Summary:

- Snap’s market cap is ~$17 billion, but it struggles with negative earnings, weak ARPU, and declining user growth, making it a poor investment.

- The company’s 2Q 2024 financial results show $1.2 billion revenue, $250 million net loss, and negative FCF, highlighting its financial struggles.

- Stagnation in key markets (North America, Europe) and rising costs, including hidden dilution from stock-based awards, further weaken Snap’s financial outlook.

- Declining usage, especially among older demographics, suggests Snap may follow the decline trend of past social networks like MySpace.

We Are

Snapchat (NYSE:SNAP) is one of the best known social media companies, with a market capitalization of almost $18 billion. The company does have a much lower valuation than many peer companies, such as Meta, as the company struggles to both maintain growth and revenue. As we’ll see throughout this article, the company’s focus outside of the U.S., will hurt future returns.

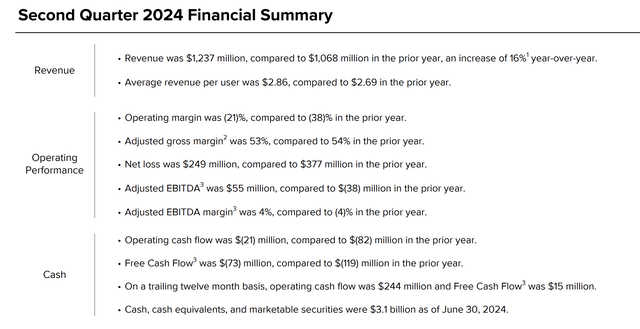

Snap 2Q 2024 Financial Results

In the company’s most recent quarter, it saw more than $1.2 billion of revenue at $2.86 per user.

Snap Investor Presentation

The company has lower revenue per user than many of its peers, highlighting continuing competition. The company has a negative margin and saw $250 million in net loss. The company’s FCF remains negative as well with the company’s TTM FCF at just a hair above $0 at $15 million. The company maintains $3.1 billion in cash and marketable securities.

With a $17 billion in market cap, and a company that’s been around for more than a decade, and public for a while, the company needs to generate FCF to come close to its valuation at some point. So far, the company has shown an inability to do just that.

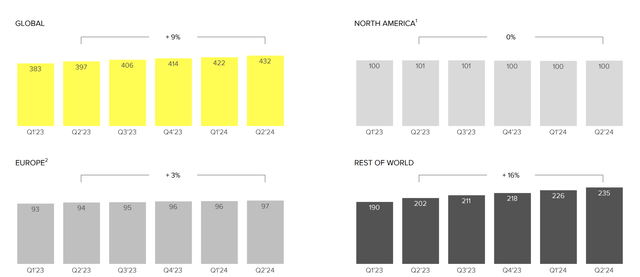

Snap Segment Performance

Snapchat has seen some growth across its markets, however, its most profitable markets, such as North America and Europe have stagnated.

Snap Investor Presentation

The company saw 9% global growth, but in North America it remained completely flat. Europe only saw 3% growth. Given that Europe + North America make up more than 80% of the company’s revenue stagnation in these markets isn’t made up by growth in the Rest of the World that the company is seeing.

Relatively modest performance in users, combined with weak financials, show Snap’s current struggles.

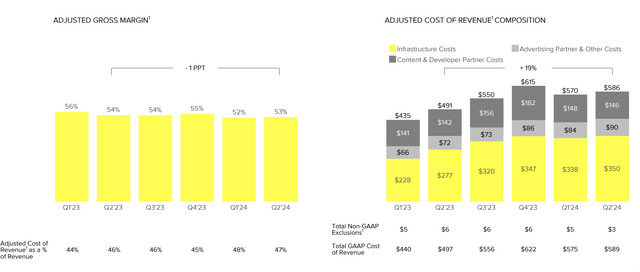

Snap Costs and Growth

Snapchat has seen its growth margin taper downwards as costs have remained lofty.

Snap Investor Presentation

The company’s adjusted gross margin is down to 53% as cost of revenue has gone up from 44% to 47% of revenue. The company’s primary cost is infrastructure costs which were ~$350 million for the quarter. The company’s content & developer partner costs have remained roughly flat, however, the company’s advertising costs have gone up.

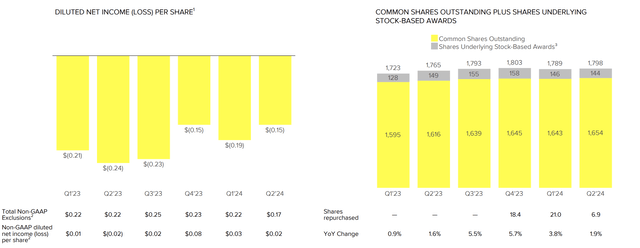

Snap Investor Presentation

Snapchat also has a hidden employee cost in the company’s continued dilution through stock-based awards. The company’s stock-based awards add roughly 40 million shares on an annual basis which comes out to $100 million per quarter in hidden dilution that the company isn’t accounting for in its expenses.

