Summary:

- I favor Wells Fargo’s Series L “busted” preferred shares due to their low call risk and potential for capital gains upon forced conversion.

- Wells Fargo’s financial results are robust, with preferred dividends well-covered, requiring only 5% of net income, ensuring reliable dividend payments.

- The Series L preferred shares offer a long-term fixed income investment, with minimal imminent call risk and potential capital gains if converted.

- With a yield of over 6%, I maintain a small long position in WFC.PR.L, expecting Wells Fargo to honor its preferred dividend commitments.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

I like the so-called “busted” preferred shares, and Wells Fargo & Company‘s (NYSE:WFC) Series L preferred shares is one of those “busted” preferred shares where it isn’t realistic to expect the preferred shares to be called in the near-term or medium-term future given the terms of a mandatory conversion. I liked these preferred shares as they add duration to the portfolio given the low probability of the securities being called. And even if they would be called, the terms of the forced conversion indicate I would be able to generate a capital gain.

Wells Fargo likely doesn’t need a lengthy introduction, as the bank is seen as a financial powerhouse with a worldwide brand and name recognition.

The financial results remain robust – and the preferred dividends are well-covered

As an investor in preferred shares, I’m obviously very interested in making sure a company, including the banks, can easily cover the preferred dividend payments. As Wells Fargo reported its financial results for the third quarter of this year a few weeks ago and as it has already filed its quarterly financials, this provides a good opportunity to use the most up to date financials to determine how safe the preferred dividends are.

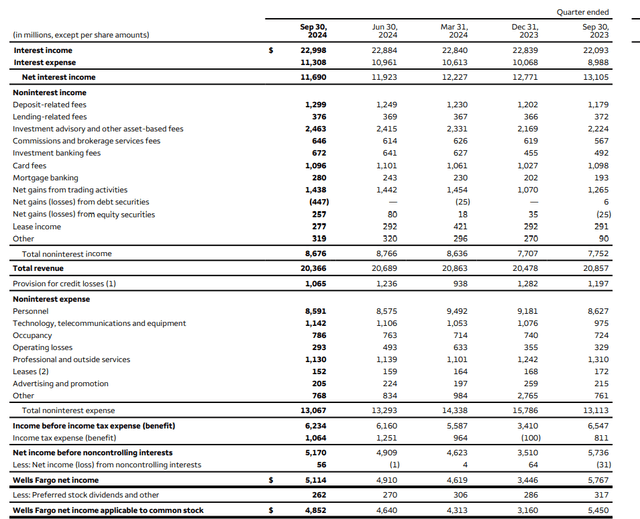

In the third quarter of this year, Wells Fargo reported a net interest income of $11.7B. Although this is lower than in the previous few quarters, it’s interesting to note that A) the total amount of net non-interest expenses decreased from just over $4.5B in the previous quarter to $4.4B in the third quarter of this year, and B) as you can see below, the total amount of loan loss provisions decreased by over $150M on a QoQ basis.

These two elements helped Wells Fargo to still report an increase in its pre-tax income, which increased by just 1% to $6.23B. After taking taxes into consideration, the net income was $5.17B, compared to $4.91B in the preceding quarter. After taking the net income attributable to non-controlling interests and the preferred dividends into consideration, the net profit attributable to the common shareholders of Wells Fargo was approximately $4.85B, which is roughly $200M higher than in the second quarter of the year and just over $0.5B higher than in the first quarter of this year.

The metric I’m most interested in is the preferred dividend ratio. As you can see in the image above, Wells Fargo only needed $262M of the $5.11B in net income to cover the preferred dividends, and this represented just around 5% of the net profit.

So from the perspective of a preferred dividend investor, I am still quite satisfied with Wells Fargo’s preferred shares as the preferred dividends are well covered by the bank’s earnings. And even if the loan loss provisions would five-fold on a quarterly basis, the preferred dividends would still be fully covered.

A closer look at the Series L preferred shares

I have always preferred (pun intended) the preferred shares trading with (NYSE:WFC.PR.L) as ticker symbol, a non-cumulative perpetual convertible share.

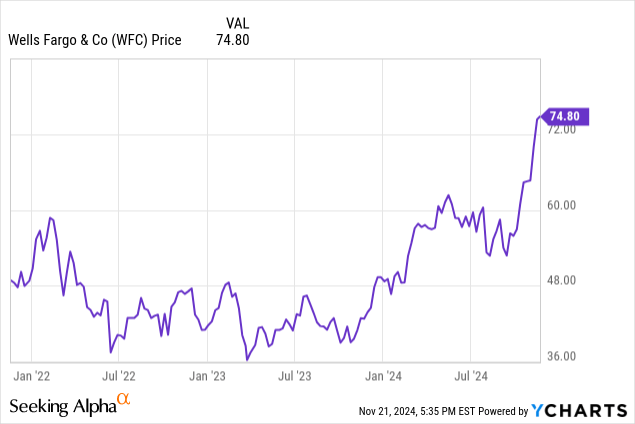

That series of preferred stock was initially issued by Wachovia and cannot be called by Wells Fargo (which acquired Wachovia). There is a conversion feature with a conversion price of $156.7, but this only comes into play when Wells’ common shares are trading well north of $200, as per the terms of the preferred shares. To be precise, the Series L preferred shares can be converted into 6.3814 shares of Wells Fargo, and WFC can only force a conversion when the common share price exceeds $203.72 for a period of 20 trading days during a 30 consecutive trading day period. If and when that happens, you’ll receive at least $1300 in common shares (6.3814 * the minimum price of $203.72 – the market price could be higher), which would allow the preferred shareholder to realize a capital gain as well.

I’m not really anticipating a forced conversion in the near future, as the share price of the common shares would almost have to triple from the current share price before the forced conversion comes into play. As such, I am currently considering this series of preferred shares as a long-term fixed income investment. While I realize there is a call risk down the road, I don’t consider that call risk to be imminent. And even if these securities would be called, I would generate a capital gain of approximately 6% as every preferred share would be converted into just over 6.38 common shares. That reduces the impact of the call risk.

Investment thesis

I have a small long position in WFC.PR.L that currently yields just over 6% based on the current share price of around $1230 per preferred share. While the yield definitely isn’t extraordinarily high, I’d like to think that this pays reliable quarterly dividend income, and although the issue is non-cumulative in nature, the reputational damage of skipping a preferred dividend would be huge. I therefore expect the bank to continue to honor its preferred dividend commitments.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC.PR.L either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!