenue of asset management stands at $402.98B, and wealth management addressable assets stand at $120.96T.

Adding all this, it can be deduced that the current addressable revenue stands at around $1.43T (when including traditional banking, investment banking, and asset management). Then, in wealth management, there is an addressable asset base of $120.96T. For 2028, these figures are expected to climb to $1.56T and $158.71T, respectively.

Valuation

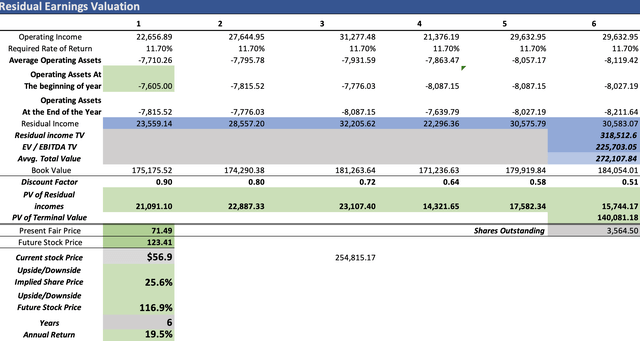

To value Wells Fargo, I will use a residual earnings model. In the table below, you can see the CAPM model that I will use to get the RRR. The beta for Wells Fargo is from MarketWatch.

| CAPM | |

| Risk-Free Rate | 4.489% |

| Beta | 1.21 |

| Market Risk Premium | 5.961% |

| Required Rate of Return | 11.702% |

The first step is to calculate revenue. The first thing I will do is to put in the box labeled “growth rate %” the growth rate of the respective market of each segment. These growth rates can be found in this article’s “Industry Outlook” subsection. This will leave wealth management and investment banking constantly growing. However, consumer & commercial banking will have ups and downs due to interest rates.

In 2022, when interest rates started to increase, it caused spending to decrease, and this caused Wells Fargo’s revenue to decrease by 12.54%. However, after that, those higher interest rates made revenue increase by 6.85% (in 2023), and currently revenue is standing at 7.17% (on a TTM basis) when compared to 2023. In the table below, you can see that the cells marked in red mean that revenue will fall by 12.54% and those in green mean that revenue will grow by 6.85%. The ones in white will grow as specified by the row labeled “Growth Rate %”.

For net income, I will calculate it through margins. The starting margin for 2024 will be the current TTM net income margin of 21.25%. Then, as consumption revitalizes due to lower interest rates in 2025, the margin will increase by 6.55% (as it did in 2023), and then it will increase again to 28.35% since interest rates will continue to be low by that year. However, in 2027, I expect the cycle to start again, and this means that as interest rates are increased, net income margin will decrease by 7.84% (as it did in 2022). Still, then it will increase again by 6.55% as higher interest profitability. Still, if rates increase, then the margin will contract by 3.54% as high-interest rates cause consumption to decrease and outweigh the benefit in profitability from high interest rates.

| My Net income Margins % | |

| 2024 | 21.25% |

| 2025 | 26.06% |

| 2026 | 28.35% |

| 2027 | 20.51% |

| 2028 | 27.06% |

| 2029 | 23.52% |

Then, I need to calculate operating income, for which I will just need to calculate how much would Wells Fargo have paid in taxes due to the net income targets previously mentioned. Currently, the tax rate stands at 27.07%.

| Revenue | Operating Income | |

| 2024 | $79,335.0 | $22,656.9 |

| 2025 | $78,934.2 | $27,645.0 |

| 2026 | $82,092.3 | $31,277.5 |

| 2027 | $77,551.1 | $21,376.2 |

| 2028 | $81,483.7 | $29,633.0 |

| 2029 | $83,356.0 | $26,348.2 |

Lastly, the model will also suggest which could be the future stock price for 2029. To do this I will be using the cash flows previous to the discounting process, which you can see in blue in the model, which is below.

As you can see, the model suggests that Wells Fargo is significantly undervalued more specifically by 25.6%, which indicates that the present fair share price stands at around $71.49. Meanwhile, the future stock price for 2029 stands at around 123.41, which translates into 19.5% annual returns throughout 2029.

What brought this huge increase in fair price compared to my previous target of $54.73 and future price of $94.86, is that in this model I took out the year 2023 and added the year 2029, which increased the overall amount of cash flows. Furthermore, there was also an increase in my previous targets on the grounds of Wells Fargo’s Q4 2023 and Q1 2024 beats.

