Summary:

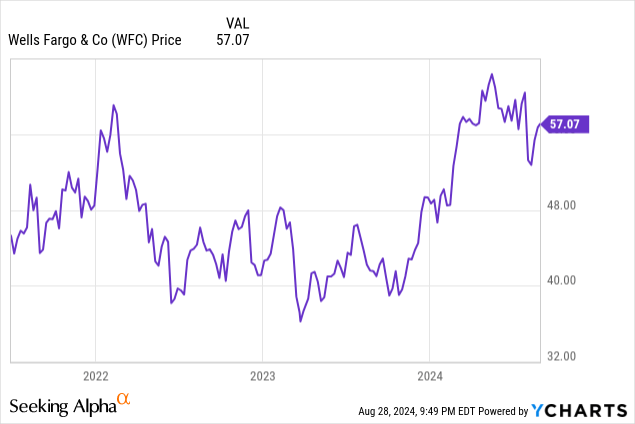

- Wells Fargo’s stock has surged around 40% from the beginning of 2023, but mid-term uncertainty remains due to potential Federal Reserve actions and regulatory changes.

- Q2 2024 results show declining Net Interest Income and loan balances, but a 19% rise in Non-interest Income due to revenue diversification efforts.

- Lower interest rates may not quickly boost loan demand, risking revenue growth; a potential lifting of the $2 trillion asset cap could benefit earnings.

- Despite the potential upside, high uncertainty and current valuation make Wells Fargo stock a hold.

Matthew Nichols

One of the largest banks in America, Wells Fargo & Company (NYSE:WFC), has seen its stock soaring significantly since 2023, around 40%. Nevertheless, it is quite difficult to envisage with a decent level of certainty what would happen with the stock in the mid-term due to the Federal Reserve being expected to cut rates later this year.

Adding to the uncertainty, it is also likely that in less than a year, the bank could see the long-awaited permission from the regulators to finally be able to increase its assets above the $2 trillion cap imposed in 2018 in response to the 2016 fake accounts scandal. For those reasons, I consider the stock to be a hold.

The current situation

Wells Fargo, following its 2023 10-K, is one of the six big banks in America, being the third-largest bank by market cap, after JPMorgan Chase & Co. (JPM) and Bank of America Corporation (BAC), and the fourth-largest by assets, behind Citigroup Inc. (C).

The company has four segments, excluding the corporate one: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management. Wells Fargo also receives revenues from these in two ways: from Interest Income and Non-interest Income.

The Q2 2024 results: interest deceleration across the board, fees soaring

The bank has reported for its Q2 of 2024 some mixed results, which, in my opinion, would be closer to being bad if it weren’t for the optimism expressed by the management in the earnings call.

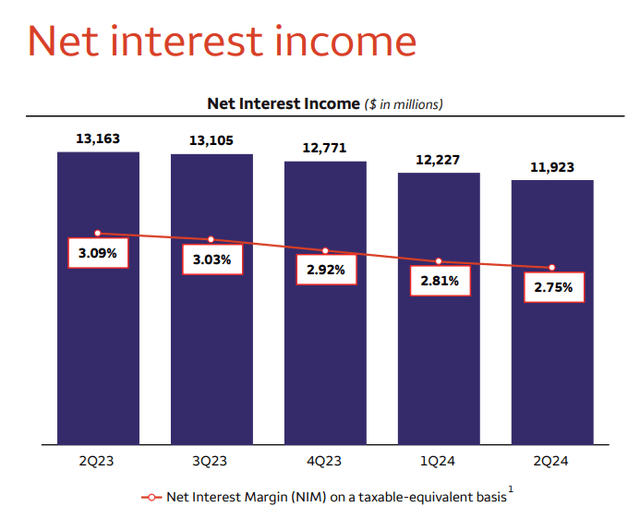

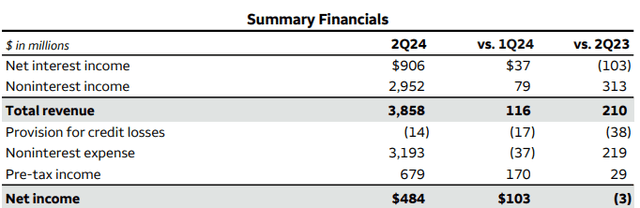

First, let’s talk about Net Interest Income and Non-interest Income. Net Interest Income has been constantly decreasing, now 9% year over year. The management explained in the earnings call that this was because of higher funding costs and lower total deposits. This is expected as consumer depositors look for better alternatives where their money can produce higher returns. The management is pretty confident that this dynamic is slowing down and will be less important as interest rates go down eventually.