That’s disappointing for a company with declining margin that’s already losing money on a per-share basis. The company seems to be losing popularity, and it should have a P/E ~10 with its stagnating financials to justify a potential investment despite declines. Being at negative profits in such a position shows the company as a poor investment.

Our View

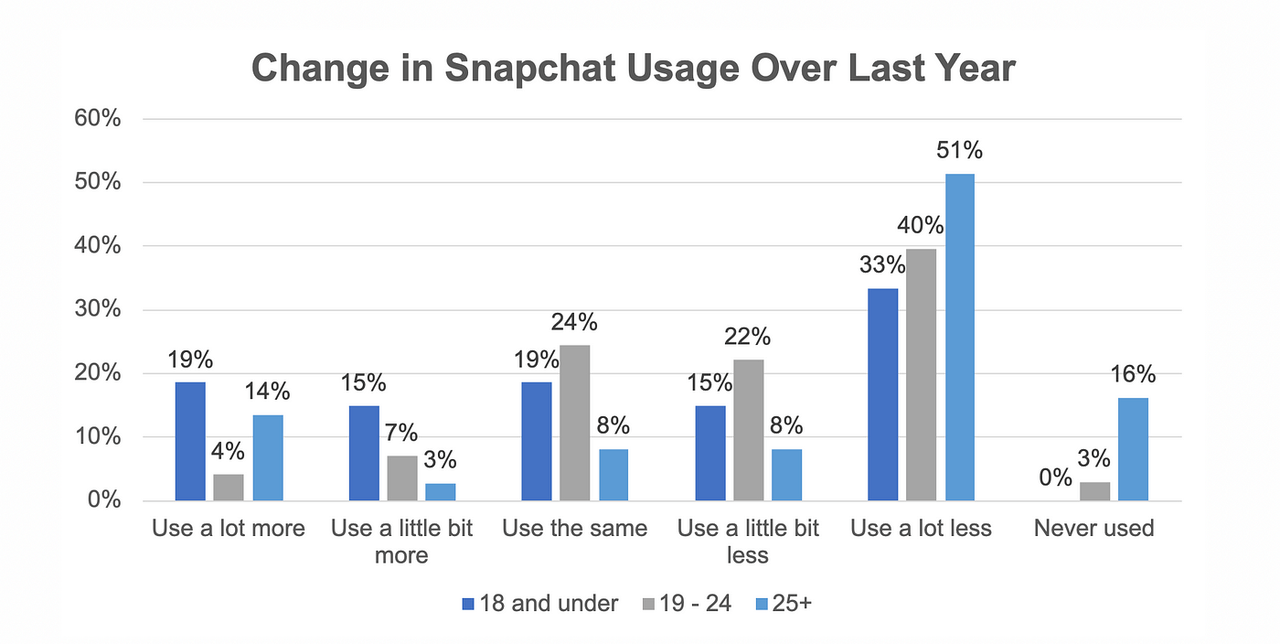

Snapchat has seen consistent struggles as usage continues to go down.

The reports of Snapchat’s death have been greatly exaggerated… | by Justine & Olivia Moore | Medium

The company has seen substantial stagnation especially among ages 19-24, at the top end, as these ages are much less interested in growing Snapchat usage. Among older people (25+) the company is seeing a substantial decline. Across the board usage is declining, which explains the company’s weak ARPU, which will hurt future returns.

Facebook was the social network that changed the trend of social networks occasionally dying out, as seen with the popularity of MySpace at one point. Snapchat, unfortunately, doesn’t seem to be avoiding that trend, and seems to be dying a slow death. That fundamentally, along with poor financials at its relative peak, makes the company a poor investment.

Thesis Risk

The largest risk to our thesis is that Snap does have hundreds of millions of regular users and the company is growing its revenue from these users. The company could manage to grow enough to justify its valuation, especially if it finds a way to become popular. That could enable increased shareholder returns.

Conclusion

Snap trades at an incredibly lofty valuation given the company’s negative earnings. The company has a market capitalization of ~$17 billion, and the company’s negative earnings, along with continued dilution of $100 million / quarter should minimize any ability to continue driving future shareholder returns.

Additionally, the company is seeing usage go down. We see the company as not an exception to the regular decline of social networks, as what was once seen with MySpace. We expect the company to fade into obscurity making it a poor long-term investment. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of SNAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.