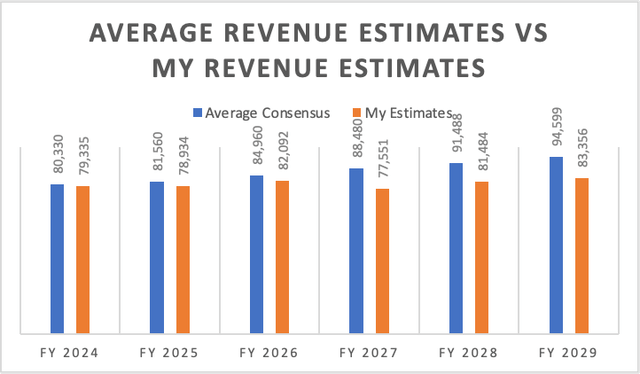

How Do My Estimates Compare Against the Average Consensus?

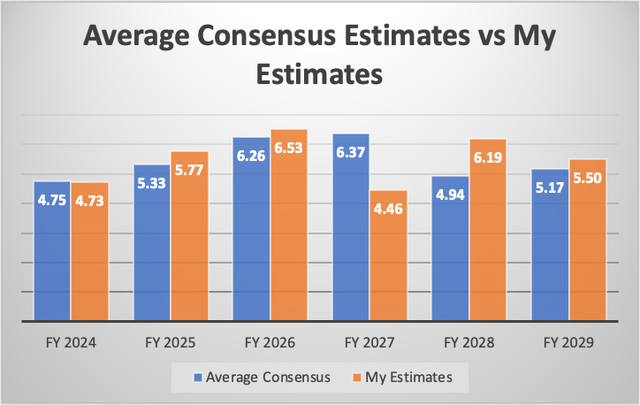

If I did a model completely based on analysts’ estimates, I would get a fair price per share of $61.06, which is a 7.3% upside from the current stock price of $56.90, and a future price per share of $103.15, which translates into 13.5% annual returns throughout 2029.

My EPS estimates are overall 1.09% higher than the average EPS consensus. In the table below, you can observe a more detailed view of each year. However, my net income margins are higher than those implied by the average consensus. You will notice that because my revenue estimates are overall 7.42% lower than the average revenue estimates.

However, it’s worth noting that the distribution of my targets compared with the average consensus is what makes both fair price results significantly apart, since the discounted amount in years nearer to the present will always be lower than those that are the farthest.

| My Net income Margins % | Average Net Income Margins Estimates | |

| 2024 | 21.25% | 21.08% |

| 2025 | 26.06% | 23.29% |

| 2026 | 28.35% | 26.26% |

| 2027 | 20.51% | 25.66% |

| 2028 | 27.06% | 19.25% |

| 2029 | 23.52% | 19.48% |

Risks to Thesis

The main risk is that Wells Fargo has been trading cheaply due to the asset cap moving all hopes for growth. The company remained intrinsically undervalued. However, sentiment is necessary to achieve any estimate. Because of that, if that asset cap is not removed in 2025, as the bank estimates, the stock could remain suppressed as it has been doing.

The second risk is that Wells Fargo has not been able to grow its cash reserves as BofA and JPMorgan because it has an asset cap of $1.97T. Nevertheless, this still puts it at a disadvantage because M&As will cost more to Wells Fargo as a percentage of its cash reserves, and it’s less prepared in case of any banking panic.

Lastly, the bank still has quite a bad reputation. Therefore, it needs to shake it off to expand rapidly after its asset cap is removed in 2025.

Conclusion

Wells Fargo has been trading at a surprising valuation after many scandals and the 2018 asset cap imposed by the Fed. This last, completely erased optimism in the stock. According to my calculations, the stock remains undervalued, but what’s important is that opportunities are aligning for Wells Fargo. If the asset cap is removed in 2025, this will unlock the necessary optimism to make Wells Fargo’s stock shoot. After that, Wells Fargo could start aggressive expansion across the states where it doesn’t operate.

After the valuation process, I concluded that the stock’s fair price per share stands at around $71.49, which is a 25.6% upside from the current stock price of $56.90. The future price stands at $123.41, which implies annual returns of 19.5% throughout 2029. For these reasons, I upgrade the stock from “buy” to “strong buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in WFC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.