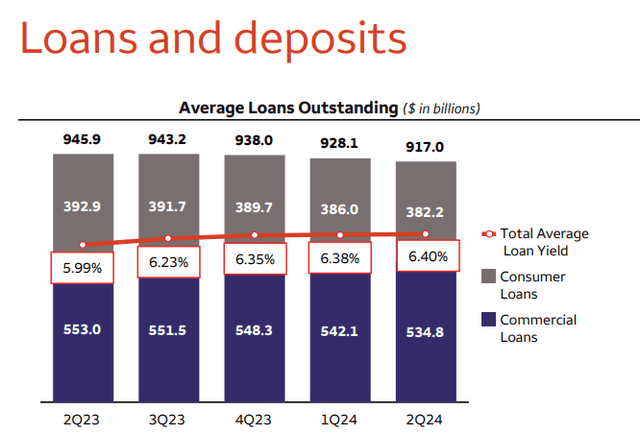

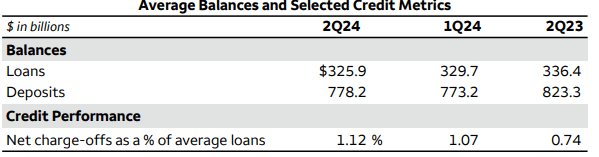

Continuing on this idea, loan balances also declined at 3% year over year and 1% quarter over quarter, although the average loan yield has expanded 40 basis points to 6.4% compared to Q2 2023. While the loan yield expanded, the management expressed this is exclusively due to higher interest rates because the company is not originating anything new for FICO scores below 660, hence not taking more risk to grow. Additionally, the good news is that Net Interest Income is expected to bottom by this year’s end.

Wells Fargo Average Loans Q2 2024 (Wells Fargo)

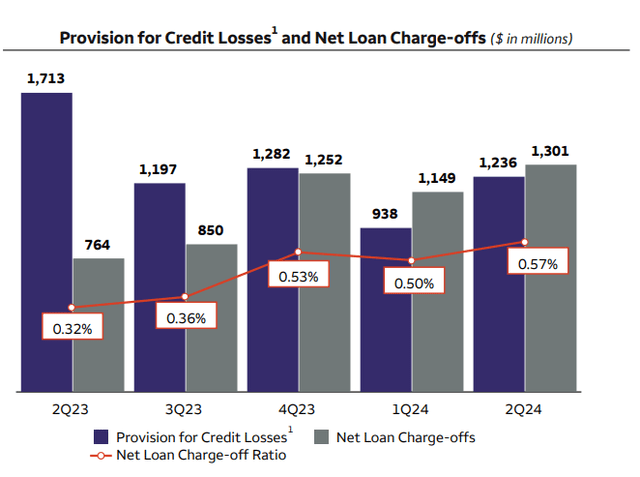

On the charge-offs side, the company saw an incremental increase compared to the Q1 2024 and Q2 2023 periods. This was caused by higher Commercial Real Estate, specifically offices, loan underperformance. I consider this a resilient result, mainly because Allowance for Credit Losses is still sitting at 1.6%. To have these numbers controlled is crucial for the management to finally get to the 15% ROTCE goal, which is currently at 13.7%.

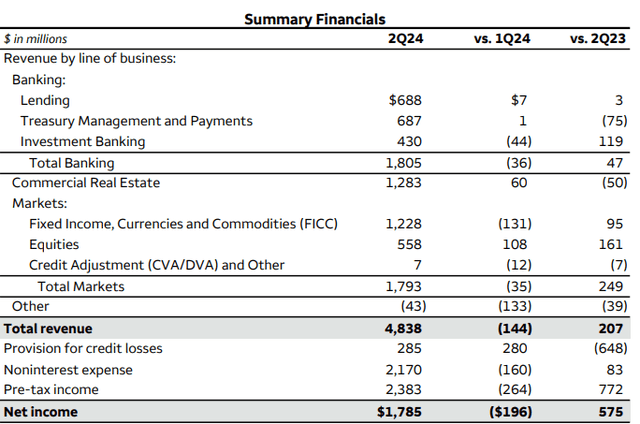

Now talking about Non-interest Income, the company saw a relevant revenue increase of 19% year over year and 1.5% quarter over quarter. This is in great part due to the efforts that the company has made to increase its revenue diversification. In my view, this will make Wells Fargo behave more like a JPMorgan and Bank of America, with a revenue mix from Wall Street and Main Street, rather than large banks like U.S. Bancorp (USB) or Truist Financial Corporation (TFC), depending mainly on its traditional banking portfolio.

Segments Review

As discussed before, Wells Fargo has four major segments. The first one, Consumer Banking and Lending, saw a big impact from lower consumer deposits, causing revenues to decline 5% from Q2 2023. The auto revenue declined 25% and was also impacted by 23% lower generations and 14% lower balance from a year ago. This was expected. Another segment that is not performing well enough is credit cards, which saw bigger net charge-offs but more originations. I believe this might be caused by a dangerous macroeconomic dynamic where new clients are trying to get liquidity while older clients are having a rough time paying down their debts. Time will tell.

Wells Fargo

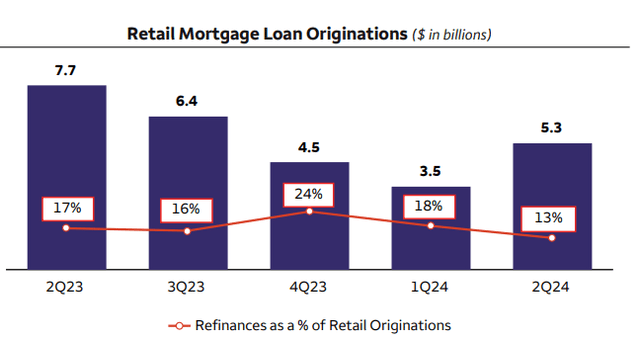

Retail mortgage originations are also down 31%. The management explains this sharp decline by market dynamics, but also because of the efficiency initiatives that have reduced the headcount in this segment by a whopping 45%. That firing activity has allowed the company to offset the decline in net interest income while also increasing efficiency and redirecting efforts through investment banking, trading, wealth, and investment management segments.

In the Commercial Banking segment, WFC saw stable middle market revenues, down just 2%, while also experiencing a big decline of 17% in asset-backed lending caused by a lower loan demand. I think this is also a sign of concern mainly because of the big sudden decline.

Wells Fargo saw some mixed results on the Corporate and Investment Banking side. In the interest-generating segments like Commercial Real Estate and lending, the bank saw stagnation, while a significant increase in investment banking due to higher demand and a big rise in equities trading from a year ago, was produced by a $24 billion increase in total trading assets from a year ago. The bank has also continued to get rid of nonperforming Commercial Real Estate assets, especially those related to offices, by 13% from a year ago.

In Wealth and Investment Management, Wells saw a welcomed 12% increase in non-interest income, mainly boosted by higher market values that brought higher income from fees.

Lower interest rates ahead, revenue growth at risk

The current situation is quite tricky for Wells Fargo. On one hand, the company would benefit from lower interest rates as loan generation might ramp up again if demand is strong enough. Unfortunately, I believe slower loan demand is a macroeconomic sign of general economic weakness and will likely come back with some lag instead of just recovering instantly.

Therefore, as interest rates drop, loan generation would not recover quickly enough to compensate for lower interest income from eventual new loans with lower average margins. This could cause the company’s revenue to have difficulty achieving growth. That is without counting a rapid increase in unemployment or some quick macroeconomic deterioration that could cause loan generation to stagnate even further.

What would happen with WFC stock and the likely asset cap lifting?

As mentioned before, Wells Fargo’s sanctions for its 2016 incident have caused the company to have a $2 trillion asset cap. This measure, in my opinion, may be too harsh, especially for the time it has lasted, and could be removed by the next year. If so, the company would benefit immensely from being able to generate more loans and acquire new assets more easily, likely propelling earnings and helping the bank to be closer to its main competitors, JPMorgan and Bank of America.

Valuation

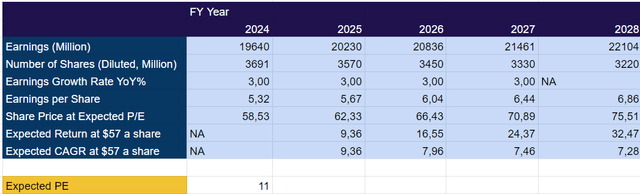

I consider Wells Fargo’s net income projections very speculative since it is difficult to see the impact of cyclicality in this new era of the Fed dropping interest rates from the current highs. Nonetheless, I think the following valuation scheme could illustrate my idea of why WFC is not a real buy at this point, nor a sell.

First, I project a very generous 3% earnings growth that might be quite optimistic and only realistic if the Fed lifts the $2 trillion asset cap. Secondly, I project around $8 billion in common stock buybacks each year, which is aggressive but feasible. I also forecast a high 11 PE ratio for a very cyclical-exposed bank like Wells Fargo.

Image created by the author based on 10-K projections (Author)

With all of these concessions I gave to the bank, the result is a shy 7% CAGR for 2028, which is lower than the average 8-10% brought on average by the S&P500, and not considering the significantly increased risks from cyclicality, higher beta and lack of diversification that an individual banking stock could bring to a portfolio. Therefore, the stock is uncompelling in my view.

Wells Fargo upside risks

The biggest upside risks for Wells Fargo are in the form of the general economy’s behavior. A major earnings growth caused by higher loan generation offsetting lower interest rates could make the stock soar. Another upside risk that the stock has comes with the lifting of the asset cap, which could bring significant decent revaluation to the company’s long-term assets, causing the bank to originate a large amount of loans more easily.

As mentioned before, WFC is a good institution overall and might have a good upside from here, but the current price and the huge uncertainty make the stock nothing more than a hold from this price.

Conclusion

Wells Fargo has demonstrated that a change in behavior is possible, at least until something new arrives. The company has increased shareholder value and has been able to capitalize on the current high interest rate environment, even with the $2 trillion asset cap.

Unfortunately, the massive uncertainty over the loan demand after the Federal Reserve begins to revert its latest monetary policy, together with high prices and even more regulatory uncertainty, make this stock only a hold at the moment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.